Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the additional tasks that I try to address each weekend is to examine my actual holdings in my Trading Account. I have been going alphabetically (by symbol), looking at one of my now nineteen positions every two or three weeks. I do this as part of the transparency of the blogging that I do on this website. So that you may better understand my philosophy, my actual decision-making, and even help decide if what I do actually works, it is useful at least for me to share with you the actual holdings and trades in my account. I hope that all of you also find it useful.

On April 21, 2007, I reviewed Universal Electronics (UEIC) on Stock Picks Bob's Advice. Going alphabetically (by symbol) I am now up to Meridian Bioscience (VIVO).

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold.

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold.

I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

My first write up of Meridian Bioscience was on April 22, 2004, the same day as my first purchase, when the stock was trading at $11.22. Adjusted for a 3:2 stock split in September, 2005, and another 3:2 stock split on May 14, 2007, this represents a pick price of $11.22 x 2/3 x 2/3 = $4.99. With the stock closing at $20.57, this represents an appreciation of $15.58 or 312.2% since the original "pick". However, due to the stock volatility, I was shaken out the next month and had to wait a year before finding the opportunity to add the stock back into the portfolio.

Even back in 2004 I was utilizing essentially the same 'stock-picking strategy' as I currently employ. In fact, when I first wrote up Meridian I had some words that ring true today:

"Meridian did ALL of the things I like a stock to do...announced great earnings, declared an INCREASED dividend, and INCREASED guidance for the rest of the year. And NATURALLY, the stock moved up nicely today after the announcement this morning."

On April 21, 2005, I "revisited" Meridian Bioscience (VIVO) when the stock was trading at $16.265. With the two stock splits first the 3:2 on 9/6/05, and the 3:2 on 5/14/07, this represented an effective pick price of $16.265 x 2/3 x 2/3 = $7.23. Again, with the stock closing at $20.57 on 5/18/07, this represents an appreciation of $13.34 or 184.5% since posting.

Let's take another look at Meridian and see if it still deserves a spot on this blog and why

MERIDIAN (VIVO) IS RATED A BUY

What exactly does this company do?

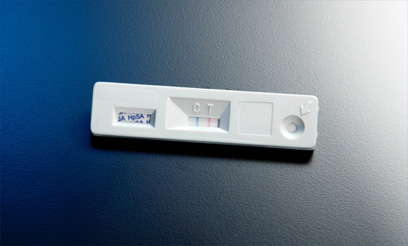

According to the Yahoo "Profile" on VIVO, the company

"...an integrated life science company, engages in the development, manufacture, sale, and distribution of diagnostic test kits primarily for respiratory, gastrointestinal, viral, and parasitic infectious diseases. The immunodiagnostic technologies used in its diagnostic test kits include enzyme immunoassay, immunofluorescence, particle agglutination/aggregation, immunodiffusion, complement fixation, and chemical stains."

How did they do in the latest quarter?

On April 19, 2007, Meridian Bioscience announced 2nd quarter 2007 results. Second quarter sales came in at $32.1 million a 14% increase over prior year same period results. Net earnings for the quarter came in at $5.88 million, an increase of 25% over the same period last year. Diluted earnings per share for the quarter were $.22/share, up 22% from last year's results. The company also raised its dividend to $.16/share, representing a 39% increase at $.64/share indicated, over last year's dividends.

The company also announced a 3:2 stock split in the same announcement. Strong earnings, raised dividends, and a stock split are in general a great recipe for continued strong stock price performance!

How about longer-term results?

Let's take another look at that Morningstar.com "5-Yr Restated" financials page! First of all we can see the steady picture of revenue growth from $59.1 million in 2002 to $108.4 million in 2006 and $112.2 million in the trailing twelve months (TTM).

Earnings have been a beautiful picture of consistent growth, with $.15/share reported in 2002, $.21 in 2003, $.27 in 2004, $.35 in 2005, $.45 in 2006 and $.49/share in the TTM.

Dividends have also been steadily been increasing with $.12/share in 2002, increasing to $.28/share in 2006, and $.31/share in the trailing twelve months (TTM). It is nice enough to have a dividend, something that I don't require, but find attractive, yet it is another level of performance to regularly increase that payment as well!

The company has slowly increased its float with 33 million shares in 2002 increasing to 39 million in 2006 and 39 million in the TTM. This represents a slightly less than 20% dilution by increasing shares during the time that revenue nearly doubled, earnings tripled and dividends more than doubled. This is an acceptable dilution from my perspective, representing a growth in shares, something that I prefer not to see, that is far less than the growth in revenue and the growth in earnings, and even the growth in the dividend payment!

Free cash flow has been positive and growing! The company reported $10 million in free cash flow in 2004, $16 million in 2005, $19 million in 2006, and $21 million in the TTM.

Finally, the balance sheet is pristine with $42.3 million in cash, enough to pay off both the $18.6 million in current liabilities and the $5.2 million in long-term liabilities almost 2x over! Combining the $42.3 million in cash and the $40.6 million in other current assets yields a total current assets of $82.9 million, which when divided by the $18.6 million in current liabilities yields a current ratio of 4.46, much higher than the minimum healthy level of 1.25.

This is really an incredible Morningstar.com page on this stock. And I am not just saying this because I own shares in this stock, which I do, but because of the numbers that show an incredible consistency in growth and financial strength!

What about some valuation numbers on this stock?

Reviewing the Yahoo "Key Statistics" on VIVO we can see that this stock is a small cap stock with a market capitalization of only $817.02 million. The trailing p/e is quite rich at 39.33, with a forward p/e of 29.39. The PEG (5 yr expected) is a bit better at 1.36 (acceptable imho is 1.0 to 1.5 on PEG).

Using the Fidelity.com eresearch website, we find that the company has a Price/Sales (TTM) of 6.96, much lower than the average of 28.09 in its industry. As measured by Return on Equity (TTM), the company is also more profitable than its peers with a ratio of 21.71%, compared to the industry average of 16.94% according to Fidelity.

Finishing up with Yahoo, we can see that there are 39.72 million shares outstanding with 32.71 million shares that float. Of these that float, there were 2.34 million shares out short as of 4/10/07, representing 6.2% of the float or 14.1 trading days of volume. This is a large number of shares sold short in anticipation of a decline in the stock price by these naysayers. With continued good news and the stock split, this represents a lot of potential buying pressure as the short-sellers get squeezed.

As noted above, the company has an annual dividend of $.43/share yielding a not-insignificant 2.10%, and last split its stock just days ago, with a 3:2 stock split on May 14, 2007.

What does the chart look like?

Let's take a look at a "Point & Figure" chart on VIVO from StockCharts.com. We can see how strong this chart is and how it almost appears to be reaccelerating from a consolidation period in July through August, 2006.

Summary: What do I think about this stock?

Well, needless to say, I own this stock, so please take that into consideration. However, the company is rather phenomenal for its consistency in delivering revenue growth, earnings growth, dividend growth, minimally increasing the stock float, increasing free cash flow and having a solid balance sheet. On the downside the stock is richly valued and shouldn't experience any mis-step or it is likely to be punished with a stock correction. However, if the company continues to generate good news, the abundance of short-sellers on this stock may well drive the stock higher as well. Finally the chart looks fine.

I like this stock a lot.

But you knew that already didn't you?

Have a great weekend! Thanks again for visiting my blog and be sure and leave a comment if you have any. You can drop me a line at bobsadviceforstocks@lycos.com if you get a chance or listen to my podcast at Stock Picks Bob's Advice Podcast Website if you are so motivated!

Regards to all of you!

Bob