Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

In general I have a very defined program for buying and selling shares based on the underlying performance of the stock in question. But simply put, Rollins (ROL) represented an over-weighted position in my trading account and I didn't like the way it was trading. In many ways, this is exactly the type of transaction I try to avoid, this gestalt approach to investing, but I have always reserved the right to make small adjustments to my account, including replacing a position, when it simply didn't seem to be trading well. For instance, the stock has been trading down when the market has been otherwise strong, and the chart looks vulnerable to a correction from my amateur perspective.

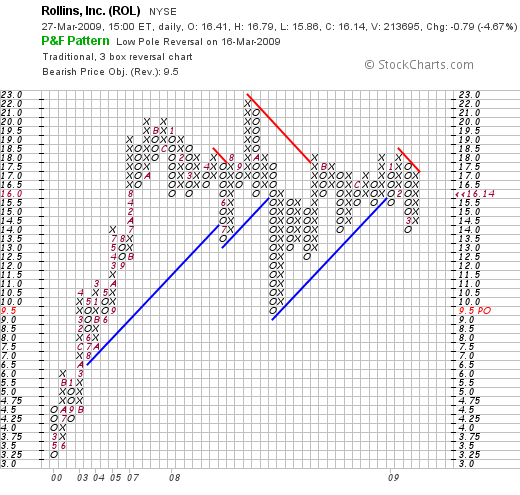

In fact, let's take a look at that 'point & figure' chart from StockCharts.com on Rollins (ROL):

This is more or less the third time the stock has broken through support levels and with the market now correcting from its recent bull move, it seemed like it might be a good time to step aside. Time will tell.

Certainly, the last quarterly report was good for Rollins (ROL)and the '5-Yr Restated' financials from Morningstar look solid except perhaps for a bit of a heavy load of current liabilities reported at $272.8 million, with $14 million in cash and $103 million in other current assets giving the current ratio a value of about .42 well under my own preferred current ratio of at least 1.0 or 1.5. Considering that the company is only generating $76 million in free cash flow for the past 12 months, from my own amateur perspective, this might mean that the company will need to be issuing shares or looking to borrow funds to cover these liabilities.

I didn't feel comfortable being overweighted in this company, and chose to switch into a new holding, Walgreen (WAG), which appeared to be outperforming the market today.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

I am a frequent visitor to my local Walgreen store, so it certainly is something I am familiar with. I am afraid that may sound a bit Peter Lynch, but this stock is also a stock that I first was introduced to as an investment via Gene Walden and his "The 100 Best Stocks to Own in America". Gene, wherever you are now, thank you for helping introduce me to some of the concepts that drive my own thinking today! For Walden, consistency of earnings, revenue growth, and even dividends was key. Walgreen (WAG) for years has been a steady performer and even in today's difficult retail and economic environment, still works to grow its presence across the United States and Canada.

Just four days ago, on March 23, 2009, Walgreen (WAG) reported 2nd quarter 2009 results. Revenue for the quarter came in at $16.48 billion up 7% over the prior year. More importantly they exceeded analysts' expectations of $16.42 billion. Earnings came in at $640 million or $.65/share. Excluding restructuring cost of $.06/share, that worked out to $.71/share and once again they managed to exceed analysts' expectations of $.66/share according to Thomson Reuters.

Interestingly, they reported a 4% increase in total prescriptions for the quarter as compared to an industry-wide decrease of 1%. Their prescription business is driving sales as same-store prescription revenue climbed 2.9% while "front-end sales" of merchandise actually fell 1.2% during this period. Really not too bad with the economic slowdown affecting retail sales.

Furthermore, it looks as if most of the damage to Walgreen (WAG) shares is at least for the time being done. If we look at the 'point & figure' chart on Walgreen (WAG) from StockCharts.com, we can see that the stock has shown strong support at the $22 range down from a plateau in the $48 to $50 range between 2005 and 2008. It appears, from my amateur perspective, to have had a triple bottom at that level.

If we examine the Morningstar.com '5-Yr Restated' financials on Walgreen (WAG), we see that the company shows a superb record of increasing revenue from $37.5 billion in 2004 to $59.0 billion in 2008 and $60.0 billion in the trailing twelve months (TTM). Earnings per share have also steadily increased from $1.31/share in 2004 to $2.17/share in 2008 only to dip slightly to $2.12/share in the TTM.

Dividends have been increased each year (a really nice finding if you can identify companies with this record) from $.18/share in 2004 to $.40/share in 2008 and $.42/share in the TTM. In addition, the company has been reducing outstanding shares from 1.03 billion in 2004 to 996 million in 2008 and 994 million in the TTM.

Free cash flow has decreased recently but is decidedly positive with $1.1 billion reported in 2006 and $588 million reported in the TTM. Unlike the balance sheet on Rollins (ROL) above, Walgreen (WAG) is reported to have cash of $866 million and $11.273 billion in other current assets. This total of $12.1 billion, when compared to the $8.5 billion in current liabilities yields a current ratio nearly at 1.5. The company does have an additional $2.9 billion in long-term liabilities per Morningstar.

According to the Yahoo "Key Statistics" on Walgreen (WAG), the company is a large cap stock with a market capitalization of $26.07 billion. The trailing p/e is a very reasonable 12.69 with a forward p/e (fye 31-Aug-10) estimated at an even nicer 11.52. The PEG works out to a very acceptable 1.1 level.

Thinking a little bit more of valuation of the company, referring to the Fidelity.com eresearch page on Walgreen, we can see that the Price/Sales works out to a nice 0.4 compared to the industry average of 1.00. In terms of profitability, the company is reported to have a Return on Equity (TTM) of 16.68%, slightly below the industry average of 18.35% according to Fidelity.

As already noted, there are 998 million shares outstanding per Yahoo, with 980.12 million that float. As of March 10, 2009, Yahoo reports that there were 23.39 million shares out short, but due to the large daily volume of 10.8 million, works out to a short interest ratio of only 2.1.

The company pays a forward annual dividend of $.45/share yielding 1.7%. Walgreen (WAG) last split their shares February 16, 1999, when they declared a 2:1 stock split.

Anyhow, I made the switch from Rollins (ROL) to Walgreen (WAG). In the process, I reduced my exposure from this relatively over-sized position to a smaller position similar to the size of my other holdings. I am still not real comfortable with the market. I am not convinced that the Geithner plan will yield quick results and that the worldwide economic challenges will be easily surmounted.

However, I am confident that my neighborhood Walgreen store will remain busy with their growing number of 24 hour pharmacies and extensive front-end merchandise!

Thanks again for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them right here on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Updated: Friday, 27 March 2009 6:21 PM CDT