Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It has been a quiet week around these parts. I haven't found many stocks to write up and it is once again the weekend and time for a review! Last week I took a look at the week of September 4, 2006. Going a week ahead, let's review the picks from the week of September 11, 2006, which was a bit busier in regards to posting than some other weeks.

Needless to remind you, these reviews assume a "buy and hold" strategy of investing in which equal dollar amounts are purchased in each of these picks from the week and held without regard to price movement. In fact, I advocate and employ a disciplined investment strategy that requires me (except when I have rashly tried to do a 'trade'), to buy stocks only when I have a market signal o buy stocks, to sell stocks on declines, and to lock in appreciating stocks by partial sales at appreciation targets. Thus, the difference between this approach and a 'buy and hold' strategy would certainly be different....not necessarily better!

But, as I have commented elsewhere, it is easier to evaluate my picks assuming a simple purchase and hold than to evaluate it otherwise. Please do take that into consideration.

I should also like to be brief this afternoon/evening as I have a 'lot of things on my plate' this weekend but did want to get around to writing up a bit on the stocks I covered last year.

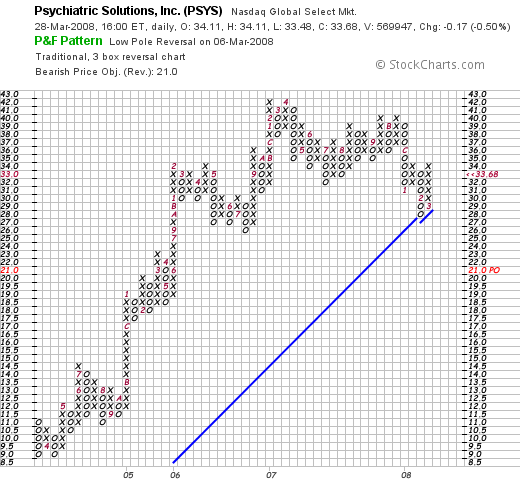

![]() On September 12, 2006, I posted Psychiatric Solutions (PSYS) on Stock Picks Bob's Advice when the stock was trading at $35.78. PSYS closed at $33.68 on March 28, 2008, for a loss of $(2.10) or (5.9)% since posting. I do not own any shares or options of Psychiatric Solutions.

On September 12, 2006, I posted Psychiatric Solutions (PSYS) on Stock Picks Bob's Advice when the stock was trading at $35.78. PSYS closed at $33.68 on March 28, 2008, for a loss of $(2.10) or (5.9)% since posting. I do not own any shares or options of Psychiatric Solutions.

PSYCHIATRIC SOLUTIONS (PSYS) IS RATED A BUY

On February 20, 2008, PSYS reported 4th quarter 2007 results. Revenue for the quarter increased 44.1% to $403.4 million, from $279.9 million the prior year same period. Net income increased to $23.2 million or $.42/diluted share, up from $17.6 million or $.32/diluted share the prior year. The company raised guidance for the 2008 fiscal year by $.10/share to $1.93 to $1.97/share reflecting the benefit of lower interest rates.

Analysts polled by Thomson Financial had been expecting 2008 results of $1.88/share. However, first quarter 2008 guidance of $.42 to $.43/share was below expectations of $.44/share. The announcement was 'mixed' because the company was reducing guidance over the short-term, but raising guidance for the full year. Within the same announcement, they optimistically estimated same-store sales figures (which for them means same-facility revenue numbers) to grow at a 7-8% rate in 2008 compared to the strong 6.5% increase reported in 2007.

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that the revenue growth is intact, earnings growth has not been interrupted, total shares while being slightly more than doubled between 2003 and 2007, have increased while revenue is up six-fold, and earnings are up six-fold as well.

Free cash flow is positive and the balance sheet appears adequate with $340 million in total current assets compared to $182.2 million in current liabilities. The company does carry a significant $1.2 billion in long-term liabilities which apparently is being managed adequately but should be noted.

Finally, looking at a 'point & figure' chart on PSYS from StockCharts.com, we can see that while under a bit of selling pressure recently (what stock isn't?), the chart actually appears to be holding up under the recent preessure and hasn't broken down from its long-term bullish move from early 2004 when the stock was selling at as low as $9/share to the high of $42 in April, 2007.

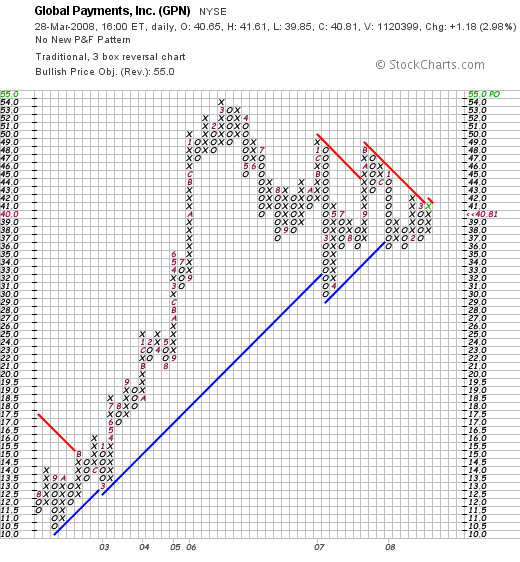

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

Just the other day, on March 27, 2008, Global Payments (GPN) announced 3rd quarter 2008 results. For the quarter ended February 29, 2008, revenue climbed 19% to $310.6 million from $260.4 million the prior year. Diluted earnings per share (excluding a one-time favorable gain) increased 5% to $.44 compared to $.42/share last year during the same period.

GPN beat expectations of analysts polled by Thomson Financial who had expected earnings of $.42/share on revenue of $300.9 million. In addition, the company raised guidance for 2008--now expecting profits of $1.95 to $1.97, up from prior January guidance of $1.89 to $.96. In addition, the range of revenue expectations for fiscal 2008 was increased to $1.25 to $1.26 billion from prior January guidance of $1.23 to $1.26 billion.

Reviewing the Morningstar.com '5-Yr Restated' financials page, we can see a beautiful picture that remains intact of steadily increasing revenue from $516 million in 2003 to $1.06 billion in 2007 and $1.16 billion in the trailing twelve months (TTM). Earnings have increased from $.70/share in 2003 to $1.75/share in 2007 and $1.84/share in the TTM. The company does pay a dividend but has kept it at $.08/share during this same period. Total shares have climbed less than 10% during this time, from 75 million in 2003 to 78 million in 2007 and 81 million in the TTM. This less than 10% share dilution occurred during the same period that revenue increased more than 100% and earnings also climbed more than 100%.

Free cash flow is solidly positive although not particularly increasing between 2005 and the present. And the balance sheet is gorgeous with $363 million in cash which by itself can easily cover both the $189.1 million in current liabilities and the $109.9 million in long-term liabilities combined. With over $500 million in total current assets, the current ratio works out to a healthy 2.70.

Reviewing the 'point & figure' chart on Global Payments (GPN) from StockCharts.com, we can see that the stock while under pressure recently has neither broken down nor 'broken out' in its price performance. Instead it has been trading in a narrower and narrower range, most recently appearing to be ready to break-out on the upside. (Or is that wishful thinking?) In any case, it certainly doesn't appear to be over-extended, nor convincingly in a decline.

GLOBAL PAYMENTS (GPN) IS RATED A BUY

The next stock I 'picked' on the blog didn't fare as well as the previous two.

The next stock I 'picked' on the blog didn't fare as well as the previous two.

NeuroMetrix (NURO) was selected for Stock Picks Bob's Advice on September 14, 2006, when the stock was trading at $20.50. I do not own any shares nor any options of this stock. NURO closed at $1.92 on March 28, 2008, for a loss of $(18.58) or (90.6)% since posting.

On February 12, 2008, NURO reported 4th quarter 2007 results. For the quarter ended December 31, 2007, revenue came in at $10.1 million, down from $14.2 million during the same period last year. They also reported a net loss of $(2.1) million this year compared to net income of approximately $1 million the prior year. This worked out to a net loss of $(.17) per share for the quarter compared with a profit of $.08/share the prior year.

According to analysts polled by Thomson Financial, the company actually beat expectations on earnings by no losing as much as was expected (!). Analysts were looking for a loss of $(.21)/share during the quarter. However, the company disappointed on revenue, as analysts were expecting revenue of $11.2 million during the period.

Reviewing the Morningstar.com '5-Yr Restated' financials on NURO, we can see that after growing their revenue from $9 million in 2003 to $55 million in 2006, the company dipped to $45 million in 2007. Earnings likewise improved from a loss of $(5.66) in 2003 to a profit of $.33/share in 2006 then turned negative at $.66 in 2007. Outstanding shares increased from 1 million in 2003 to 13 million in 2005 but have stayed stable since.

Free cash flow increased from $1 million in 2005 to $7 million in 2006 then turned negative at $(8) million in 2007. The balance sheet is solid with $7 million in cash and $35 million in other current assets easily covering the $8.7 million in current liabilities and the $.9 million in long-term liabilities reported on Morningstar.

Finally, looking at the 'point & figure' chart on NeuroMetrix (NURO) from StockCharts.com, we can see the dismal price performance of this pick. The stock declined gradually from $41 in April, 2006, to a level of $11.00 in January, 2008, only to plunge recently to the $1.92 level in March, 2008.

Even though it appears rather late with this assessment, with the poor earnings report, the poor Morningstar.com page, and the terribly weak price chart,

NEUROMETRIX (NURO) IS RATED A SELL

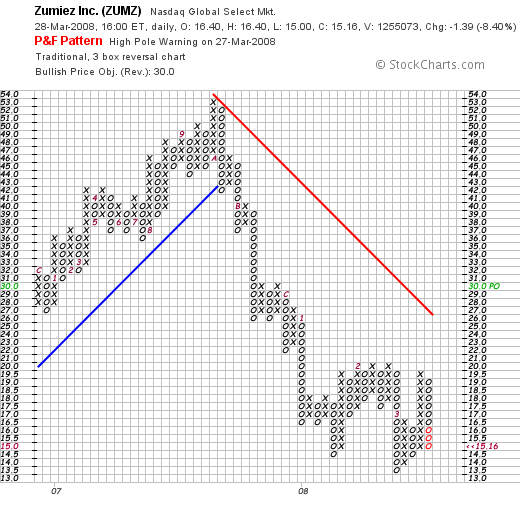

Finally, on September 16, 2006, I posted Zumiez (ZUMZ) on Stock Picks Bob's Advice when the stock was trading at $26.24 per share. I do not own any shares or options on this company.

Finally, on September 16, 2006, I posted Zumiez (ZUMZ) on Stock Picks Bob's Advice when the stock was trading at $26.24 per share. I do not own any shares or options on this company.

Zumiez closed at $15.16 on March 28, 2008, for a loss of $(11.08) or (42.2)% since posting.

On March 14, 2008, Zumiez (ZUMZ) reported 4th quarter 2007 results. For the quarter ended February 2, 2008, total net sales increased 12.7% to $126.6 million from $112.4 million in the same quarter last year. Net income for the quarter came in at $12.4 million or $.42/diluted share up from $11.3 million or $.39/share last year.

However, while positive, the torrid rate of growth at this retailer slowed considerably. For the quarter, same-store sales increased 4.0% compared with last year's same-store sales growth of 12.0%.

The company beat expectations during the quarter both on earnings and revenue. Sales, according to analysts polled by Thomson Financial, had been expected to come in at $126.1 million (they camne in at $126 million) and earnings were expected at $.38/share (they came in at $.42/share).

The company predicted low single digit same store sales growth in 2008 and profit of about $.90 to $.93/share. This was essentially in line with analysts' expectations for $.92/share in 2008.

With the recent recession fears and reports of weak retail sales, it is not surprising that Oppenheimer analyst Roxanne Meyer recently cut the ratings of Zumiez to "perform". However, with the relatively strong quarterly report,

ZUMIEZ (ZUMZ) IS RATED A HOLD

Reviewing the Morningstar.com '5-Yr Restated' financials, we can see that the record of steady revenue growth, earnings growth, stable shares, and positive free cash flow is intact. The balance sheet is solid with $136 million in total current assets, compared to $43.4 million in current liabilities and the $18.1 million in long-term liabilities.

Finally, looking at the 'point & figure' chart on Zumiez from StockCharts.com, we can see the terrible weakness in the price chart that developed in October, 2007, when the price declined from a peak of $53 to a low of $13.50 in March, 2008. Currently at $15.16, the stock is struggling to find support at this lower level. I do not like the technicals on this chart, but from the earnings news and the Morningstar.com report, I have to feel that the reaction of the street must be overdone on this chart and a reversal in price sentiment must soon be overdue.

In any case, thank you again for visiting! If you have any commnents or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my actual trading account is tracked and analyzed, my SocialPicks Page where my stock picks from the last year or so have been monitored, and my Podcast Page where you can listen to me discuss some of the same stocks I write about here on this website.

Have a great Sunday and a solid week ahead.

Yours in investing,

Bob

Updated: Tuesday, 8 April 2008 11:13 AM CDT