Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please consult with your professional investment advisors before making any decisions based on information on this website!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please consult with your professional investment advisors before making any decisions based on information on this website!I was looking through the list of top % gainers on the NASDAQ and came across Hibbett (HIBB). Since HIBB is one of the first stocks I owned in my "Trading Portfolio", I was certain that I had discussed this somewhere in depth. Actually, I discussed HIBB not too long ago, when it was flirting with a sale on the downside. HIBB was acquired by me on 3/6/03 and I have a cost basis of $9.74/share. To give you the appropriate perspective, HIBB is trading at $29.49, as I write, up $2.75 or 10.28% on the day!

According to the Yahoo "Profile" on HIBB, Hibbett "...is an operator of athletic sporting goods stores in small to mid-sized markets predominantly in the southeast, mid-Atlantic and Midwest United States."

According to the Yahoo "Profile" on HIBB, Hibbett "...is an operator of athletic sporting goods stores in small to mid-sized markets predominantly in the southeast, mid-Atlantic and Midwest United States."What has been driving the stock higher was the 4th quarter 2004 earnings results which were announced yesterday and a conference call today.

For the fourth quarter, revenue increased to $107.1 million from $91.2 million last year. Earnings came in at $8.2 million, or $.35/share, up from $6.5 million or $.27/share during the final quarter in 2003. For 2006, the company raised guidance to $1.26-$1.32/share, while the "street" was looking for $1.24. The news was enough to push the stock higher today!

For the fourth quarter, revenue increased to $107.1 million from $91.2 million last year. Earnings came in at $8.2 million, or $.35/share, up from $6.5 million or $.27/share during the final quarter in 2003. For 2006, the company raised guidance to $1.26-$1.32/share, while the "street" was looking for $1.24. The news was enough to push the stock higher today!How about longer-term? Taking a look at the Monrningstar.com "5-Yr Restated" financials, we can see what I think is one of the prettiest financial pictures in my portfolio or on this blog!

First, revenue has grown steadily from $174 million in 2000 to $362 million in the Trailing twelve months. Second earnings have grown also incredibly steadily from $.39/share in 2000 to $.99/share in the trailing twelve months (TTM). Free cash flow has been solid and growing: from $4 million in 2002 to $24 million in the TTM.

The balance sheet is also pristine, with $44.5 million in cash and $112.5 million in other current assets reported on Morningstar.com. Against this, HIBB has $46.3 million in current liabilities and only a $.5 million of long-term liabilities is reported!

What about valuation questions? Taking a look at "Key Statistics" on HIBB from Yahoo, we can see that this is really a small company, barely a mid cap stock with a market capitalization of $693.16 million. The trailing p/e is a bit rich at 29.62, but the forward p/e (fye 31-Jan-06) is a bit better at 23.81. Thus, the 5-Yr PEG isn't bad at 1.18. Price/sales also not too rich at 1.74.

What about valuation questions? Taking a look at "Key Statistics" on HIBB from Yahoo, we can see that this is really a small company, barely a mid cap stock with a market capitalization of $693.16 million. The trailing p/e is a bit rich at 29.62, but the forward p/e (fye 31-Jan-06) is a bit better at 23.81. Thus, the 5-Yr PEG isn't bad at 1.18. Price/sales also not too rich at 1.74.Yahoo reports 23.47 million shares outstanding with 18.40 million that float. Of these, 686,000 shares are out short as of 2/8/05, representing 3.73% of the float or 4.426 trading days of volume.

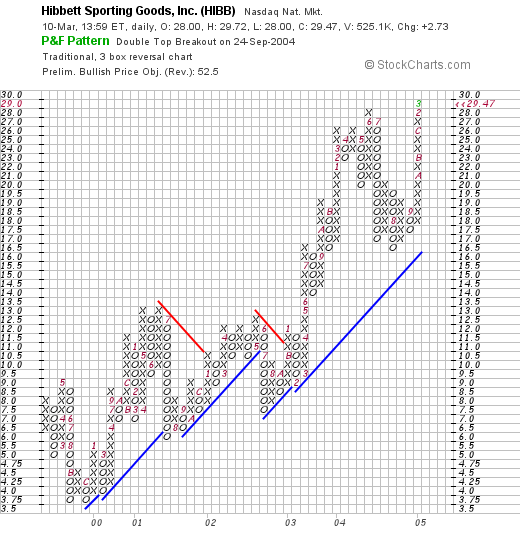

So what does the chart look like? Taking a look at a Point & Figure chart from Stockcharts.com:

We can see that the stock has traded higher since January, 2000, when it was about $3.75/share to the current levels around $29.50. The graph really appears quite strong to me!

So what do I think? Well, I own the stock, so you know I like it! Especially after picking up shares in March, 2003, when HIBB was only $9.74/share! But seriously, the earnings are solid, the most recent same-store sales growth is just above 5%, the trend in revenue and earnings is quite impressive, valuation is reasonable, the balance sheet is super, well what IS there that I don't like? I can't really think of anything offhand :).

Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob