Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the market correction ongoing, my portfolio has been reduced in size (as it is supposed to!) down to seven positions. As is my practice, I have been trying to share with you my performance on the actual stocks that I own in addition to the many stocks I write about on this blog.

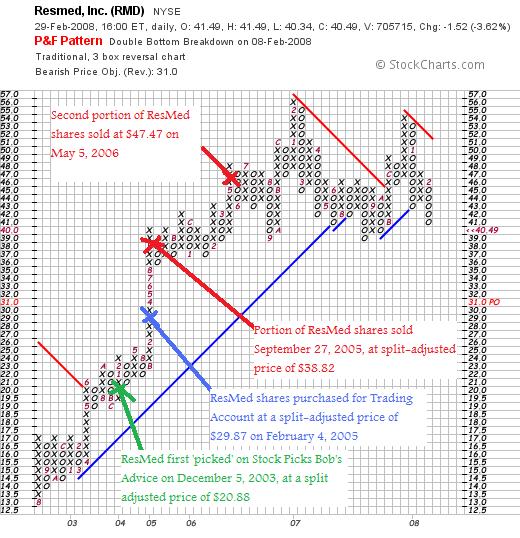

My last review was Morningstar (MORN), a holding that I discussed on January 19, 2008. Going alphabetically (by symbol) I am up to my ResMed position. I currently own 150 shares of ResMed (RMD) that were acquired on 2/4/05 at a cost basis of $29.87. ResMed closed at $40.49 on 2/29/08 for an unrealized gain of $10.62 or 35.5% on these shares.

My last review was Morningstar (MORN), a holding that I discussed on January 19, 2008. Going alphabetically (by symbol) I am up to my ResMed position. I currently own 150 shares of ResMed (RMD) that were acquired on 2/4/05 at a cost basis of $29.87. ResMed closed at $40.49 on 2/29/08 for an unrealized gain of $10.62 or 35.5% on these shares.

ResMed is an old favorite of mine, having first reviewed the stock (before owning the shares) back on December 5, 2003, when the stock was trading at $41.76. Adjusted for the 2:1 stock split on October 3, 2005, this works out to a pick price of $20.88. The stock has actually appreciated $19.61 or 94% since that original posting.

As is my practice, I have sold portions of my ResMed position twice as they hit appreciation targets of 30% and 60% over the purchase price. I sold shares 9/27/05 at a split-adjusted price of $38.82, representing a gain of $8.95 or 30.0%, and another batch of shares at $47.47 on 5/5/06, representing a gain of $17.60 or 59.0% since purchase.

When would I sell shares next?

Well, on the downside it has been my policy to sell shares if they retrace back to 1/2 of the highest percentage at which I have sold shares (if I have sold more than once). In this case, with the highest % sale at the 60% appreciation level, I plan on selling all of my shares should ResMed trace back to the 30% appreciation level (which it has been flirting with several times already). This would work out to 1.3 x $29.87 = $38.83.

On the other hand, if the stock should move higher, the next targeted sale in my 'system' is at the 90% appreciation level at which time I would plan on selling 1/7th of my remaining shares. This works out to 150 x 1/7 = 21 shares, which would be sold should the stock reach 1.9 x $29.87 = $56.75.

Unfortunately, the stock is far closer to the sale on the downside rather than the sale on appreciation. Time will tell.

Let's take a closer look at this company and decide how we should rate this stock for the blog!

First of all,

What exactly does this company do?

According to the Yahoo "Profile" on ResMed, the company

"...engages in the design, manufacture, and marketing of equipment for the diagnosis and treatment of -disordered breathing, including obstructive sleep apnea, and other respiratory disorders that occur during sleep. It offers airflow generators, diagnostic products, mask systems, headgear, and other accessories, including humidifiers, cold passover humidifiers, carry bags, and breathing circuits."

How did they do in the latest quarter?

On February 8, 2008, ResMed (RMD) reported 2nd quarter 2008 results. For the quarter ended December 31, 2007, revenue increased 14% to $202.7 million from $178.4 million a year earlier. This exceeded estimates of $183.8 million.

Earnings dipped to $26.9 million or $.34/share this year compared to last year's $29 million or $.37/share. However, removing one-time stock-based compensation costs and restructuring charges and other one-time items, profit came in at $32.1 million or $.41/share, down from $33.7 million last year. However, the $.41/share figure exceeded estimates of $.35/share according to analysts polled by Thomson Financial.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials page, we can see a little bit of a mix of results. Revenue growth has been particularly stable with $274 million in 2003 increasing to $716 million in 2007 and $763 million in the trailing twelve months (TTM). Earnings had a steady growth record from 2003 to 2006 when they increased from $.67/share in 2003 to $1.16/share in 2006. Earnings however dipped to $.85/share in 2007 and $.81/share in the TTM. These results of course exclude 'one-time' events. But they should be respected.

Free cash flow has improved after dipping from $31 million in 2005 to a negative $(4) million in 2006, improving to $14 million in 2007 and $22 million in the TTM.

The balance sheet is solid with $279.0 million in cash and $411.0 million in other current assets. This total of $690 million, when compared to the $162.7 million in current liabilities yields a current ratio of 4.24. (I use a level of 1.25 on the current ratio as a minimum to consider the balance sheet 'healthy'.) RMD has a relatively small level of long-term liabilities at $142.0 million.

What about some valuation numbers?

Examining the Yahoo "Key Statistics" on ResMed (RMD), we can see that this is a mid cap stock with a market capitalization of $3.15 billion. The trailing p/e is rather rich at 50.24, the forward p/e (fye 30-Jun-09) is estimated at 21.77 and with the rapid growth in earnings expected, the PEG ratio works out to an acceptable level of 1.46.

Utilizing the Fidelity.com eresearch website, we find that the Price/Sales (TTM) is reasonably priced at less than its peers at 4.12, compared to an industry average of 4.91. The company is not as profitable as its peers per Fidelity with a Return on Equity (TTM) of 6.66% compared to the industry average of 20.68%.

Finishing up with Yahoo, we find that there are 77.68 million shares outstanding with 75.14 million that float. As of 1/10/08, there were 5.85 million shares out short, well above my 3 day rule of significance, with the short ratio working out to 8.1 days of trading volume. No dividends are paid and the last stock split was a 2:1 paid on October 3, 2005.

What does the chart look like?

Reviewing the 'point & figure' chart on ResMed from StockCharts.com, we can see the strong price appreciation from August, 2002, when the stock was trading at $13.00/share, to a peak of $56 in February, 2007. The stock broke through support on the downside in August, 2007, when it dipped below $42. The stock has been struggling technically (from my amateur perspective) and once again broke through support at $42 this month. Short-term, the chart looks weak without showing a complete break-down in support.

Summary: What do I think?

I really am very biased about this stock. I think there are loads of people out there with sleep apnea and Resmed has a great product and great future. THAT is my 'Peter Lynch' portion of this stock pick.

I have some concerns about the latest quarter with all sorts of one-time charges needing to be sorted out to get to a result that still shows a decline year-over-year. And this has been going on for at least a year as the Morningstar.com report suggests. Furthermore, valuation is a bit rich with a p/e over 50 (although I can live with the PEG). The Price/Sales suggests a reasonable valuation, but the Return on Equity suggests that profitability might be lagging. The rest of the Morningstar report is solid. However, the chart also gives me pause. What this company really needs is a blow-out quarter!

Anyhow, even though I own shares, the best I can come up with is...

RESMED (RMD) IS RATED A HOLD

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and stop by my Covestor Page where you can see how my Trading Portfolio is doing relative to the S&P and other investors, my SocialPicks page where my stock picks from the last year or two are reviewed and analyzed, and my Podcast Page where you can download a show or two about some of the many stocks I write about here on the website!

Wishing you a happy weekend and a successful week ahead trading!

Yours in investing,

Bob

Updated: Saturday, 1 March 2008 8:45 PM CST