Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have been writing a lot about different trades and the like that I have personally been implementing. As a nice change, I wanted to write today about a stock that made the list of top % gainers, a stock that I have written up previously, and still fits my 'criteria' for inclusion on this blog.

I have been writing a lot about different trades and the like that I have personally been implementing. As a nice change, I wanted to write today about a stock that made the list of top % gainers, a stock that I have written up previously, and still fits my 'criteria' for inclusion on this blog.

Gardner Denver closed today at $35.20, up $2.83 or 8.74% on the day. I do not own any shares nor do I have any options on this stock. This stock is an 'old favorite' of mine, which I first wrote up on Stock Picks Bob's Advice on February 7, 2006, when the stock was trading at $58.68/share. Adjusting for a 2:1 stock split, the stock was picked at a price of $29.34. Thus the stock has appreciated $5.86 or 20.0% since posting.

Gardner Denver closed today at $35.20, up $2.83 or 8.74% on the day. I do not own any shares nor do I have any options on this stock. This stock is an 'old favorite' of mine, which I first wrote up on Stock Picks Bob's Advice on February 7, 2006, when the stock was trading at $58.68/share. Adjusting for a 2:1 stock split, the stock was picked at a price of $29.34. Thus the stock has appreciated $5.86 or 20.0% since posting.

Briefly, GDI reported a strong 4th quarter 2007 report yesterday after the close of trading. Revenues climbed 16%, net income was up 71% and diluted earnings per share were ahead by 69% from the year earlier fourth quarter. Just as importantly, the company beat expectations on both earnings and revenue results, and then went ahead and raised guidance for 2008. These are the kind of results I look for, and clearly, there were other investors interested in these numbers which drove the stock higher today.

The Morningstar.com "5-Yr Restated" financials are solid. The company has increased the total shares from 32 million to 53 million from 2002 to 2006 but during the same period, revenue was up over 200% and earnings climbed over 200% as well. The rest of the report looks great.

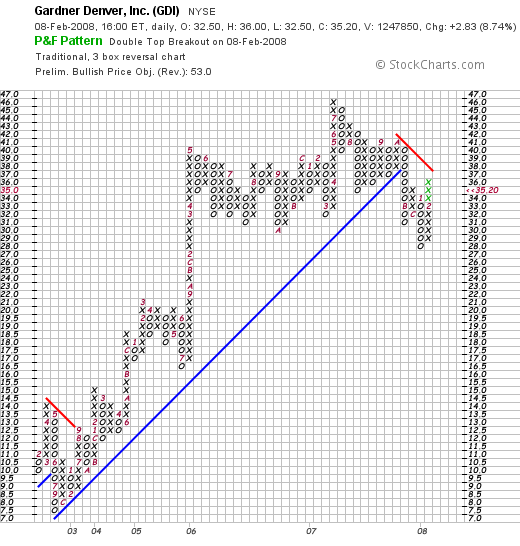

Certainly the 'point & figure' chart on GDI from StockCharts.com shows the effects of the difficult stock trading environment with the stock price pulling back from its recent move higher. Just 'eye-balling' the chart, it appears that GDI would need to trade north of $41 before convincingly breaking out from the appearance that the chart has 'rolled over' after peaking at $46 in July, 2007.

This is a very interesting stock with great prospects and cheap valuation. Valuation-wise, per Yahoo "Key Statistics", the company sports a p/e of 10.63 and a PEG of only 0.44. Thus,

GARDNER DENVER (GDI) IS RATED A BUY

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor website where all of my actual holdings are reviewed, my SocialPicks website where my recent stock picks are monitored, and my Podcast Page where you can download programs in which I discuss many of the same stocks I write about here on this blog.

Regards to all of my friends! Wishing you a great weekend!

Bob