Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

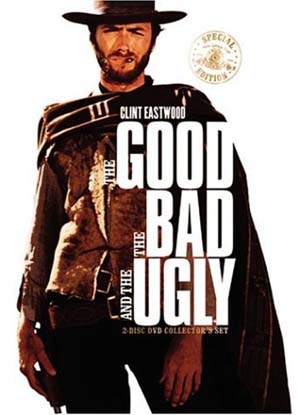

I probably should rename this blog, The Good The Bad The Ugly, after that 1966 'spaghetti western' starring Clint Eastwood. It is a great movie if you somehow haven't seen it.

I probably should rename this blog, The Good The Bad The Ugly, after that 1966 'spaghetti western' starring Clint Eastwood. It is a great movie if you somehow haven't seen it.

There have been a lot of great stock picks on this blog. But then again, we have a few duds now and then. I emphasize over and over the need to manage one's holdings, to limit one's losses, and not to stick one's head in the sand and ignore the world.

It just isn't a good idea.

I unfortunately wrote up New Century Financial (NCEN) and also spent some time as a stockholder It wouldn't have been a good stock to hold long-term at all.

This was my tenth stock discussed on this blog. I wrote up New Century Financial (NCEN) on May 22, 2003, when the stock was trading at $47.02/share. This company is probably the most concentrated stock in the sub-prime mortgage area. Needless to say, its current financial status is rather bleak, and the company now trades on the pink sheets and is now a very speculative penny stock that last traded at $.10/share and trades under the new symbol NEWCQ.PK.

This is what I wrote on May 22, 2003, about this company:

"May 22, 2003

New Century Financial (NCEN)

As you can see from my post yesterday on the main website page here (http://bobsadviceforstocks.tripod.com), I am an owner of New Century Financial...in my trading account. I have actually purchased this several times starting in 12/02 when I purchased 100 at an average cost of $23.41, 12/24/02 another 100 at an average cost of $26.68, and a final 100 at an average cost of $28.03. Following my own rules, I sold 100 on 5/5/03 for an average cost of $39.93. I had reached over a 50% gain in this issue in a short period of time and starting lightening up a little. So important to sell losses QUICKLY and sell gainers SLOWLY. Can only help to bias your results to the upside.

Anyhow, NCEN is having a GREAT day trading at $47.02 up $6.57 as we write at 9:22 am Central Time. What caused this pop is the fact that NCEN TODAY announced that in was INCREASING 2003 eps guidance from the $7.40-$7.50 range up to $8.75 to $9.25 range. Yes....this company is anticipating earnning about $9.00 per share (!!!) and sells even after this move for only $46. The company "is engaged in originatin, purchasing, selling and servicing subprime mortgage loans secured by first mortgages on single-family residences," according to the CNN.money site http://money.cnn.com/MGI/snap/A1434.htm (I hope that works for you to get to the profile section). Last quarter total revenues rose 61% to $181 million and net income rose 50% to $45.7 million.

Looking at Morningstar.com on this issue, we find

sequential growth in revenue from $98.6 million in 1997, $176.4 million in 1998, $233.9 million in 1999, $163.9 million in 2000 (which IS a drop which I would RATHER not see....but the rest of this is so good!), $293.3 million in 2001 and $511.1 million in the 'trailing twelve months'.

In addition, in today's announcement, NCEN indicated that they would maintain their $.10/share dividend (an added plus)...which means in effect a 50% increase in effective dividend return. This is a 50% increase because they announced a 3 for 2 stock split.

Unfortunately, Morningstar does not have the free cash flow report but interestingly does have the growth in revenue the last four quarters showing a 779.39%, 134.17%, 117.42%, and 86.84% increase in revenue each quarter. Pretty impressive!

For a final note, even AFTER today's big price rise, NCEN sells at a p/e ratio of only 6.18 suggesting tremendous value in their shares.

As a caveat, I know NOTHING about the management of this company...and would hold to an 8% stop loss on any purchase which I always suggest on all issues. If the stock should rise further....start selling some shares at a 40-50% range in gain....this is really an insurance of reducing your overall coston any purchase. Good luck and happy investing."

"New Century has yet to report financial results for the first quarter and for full-year 2006.The last time the company issued financial results was November, when it reported its third-quarter 2006 performance.

New Century had been the second-largest provider of home loans to high-risk borrowers but New Century collapsed after a spike in mortgage defaults led its lenders to pull funding and demand that it buy back bad loans.

The company stopped trying to make new home loans in March due to lack of funds."

Anyhow, THAT was pick #10. I managed to get in an out of it fairly quickly, and I think I could even see the writing on the wall shortly after writing up the stock when the stock price started declining on what was really good news they reported.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob