Stock Picks Bob's Advice

Saturday, 12 March 2005

A Reader Writes, "Can you give me some suggestions?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As I do just about every time I write, I want to remind you that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

Checking my mail this evening, I received a very nice note from Rasik J. from New Jersey. Rasik writes:

Hi Bob,

You personal blog "Advice for stocks" is awesome. Its my first

visit to your site. I like it

sooooooo much. I will be happy learn some new stocks in future. I

never invested in stocks till

now. But I want to start investing now. Can you give me some

suggestions on starting the

investment process.

Also, since oil stocks and steel stocks are on rise. Can you write

something interesting about

(buy/sell) of energy and steel stocks.

I will keep watching your blog...

If you have any mailing list. add me to your mailing list.

Thankyou

Rasik J.

New Jersey.

Thank you Rasik! Your words offer me some encouragement, and I hope that somehow what I write is helpful to you in your thoughts about investing. Remember that I truly AM an amateur, so be sure to get professional advice as needed and do a lot of homework yourself on some of these issues.

You write about "starting the investment process". In general, as I have written elsewhere on Stock Picks, I believe that one should think about a portfolio of stocks in general terms first; that is how many issues you want to hold, how much invested per issue, etc. I would think that 12 stocks would be a nice goal for an initial portfolio (?), but you could raise or lower that depending on your own needs.

I think that it would be wise to start 50% invested, that is with 50% of the number of issues invested with 50% of the cash available. I like to automatically add some cash to the portfolio each month. I would only add a position (until you get to the maximum number planned), if you sell a portion of one of your holdings at a gain (if you want to do it like I do.) And also sell stocks down to 25% invested on losses. I would keep at least 25% invested at all times and would also not go over the original planned number of shares.

You can pick stocks in any way you feel works for you. I have lots of stocks on my blog that I have commented on, and if the same criteria applies, they may be good candidates for purchase.

As far as energy/steel stocks are concerned, I treat them the same way I treat everything else. However, I believe that steady growers might be better than cyclicals, and if I can find a more steady grower of revenue and earnings, then I wouldn't mind owning an oil stock (I own CDIS) or a steel stock (I have owned Schnitzer Steel in the past).

But my system is not about anticipating trends in the economy and investing in those hot sectors. I pick stocks based on their performance on a same-day momentum screen (greatest % gainers).

Is this the best way? Probably not. Does it work? I think so. Time will tell.

Thanks again for stopping by and visiting. Let me know how you do in your new investment activity and what stocks you picked and why....you don't have to answer all of that, but it might be interesting!

Drop me a line at bobsadviceforstocks@lycos.com if you have any additional questions!

Bob

"Looking Back One Year" A review of stock picks from the weeks of January 19, 2004 and January 26, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was away from my computer the week of January 19, 2004, and did not post any stock picks. The next stock pick posted after that week was the

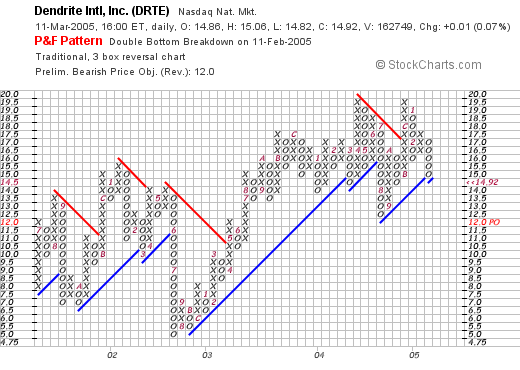

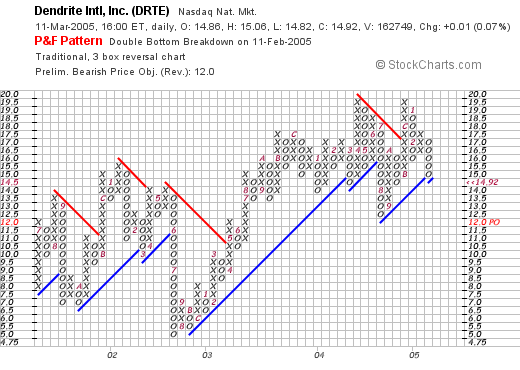

selection of Dendrite (DRTE) on Stock Picks on January 30, 2004 at $16.99/share. DRTE closed at $14.92 on 3/11/05, for a loss of $(2.07) or (12.2)%.

On February 3, 2005, DRTE

reported 4th quarter 2004 results. Revenue for the quarter ended December 31, 2004, grew 6% to $104.8 million. Net income came in at $8.8 million, up 51% from $5.8 million the prior year. On a diluted eps basis, this came in at $.20/share, up 47% from $.14/share the prior year.

Since I am only reviewing one stock, let's take a look at their

point and figure chart from Stockcharts.com:

The chart actually looks pretty steady, with the stock dropping from a peak of $16.00 in January, 2002, down to $5.00/share in July, 2002, but then climbing steadily right back to its current level at $14.92. The stock has shown a little weakness, testing its support level at $15.00 at the moment.

Thus, for the week, I just had one selection :(. Dendrite (DRTE), that dropped (12.2)%. Of course, in practice, I aggressively use an 8% loss limit (manually executed) to limit my losses on the downside. For the sake of illustration, this review assumes a buy and hold strategy for determining the performance of stock picks.

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to post them right here, or email me at bobsadviceforstocks@lycos.com.

Bob

"A look at my Trading Portfolio"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It has been awhile since I reviewed my holdings here and this is about as good a time as any to do this. I currently have 18 positions in my "trading portfolio" and my goal is to get it up to 25 positions. These are my stocks as of today and some of my sale points:

1) Affymetrix (AFFX): I purchased 160 shares of AFFX on 1/27/05 at a cost basis of $40.98, no sales have been made, and the current price is $41.45. I have a gain of 1.15%, and shall either be selling it next at a loss of (8)%, or 1/4 of my holdings at a gain of 30%.

2) American Healthways (AMHC): I purchased 300 shares on 6/18/04 at a cost basis of $23.53. 75 shares were sold 11/3/04 at $32.65, for a gain of $9.12 or 38.8%. Currently, AMHC closed at $32.08 for a gain of 36.36%. My next sale point will be at a 60% gain on the upside, or at break-even on the downside.

3) American Medical Systems (AMMD): I purchased 200 shares of AMMD with a cost basis of $25.82 on 1/9/04. I sold 50 shares at $32.08 on 6/24/04 for a gain of $6.26 or 24.2%. My second sale was 35 shares on 12/21/04 at $40.92 for a gain of $15.10 or 58.5%. Currently, AMMD closed at $38.00 with a gain of 47.17%. My sale point on the way down will be back at a 30% gain (1/2 retracement of the top sale-point), or at a 90% gain on the upside, in which case I will once again sell a 1/4 position.

4) Cal Dive Intl (CDIS): I purchased 200 shares on 11/3/04, with a cost basis of $38.20. My first sale was 50 shares on 2/25/05 at a price of $49.87, for a gain of $11.67 or 30.5%. CDIS closed today at $47.730, for a gain of 24.95%. I shall be selling the remaining shares on the downside if it crosses "break-even", otherwise, another 1/4 position is planned to be sold at a 60% gain level.

5) Cantel Medical (CMN): My shares have a cost basis of $13.36. I have sold shares three times, at the 30, 60, 90% level. Thus, I shall be selling an additional 1/4 position if the stocks hit a 120% gain, otherwise, the remaining shares will be sold on the downside if the stock retraces to a 45% gain. CMN closed at $26.94, for a 101.65% gain from the purchase.

6.) Coach (COH): I have 68 shares remaining at $59.13 for a 254.87% gain. COH shares were acquired in 2/25/03 at a cost basis of $16.66. I have sold COH shares six times (!), at 30, 60, 90, 120, 180, and 240% levels. The next sale on the upside is at a 300% gain level. On the downside, remaining shares will be sold if the stock retraces to a 120% gain.

7.) Cooper (COO): I have 45 shares remaining at $83.00/share for a gain of 207.64%. These shares were originally acquired 2/20/03 with a cost basis of $26.98/share. I have sold portions of my position five times: at a 30, 60, 90, 120, and 180% level. My next sale point on the upside is a 1/4 postion sale at 240%. On the downside, remaining shares will be sold if the stock retraces back to a 90% gain.

8.) Cytyc (CYTC): I have 225 shares of CYTC which closed at $22.160, for a 49.17% gain. CYTC shares were purchased 1/29/04, with a cost basis of $14.86. I have sold shares of CYTC three times, and thus, if the stock retraces back to a 45% gain, then the stock should be sold. On the upside, I am waiting for a 120% gain and then shall be able to sell a portion!

9.) Dell (DELL): I have 120 shares of DELL which closed at $39.710 today, for a gain of 57.99%. DELL shares were acquired 2/14/03 at a cost basis of $25.13. I have sold shares twice (30%, and 60% gains); and shall sell again at a 90% gain, or at 30% on the downside.

10.) Exactech (EXAC): I have 135 shares of EXAC which has a cost basis of $10.78, closed today at $16.52, with a gain of 53.21%. I have sold EXAC three times: at 30, 60, and 90% gains. Thus, I should be selling the remaining shares if it passes the 45% gain level going lower, or sell another 1/4 of my shares if the stock price rises to a 120% gain.

11.) Hibbett Sporting Goods (HIBB): I have 130 shares remaining at $29.30, with a gain of 200.71%. These shares were originally purchased 3/6/03 with a cost basis of $9.74. I have sold HIBB shares five times (30, 60, 90, 120, 180% gain). Thus, on the downside, I would be a seller of the remaining shares at a 90% gain or at 240% on the upside!

12.) Mentor (MNT): I have 200 shares at $31.970, which closed at $31.97, with a loss of $(480.00), or (6.98)%. These shares were purchased 2/3/05 with a cost basis of $34.37. Thus, the stock will be sold if the stock closes at or trades through an 8% loss; otherwise, I shall be selling a portion at a 30% gain.

13.) Quality Systems (QSII): I have 68 shares remaining at $89.00/share for a gain of 187.14%. These shares were acquired 7/28/03 at a cost basis of $31.00/share. I have sold shares of this stock five times with a 30, 60, 90, 120, 180% gain. My next sale on the upside is 240% gain, otherwise I shall sell the remaining shares if the stock drops to a 90% gain level.

14.) ResMed (RMD): I have 120 shares which closed at $56 for a loss of (6.26)%. These shares were acquired on 2/4/05, with a cost basis of $59.74. The stock shall be sold if it hits an (8)% loss on the downside, or 1/4 position sold at a 30% gain on the upside.

14.) Starbucks (SBUX): I have 35 shares of SBUX which closed at $53.50 today for a gain of 134.55%. These shares were acquired 1/24/03 with a cost basis of $22.81/share. I have sold portions of my position four times at 30, 60, 90, and 120% gain levels. Thus, my next sale on the upside is a 180% gain, and on the downside, would liquidate the remaining shares at a 60% gain.

15.) SRA Int'l (SRX): I have 160 shares which closed at $61.410 for a gain of 2.95%. These shares were acquired 2/1/05 for a cost basis of $59.65/share. I have not sold any shares of this original position, and thus, will sell all shares at a loss of (8)% or sell 1/4 of shares at a 30% gain.

16.) St Jude Medical (STJ): I have 240 shares of STJ which closed at $37.660, for a gain of 30.33%. These shares were acquired 10/15/03 with a cost basis of $28.90. Thus far, I have sold only one portion of my holdings at a 30% gain range. Thus, on the downside, will sell remaining shares at break-even. On the upside, another 1/4 of shares will be sold if the stock hits a 60% gain.

17.) Sybron Dental (SYD): I have 150 shares of SYD which closed at $35.85 for a gain of 38.74%. These shares were purchased 11/18/03 at a cost basis of $25.84. I have made one sale at a 30% gain on 1/25/04, so I shall be selling the remaining shares at break-even or another 1/4 of shares at a 60% gain.

18.) Ventana Medical Systems (VMSI): I have 150 shares of VMSI which closed at $68.11 for a gain of 45.10%. VMSI shares were purchased 4/16/04 for a cost basis of $46.94. A single portion of the holdings was sold on 11/29/04 at the 30% gain level. Thus, I shall be selling remaining shares if the stock retraces to break-even, or 1/4 of my position if the stock continues rising to a 60% gain.

To be fair, I sell my losers quickly, so there ARE a lot of sales at losses that are not posted above this and last year. As of 3/12/05, for 2005, I have taken a net of $(1,343.96) in short-term losses (under 12 months), and a net of $4,739.82 in long-term gains. So "realized" profits and losses are still in the profit column.

In 2004, I ended up with $457.42 in short-term gains and $4,376.29 in long-term gains that were realized.

Since many of my positions show "paper-profits", that is gains that have not been taken (I have not sold the stocks yet), my "unrealized gains" stand at $30,816.58.

Additional facts about my trading account. As of 3/12/05, the account had a net worth of $56,884.47. I do have a heavy margin load that I would ultimately like to pay down as this magnifies the volatility in both directions. My "Margin Equity Percentage" is 51.80%, with my securities market value of $109,810.24, with $52,925.77 in margin. I would NOT recommend this margin to anyone!

I hope that this is helpful for you to see what I have been holding, and my actual trading gains and losses. Mentor and ResMed are threatening to be sold at that 8% loss...and Exactech is also threatening a sale at the downside. You can see how the portfolio, however slowly, tends to move out of equities in a down market. Please let me know if this review is helpful for you in understanding what I am doing in my trading activities. I try to be as transparent as possible in all of this! Regards!

Bob

Posted by bobsadviceforstocks at 12:56 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 12 March 2005 7:59 AM CST

Thursday, 10 March 2005

March 10, 2005 Hibbett Sporting Goods (HIBB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please consult with your professional investment advisors before making any decisions based on information on this website!

I was looking through the

list of top % gainers on the NASDAQ and came across Hibbett (HIBB). Since HIBB is one of the first stocks I owned in my

"Trading Portfolio", I was certain that I had discussed this somewhere in depth. Actually, I discussed HIBB not too long ago, when it was flirting with a sale on the downside. HIBB was acquired by me on 3/6/03 and I have a cost basis of $9.74/share. To give you the appropriate perspective, HIBB is trading at $29.49, as I write, up $2.75 or 10.28% on the day!

According to the

Yahoo "Profile" on HIBB, Hibbett "...is an operator of athletic sporting goods stores in small to mid-sized markets predominantly in the southeast, mid-Atlantic and Midwest United States."

What has been driving the stock higher was the

4th quarter 2004 earnings results which were announced yesterday and a conference call today.

For the fourth quarter, revenue increased to $107.1 million from $91.2 million last year. Earnings came in at $8.2 million, or $.35/share, up from $6.5 million or $.27/share during the final quarter in 2003. For 2006, the company raised guidance to $1.26-$1.32/share, while the "street" was looking for $1.24. The news was enough to push the stock higher today!

How about longer-term? Taking a look at the

Monrningstar.com "5-Yr Restated" financials, we can see what I think is one of the prettiest financial pictures in my portfolio or on this blog!

First, revenue has grown steadily from $174 million in 2000 to $362 million in the Trailing twelve months. Second earnings have grown also incredibly steadily from $.39/share in 2000 to $.99/share in the trailing twelve months (TTM). Free cash flow has been solid and growing: from $4 million in 2002 to $24 million in the TTM.

The balance sheet is also pristine, with $44.5 million in cash and $112.5 million in other current assets reported on Morningstar.com. Against this, HIBB has $46.3 million in current liabilities and only a $.5 million of long-term liabilities is reported!

What about valuation questions? Taking a look at

"Key Statistics" on HIBB from Yahoo, we can see that this is really a small company, barely a mid cap stock with a market capitalization of $693.16 million. The trailing p/e is a bit rich at 29.62, but the forward p/e (fye 31-Jan-06) is a bit better at 23.81. Thus, the 5-Yr PEG isn't bad at 1.18. Price/sales also not too rich at 1.74.

Yahoo reports 23.47 million shares outstanding with 18.40 million that float. Of these, 686,000 shares are out short as of 2/8/05, representing 3.73% of the float or 4.426 trading days of volume.

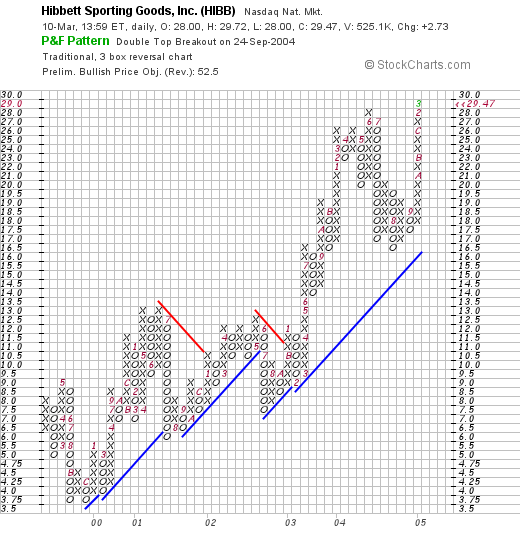

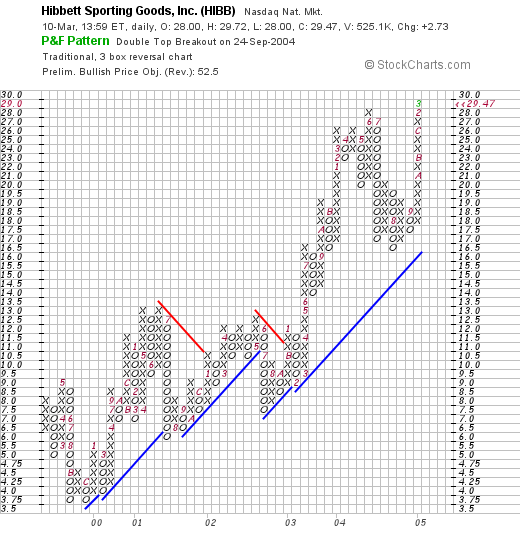

So what does the chart look like? Taking a look at a

Point & Figure chart from Stockcharts.com:

We can see that the stock has traded higher since January, 2000, when it was about $3.75/share to the current levels around $29.50. The graph really appears quite strong to me!

So what do I think? Well, I own the stock, so you know I like it! Especially after picking up shares in March, 2003, when HIBB was only $9.74/share! But seriously, the earnings are solid, the most recent same-store sales growth is just above 5%, the trend in revenue and earnings is quite impressive, valuation is reasonable, the balance sheet is super, well what IS there that I don't like? I can't really think of anything offhand :).

Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 8 March 2005

"Trading Transparency" SYNA

Hello Friends! Is this market talking to me or what? A few moments ago, my Synaptics stock (SYNA) hit the 8% loss limit and I placed a trade to sell my 300 shares at $21.90. These shares were also recently acquired on 2/25/05, for a cost basis of $24.05/share. Thus, I had a loss of $(2.15)/share or (8.9)% and out they went. You can see how my portfolio is moving back towards cash automatically. (Yikes). Anyhow, I shall be sitting on my hands, NOT replacing these positions, until one of my other holdings hits a sale point on a gain.

I hope you follow :). Thanks again for stopping by. Please feel free to email me at bobsadviceforstocks@lycos.com if you have any questions!

Bob

"Trading Transparency" PRFT

Hello Friends! Do you think I will ever learn? A few moments ago I unloaded my 400 shares of Perficient (PRFT) at $8.37/share. I have a cost basis of $9.37/share and had purchased them just four days ago on 3/4/05. YIKES. That is a loss of $(1.00)/share or (10.7)%. Ouch. Maybe next time I will learn to stick with stocks over $10. But those numbers were very attractive.

Just wanted to keep you posted! Have a great day trading! And whatever you do the rest of the time!

Bob

Monday, 7 March 2005

March 7, 2005 Egl Inc. (EAGL)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to check with your professional investment advisors prior to making any investment decisions based on information on this website.

I have written some fairly in depth explanations about how I have been picking stocks so let me see if I can just get right to the important facts on this stock today!

First of all, reviewing the

list of top % gainers on the NASDAQ today, I came across Egl Inc. (EAGL) which closed at $26.97, up $2.30 on the day or 9.32%. I do not own any shares nor do I own any options on this stock.

According to the

Yahoo "Profile" on EAGL, EGL "...is a global transportation, supply chain management and information services company that provides logistics solutions, such as air and ocean freight forwarding, customs brokerage, local pick up and delivery service, materials management, warehousing, trade facilitation and procurement and integrated logistics and supply chain management services." As noted on the

EGL website, EGL "...was the first US transport and logistics company to establish a proven freight delivery system in Iraq." I am not sure how much this Iraq work has contributed to their growth.

Looking for the latest quarterly report, I found that EGL

reported 4th quarter 2004 results on March 3, 2005. Revenues for the quarter grew 16% to $230 million. Operating income for the quarter increased 66% to $27.6 million compared to the prior year same quarter. This worked out to $.26/diluted share, up from $.19/diluted share the prior year.

How about longer-term? Looking at

"5-Yr Restated" financials on EAGL from Morningstar, we can see that revenue has grown fairly steadily from $1.4 billion in 1999 to $2.6 billion in the trailing twelve months (TTM).

Earnings have been rather erratic, dropping from $1.11/share in 1999 to a loss of $(.84)/share in 2001. Since that time, earnings have steadily increased to the $.94/share in the TTM.

Free cash flow has also not been perfect with $(41) million in negative free cash flow in 2001, improving to $23 million in 2002, but dropping to $(1) million in the TTM. This is a negative for this stock, but overall the rest of the numbers were fairly solid, so I decided to go ahead with the post.

The balance sheet is also fairly good with $97.3 million in cash and $633.4 million in other current assets, balanced against $488.8 million in current liabilities and $140.6 million in long-term liabilities.

What about "valuation"? Looking at

"Key Statistics" on Yahoo for EAGL, we can see that this is a mid cap stock with a market capitalization of $1.23 billion. The trailing p/e isn't too bad at 26.57 and the forward p/e (fye 31-Dec-05) is better at 16.86. Thus, the five-yr PEG is under 1.0 at 0.94. In addition, the Price/sales is also below 1.0 at 0.41. Valuation looks nice to me.

Yahoo reports 45.59 million shares outstanding with 35.60 million shares that float. Of these, 1.54 million were out short as of 2/8/05, representing 4.33% of the float or 3.3318 trading days. This is just above the significant level of 3.0 (which is my own level that I use to judge short interest), but doesn't look like it is a big factor for this particular stock at this time.

No cash dividend is paid and the last stock split reported on Yahoo was a 1999 3:2 stock split.

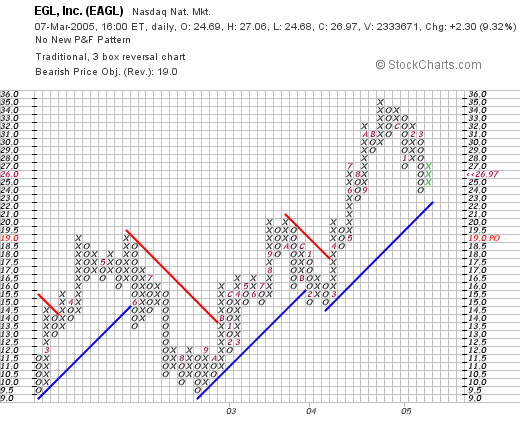

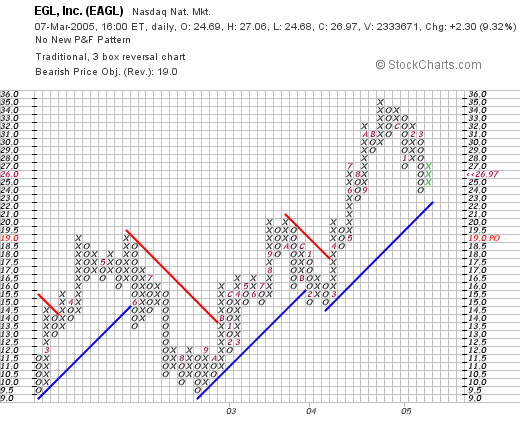

How about "technicals"? Taking a look at a

"Point & Figure" chart from Stockcharts.com:

We can see that this stock which was trading lower between late May, 2002, when it was at $18.00, dropped to a low in September, 2002, at around $9.50. Since that time, except for momentary weakness in February, 2004, this stock has been trading strongly higher. The graph looks strong but not over-extended imho.

So what do I think? Well the latest quarterly report looks quite strong, the five year record is nice, free cash flow is NOT as strong as I would like, the balance sheet is solid, and valuation is quite reasonable. The chart looks solid as well. I am not sure what this Iraq business is all about, but it is clear this company has been in business before all of this developed.

Now if I just had some money :) I might be buying some stock. But I just SOLD some stock on questionable news, and thus, I shall be sitting on my hands once again!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Trading Transparency "DVA"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to taking any action based on information on this website.

A few moments ago, I unloaded my remaining 200 shares of Davita (DVA), the renal dialysis company, at $42.29/share. I purchased these shares at a cost basis of $36.29/share on 12/6/04, for a gain of $6.00/share or 16.5%. I sold because of news of a federal investigation into the accounting practices and chose not to ride this one out. Hopefully, I have not once again been "shaken out" of Davita unnecessarily.

I have owned Davita once before in 2003, and sold on news that turned out not to be fundamentally significant...so I may have done it once again...:).

In any case, with a sale of shares on "bad news" I am once again sitting on my hands, applying the proceeds of that sale to my margin...and waiting for a sale on "good news" before adding or replacing that position.

Thanks so much for visiting. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 6 March 2005

A Reader Writes "When do you think I should start to purchase more stocks?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I do however enjoy receiving mail from readers and if you would like to drop me a line, you can reach me at bobsadviceforstocks@lycos.com. Please remember that I cannot answer all letters that I receive and I cannot address individual investment issues....those are the things you need to use your own professional investment advisor to assist you with.

A week or so ago, Chris, who is a student over in Boston, Massachusetts, inquired about a class project. I answered him in the blog, and he has followed up with a progress report! (Thanks Chris for keeping me posted!). Chris wrote:

Hey Bob,

Sorry for the late response. Originally I had posted a comment but I

guess it didn't appear on the blog. What my partner and I decided to

do was use a variety of stratgies. We decided to each pick 3 stocks

and screen them with the suggestions you made. When my professor

returned out paper he said that your advice was sound in that it is

essential for us to follow the steps that you outlined, however, he

mentioned that we should use even more sources just to justify the

validity of your method.

My half of the portfolio mainly consisted of things that were a bit

safer including a blue chip and one of the stocks in your portfolio,

while my partner decided to invest in a mining company to balance our

beta, a reit, and another company which I don't recall at the

moment.. With the six stocks chosen I used 300,000 or so of our

million dollars. Now I will put your selling policies into place but

I was wondering when you think I should start to purchase more stocks.

Thanks for the time you put into helping us. It was a long entry

with a lot of great advice. If the return on our portfolio's was

real we'd surely pay you a fee :)

Chris

Well Chris, let me see if I may be of assistance. I think your professor's suggestion of using more sources is a good one. However, I suspect that the sources that I have been using are probably more than adequate. But more is better :).

You said your half of the portfolio consists of "...things that were a bit safer including a blue chip and one of the stocks in your portfolio". If I was your professor, I would inquire

why you decided your picks were "safer"? And balancing with a mining stock and a REIT....well, this is getting interesting!

O.K., so you have used $300,000 of your $1 million to get started. When should you buy additional stocks? Well, from my perspective starting out at 30% invested is probably way too conservative. I think that 50% invested would be a great place to start. I would of course suggest that you look through my blog and page back through prior posts the last few months....as long as latest earnings are intact...you probably could find a few more stocks of interest. The stocks on my blog run the gamut in size and maybe you would be comfortable with a coupld of them.

My buying and selling strategy for a portfolio, that you could certainly adapt for your use, consists of an "internal barometer"....that is I like to use the performance of my own stocks to tell me when I should be buying and when I should be, as I like to say, "sitting on my hands."

What I would suggest is that you invest your $'s in your portfolio in fairly equal amounts among the different stocks. Predetermine how many stocks you want to have to feel adequately, yet not overly-diversified. For argument sakes, let's say 20. (I use 25 in my trading portfolio and am currently at 22.)

If you are at 50% invested, I would think you should thus be at 10 stocks. However, if you have only 6 stocks at 50%, well then 12 stocks would be your max.

I would suggest that your minimum # of holdings be half of your original # in your portfolio. I hope you are following. Thus, if you start at 6 stocks, you could drop down to three. If you get down to three stocks, I would then replace them if they are sold. If you get up to your maximum # of issues, for instance 12 stocks in this example, then if you have a signal to add a position, simply ignore this signal and instead add to your cash position.

O.K. what ARE the signals you are asking? Well, it is simple, as you know, I like to sell losers quickly, and winners slowly. These sales on gains or losses are the signals I use to add to the positions, or add to the cash.

There is an interesting book that you might like to discuss with your professor called "How to make $1,000,000 in the Stock Market Automatically!" by Robert Lichello that helped stimulate my own thoughts on this process. He does something rather different, but it is an interesting theory on portfolio management.

O.K. back to the signals! First, I have sale points on stocks rising in price. (I actually do this stuff!). What are they? For me, I sell 1/4 of a position remaining each time (1/4 of the shares), at sale points of gains of 30%, 60%, 90%, 120%, then by 60%: 180%, 240%, 300%, 360%, then by 90%....etc. I haven't got to those levels yet...but have sold some shares at 240% gains!

These sales on a gain, are signals that the market is in a healthy environment and I add a position (if I haven't reached my maximum # of positions in my portfolio).

Now on the downside: first sale is at a loss of 8%...out the stock goes. No matter how long I have held it. I usually give it at least a day :). However, if a stock has risen enough to have sold a portion at a gain, I will do the following: after the first sale (30% range), I sell if it hits "break-even". After that, I sell if it retraces 50% of its highest sale point...that is if I sold a portion at 90% gain, I will allow the stock to retrace back to 45%.

I also will sell a stock if there is something fundamentally wrong reported....like bad news. However, I really have been moving away from this, I don't want to have much "subjective" input on my holdings, and would prefer to let the market dictate my actions.

Well that is about what I do! I hope you can follow. See what your professor thinks and get back to me. I have enjoyed our correspondence and wish you well in your class!

Bob

Saturday, 5 March 2005

"Looking Back One Year" A review of stock picks from the week of January 12, 2004.

Hello Friends! Thank you so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

A year ago, last January, I was off on vacation enjoying some scenery with friends and family. I didn't make any posts that week, thus, I shall review the following week's posts next week!

Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 4:36 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 12 March 2005 1:47 PM CST

Newer | Latest | Older

I was away from my computer the week of January 19, 2004, and did not post any stock picks. The next stock pick posted after that week was the

I was away from my computer the week of January 19, 2004, and did not post any stock picks. The next stock pick posted after that week was the  On February 3, 2005, DRTE

On February 3, 2005, DRTE

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  According to the

According to the  For the fourth quarter, revenue increased to $107.1 million from $91.2 million last year. Earnings came in at $8.2 million, or $.35/share, up from $6.5 million or $.27/share during the final quarter in 2003. For 2006, the company raised guidance to $1.26-$1.32/share, while the "street" was looking for $1.24. The news was enough to push the stock higher today!

For the fourth quarter, revenue increased to $107.1 million from $91.2 million last year. Earnings came in at $8.2 million, or $.35/share, up from $6.5 million or $.27/share during the final quarter in 2003. For 2006, the company raised guidance to $1.26-$1.32/share, while the "street" was looking for $1.24. The news was enough to push the stock higher today! What about valuation questions? Taking a look at

What about valuation questions? Taking a look at

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  First of all, reviewing the

First of all, reviewing the  Looking for the latest quarterly report, I found that EGL

Looking for the latest quarterly report, I found that EGL  What about "valuation"? Looking at

What about "valuation"? Looking at

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Hello Friends! Thank you so much for stopping by and visiting my blog,

Hello Friends! Thank you so much for stopping by and visiting my blog,