Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my weekend tasks that I like to try to accomplish has been to look way back into the early posts of this blog and see how they have turned out. Of course, just like my 'looking back one year' reviews, these assessments assume a buy and hold approach to my picks. In practice I advocate and employ a very disciplined, idiosyncratic process of selling stocks quickly on declines and slowly and partially on appreciation. This difference in managing a holding would of course affect the performance of any stock actually purchased. But for the ease of review, let's take a look at a pick from the 'early days' of this blog and see how the company and the stock is doing now!

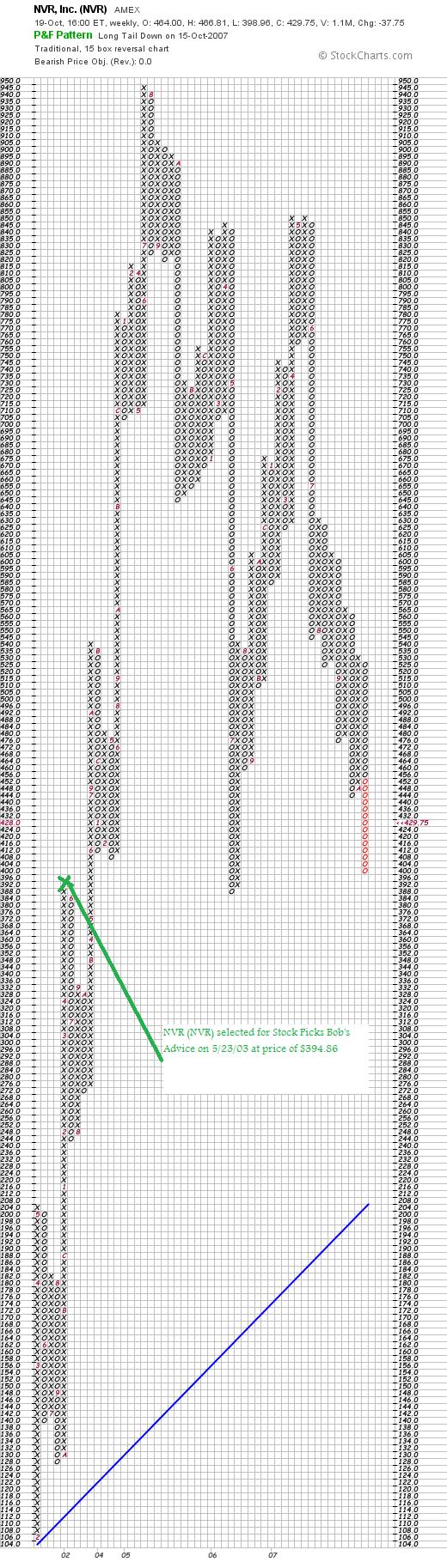

Last week I reviewed my stock pick #13, Red Robin Gourmet Burger (RRGB); on the same day I also reviewed NVR, a stock that I selected for this blog on May 23, 2003, when the stock was trading at $394.86, almost 4 1/2 years ago. In the meantime, this real estate related stock experienced the boom of that market climbing into the $900 range, and recently has suffered the collapse of the same market, trading back just over where it was picked. NVR closed at $429.75 on October 19, 2007, for a gain of $34.89 or 8.8% since the original post. Here is what I wrote:

Last week I reviewed my stock pick #13, Red Robin Gourmet Burger (RRGB); on the same day I also reviewed NVR, a stock that I selected for this blog on May 23, 2003, when the stock was trading at $394.86, almost 4 1/2 years ago. In the meantime, this real estate related stock experienced the boom of that market climbing into the $900 range, and recently has suffered the collapse of the same market, trading back just over where it was picked. NVR closed at $429.75 on October 19, 2007, for a gain of $34.89 or 8.8% since the original post. Here is what I wrote:

"May 23, 2003

NVR, Inc. (NVR) (AMEX stock)

It is getting late in the session...I guess you could say it is long in the tooth and I need something better for all of you stock fans.

Didn't see much on the NYSE or NASDAQ but on the Amex list we have one called NVR, Inc. According to Morningstar, NVR "builds single-family homes, condominiums, and townhouses, primarily in the Washington, D.C. area. The company builds about 3,000 homes per year ranging in price from $70,000 to $640,000 and averaging $182,000." NVR "also provides morgage financing through 23 offices in 15 states." A little bit of overlap with our New Century Financial I guess....but not much.

Not a cheap price, but not at the Berkshire Hathaway level (!), but today stock is trading at $394.86 (!) up $16.36 at 1:32 pm (CST) or a 4.32% increase.

Driving this stock higher was the release on April 16th of the first quarter result ending March 31, 2003. They announced that total revenue increase to $743 million compared to $692.2 million last year, and earnings per share exceeded last year's result by 24%.

Looking at the last 5 years, we find that revenue has grown from 1.5 billion in 1998, 2.0 billion in 1999, 2.3 billion in 2000, 2.6 billion in 2001, and 3.1 billion in 2002.

Free cash flow, as reported in Morningstar, has grown from 189 million in 2000, to 149 million in 2001 (a decrease), then back up to 369 million in 2002. This company really generates money!

Market cap is 2.7 billion, no dividend is paid, and the p/e is a rather cheap 10.94. Just the PRICE is high! (Just buy less shares). I do not own any shares of this company...but it looks like a nice investment to me! Happy investing and a Peaceful Memorial Day to all my friends! Bob"

Let's take a closer look at NVR today.

NVR just posted their 3rd quarter 2007 results on October 19, 2007. For the quarter ended September 30, 2007, revenue declined (17)% to $1.29 billion, down from $1.55 billion in the prior year. Earnings for the quarter were $91.1 million or $15.26/diluted share, down 22% from $129.3 million or $19.63/diluted share.

NVR just posted their 3rd quarter 2007 results on October 19, 2007. For the quarter ended September 30, 2007, revenue declined (17)% to $1.29 billion, down from $1.55 billion in the prior year. Earnings for the quarter were $91.1 million or $15.26/diluted share, down 22% from $129.3 million or $19.63/diluted share.

The company actually beat expectations on earnings which had been expected to come in at $11.97/share, but missed expectations on sales which were expected to be $1.32 billion.

Looking at the 'point & figure' chart on NVR from StockCharts.com, we can see the wild ride this stock has had with the stock climbing sharply after the purchase to reach a high of $945 in July, 2005, only to start a gradual decline to the current levels.

With the weak quarterly report, the overal weakness in the housing industry, and the unimpressive stock chart,

NVR (NVR) IS RATED A SELL

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Site (where I need to post a new show soon!), my Covestor Page which analyzes my actual stock holdings in my trading account, and my SocialPicks page where my stock picks are evaluated since the first of this year.

Have a successful week trading everyone!

Bob