Stock Picks Bob's Advice

Sunday, 23 March 2014

Ecolab (ECL) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please rememeber that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

On April 15, 2009, my Covestor Growth and Momentum Model (Originally called "Buy and Hold Value") was initiated as one of the first ten models on the Covestor website. Since that time, as of March 20, 2014, the Portfolio has returned an annualized 12.4% and during the past 365 days 20.1% slightly behind the S&P 500's 22.7% return.

Ecolab (ECL) is currently my top gainer in my Growth and Momentum Model on Covestor. It also is a favorite of mine on my blog where I last wrote it up on May 2, 2010, almost 4 years ago. I also commented on Ecolab on February 8, 2009 and previously commented on December 13, 2008. Clearly I like this stock! I like their business, their financial results, and the performance of their stock. Currently in my Covestor model I have an average cost of $66.29. Ecolab (ECL) closed at $110.73 on March 21, 2014, with a gain of $.69 or 0.63% on the day.

Ecolab (ECL) is currently my top gainer in my Growth and Momentum Model on Covestor. It also is a favorite of mine on my blog where I last wrote it up on May 2, 2010, almost 4 years ago. I also commented on Ecolab on February 8, 2009 and previously commented on December 13, 2008. Clearly I like this stock! I like their business, their financial results, and the performance of their stock. Currently in my Covestor model I have an average cost of $66.29. Ecolab (ECL) closed at $110.73 on March 21, 2014, with a gain of $.69 or 0.63% on the day.

According to the Yahoo "Profile" on Ecolab (ECL), the company

"... provides water, hygiene, and energy technologies and services for customers worldwide. The company operates in four segments: Global Industrial, Global Institutional, Global Energy, and Other. The Global Industrial segment provides water treatment and process applications,  and cleaning and sanitizing solutions primarily to large industrial customers within the manufacturing, food and beverage processing, chemical, mining and primary metals, power generation, pulp and paper, and commercial laundry industries. The Global Institutional segment offers specialized cleaning and sanitizing products to the foodservice, hospitality, lodging, healthcare, government and education, and retail industries. The Global Energy segment provides the process chemicals and water treatment needs of the petroleum and petrochemical industries in both upstream and downstream applications. The Other segment offers pest elimination, and kitchen repair and maintenance services."

and cleaning and sanitizing solutions primarily to large industrial customers within the manufacturing, food and beverage processing, chemical, mining and primary metals, power generation, pulp and paper, and commercial laundry industries. The Global Institutional segment offers specialized cleaning and sanitizing products to the foodservice, hospitality, lodging, healthcare, government and education, and retail industries. The Global Energy segment provides the process chemicals and water treatment needs of the petroleum and petrochemical industries in both upstream and downstream applications. The Other segment offers pest elimination, and kitchen repair and maintenance services."

On February 21, 2014, Ecolab reported fourth quarter 2013 results. For the quarter ended December 13, 2013, sales increased 17% to $3.6 billion compared to $3.04 billion in the prior year same period. Operating income for the quarter grew 19% to $471 million from $396 million the prior year. Diluted earnings per share increased 17% to $1.04 on an adjusted basis compared to prior year results of $.89/share. At the same time the company provided strong guidance for 2014 full-year earnings in the $4.10 to $4.20/share range representing a 16-19% increase for the year. Guidance for the first quarter 2014 was also shared and represented a strong 18-25% increase in earnings to the $.70-$.75 range. Overall a very nice report!

Reviewing the "5 years" financials on Morningstar for Ecolab, we can see that revenue has climbed from $5.9 billion in 2009 the $13.3 billion in 2013, Diluted earnings have grown from $1.74/share in 2009 to $3.16/share in 2013. Diluted shares have increased from 240 million in 2009 to 306 million in 2013.

Morningstar reports Total Current Assets of $4.7 billion compared to Total Current Liabilities of $3.5 billion for a calculated current ratio of 1.34. Free cash flow has increased from $398 million in 2009 to $898 million in 2013.

Reviewing some valuation numbers on Yahoo "Key Statistics" for Ecolab, we can see that the company is a large cap stock with a market capitalization of $33.3 billion. The trailing P/E is a bit rich at 35.04 but with continued growth expected carries a forward P/E (fye Dec 31, 201) of 22.97 yielding a PEG ratio of 1.85 still a bit rich with my preferred range being 1.0-1.5. Yahoo reports 300.77 million shares outstanding with 271.3 million that float. As of February 28, 2014, there were 2.4 million shares out short yielding a short interest ratio of 2.0 (below my own arbitrary 3 day rule for significance.)

Ecolab pays a forward annual dividend rate of $1.10 yielding 1.00%. (This is an increase from the trailing dividend of $1.01). The company has a payout ratio of 31% suggesting room for future dividend increases. The last stock split was a 2:1 split back on June 9, 2003.

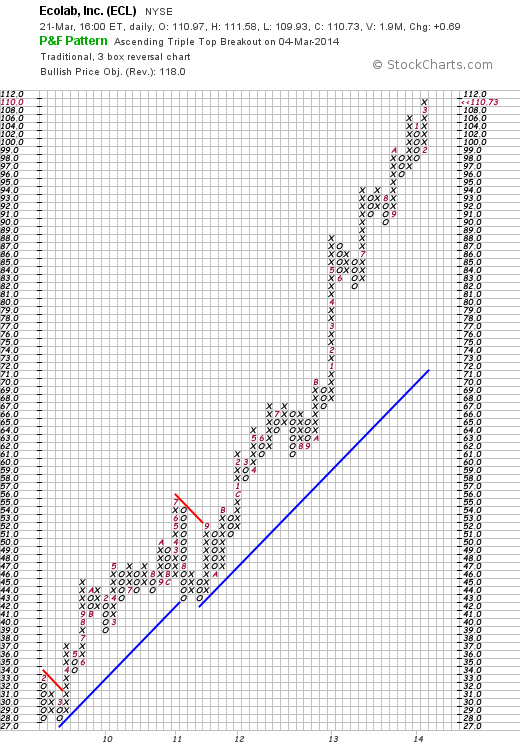

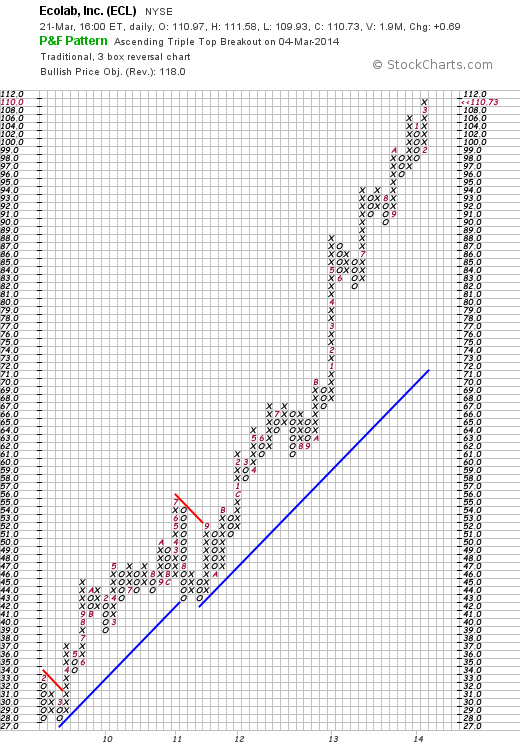

Technically, Ecolab has a beautiful chart as this Point & Figure chart from StockCharts.com demonstrates. From $28 a share in March, 2009, the stock has steadily climbed to its current lofty level of $110.73. If anything the stock has gotten a little ahead of itself but with continued strong earnings reports, I suspect this chart can be sustained.

In summary, Ecolab (ECL) has been a stock that has caught my attention here on this blog in the past. I do own shares of this stock in my Covestor Growth and Momentum Model where it has performed the strongest of my holdings.

They recently reported strong earnings, guided to a strong first quarter and year 2014, and have a terrific chart. They are a bit richly priced with a P/E in the mid 30's and a PEG just over 1.5. However the consistent financial results appear to be well worth the premium. I like the service industry that Ecolab finds itself where it is a bit of a competitor to another favorite of mine Sysco (SYY) which I shall need to revisit at another time!

To summarize Ecolab helps business clean things and this investor has been cleaning up with Ecolab.

If you have any comments or questions, please feel free to leave them here.

Yours in investing,

Bob

Saturday, 22 March 2014

The Covestor Healthcare Model Catches a Cold

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on this website.

Since October 6, 2010, I have been managing the Covestor Healthcare Model which has had a terrific performance to date! Since that time, the portfolio has returned an annualized 21.8% exceeding the S&P 500 during that time which returned 17.3% but slightly lagging the S&P 500 Healthcare Index which actually has returned 23.6% during the same period.

In fact, over the past 365 days, the portfolio as of Friday, March 21st was up 52.9% in a phenomenal run. That is until Friday when some of the top performers in my Model came under pressure when questions were raised in Congress regarding the cost of some of the more expensive treatments including the $84,000 12 week treatment for Hepatitis C.

Some of the high-fliers in my model that were hit hard include Alexion (ALXN) which closed at $159.79, down $13.87 (7.99)%, Biogen Idec (BIIB) which dipped $28.51 to close at $318.53 or (8.22)%, Gilead Sciences (GILD)down $3.46 to $72.07 or (4.57)%, Questcor Pharmaceuticals down $1.84 (2.87)% to $62.30, and Illumnia (ILMN) down $8.74 (5.42)% to $152.60.

With markets already skittish over the problems in the Ukraine, continued concerns about further Fed tapering and interest rate increases, and recent suggestions that the American economy is far from experienceing a robust recovery, and the S&P already near a record high, it didn't take much of a prod to get me to sell many of these terrific companies that had produced the terrific portfolio for my Covestor model.

I sold my Alexion (ALXN) shares of Friday 3/21/14 at $165.24, my Biogen Idec (BIIB) shares at $324.30, Gilead (GILD) at $71.40, Illumnia (ILMN) at $153.80, and Questcor (QCOR) at $61.91.

It is a big responsibility being a manager of a Covestor Model. Besides managing one's own holdings, one must be aware of the responsibility that a manager has to others who may be mirroring his or her moves. I remain committed to identifying investment opportunities while remaining very risk averse. As I have demonstrated, I am prepared to sell even some of my favorite stocks if I believe that the risks have grown beyond the opportunities presented. I know that some of my decisions will be wrong but over the long haul, I hope that I can continue to keep this portfolio performing in a respectful fashion.

After the above sales, the portfolio remains 70% in equities and only 30% in cash. Some of the stronger stocks in the portfolio include Actavis (ACT), the generic drug manufacturer, McKesson (MCK) the pharmaceutical distributor, StJude (STJ) the medical device manufacturer, and Amgen (AMGN), another biotech stock I have stayed with.

As the dust settles out, I am prepared to re-enter the market in many of the same names I just cut from the portfolio. The Covestor Healthcare Portfolio caught a bad cold Friday. I gave it my best treatment and hopefully this patient will be up and moving again next week.

Yours in investing,

Bob

Sunday, 19 January 2014

A New Covestor Model

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decision based on information on this website.

As many of the regular readers to this blog realize, I have had the opportunity to work with Covestor to establish models based on my own ideas for investing. My very first model to be available to the public was the Growth and Momentum Model which dates back to April 15, 2009, and had a great 2013 with a 37.8% appreciation. Since inception, this model has returned an average of 12.9% net of fees.

As many of the regular readers to this blog realize, I have had the opportunity to work with Covestor to establish models based on my own ideas for investing. My very first model to be available to the public was the Growth and Momentum Model which dates back to April 15, 2009, and had a great 2013 with a 37.8% appreciation. Since inception, this model has returned an average of 12.9% net of fees.

On October 6, 2010, my Healthcare Model was released on Covestor. By far this has been my best performer due to what I hope is good decisions on my part as well as simply having a portfolio in a very hot sector! In 2013, this model returned 49.8% (net of fees) beating the very strong S&P 500 Healthcare Index which returned 41.5% and the still strong S&P 500 which finished out the year with a 32.4% gain.

On December 26, 2011, Covestor launched my Sustained Momentum Model. This model was my first 'algorithmic investing' model. Although not implemented by a computer program, but rather by my own entered trade instructions, this portfolio is designed to invest in 10-12 of the top performing stocks within a larger group of approximately 50 stocks that I am monitoring. Simply put, I am investing and holding on to the top 10-12 stocks based simply on their past price momentum since I began monitoring them. This particular model includes strong stocks like Valeant Pharmaceuticals (VRX) and Johnson Controls (JCI) which have done quite well for me. In 2013, this model trailed the S&P 500 with a still strong performance of 27.6% (net of fees) behind the S&P 500 return of 32.4%.

This past week Covestor launched my fourth model, another algorithmic model, called the Large Cap Momentum Model. I sometimes have a hard time explaining and can imagine the questions regarding my Sustained Momentum Model. That is, what exactly is in the 50 stock portfolio I am monitoring, and how do I include or exclude stocks.

For this model I chose to start with the 100 stocks in the S&P 100 index itself. These are large cap stocks that are well known businesses and stocks. Placing them in a 'fantasy portfolio' I then started weighting them towards the strongest stocks in terms of price performance. Of these 100 stocks I created a real portfolio of the top 10-12 constitutents and this became the basis for the Large Cap Momentum Model.

Weighted Index Funds are big business. As this Wall Street Journal article points out, there are currently approximately $40 billion in exchange-traded-funds tracking alternative indexes. My own model is hardly an index fund holding only a fraction of the underlying S&P 100 stocks. But hopefully, it can over time outperform the underlying index.

I am well aware how difficult it is for a Mutual Fund to even beat the underlying market index. As this article points out:

"In 2012, 66.08 percent of all domestic equity mutual funds underperformed when matched against the S&P 1500. In 2011 a swollen 84.07 percent were laggards, while in 2010 “only” 57.63 did worse than the averages."

With the Large Cap Momentum Model, I am trying to keep up with and eventually exceed the underlying index using components of the same index. Wish me good luck!

Like Indiana Jones and the Last Crusade, I, like Harrison Ford in this movie, am in pursuit of the Holy Grail. That is to find the formula, the strategy, the approach that beats the underlying market. Larry Swedroe published a whole book on the futile nature of this pursuit. Count me in as a doubter. Meanwhile stay tuned.

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them right here on the website.

Yours in investing,

Bob

Saturday, 4 January 2014

Worthington Industries (WOR)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Reading news about the economic recovery in the United States, I came across Worthington Industries (WOR) and their recent good financial results. The stock has been trading quite well the past few days and I have given some thought to purchasing some shares. I do not own any shares of Worthington (WOR) at the time of writing but may well buy some shares if the opportunity presents. But first let me share with you more about Worthington and see if you will share my own enthusiasm.

Reading news about the economic recovery in the United States, I came across Worthington Industries (WOR) and their recent good financial results. The stock has been trading quite well the past few days and I have given some thought to purchasing some shares. I do not own any shares of Worthington (WOR) at the time of writing but may well buy some shares if the opportunity presents. But first let me share with you more about Worthington and see if you will share my own enthusiasm.

As I noted above, what drove the Worthington stock higher the last couple of weeks has been the 2nd quarter 2014 earnings report which at first glance showed a dip in second quarter earnings, however deducting one-time items, as this Zacks report demonstrates, results in a earnings result of $.57/share, a bit ahead of the $.56 expected by Zacks. Revenues for the quarter ended November 30, 2013, rose 24% over the prior year to $769.9 million well ahead of the Zacks estimate of $685 million. Gross margins also increased to 16.7% from 15.2% the prior year---altogether a very nice report.

Worthington closed at $42.71 on January 3, 2014, up $1.09 or 2.62% on the day.

By the way, let's take a look at what the company does! According to the Yahoo "Profile" on Worthington, the company

"...focuses on value-added steel processing and manufactured metal products in the United States, Canada, Europe, and internationally. It operates through three segments: Steel Processing, Pressure Cylinders, and Engineered Cabs."

"...focuses on value-added steel processing and manufactured metal products in the United States, Canada, Europe, and internationally. It operates through three segments: Steel Processing, Pressure Cylinders, and Engineered Cabs."

As this earnings review from the Investors Business Daily points out, Worthington is benefiting from its cooperative ventures in China with Nisshin Steel and Maruben-Itochu Steel to "make strip steel for the country's growing automotive industry." The Chinese auto industry, while slowing recently after red-hot growth, remains a strong growth industry and Worthington is set to benefit from this relationship.

Reviewing the Morningstar.com '5 Years Financials' for a longer term look at this company, we can see that the recent growth in revenue has been a change from a relatively flat revenue curve for this cyclical company. Revenue came in at $2.63 billion in 2009, dipped to $1.9 billion in 2010, and since then has rebounded back to the $2.64 billlion reported in the trailing twelve months (TTM). Diluted earnings per share have improved from a loss of $(1.37) in 2009, to $.57/share in 2010 and up to $2.18/share in the TTM. Outstanding shares have been reduced from 79 million in 2009 to 72 million in the TTM.

Morningstar reports $867 million in total current assets as of May, 2013, compared to total current liabilities of $449 million for a healthy current ratio of 1.93. Free Cash Flow dipped from $190 million in 2009 to a low of $50 million in 2011 and since then has strongly increased to $228 million in fiscal 2013 to $255 million in the TTM.

Looking at some valuation numbers on this stock, according to the Yahoo "Key Statistics" on Worthington, this is a mid-cap stock with a market capitalization of $2.95 billion. The trailing P/E is reported at 20.84 with a forward P/E (fye May 31, 2015) estimated at 14.93. With steady growth in earnings predicted to continue, the PEG works out to a reasonable 1.42. There are 69.14 million shares outstanding with only 38.42 million that float. As of December 13, 2013, Yahoo reports that there were 1.12 million shares out short resulting in a moderately significant short interest ratio of 3.4 days. (My own arbitrary 3 day rule for significance!)

The company pays a forward annual dividend of $.60 for a yield of 1.4%. They have room to raise their dividend with a payout ratio of only 26.0%. In fact as Worthington's fortunes have improved the last couple of years, they have indeed been increasing their cash payout.

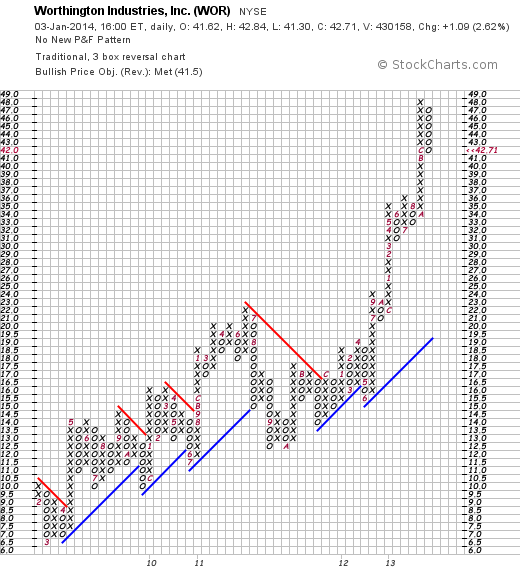

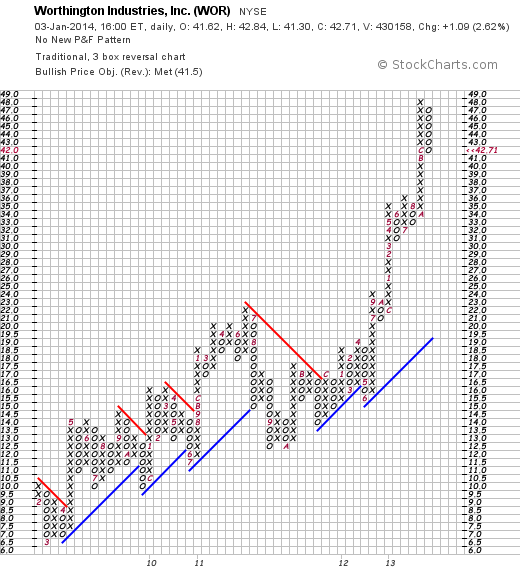

In terms of price performance, if we examine the 'point & figure' chart on Worthington from StockCharts.com, we can see that the stock has appreciated nicely from early 2009 until mid-2011 when it corrected from $23 to about $12.50. The stock since then has broken through resistance levels and has moved strongly higher to its current level of $42.71. (January 3, 2014)

In summary, Worthington is a cyclical steel manufacturer that has been benefiting from the economic recovery and has improved its future possibilities with recent investments in the Chinese steel market. They just reported a solid earnings report that exceeded expectations, they have been raising their modest dividend and valuation-wise they do not appear overpriced to me. Looking at their chart, we can see the impressive strength of the stock price. From my perspective this would be a great addition to my own portfolio.

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them here!

Wishing all of you a very healthy and prosperous 2014!

Yours in investing,

Bob

Sunday, 22 December 2013

Cintas (CTAS) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is often hard to believe that I have been blogging here on this website since May 12, 2003, over 10 years ago, when I wrote up my first entry St Jude Medical. For those of you who have become regular readers here, I thank you and hope that I have in some small way added to your own understanding of looking at stocks. I know that it has been a very useful experience for me giving me the experience of examining literally thousands of stocks right here and developing my own appreciation of 'good' and 'bad' investments. I do not claim to be more than an amateur seriously, but have learned quite a bit through this process.

It is often hard to believe that I have been blogging here on this website since May 12, 2003, over 10 years ago, when I wrote up my first entry St Jude Medical. For those of you who have become regular readers here, I thank you and hope that I have in some small way added to your own understanding of looking at stocks. I know that it has been a very useful experience for me giving me the experience of examining literally thousands of stocks right here and developing my own appreciation of 'good' and 'bad' investments. I do not claim to be more than an amateur seriously, but have learned quite a bit through this process.

In fact, I often come back to many of the same names over the years. These are the kind of stocks that I believe that Gene Walden, a favorite mentor of mine, might think worthy of inclusion in a 100 Best book of his. What these stocks represented were the companies that through wise management were able to offer America a product or service that could grow steadily over a long period of time and along with it, an appreciating stock price that would make holding shares worthwhile.

mentor of mine, might think worthy of inclusion in a 100 Best book of his. What these stocks represented were the companies that through wise management were able to offer America a product or service that could grow steadily over a long period of time and along with it, an appreciating stock price that would make holding shares worthwhile.

On July 15, 2005, I first wrote up Cintas (CTAS) when it was trading at $44.00/share. At that time I did not own any shares. On April 9, 2013, I purchased shares of Cintas (CTAS) at $44.49 in my Covestor Growth and Momentum Model which I manage on the Covestor Website. It is an interesting coincidence that I purchased shares years later when the stock was trading at virtually the same price. CTAS had a good day Friday, December 20, 2013, closing at $59.30 on a strong earnings report.

According to the Yahoo "Profile" on Cintas, the company

"...provides corporate identity uniforms and related business services for approximately 1 million businesses primarily in North America, Latin America, Europe, and Asia. The company operates in four segments: Rental Uniforms and Ancillary Products; Uniform Direct Sales; First Aid, Safety and Fire Protection Services; and Document Management Services."

Looking closer at that second quarter 2013 earnings report that I mentioned above, CTAS reported on December 20, 2013, that earnings came in at $.70/share, above the Zacks Estimate at 11.1% improvement over last year's $.63/share result. Revenue grew 7.9% from last year to $1.14 billion, also ahead of Zacks estimates. The company also raised guidance for the lower end of the range on both revenue for 2014 and earnings.

Reviewing longer-term results, the Morningstar 5 Years Financials shows that Cintas has grown its revenue from $3.78 billion in 2009 to $4.31 billion in 2013 and $4.39 billion in the trailing twelve months (TTM). Diluted earnings per share actually dipped from 2009 at $1.48/share to $1.40/share in 2010. However, since then earnings have steadily grown to $2.52 in 2013 and $2.56 in the TTM. Outstanding shares have declined as the company repurchased shares with 153 million shares in 2009 declining to 124 million shares in the TTM.

Morningstar reports the company's balance sheet as of May, 2013, showing $1.63 billion in current assets and $556 million in total current liabilities yielding a current ratio of 2.93. Free cash flow per Morningstar has been positive and steady with $363 million in free cash flow as of 2009 and $354 million in free cash flow in the TTM.

Examining some valuation numbes on Cintas as reported on the Yahoo "Key Statistics", we find that Cintas Corporation (CTAS) is a mid cap stock with a market capitalization of $7.11 billion. The trailing P/E is a moderat 22.71. Forward P/E is better (fye May 31, 2015 estimated) at 19.38. But the PEG ratio still remains somewhat rich at 2.01. Yahoo reports 119.82 million shares outstanding with 99.82 million that float. As of November 9, 2013, there were 6.89 million shares out short. Considering the average daily volume of 557,398 (past 3 months), this works out to a short interest ratio of 18.60. This is well above my own arbitrary '3 day rule' for significance. Thus, this past Friday when the company reported solid earnings (as discussed above), the stock climbed sharply. One can only wonder whether a bit of a 'short squeeze' was in action.

Cintas pays a forward dividend of $.77 with an estimated yield going forward of 1.30%. The company has a payout ratio of 29% suggesting some room for dividend boosts going forward. Cintas last split its stock in the form of a 3:2 stock split on March 8, 2000.

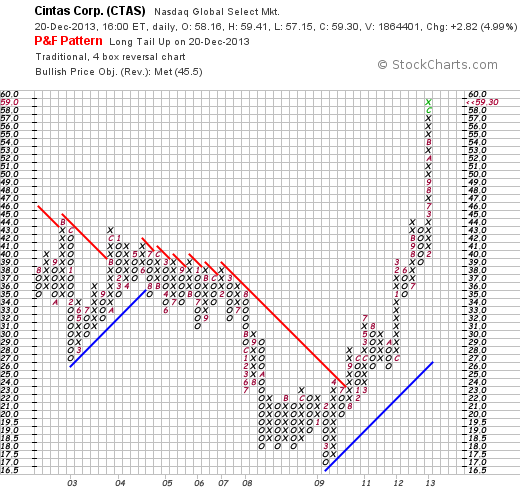

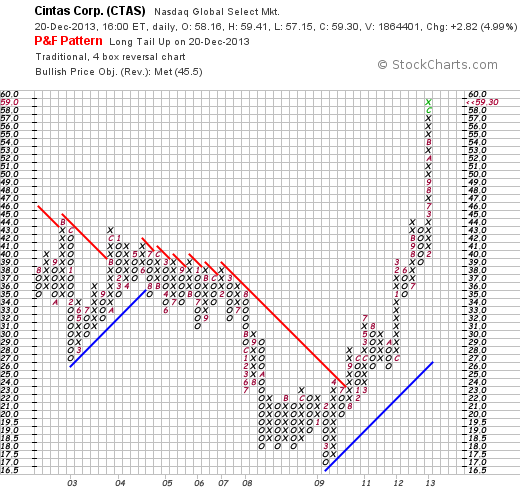

Over the years I have learned that one of the safest stocks to purchase was one in which the chart showed strength, which for me is a chart showing stock price appreciation. Looking at the Point & Figure Chart from StockCharts.com on Cintas, we can see that the stock price dipped after my initial write-up in 2005. In fact looking back at my own comments I wrote:

" I see what looks like a long-term declining trend in stock price from $56, all the way back in May, 2002, to the $44 level where it closed today. What concerns me is what appears to be a series of declining highs, but the recent move breaking through a resistance level is moderately encouraging. Certainly the stock chart is not ahead of itself, and I wouldn't call this one over-extended. Yet the question remains whether this shows any significant upward momentum at all!"

It certainly wasn't a good price entry back in 2008 and the chart looked awful! The chart looks much stronger today! Since dipping to as low of $17 in March, 2009, this stock has been on a tear climbing to its current levle of $59.30.

To summarize, Cintas is now a holding in one of my Covestor models, and has been showing price appreciation since purchase six months ago. The company has been steadily growing its uniform and business support enterprise with steady increases in revenue and earnings while gradually decreasing its outstanding shares. The company has a strong balance sheet and continues to generate solid free cash flow. In addition, the company pays a modest dividend.

The company is a bit richly priced based on P/E and PEG values so it may have gotten a little ahead of itself in terms of a new purchase. The chart is quite strong and there are lots of shares out short betting against the stock meaning they will need to be covered if the stock remains strong.

Thank you again for stopping by and a special thank you to the loyal visitors who have stopped by here year after year! Wishing you all the best of health and good fortune in 2014.

Yours in investing,

Bob

Saturday, 14 December 2013

Alexion Pharmaceuticals (ALXN)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

On December 9, 2013, I purchased shares of Alexion Pharmaceuticals (ALXN) for my Covestor Healthcare Model at a cost of $126.24. ALXN closed Friday, 12/13/14 at $123.69, up $1.34 or 1.10% on the day yet is still trading at a couple of dollars below my own purchase price. Let's take a closer look at this stock and see if it remains a promising investment for my portfolio.

On December 9, 2013, I purchased shares of Alexion Pharmaceuticals (ALXN) for my Covestor Healthcare Model at a cost of $126.24. ALXN closed Friday, 12/13/14 at $123.69, up $1.34 or 1.10% on the day yet is still trading at a couple of dollars below my own purchase price. Let's take a closer look at this stock and see if it remains a promising investment for my portfolio.

According to the Yahoo.com "Profile" on Alexion, the company is

"...a biopharmaceutical company, engages in the development and commercialization of life-transforming therapeutic products. The company offers Soliris (eculizumab), a therapeutic product for the treatment of patients with paroxysmal nocturnal hemoglobinuria (PNH), a blood disorder; and atypical hemolytic uremic syndrome (aHUS), a genetic disease. It also conducts Phase IV clinical trails on Soliris for its usage for the treatment of PNH  registry, and aHUS for pediatric and adult; and various Phase II clinical trails for its usage for the treatment of PNH pediatric trial, cold agglutinin disease, MPGN II/C3 nephropathy, hemolytic uremic syndrome, presensitized renal transplant, delayed kidney transplant graft function, ABO incompatible renal transplant, neuromyelitis optica, and myasthenia gravis. In addition, the company develops Asfotase alfa that is under Phase II clinical trail for the treatment of metabolic disorders, including hypophosphatasia; ALXN 1102/1103, which is in Phase I trial for PNH; and ALXN 1007, a novel humanized antibody for treating inflammatory disorders. Further, the company conducts preclinical trails on cPMP for treating metabolic disorders."

registry, and aHUS for pediatric and adult; and various Phase II clinical trails for its usage for the treatment of PNH pediatric trial, cold agglutinin disease, MPGN II/C3 nephropathy, hemolytic uremic syndrome, presensitized renal transplant, delayed kidney transplant graft function, ABO incompatible renal transplant, neuromyelitis optica, and myasthenia gravis. In addition, the company develops Asfotase alfa that is under Phase II clinical trail for the treatment of metabolic disorders, including hypophosphatasia; ALXN 1102/1103, which is in Phase I trial for PNH; and ALXN 1007, a novel humanized antibody for treating inflammatory disorders. Further, the company conducts preclinical trails on cPMP for treating metabolic disorders."

As you can see, there is little "Peter Lynch" about an investment in Alexion (ALXN) or other similar biotech companies. Investors are dependent on other analysts who may well be able to measure the potential of drugs like eculizumab unlike a company like Coca-Cola (KO) in which an investor could at least try a little over ice!

It is true that Alexion (ALXN) just entered into a voluntary recall of a couple of lots of its Soliris medication. However, this appears to be a short-term blip in this drug's sales. Recently, additional clinical evidence for the utility of Soliris for patients with atypical hemolytic uremic syndrome (aHUS) was presented at the American Society of Hematology. Alexion plays a key role in this rare but life-threatening disorder.

In terms of the latest quarterly results, Alexion (ALXN) reported third quarter 2013 results on October 24, 2013. Sales for the quarter increased 36% to $400.4 million compared to sales of $294.1 million the prior year. GAAP net income increased to $93.8 million or $.47/share compared to $92.2 million or $.46/share the prior year. These results exceeded expectations on both earnings and revenue as had been forecast by Zacks.

In terms of a longer-term view, we can see from the Morningstar.com 'financials' on Alexion that the company has rapidly grown revenue from $259 million in 2008 to $1.13 billion in 2012 and $1.43 billion in the trailing twelve months (TTM). Diluted earnings which spike from $.20/share in 2008 to $1.63/share in 2009, dipped back to $.52/share in 2010. However, since 2010, they have steadily climbed reaching $1.28/share in 2012 and $1.77/share in the TTM. During this time, Alexion has grown its shares outstanding modestly from 180 million shars in 2008 to 199 million in 2012 and in the TTM.

According to the Morningstar Balance Sheet numbers on Alexion, the company appears extremely solvent with current assets of $1.50 billlion compared to only $360 million in current liabilities, yielding a current ratio of 4.16.

Looking at the free cash flow history on Morningstar, we can see that the company has been generating a growing amount of free cash with $5 million reported in 2008, $389 million in 2012 and $365 million in the TTM.

In terms of valuation, Alexion (ALXN) is a large cap stock with a market capitalization of $24.25 billion according to the Yahoo "Key Statistics" on this stock. The trailing P/E is a very rich 69.96 (compared to the S&P 500 which currently trades with a P/E of 19.9!) However it is always important for an investor to consider what the future holds for a stock not just where it is now. In other words, if we take into consideration anticipated growth of earnings, the PEG ratio is much more down to earth with a level of 1.60 (5-yr expected).

Yahoo reports that the company has 196.3 million shares outstanding with only 1.07% held by insiders. As of October 31, 2013, there were 3.3 million shares out short and with average volume of 1.1 million shares traded, this yields a short interest ratio of 3.00--right at my own arbitrary cut-off for significance. No dividends are paid and the last stock split was on May 23, 2011, when the company declared a 100% stock dividend effecting a 2:1 stock split.

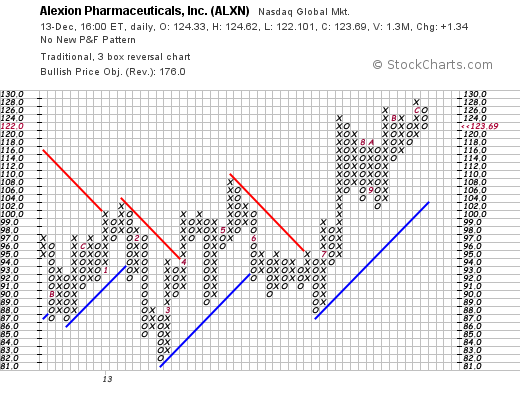

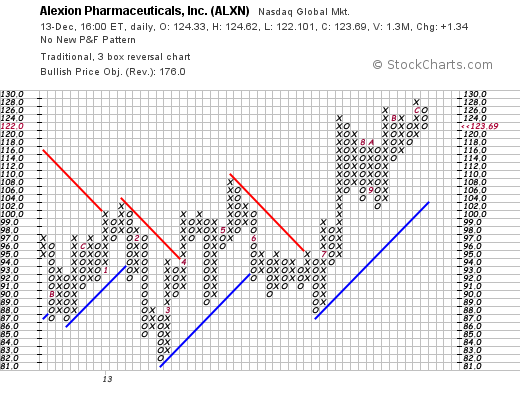

Examining the 'point & figure' chart from StockCharts.com on Alexion, we can see that the stock has demonstrated fairly significant price volatility in 2013 but has climbed from a low of $82 to a high of $128 earlier this month closing 12/13/13 at $123.69. Overall the chart looks strong and heading higher from my own amateur perspective!

In conclusion, I recently purchased Alexion Pharmaceuticals (ALXN) for my Covestor Healthcare Model that I manage and personally own the portfolio upon which it is based. Alexion has been growing rapidly selling orphan drugs for deadly diseases and has recently demonstrated additional evidence that its treatment is effective. Soliris has the dubious distinction of being one of the world's most expensive medications costing a patient about $400,000/year for treatment. The company has fundamental strength, technical price strength and hopefully will become a strong holding within my own portfolio.

Thank you again for visiting my blog. If you have any comments or questions, please feel free to leave them right here on the website.

Yours in investing,

Bob

Sunday, 8 September 2013

Prestige Brands (PBH)

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on this website.

I don't spend a lot of time talking about how I got interested in investing years ago, but I give credit mostly to my father, the late Lt. Col. Sumner Freedland, who taught me to look at labels, read stock prices, and buy equities. I purchased my first shares 46 years ago this month and have followed the market since.

I don't spend a lot of time talking about how I got interested in investing years ago, but I give credit mostly to my father, the late Lt. Col. Sumner Freedland, who taught me to look at labels, read stock prices, and buy equities. I purchased my first shares 46 years ago this month and have followed the market since.

In his own Peter Lynch style, my father like to invest in things he understood. I remember that his favorite investments were AT&T (T) (way prior to the spin off of all of the 'baby bells'), and Merck (MRK). He used to enjoy showing me all of his stock certificates and the many splits he had received over the years. He convinced me!

Like my father, I occasionally get on what might be called 'health kicks'. I have been convinced of the helpfulness of Vitamin D in the diet and take a supplement, I take some Omega 3's (being aware of recent controversy about Omega 3's and Prostate Cancer), and I use a fiber supplement for those benefits.

I will attest to greater compliance attributable to gummies even as an adult. I am not put off by another pill or two to swallow when given the alternative of a good tasting gummy instead! There are some anecdotal suggestions that compliance in vitamin regimens will be improved as the vitamins are available in a pleasant tasting form.

Two of the brand names that I consume include vitafusion for multiple vitamins and Fiber Choice for a fiber supplement. It turns out that vitafusion is produced by Northwest Natural Products which is now owned and produced by another one of my favorite companies, Church & Dwight (CHD). However, Fiber Choice is now owned by Prestige Brands (PBH). In some ways this is a 'revisit' of a stock pick because the original owner of Fiber Choice was a company CNS (CNXS) that I reviewed back in April, 2005.

Two of the brand names that I consume include vitafusion for multiple vitamins and Fiber Choice for a fiber supplement. It turns out that vitafusion is produced by Northwest Natural Products which is now owned and produced by another one of my favorite companies, Church & Dwight (CHD). However, Fiber Choice is now owned by Prestige Brands (PBH). In some ways this is a 'revisit' of a stock pick because the original owner of Fiber Choice was a company CNS (CNXS) that I reviewed back in April, 2005.

On October 16, 2005, GlaxoSmithKline (GSK) announced its purchase of CNS, Inc. for $566 million. In December, 2011, GlaxoSmithKline sold 17 over-the-counter medicines to Presige Brands Holdings (PBH) where Fiber Choice ended up today. Thus the circuitous route of this supplement to my medicine cabinet!

I do not currently own any shares of Prestige Brands (PBH) although I briefly held some shares this past month but sold them as the market weakened. Prestige Brands closed at $31.81 on September 6, 2013.

According to the Yahoo "Profile" on PBH, the company

"....through its subsidiaries, engages in the marketing, sale, and distribution of over-the-counter healthcare and household cleaning products in North America and internationally. It operates through two segments, Over-The-Counter Healthcare and Household Cleaning. The Over-The-Counter Healthcare segment offers a portfolio of OTC products under 14 primary OTC brands, including Chloraseptic sore throat remedies, Clear Eyes eye drops, Compound W wart removers, Little Remedies pediatric healthcare products, The Doctor’s brand of oral care products, Efferdent and Effergrip denture products, Luden's cough drops, PediaCare pediatric healthcare products, Dramamine motion sickness products, BC and Goody's Analgesic powders, Beano gas prevention, Gaviscon antacids, and Debrox ear drops. The Household Cleaning segment markets household cleaning products, such as Chore Boy scrubbing pads and sponges; Comet abrasive powders, creams, liquids, and non-abrasive sprays; and Spic and Span dilutables, sprays for counter tops, glass cleaners."

On August 1, 2013, Prestige Brands Holdings (PBH) announced 1st quarter 2014 results. Adjusted revenue for the quarter actually dipped 1.9% to $143.0 million from last year's $145.8 million. Net income, however, came in at $20.7 million or $.40/diluted share, up 41.2% from the prior year's result of $14.7 million or $.29/diluted share. Analysts had been expecting $.38/share which the company beat, but they had also expected revenue of $147.1 million below expectations. Altogether, a bit of a mixed quarter.

Reviewing the Morningstar.com financials on Prestige Brands Holding (PBH), we can see that revenue has grown from $313 million in 2009, dipping to $302 million in 2010, then steadily climbing to $624 million in 2013 before the dip to $620 million in the latest twelve months (TTM).

Diluted earnings per share have improved from a loss of $(3.74) in 2009 to $1.27 in 2013 and $1.38 in the TTM. During this period outstanding shares have been fairly constant at 50 million in 2009 increasing to 51 million in 2013 and 52 million in the TTM.

Free cash flow has improved from $66 million in 2009, dipping to $59 million in 2010, and increasing to $127 million in 2013 and $135 million in the TTM.

In terms of a simplified view of the balance sheet, Morningstar reports PBH with $164 million in current assets as of March, 2013, and $97 million in total current liabilities. This results in a healthy current ratio of 1.69.

Looking at the Yahoo "Key Statistics" on Prestige Brands to get a feel for some valuation numbers, we can see that the stock is a small cap stock with a market cap of $1.63 billion. The trailing P/E is moderate at 23.05 with a forward P/E (fye Mar 31, 2015) a little better at 17.29. Still the growth rate is expected to fail to reduce the PEG into what I would consider a reasonable range (under 1.5) with a current PEG reported at 1.95.

Prestige Brands has 51.17 million shares outstanding with 50.81 million that float. Currently there is a modest number of shares out short reported to be 442,730 shares as of August 15, 2013. This results in a similarly modest short interest ratio of 1.60. (Generally I use 3.0 days to cover as suggestive of significance---my own arbitrary cut-off.) The company does not pay a dividend and no stock splits are reported on Yahoo.

Examining the 'point & figure' chart on PBH from StockCharts.com, we can see what appears to be a very strong technical chart with a sharp ascent in stock price from early 2009 when it was trading at around $4.25 to its current level of $31.81. Currently the stock is consolidating but appears (if I may be free to speculate here) that the stock is poised to move higher.

In summary, this stock market idea took a circuitous route from my bathroom medicine cabinet to this blog! Prestige Brands, a little like Church & Dwight (CHD), is putting together a large group of familiar household brands and is doing so without an excessive increase in outstanding shares or excessive debt. In addition, as this Motley Fool article points out, they are generating plenty of free cash flow that can be used for enhancement of shareholder value or perhaps a dividend (?) down the road.

The stock appears to be fairly fully priced but does have a very strong chart as well making it attractive from my perspective. I do not own any shares, but this one certainly is on my horizon and I hope to revisit this as a shareholder in the future.

Thank you again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them here and I shall try to respond the best I can.

Yours in investing,

Bob

Wednesday, 26 June 2013

Heartland Payment Systems (HPY)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the market's recent correction, I found myself selling a couple of recent purchases including Interxions Holdings NV (INXN) after accruing a small loss after my initial purchase in my Covestor Growth and Momentum Model. However, with the stock market rebounding on realization that the sky was indeed not falling, I found myself looking around for a new position and decided upon Heartland Payment Services (HPY). On June 25, 2013, I picked up shares of Heartland Payment Systems (HPY) at a cost of $34.46. HPY closed at $35.96 on 6/26/13, up $1.50 or 4.35% on the day. Thus far, it has been a good purchase for the portfolio.

With the market's recent correction, I found myself selling a couple of recent purchases including Interxions Holdings NV (INXN) after accruing a small loss after my initial purchase in my Covestor Growth and Momentum Model. However, with the stock market rebounding on realization that the sky was indeed not falling, I found myself looking around for a new position and decided upon Heartland Payment Services (HPY). On June 25, 2013, I picked up shares of Heartland Payment Systems (HPY) at a cost of $34.46. HPY closed at $35.96 on 6/26/13, up $1.50 or 4.35% on the day. Thus far, it has been a good purchase for the portfolio.

According to the Yahoo "Profile" on HPY, the company

"...provides bankcard payment processing services in the United States  and Canada. It facilitates the exchange of information and funds between merchants and cardholder’s financial institutions; and offers end-to-end electronic payment processing services, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support, and risk management to merchants. The company also provides other merchant services comprising payroll processing, gift and loyalty programs, and prepaid and stored-value solutions; paper check processing; payroll and related tax filing services; and secure point-of-sale solutions, as well as sells and rents point-of-sale devices and supplies."

and Canada. It facilitates the exchange of information and funds between merchants and cardholder’s financial institutions; and offers end-to-end electronic payment processing services, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support, and risk management to merchants. The company also provides other merchant services comprising payroll processing, gift and loyalty programs, and prepaid and stored-value solutions; paper check processing; payroll and related tax filing services; and secure point-of-sale solutions, as well as sells and rents point-of-sale devices and supplies."

On April 30, 2013, Heartland Payment Services announced 1st quarter 2013 results. Revenue came in at $501.2 million, up 7% from the prior year's $467.6 million. This was slightly under analysts expectations of $511.5 million. Earnings, however, came in at $.41/share (after stock-based compensation and other items) ahead of analysts' expectations of $.40/share. Net income climbed 42% year-over-year to $19.6 million or $.51/share compared to the prior year result of $13.8 million or $.34/share.

The company also raised guidance for 2013 results to adjusted earnings between $2.29 and $2.33/share ahead of analysts who had been expecting earnings of $1.94/share. All-in-all a very solid report in a relatively weak economic environment.

Longer-term, reviewing the Morningstar.com "Financials" on Heartland Payment Systems, we can see that revenue has grown steadily from $1.54 billion in 2008 to $2.013 billion in 2012 and $2.047 billion in the trailing twelve months (TTM). Operating income came in at $71 million in 2008 then dipped to $46 million in 2010 then rebounded strongly to $78 million in 2011, $110 million in 2012 and $114 million in the TTM.

Similarly earnings per share dipped from $1.08 in 2008 to a loss of $(1.38) in 2009, then rebounded sharply to $.88/share in 2010, $1.09/share in 2011, $1.64/share in 2012 and $1.81/share in the TTM.

Looking at the HPY "Balance Sheet" figures from Morningstar.com, this company is reported to have total current assets of $409 million and total current liabilities of $495 million, yielding a Current Ratio of .83, a bit below a minimum of 1.0 suggesting that the company might have some financial stress meeting current obligations. Free cash flow of $106 million in the TTM however suggests that the company is generating enough cash to pay its current obligations and also pay a dividend. In fact, the company has been paying a dividend since 2006 and has been raising iton a regular basis as this payment history reflects.

In terms of valuation, examination of some of the Yahoo "Key Statistics" on Heartland reveals that the company is a small cap stock with a Market Capitalization of only $1.31 billion. The trailing P/E is a moderate 19.77 with a forward P/E (fye Dec 31, 2014) estimated at 16.35. With its rapid growth in earnings, the "G" in the PEG ratio is large enough that the PEG ratio works out to a modest 1.13.

Yahoo reports only 36.33 million shares outstanding with 35.02 million that float. As of May 31, 2013, there were 9.54 million shares out short creating a very significant short interest ratio of 13.20. (Generally I arbitrarily view 3 days as my own 'cut-off' for significance). With good news and an increasing stock price, we may be setting the stage for a 'squeeze' on short-sellers of this stock. As a holder of these shares, one can only hope!

Heartland Payment Systems (HPY) pays a forward estimated dividend of $.28/share with a modest yield of 0.80%. This is ahead of the trailing dividend of $.26/share. No stock splits are reported on Yahoo.

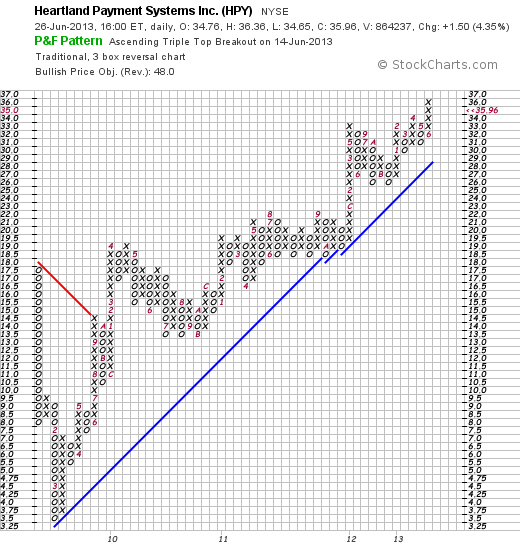

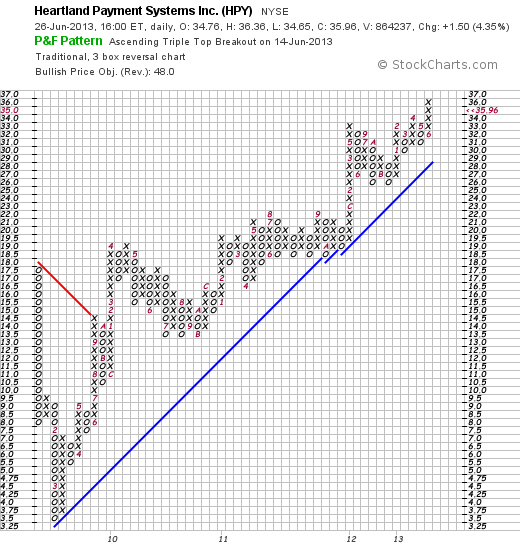

Examining the 'point and figure' chart on HPY from StockCharts.com, we can see that after a sharp sell-off in early 2009 from $17.50/share to a low of $3.50/share in February, 2009, HPY has had a remarkable record of price appreciation to its current level of $35.96. This is a very strong technical chart in my amateur perspective.

If we put this all together we have an interesting company involved in credit card processing and online payment processing for businesses that recently reported a strong quarter that while coming in a bit under expectations in terms of revenue, exceeded analysts' views in terms of earnings. The company confidently raised guidance for the year ahead of what was expected. This all done in a relatively weak economic environment.

Looking at some of the financials from Morningstar, the company has grown its revenue and earnings in a very strong fashion the past few years. Their current ratio is a bit weak which deserves some attention but the strong free cash flow and the confidence the company has demonstrated with boosting its cash dividend and expanding its share buyback, suggest that this isn't very significant. Furthermore, the valuation is really modest with the strong growth in earnings giving us a PEG just over 1.0. To top it off, there are a lot of naysayers outstanding with a large short interest ratio suggesting lots of shares that are waiting to be covered with purchases likely to support the stock price appreciation.

There aren't any perfect stocks. I suppose like there aren't any perfect investors. Yours truly included. I also get anxious as markets decline and confess to occasional euphoria as they climb. I will maintain my discipline of selling stocks, even ones like this, if they do decline in the market to limit my losses. However, if we as investors can get a bit lucky and get ahead of the stock price we may be able to ride a stock higher as it grows hopefully for a very long time.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here.

Yours in investing.

Bob

Monday, 17 June 2013

Medtronic (MDT)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my recent purchases for my Covestor Healthcare Model is Medtronic, Inc. (MDT). I purchased shares May 1, 2013, at an effective cost of $47.00. Medtronic closed at $53.51, up $.59 or 1.11% on the day (June 17, 2013). This is already a strong performer in my portfolio.

One of my recent purchases for my Covestor Healthcare Model is Medtronic, Inc. (MDT). I purchased shares May 1, 2013, at an effective cost of $47.00. Medtronic closed at $53.51, up $.59 or 1.11% on the day (June 17, 2013). This is already a strong performer in my portfolio.

Being located in the midwest, I am always proud of America's most innovative companies originating in the 'heartland'. Medtronic is headquartered just north of Minneapolis in the city of Fridley.

Medtronic has a classic history of American innovation. As the Medtornic website relates:

"Today, we are the world's largest medical technology company, but we come from humble beginnings. Medtronic was founded in 1949 as a medical equipment repair shop by Earl Bakken and his brother-in-law, Palmer Hermundslie.

"Today, we are the world's largest medical technology company, but we come from humble beginnings. Medtronic was founded in 1949 as a medical equipment repair shop by Earl Bakken and his brother-in-law, Palmer Hermundslie.

Did these two men set out to change medical technology and the lives of millions of people? No. But they did have a deep moral purpose and an inner drive to use their scientific knowledge and entrepreneurial skills to help others."

According to the Yahoo "Profile" on Medtronic, the company

"...provides products to diagnose, treat, and manage heart rhythm disorders and heart failure, including implantable cardiac pacemakers, implantable cardioverter defibrillators, cardiac resynchronization therapy devices, arctic front cardiac cryoablation catheters, arctic front cardiac cryoablation catheters, and patient management tools. The company also offers cardio vascular products, such as percutaneous coronary intervention device that is used to treat  patients with coronary artery disease; renal denervation for the treatment of chronic uncontrolled hypertension; endovascular stent grafts to treat abdomen and thoracic regions of the aorta; peripheral vascular intervention that encompasses various procedures to treat patients with peripheral vascular disease; surgical valve replacement and repair products for damaged or diseased heart valves; transcatheter heart valves; a line of blood-handling products used in arrested heart surgeries; positioning and stabilization technologies that assist physicians performing beating heart surgery; and surgical ablation system, which allows cardiac surgeons to create ablation lines during cardiac surgery. In addition, it provides medical devices and implants that are used in the treatment of the spine and musculoskeletal system comprising thoracolumbar, cervical, and biologics products; neurostimulators for chronic pain, implantable drug delivery systems, and deep brain stimulation systems, as well as urology, fecal, and gastroenterology devices; and integrated diabetes management solutions. Further, the company offers products and therapies to treat diseases and conditions of the ear, nose, and throat, as well as certain neurological disorders; and image-guided surgery and intra-operative imaging systems."

patients with coronary artery disease; renal denervation for the treatment of chronic uncontrolled hypertension; endovascular stent grafts to treat abdomen and thoracic regions of the aorta; peripheral vascular intervention that encompasses various procedures to treat patients with peripheral vascular disease; surgical valve replacement and repair products for damaged or diseased heart valves; transcatheter heart valves; a line of blood-handling products used in arrested heart surgeries; positioning and stabilization technologies that assist physicians performing beating heart surgery; and surgical ablation system, which allows cardiac surgeons to create ablation lines during cardiac surgery. In addition, it provides medical devices and implants that are used in the treatment of the spine and musculoskeletal system comprising thoracolumbar, cervical, and biologics products; neurostimulators for chronic pain, implantable drug delivery systems, and deep brain stimulation systems, as well as urology, fecal, and gastroenterology devices; and integrated diabetes management solutions. Further, the company offers products and therapies to treat diseases and conditions of the ear, nose, and throat, as well as certain neurological disorders; and image-guided surgery and intra-operative imaging systems."

Medtronic (MDT) has been a favorite on my blog. I first wrote up Medtronic on November 13, 2003 (excuse the typo on the entry that says incorrectly 2002). I then revisited this stock pick on November 29, 2009. One has to be impressed with the wide breadth of medical technology products coming out of this company and the continued innovation. In fact, in 2010 Medtronic was recognized by the Massachusetts Institute of Technology Review as one of the 50 most innovative companies in the world.

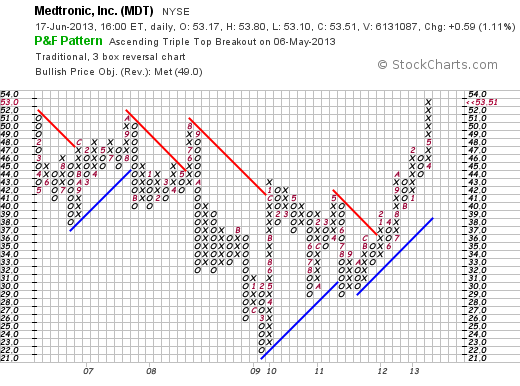

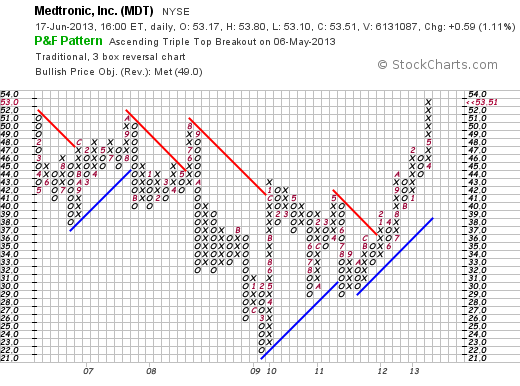

What really attracted me to the company last month was the strong technical strength of the stock as it began to clear past stock price 'highs' set in 2007 and 2008. As this StockCharts.com 'point & figure' chart shows, the company has had a superb performance since bottoming out at about $21 in March, 2009, and has moved strongly ahead, at first with a sharp correction in May, 2011.

To be sure, Medtronic (MDT) has found itself embroiled in controversy over the years with the Medtronic Infuse scandal being typical as accusations of payments from Medtronic to investigators publishing review articles. In May, 2012, the Department of Justice closed their investigation of Medtronic without finding any wrongdoing in regards to the Infuse Bone Graft product. For the most part this 'overhang' of litigation that has suppressed the stock price, from my perspective, has been removed. However, trial attorneys are still seeking plaintiffs for continued litigation against the company. In any case, the above chart suggests that investors have breathed a collective sigh of relief with the Justice Department decision and the company stock appears to be continuing to appreciate to multi-year highs.

Part of the continued bump in the stock price has been the company's latest financial results. On May 21st Medtronic (MDT) reported 4th quarter results. Net income came in at $969 million, or $.96/share ahead of last year's $991 million or $.94/share. Sales also grew to $4.46 billion against last year's $4.3 billion. Adjusted earnings were $1.10/share ahead of analysts' estimated $1.03 in earnings. Sales also exceeded expectations of $4.38 billion. The company raised guidance for revenue to $17.1 billion to $17.3 billion in 2014 ahead of FactSet estimates of $16.9 billion.

Reviewing the Morningstar.com financials on MDT, we can see that Medtronic is continuing to grow its revenue with $13.5 billion reported in 2008 increasing to $16.2 billion in 2012 and $16.4 billion in the trailing twelve months (TTM). More recently the rate of revenue growth has decreased from rates of growth between 2008-2010.

Diluted earnings per share have grown from $1.95/share in 2008 to $3.41 in 2012 and a slight dip to $3.38 in the TTM. Outstanding shares have steadily decreased from 1.14 billion in 2008 to 1.03 billion in the TTM. Medtronic continues to actively buy back its own shares supporting some of the 'per share' results noted.

In terms of the balance sheet, Morningstar reports Medtronic with current assets of $9.5 billion, and current liabilities of $5.9 billion yielding a Current Ratio of 1.61. Medtronic has nicely grown free cash flow from $2.88 billion in 2008 to $3.97 billion in 2012 and $4.28 billion in the TTM.

Looking at some Key Statistics on Medtronic from Yahoo, we can see that this is a large cap stock with a market capitalization of $54.37 billion. The trailing P/E is a moderate 15.88 with a forward P/E (fye Apr 26, 2015) working out to 12.99. The PEG ratio, however, remains rich at 2.03 with only a modest growth in earnings expected.

Yahoo reports 1.02 billion shares outstanding with 1.01 billion that float. As of May 31, 2013, there were 10.64 million shares out short yielding a short interest ratio of only 2.0. (Under my own arbitrary 3 day rule for significance). The company pays a nice dividend of $1.04 yielding 2%. The payout ratio is a moderate 31% suggesting ample room for further dividend boosts. The last time the stock was split was back in September, 1999, when shareholders got a 100% stock dividend for a 2:1 stock split.

To summarize, Medtronic has over the past several years been embroiled in some controversy regarding research results and payments to investigators. The Justice Department has found no evidence of significant wrongdoing and has closed its case. The company meanwhile has continued to generate very large amounts of cash, using it to pay an increasing stock dividend and purchase back its own shares.

The company produces many innovative products spanning multiple fields of medicine from Orthopedics, to Cardiology to Nephrology. It is unnecessary to remind anyone that as our population ages and as more people in this country through the Affordable Care Act ('Obamacare") and overseas through growing middle class populations in nations like India and China find their access to healthcare improving, that purchases of medical devices by practitioners is likely to continue to grow.

Finally, after years of essentially going 'nowhere' the stock appears to be breaking out to multi-year highs and demonstrates strong price momentum. I liked this stock enough to buy some shares and thus far it appears to be a good decision. Like all of my purchases, I always reserve the right to sell any position on either technical or fundamental weakness, a discipline I believe is essential to success in investing.

Thank you so much for stopping by and visiting this website once again. If you have any comments or questions, please feel free to leave them right here.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:44 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 17 June 2013 10:47 PM CDT

Sunday, 9 June 2013

Tile Shop Holdings, Inc. (TTS)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on this website.

Last week I purchased shares of Tile Shop Holdings, Inc. (TTS) in my Covestor Growth and Momentum model. The shares were acquired on June 6, 2013, at a cost of $27.12/share. TTS closed at $28.78 on June 7th, 2013, for a gain of $1.66 or 6.12% on the day.

Last week I purchased shares of Tile Shop Holdings, Inc. (TTS) in my Covestor Growth and Momentum model. The shares were acquired on June 6, 2013, at a cost of $27.12/share. TTS closed at $28.78 on June 7th, 2013, for a gain of $1.66 or 6.12% on the day.

The Tile Shop appears to be benefiting from the housing rebound and the recent news of a rebound in the price of housing in the United States. A similar argument could made for Lumber Liquidators (LL) that I reviewed here previously and is a strong performer in my Covestor Growth and Momentum Model already. This same housing rebound is driving other stocks like Home Depot to all-time highs.

According to the Yahoo Profile on Tile Shop Holdings, the company

According to the Yahoo Profile on Tile Shop Holdings, the company

"...operates as a specialty retailer of manufactured and natural stone tiles, setting and maintenance materials, and related accessories in the United States. It offers floor, wall, natural stone, ceramic, porcelain, glass, and metal tile products; tile patterns; basins; fixtures; listellos/borders; and profiles. The company also provides installation products consisting of heated floors, shower pans, tile threshold and edging products, sealants and caulks, tile maintenance and cleaning products, adhesives, substrates, and recessed shelves, as well as installation, cutting, and grout tools; and care and maintenance products. As of January 2, 2013, it operated 68 stores in 21 states."

On May 1, 2013, The Tile Shop (TTS) reported 1st quarter 2013 results. Net sales increased 23.9% to $56.8 million for the quarter ended March 31, 2013 up from $45.9 million in sales for the same quarter the prior year. Importantly, comparable store sales grew 10.4%, and sales in new stores added $6.2 million. Adjusted EBITDA grew 17.9% to $16.4 million, up from $13.9 million the prior year. However, going forward analysts have decreased their estimates for the next quarter to a profit of $.15 from $.16 and for the year estimates have dropped to $.51/share from $.55/share previously estimated.

Reviewing the Morningstar.com Financials on TTS, we can see that the data is limited as the company went public in 2012.The Tile Shop is not a new outfit as it dates back to 1985 when it opened its first shop in Rochester, Minnesota. In 1992, the company expanded outside of Minnesota and has continued to add stores and expand its business territory since.

The Morningstar report shows that the company increased its revenue from $183 million in 2012 to $194 million in the trailing twelve months (TTM). Earnings have actually decreased as the company is still losing money with $(1.31) reported in 2012, and $(2.61) reported in the TTM. The company has increased its float from 6 million shares in 2010 to 36 million in 2012 and 39 million in the TTM.

In terms of the Morningstar-reported balance sheet for TTS, the company has $72 million in total current assets and $36 million in total current liabilities yielding a current ratio of 2.0. The company is generating postive free cash flow as reported by Morningstar, with $18 million reported in 2012 and $12 million in the TTM.

In terms of some valuation numbers, referring to the Key Statistics on Yahoo for Tile Shop Holdings (TTS), Tile Shop Holdings is a small cap stock with a market capitalization of $1.53 billion. With a trailing loss, there is no P/E ratio, but going forward the PEG ratio (5 yr expected) is a bit rich at 2.26. There are 53.13 million shares outstanding with 20.35 million that float. As of May 15, 2013, there were 421,830 shares out short yielding a short interest ratio of 2.20. (This is below my own arbitrary 3 day rule for significance.) No dividends are paid and no stock splits are reported by Yahoo.

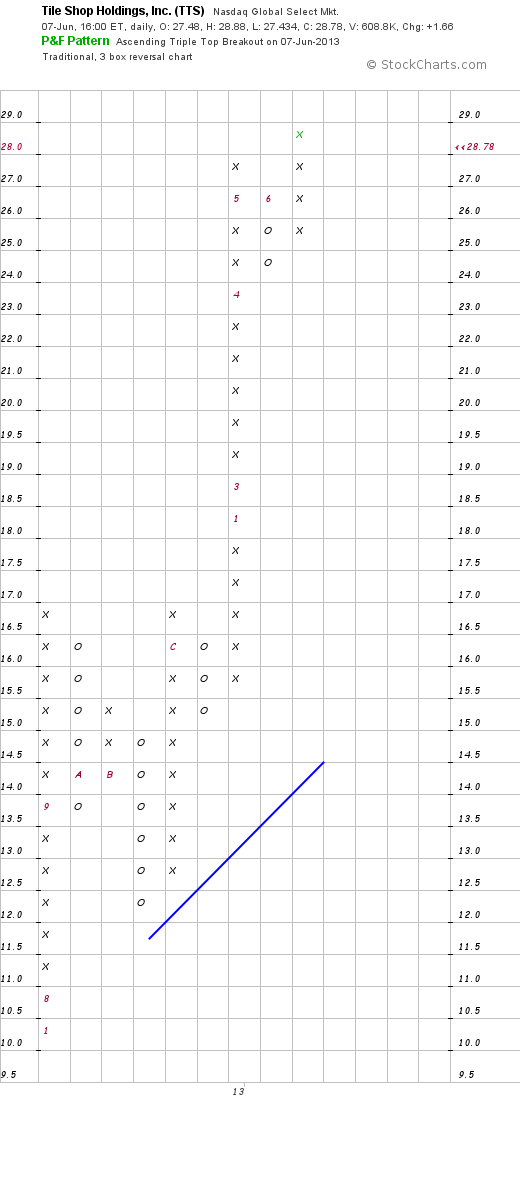

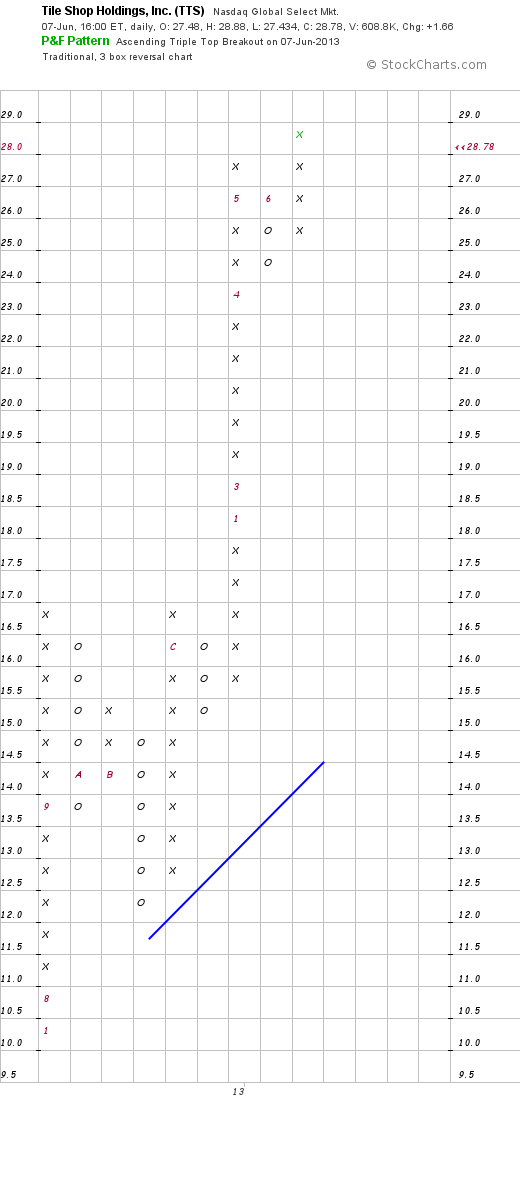

Looking at the 'point and figure' chart on Tile Shop Holdings (TTS) from StockCharts.com we can see a very strong but limited chart.

Reviewing some of the recent analyses on Tile Shop Holdings, Motley Fool published a nice article on this company's ability to play 'America's Housing Boom'. Josh Arnold also wrote a nice review of The Tile Shop on Seeking Alpha.

To summarize, I am a recent purchaser of Tile Shop Holdings (TTS) stock in my Covestor Growth and Momentum Model. This is a very small company that is growing quickly and participating in the rebound of real estate, especially housing in this country. This strategy has worked well with my purchase of Lumber Liquidators (LL) which also is involved in flooring but hardwood floors rather than tile sales. In general, I am a big advocate of identifying retail concepts that can be 'rolled out' from a small base to a larger number of stores in a broader geographic area. The fact that TTS has done so this past year with strong (10%+) same-store-sales growth is very encouraging.

On the negative side, the company is still losing money and even going five years out, the current valuation is a bit rich as estimated by the PEG ratio reported.

With the very strong chart and technical strength and with a 'story' that is quite compelling, I added a position to my own holdings and am optimistic that this will prove to be a good move. Like any of my purchases, if the stock incurs a loss, I shall be quick to part company regardless of my belief in the long-term outlook.

Thank you so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them right here.

Yours in investing,

Bob

Newer | Latest | Older

Ecolab (ECL) is currently my top gainer in my Growth and Momentum Model on Covestor. It also is a favorite of mine on my blog where I last wrote it up on May 2, 2010, almost 4 years ago. I also commented on Ecolab on February 8, 2009 and previously commented on December 13, 2008. Clearly I like this stock! I like their business, their financial results, and the performance of their stock. Currently in my Covestor model I have an average cost of $66.29. Ecolab (ECL) closed at $110.73 on March 21, 2014, with a gain of $.69 or 0.63% on the day.

Ecolab (ECL) is currently my top gainer in my Growth and Momentum Model on Covestor. It also is a favorite of mine on my blog where I last wrote it up on May 2, 2010, almost 4 years ago. I also commented on Ecolab on February 8, 2009 and previously commented on December 13, 2008. Clearly I like this stock! I like their business, their financial results, and the performance of their stock. Currently in my Covestor model I have an average cost of $66.29. Ecolab (ECL) closed at $110.73 on March 21, 2014, with a gain of $.69 or 0.63% on the day.and cleaning and sanitizing solutions primarily to large industrial customers within the manufacturing, food and beverage processing, chemical, mining and primary metals, power generation, pulp and paper, and commercial laundry industries. The Global Institutional segment offers specialized cleaning and sanitizing products to the foodservice, hospitality, lodging, healthcare, government and education, and retail industries. The Global Energy segment provides the process chemicals and water treatment needs of the petroleum and petrochemical industries in both upstream and downstream applications. The Other segment offers pest elimination, and kitchen repair and maintenance services."

As many of the regular readers to this blog realize, I have had the opportunity to work with

As many of the regular readers to this blog realize, I have had the opportunity to work with  Reading

Reading

It is often hard to believe that I have been blogging here on this website since May 12, 2003, over 10 years ago, when I wrote up my first entry

It is often hard to believe that I have been blogging here on this website since May 12, 2003, over 10 years ago, when I wrote up my first entry  mentor of mine, might think worthy of inclusion in a

mentor of mine, might think worthy of inclusion in a

On December 9, 2013, I purchased shares of Alexion Pharmaceuticals (ALXN) for my

On December 9, 2013, I purchased shares of Alexion Pharmaceuticals (ALXN) for my  registry, and aHUS for pediatric and adult; and various Phase II clinical trails for its usage for the treatment of PNH pediatric trial, cold agglutinin disease, MPGN II/C3 nephropathy, hemolytic uremic syndrome, presensitized renal transplant, delayed kidney transplant graft function, ABO incompatible renal transplant, neuromyelitis optica, and myasthenia gravis. In addition, the company develops Asfotase alfa that is under Phase II clinical trail for the treatment of metabolic disorders, including hypophosphatasia; ALXN 1102/1103, which is in Phase I trial for PNH; and ALXN 1007, a novel humanized antibody for treating inflammatory disorders. Further, the company conducts preclinical trails on cPMP for treating metabolic disorders."

registry, and aHUS for pediatric and adult; and various Phase II clinical trails for its usage for the treatment of PNH pediatric trial, cold agglutinin disease, MPGN II/C3 nephropathy, hemolytic uremic syndrome, presensitized renal transplant, delayed kidney transplant graft function, ABO incompatible renal transplant, neuromyelitis optica, and myasthenia gravis. In addition, the company develops Asfotase alfa that is under Phase II clinical trail for the treatment of metabolic disorders, including hypophosphatasia; ALXN 1102/1103, which is in Phase I trial for PNH; and ALXN 1007, a novel humanized antibody for treating inflammatory disorders. Further, the company conducts preclinical trails on cPMP for treating metabolic disorders."

I don't spend a lot of time talking about how I got interested in investing years ago, but I give credit mostly to my father, the late Lt. Col. Sumner Freedland, who taught me to look at labels, read stock prices, and buy equities. I purchased my first shares 46 years ago this month and have followed the market since.

I don't spend a lot of time talking about how I got interested in investing years ago, but I give credit mostly to my father, the late Lt. Col. Sumner Freedland, who taught me to look at labels, read stock prices, and buy equities. I purchased my first shares 46 years ago this month and have followed the market since. Two of the brand names that I consume include

Two of the brand names that I consume include

With the market's

With the market's  and Canada. It facilitates the exchange of information and funds between merchants and cardholder’s financial institutions; and offers end-to-end electronic payment processing services, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support, and risk management to merchants. The company also provides other merchant services comprising payroll processing, gift and loyalty programs, and prepaid and stored-value solutions; paper check processing; payroll and related tax filing services; and secure point-of-sale solutions, as well as sells and rents point-of-sale devices and supplies."

and Canada. It facilitates the exchange of information and funds between merchants and cardholder’s financial institutions; and offers end-to-end electronic payment processing services, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support, and risk management to merchants. The company also provides other merchant services comprising payroll processing, gift and loyalty programs, and prepaid and stored-value solutions; paper check processing; payroll and related tax filing services; and secure point-of-sale solutions, as well as sells and rents point-of-sale devices and supplies."

One of my recent purchases for my

One of my recent purchases for my

patients with coronary artery disease; renal denervation for the treatment of chronic uncontrolled hypertension; endovascular stent grafts to treat abdomen and thoracic regions of the aorta; peripheral vascular intervention that encompasses various procedures to treat patients with peripheral vascular disease; surgical valve replacement and repair products for damaged or diseased heart valves; transcatheter heart valves; a line of blood-handling products used in arrested heart surgeries; positioning and stabilization technologies that assist physicians performing beating heart surgery; and surgical ablation system, which allows cardiac surgeons to create ablation lines during cardiac surgery. In addition, it provides medical devices and implants that are used in the treatment of the spine and musculoskeletal system comprising thoracolumbar, cervical, and biologics products; neurostimulators for chronic pain, implantable drug delivery systems, and deep brain stimulation systems, as well as urology, fecal, and gastroenterology devices; and integrated diabetes management solutions. Further, the company offers products and therapies to treat diseases and conditions of the ear, nose, and throat, as well as certain neurological disorders; and image-guided surgery and intra-operative imaging systems."

patients with coronary artery disease; renal denervation for the treatment of chronic uncontrolled hypertension; endovascular stent grafts to treat abdomen and thoracic regions of the aorta; peripheral vascular intervention that encompasses various procedures to treat patients with peripheral vascular disease; surgical valve replacement and repair products for damaged or diseased heart valves; transcatheter heart valves; a line of blood-handling products used in arrested heart surgeries; positioning and stabilization technologies that assist physicians performing beating heart surgery; and surgical ablation system, which allows cardiac surgeons to create ablation lines during cardiac surgery. In addition, it provides medical devices and implants that are used in the treatment of the spine and musculoskeletal system comprising thoracolumbar, cervical, and biologics products; neurostimulators for chronic pain, implantable drug delivery systems, and deep brain stimulation systems, as well as urology, fecal, and gastroenterology devices; and integrated diabetes management solutions. Further, the company offers products and therapies to treat diseases and conditions of the ear, nose, and throat, as well as certain neurological disorders; and image-guided surgery and intra-operative imaging systems."

Last week I purchased shares of Tile Shop Holdings, Inc. (TTS) in my

Last week I purchased shares of Tile Shop Holdings, Inc. (TTS) in my  According to the

According to the