Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

While the rest of the market and all of the traders are anxiously awaiting the Fed and the probably 1/4% interest hike, I was out looking for new prospects and re-examining old stock picks. Looking through the list of top % gainers on the NASDAQ this afternoon, I saw an old name, almost an old 'friend'--as I like to refer to some of my old stock picks--TALX Corp (TALX) making a nice move today. As I write, TALX is trading at $28.26, up $1.84 or 6.96% on the day.

I first wrote up TALX on Stock Picks Bob's Advice on September 17, 2003, when the stock was trading at $26.25. TALX split 3:2 2/18/05, and then split again 3:2 on 1/18/06. This gives my pick an effective price of $26.25 x 2/3 x 2/3 = $11.67. With the current (as I write) price of $28.27, this gives this stock pick a gain of $16.60 or 142.2% since selected on this blog. Unfortunately, I didn't buy any shares or options on this stock then and I don't own any shares or options now.

I first wrote up TALX on Stock Picks Bob's Advice on September 17, 2003, when the stock was trading at $26.25. TALX split 3:2 2/18/05, and then split again 3:2 on 1/18/06. This gives my pick an effective price of $26.25 x 2/3 x 2/3 = $11.67. With the current (as I write) price of $28.27, this gives this stock pick a gain of $16.60 or 142.2% since selected on this blog. Unfortunately, I didn't buy any shares or options on this stock then and I don't own any shares or options now. And what exactly does this company do?

Taking a look at the Yahoo "Profile" on TALX, we find that the company

"...provides automated employment and income verification, tax management services, and other outsourced employee self-service applications. Its services use Web access, interactive voice response, fax, document imaging, and other technologies to enable mortgage lenders, pre-employment screeners, credit issuers, social service agencies, and other authorized users to obtain payroll and human resources information; and enables employees and their managers to review and modify information in payroll and human resources management information systems."And how about the latest quarterly results?

On January 25, 2006, TALX announced 3rd quarter 2006 results. Revenue for the quarter ended December 31, 2005, climbed 31% to $52.3 million from $39.8 million in the same quarter the prior year. Earnings from continuing operations climbed 54% to $7.4 million, from the year ago $4.8 million figure. On a diluted per share basis, this worked out to $.22/share up almost 50% from the $.15/share reported the prior year.

One of the most important things, imho, that may be found in a quarterly report is new guidance. And TALX did exactly this. As reported in the report:

"Because of the favorable operating trends, as well as recent acquisitions, TALX is again raising guidance for the fiscal year ending March 31, 2006. Revenue is now estimated to be a range of $205 million to $207 million compared with previous guidance of $193 million to $196 million. On a post-split basis, the estimate for diluted earnings per share from continuing operations is now a range of $0.86 to $0.87 compared with the previous guidance of $0.80 to 0.83 ($1.20 to $1.24 on a pre-split basis)."This looks like a nice earnings report from my perspective.

What about longer-term results? My goal for stocks is to pick companies that can consistently and persistently produce good financial reports. I cannot foretell the future, but I depend on past results to give an indication of future prospects.

Looking at the "5-Yr Restated" financials from Morningstar.com, we see that this company is relatively new, with no meaningful revenue in 2001, growing to $35.4 million in 2002, and to $158.4 million in 2005. They reported $193.3 million in the trailing twelve months (TTM).

Earnings during this same period have grown steadily from $.01/share in 2001, to $.51/share in 2005 and $.86/share in the TTM.

An added plus, imho, is the presence of dividends. While not necessary for me to like a stock, the payment of dividends makes a company more attractive to many other investors, and also helps support a stock price in a market correction. In addition, the company has a pattern of increasing its dividend each year! They paid $.03/share in 2001, increasing it annually to $.10/share in 2005 and $.12/share in the TTM.

The number of shares outstanding has grown slightly as the company has apparently been using shares for financing operations and acquisitions, increasing from 25 million shares in 2001 to 31 million in 2005 and 32 million in the TTM. This 33% increase in shares, while a bit more than I would like, did coincide with an approximately 500% increase in revenue. I view this as a satisfactory trade-off.

What about free cash flow? This has been steady but not growing with $24 million reported in 2003, $24 million in 2005 and $24 million in the TTM.

And the balance sheet?

Let me use this entry to touch on the top of "current ratio" that I have been using in this and other entries. Not being an accountant or finance person, I depend on other experts for explanations.

I found a nice explanation of the current ratio where it is explained:

"The current ratio is another test of a company's financial strength. It calculates how many dollars in assets are likely to be converted to cash within one year in order to pay debts that come due during the same year. You can find the current ratio by dividing the total current assets by the total current liabilities. For example, if a company has $10 million in current assets and $5 million in current liabilities, the current ratio would be 2 (10/5 = 2).On many entries, I have been referring to this "1.5" figure as a cut-off for 'good health'. This is where I got this figure.

An acceptable current ratio varies by industry. Generally speaking, the more liquid the current assets, the smaller the current ratio can be without cause for concern. For most industrial companies, 1.5 is an acceptable current ratio. As the number approaches or falls below 1 (which means the company has a negative working capital), you will need to take a close look at the business and make sure there are no liquidity issues. Companies that have ratios around or below 1 should only be those which have inventories that can immediately be converted into cash. If this is not the case and a company's number is low, you should be seriously concerned."

Anyhow, looking again at the Morningstar results, we can see that TALX has $7.8 million in cash and $48.7 millin in other current assets. This $56.5 million, when balanced against the $31.3 million in current liabilities, gives us a current ratio of approximately 1.8. A healthy if not spectacular figure. In addition, the company has another $132.6 million in long-term debt. With the growth in revenue, the growth in earnings, the steady free cash flow, I suspect that this debt load will not be a problem imho.

What about some valuation numbers on this company?

Reviewing Yahoo "Key Statistics" on TALX, we find that this is a mid-cap stock with a market capitalization of $900.18 million. The trailing p/e is a moderate 32.75, with a forward p/e (fye 31-Mar-07) of 25.52. With the rapid growth in earnings expected (5 Yr expected), we are left with a PEG of .88 which is quite reasonable imho.

Insofar as the Price/Sales ratio is concerned, using the Fidelity.com eresearch website, we can see that this stock is in the "Business Software & Services" industrial group. Within this group, TALX is actually the 'priciest' or richest in valuation with a Price/Sales ratio of 4.7. This is followed by BEA Systems (BEAS) at 4.4, First Data (FDC) at 3.6, Business Objects (BOBJ) at 3.2, Automatic Data Processing (ADP) at 3.1, and Fiserv (FISV) at 2. Thus, from this perspective, TALX is fairly richly valued.

Going back to Yahoo for a few more numbers, we find that the company has only 32.07 million shares outstanding with 29.7 million that float. Of those that float, 1.60 million shares or 5.10% of the float, is out short. This represents only 2.6 average trading days of volume (the short ratio). IMHO, this is not significant, as it is under 3 days which I have arbitrarily set to distinguish those companies which have a large number of shares out short.

As noted above, the company pays a $.16/share dividend with a yield of .60%. The last stock split, as I also noted earlier, was on 1/18/06, when the stock split 3:2, the second split in as many years.

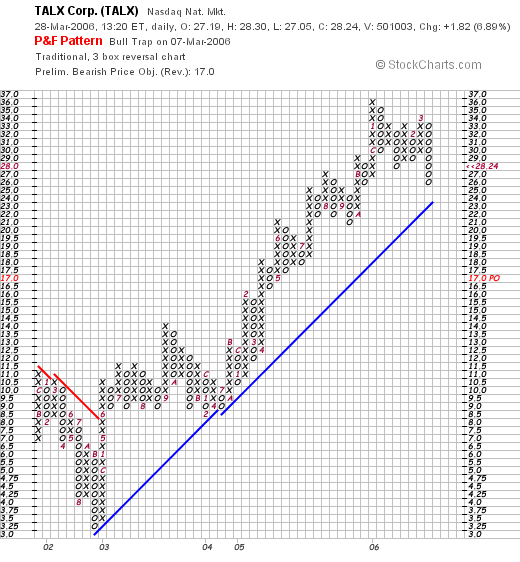

What about a chart?

Taking a look at the "Point & Figure" chart on TALX from Stockcharts.com, we can see that from a level of $10.50 in late 2001, to a bottom of $3.25 in October, 2002, the company showed considerable weakness in its stock price. However, after breaking through resistance at $8.00/share in May, 2003, the stock has moved steadily higher to the current $28 level.

So what do I think about this stock?

Well basically I like this stock a lot, even though I do not own any shares! The stock is making a nice move higher today apparently on an analyst upgrade. More importantly, the latest quarterly result was strong with growth in both earnings and revenue and the company raised guidance. The Morningstar evaluation looks nice with a steady growth in revenue, and also a steady growth in earnings which is often erratic in a small company like this. To top this off, the company pays a small dividend and has been raising (!) the dividend every year.

Valuation-wise, the p/e is a tad rich but the PEG is under 1.0. The Price/Sales ratio is the top in its group so no bargain there, but I am willing to endorse a stock with that particular ratio on the high end with everything else in line. On top of this, the chart looks strong.

Anyhow, that's a stock for you to chew on! I hope I haven't been too verbose, but if so, let me know and I will try to shorten these entries :). Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please be sure to visit my podcast website at http://bobsadviceforstocks.podomatic.com where you can listen to me droning on and on :) about many of these same stocks!

Bob