Stock Picks Bob's Advice

Tuesday, 21 June 2005

"Revisiting a Stock Pick" Somanetics (SMTS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As I always remind you, please remember that I am truly an amateur investor and prior to making any investment decisions based on information on this website, you should consult with your professional investment advisors.

Looking through the

list of top % gainers on the NASDAQ today, I came across an old name, a stock that I have reviewed previously. Somanetics (SMTS) is having a nice day, trading as I write, at $22.25, up $1.51 or 7.28% on the day. I do not own any shares or options on this company.

I first

posted Somanetics (SMTS) on Stock Picks on March 14, 2004, when it was trading at $11.50 (!). Thus, the stock has appreciated $10.75 or 93.5% since posting a little more than a year ago.

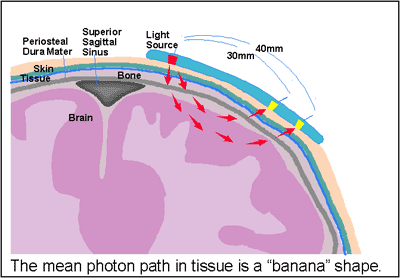

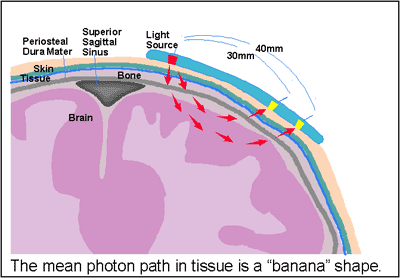

According to the

Yahoo "Profile" on Somanetics, the company "...engages in the development, manufacture, and marketing of medical devices primarily in the United States. Its INVOS Cerebral Oximeter, a noninvasive patient monitoring system, provides continuous information about changes in the blood oxygen level in the brain."

On June 14, 2005,

Somanetics reported 2nd quarter 2005 results. For the three months ended May 31, 2005, revenue climbed 68% to $5.1 million from $3 million. Earnings came in at $890,183 or $.08/share, up 100% from $409,730 or $.04/share the prior year. They beat analysts expectations on both earnings and revenue; they were expected to come in at $.05/share on revenue of $4.4 million.

Looking at the

"5-Yr Restated" financials from Morningstar.com, we can see the steady revenue growth from $5.1 million in 2000 to $12.6 million in the trailing twelve months (TTM).

Earnings during this period have improved consistently from a loss of ($.57)/share to $.79/share in the TTM.

Free cash flow which was negative at ($1) MILLION IN 2002 has also improved to a positive $2 million in the TTM.

The balance sheet, as presented by Morningstar.com, looks solid with $7.5 million in cash, alone able to cover the short-term liabilities of $1 million, and no long-term debt at all. In addition, SMTS has another $3.7 million in other current assets.

Looking at

"Key Statistics" on SMTS from Yahoo, we can see that this is virtually a micro-cap stock with a market capitalization of $222.84 million. The trailing p/e is 27.97. I do not trust the forward p/e number from Yahoo, but they are anticipating a 53.42 p/e (which would go along with a halving of earnings instead of the doubling just reported.) for fye 30-Nov-06. I suspect, unless there is something else I don't know about this company, that this forward p/e has just not caught up with analysts or vice versa because of the very small nature of this company. The same goes with the PEG which is at 2.07.

Yahoo shows a Price/Sales of 15.10, which certainly looks rich to me. Referring to Fidelity Brokerage, SMTS is in the "Medical Appliances/Equipment" industry group. Within this group, this Price/Sales ratio puts it at the top in terms of this ratio. Other stocks in this group, trailing SMTS in the Price/Sales ratio, include Zimmer (ZMH) at 6.5, Medtronics (MDT) at 6.4, St. Jude (STJ) at 6.2, Biomet (BMET) at 5.1, and Edwards Lifesciences (EW) at 2.7.

Going back to the Yahoo information, we can see that there are 10.18 million shares outstanding with 9.63 million that float. Currently there are 314,260 shares out short representing 3.2% of the float or 6 trading days. This is significant (imho), with my own cut-off of 3 trading days that I use to look at stocks. Thus, this adds to the buying pressure.

No cash dividends reported on Yahoo and the last stock split was a "reverse" 1:10 stock split carried out in April, 1997. For those of you who may not understand reverse splits, this is usually done to actually boost a poorly performing stock to increase the stock price. For instance, if you were the owner of 100 shares prior to a 1:10 split, after the split, you would only own 10 shares of the new issue. The stock price goes up proportional to the split. If a stock was trading at $1 before a 1:10 split, it should be trading at $10 after the split.

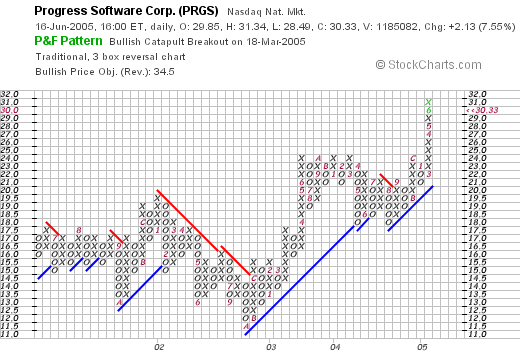

What about the chart? If we look at a

"Point & Figure" chart from Stockcharts.com, we can see that this stock was trading lower throughout most of 2002, dropping from $4.75 in April, 2002, to a low of $%1.25 in August, 2002. Since that time, the stock has essentiall traded steadily higher to its current levels around $22.

So what do I think about this stock? Well, first of all, I wish I had bought some shares last year when I first posted it :(. However, let's review some of the things I have written: the stock is making a nice move today on the back of a fabulous earnings report that beat analysts expectations with a 68% rise in revenue with a 100% jump in earnings. In addition, the company has steadily been growing both revenue and earnings the past five years. They are spinning off free cash flow and the balance sheet looks terrific.

A couple of negatives. The valuation is steep with a Price/Sales ratio off the chart. However, the rest of the valuation isn't bad with a p/e in the low 20's and the latest quarter showing 100% growth in earnings. I am not sure about the other valuation numbers on Yahoo with a forward p/e so much higher than the current p/e. That needs investigation.

The short interest adds buying pressure and the chart looks great. I still find this stock very attractive. Of course, any small slip-up will hand you a loss on a small cap stock like this. However, the potential seems quite large, and the stock might just be an acquisition target for a larger company looking at expanding its medical equipment line. I certainly do NOT know of anything going on at this time.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them right here on the blog or you can email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 20 June 2005

June 20, 2005 Molecular Devices (MDCC)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to check with your professional investment advisors prior to making any decisions based on information on this website.

Overall the market is behaving poorly this morning. The Dow and the NASDAQ are down and oil is flirting with $60/barrel. In my own trading account, my Kyphon (KYPH) is also flirting with an 8% loss, and I shall be letting that one go if it does break down to that level. This is actually the second time in the past few years that I have tried to make Kyphon work for me. Hopefully, things turn around a bit, but the market will dictate my own action.

I was looking through the

list of top % gainers on the NASDAQ this morning and came across Molecular Devices (MDCC). As I write, MDCC is trading at $21.20, up $1.90 or 9.84% on the day. I have looked at this stock in the past, and I believe I used to own some shares of this, but I do not currently own any shares or options in MDCC.

According to the

Yahoo "Profile" on MDCC, this company "...engages in the design, development, manufacture, sale, and servicing of bioanalytical measurement systems for drug discovery and other life sciences research."

One of my first "stops" in reviewing a stock is to check the latest quarterly report. I am looking for growth both in revenue and earnings.

On April 28, 2005, Molecular Devices announced

1st quarter 2005 earnings results. For the quarter ended March 31, 2005, revenues grew 43% to $39.1 million, up from $27.3 million in the prior year same period. Net income increased 50% to $2.2 million from $1.4 million last year. On a per share fully diluted basis, earnings increased 30% to $.13/share up from $.10/share last year. These were solid results imho.

My next step in looking at a stock is to take a longer perspective. It is my view, that like a physics theorem, that things in motion tend to stay in motion :). This really an earnings momentum view. In other words, a stock of a company that has been posting excellent results for the last several years and the latest quarter is more likely to continue to post good results than a company with a more inconsistent record. I don't believe that earnings and revenue growth are random events. They are a product of an outstanding management team in conjunction with an outstanding product or service.

For this longer-term view, I find the analysis on Morningstar.com very helpful. In fact the

"5-Yr Restated" financials on MDCC give us quite a bit of useful information. First of all, revenue growth has not been perfect, yet it is very impressive. Morningstar does show a dip in revenue from 2000 when MDCC reported $96.0 million, to $92.2 million in 2001. However, since 2001, the revenue has steadily increased to $160.3 million in the trailing twelve months (TTM).

Looking at earnings, we can see that the company was losing money in both 2000 and 2001, when they posted $(.32)/share earnings. Since that time, MDCC has impressively been improving its earnings picture each year, posting $1.07/share in the trailing twelve months (TTM).

Free cash flow has been positive and steady (but not really growing) with $13 million posted in 2002 and $14 million in the TTM.

The Morningstar balance sheet results also look solid with $74.1 million in "other current assets" along with $8.3 million in cash, balanced against $30.9 million in current liabilities and $6.7 in long-term liabilities.

There are many ways of investing. I like to be "eclectic" and draw from different strategies. The underlying philosophy that drives my trading remains "momentum" but still, I do not close my eyes to technical, or valuation issues.

For valuation, I like to look at Yahoo "Key Statistics" and I also use my Fidelity online site for questions about comparative valuation. Looking at

Yahoo "Key Statistics" on MDCC, we can see that this is a small cap stock with a market capitalization of only $359.95 million.

The trailing p/e is very nice (imho) at 20.32, with a forward p/e (fye 31-Dec-06) of only 19.34. The (5 yr expected) PEG is 0.93, making it very attractive (under 1.0) on a valuation basis.

MDCC sports a Price/Sales ratio of 2.04. MDCC, according to my Fidelity source, is in the "Scientific/Tech Instruments" industry. This Price/Sales is fairly reasonable compared to the other companies in this group. Garmin (GRMN) tops this group at 6.1 Price/Sales, Flir (FLIR) is just under that at 4.3, Applied Biosystems (ABI) is at 2.4, followed by MDCC at 2, Beckman Coulter (BEC) at 1.7, and Agilent (A) at 1.7. Thus, even with this parameter as well, MDCC looks like a good value!

Other statistics on Yahoo show that MDCC has 16.92 million shares outstanding. 15.91 million of them float. There are currently 893,550 shares out short (5/10/05) representing 5.5 trading days of volume. Over the 3.0 day trading day, (my own level of "significance") this only adds to the bullish activity in this stock.

Yahoo does not report any stock dividends nor any cash dividends.

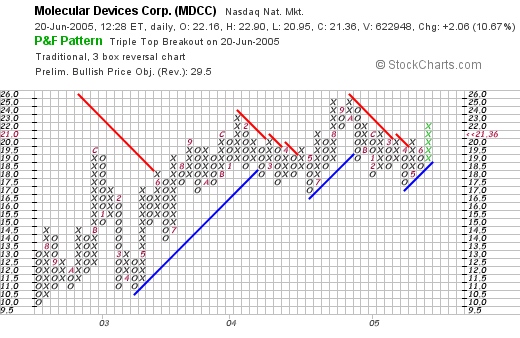

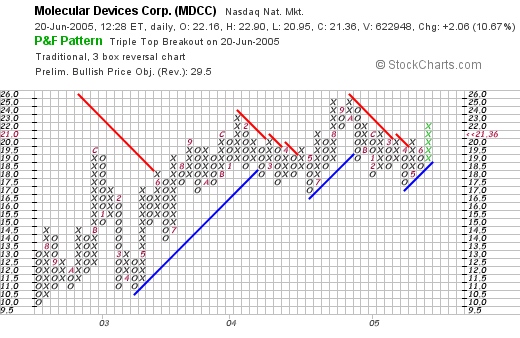

What about "technicals"? Does the chart look encouraging? For this I like to use Stockcharts.com, and looking at the

"Point & Figure" chart from Stockcharts.com on MDCC:

We can see that this stock broke through a resistance level at $18 in June, 2003, after climbing from a low of $10 in July, 2002. However, the stock has basically traded sideways since that time. It currently has broken through resistance at $20, and is trading higher. It is certainly not what I would call overextended, going along with its excellent valuation.

So what do I think about all of this? Let's review. The stock is making a nice move today, last quarter's results were solid with both impressive revenue and earnings growth, the last five years have also been terrific, with except for one down year in revenue four yeasrs ago, the company has been growing revenue steadily, turned profitable from a loss, and has been spinning off steady amounts of free cash. The balance sheet is solid, and valuation looks great with a p/e just over 20, a PEG under 1.0, a Price/Sales in the lower part of its industry group. There is even a significant number of shares out short that need to be covered, adding to buying pressure. The graph doesn't look overwhelming bullish, but the stock has been consolidating and appears to be moving higher. On the chart, I would love to see the stock break past its previous high of around $25, to confirm the move higher.

Now, if I only had money or a reason to be buying a stock. I shall be sitting on my hands until I sell a position at a gain, and have less than 25 positions in my trading portfolio. Meanwhile, I can just keep this one on the back burner for a future date!

Thanks again for stopping by and visiting! If you have any questions, comments, or words of encouragement, please feel free to post them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 19 June 2005

"Looking Back One Year" A review of stock picks from the week of April 26, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

It is the weekend and this is the time that I like to go back a year and see how picks that were mentioned on this website. Last week I reviewed the week of April 19, 2004, and this week, let's take a look at the week of April 26, 2004.

This analysis assumes a buy and hold strategy which is not what this blog and not what I practice in my actual trading portfolio. However, for the sake of finding out what happened to my "picks", it is at least helpful to see what would have happened if all stocks mentioned were indeed purchased and you still owned them today. In practice, I strongly believe in selling my declining stocks quickly, and selling portions of my climbing stocks slowly.

On April 28, 2004, I

posted Trimble Navigation (TRMB) on Stock Picks at a price of $25.98. TRMB closed on 6/17/05 at $38.01 for a gain of $12.03/share or 46.3%.

On April 21, 2005, TRMB

reported 1st quarter 2005 results. Revenue for the quarter ended April 1, 2005, increased 25% from $156.5 million last year to $195.4 million this year. Net income for the quarter grew 36% to $17.4 million or $.31/share, up from $12.8 million or $.24/share the prior year.

On April 29, 2004, I

posted INAMED (IMDC) on Stock Picks at a price of $58.03. IMDC closed at $64.98 on 6/17/05 for a gain of $6.95 or 12.0%.

On May 9, 2005,

IMDC reported 1st quarter 2005 results. For the quarter ended March 31, 2005, revenue grew 16% to $105.2 million, up from $90.8 million. Diluted GAAP earnings came in at $.38/share, down from $.49/share in the same quarter last year. (I don't give a quarterly report a "thumbs-up" unless both revenue and earnings have increased!)

On April 29, 2004, I

posted Fisher Scientific (FSH) on Stock Picks at a price of $58.60. FSH closed at $63.48 on 6/17/05 for a gain of $4.88 or 8.3%.

On May 9, 2005, Fisher Scientific

reported 1st quarter 2005 results. Revenue for the quarter, in large part aided by the acquisition of Apogent Technologies, grew 35% to $1.35 billion from $1 billion in the same quarter the prior year. Earnings rose to $77 million or $.61/share, up from $34.6 million, or $.51/share last year.

My last stock pick, Intuitive Surgical (ISRG) was

selected for Stock Picks on April 30, 2004, at a price of $16.35. ISRG has had a phenomenal run since that time closing at $50.40 on 6/17/05 for a gain of $34.05 or 208.3% since the selection!

On April 21, 2005, ISRG

reported 1st quarter 2005 results. For the quarter ended March 31, 2005, sales grew 54% from $27.1 million last year to $41.6 million this year. Net income was up 900% to $9.1 million or $.25/diluted share from $.9 million or $.02/diluted share last year. This was a phenomenal quarter!

So how did I do on these four picks. I am happy to report that this particular week was TERRIFIC for Stock Picks! And you know that I don't always hit that ball out of the park. There were four selections and all four showed gains, ranging from 8.3% to 208.3%! The average gain for these particular four stocks was 68.7% driven in large part by the outsized gain on ISRG, but also, with a solid performance (46.3% gain) from TRMB.

Thanks again for stopping by! I don't usually do this well on the picks so please remember that past performance is NO guarantee of future performance! But still, THAT was pretty impressive :).

If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 17 June 2005

A Reader Writes "Why do you sell at Percentages?"

One of my regular readers dropped me a line today, but it looks like I deleted it before I got around to answering. But let me tell you what he wrote:

Basically, why do I sell stocks at percentage targets? Why don't I buy stocks if they are a good value and decline as they would be a better value at that price?

I believe that was the thrust of the correspondence.

To answer this question, let me just say that for most of my trading existence THAT was exactly what I did. Unfortunately, that brings a lot of emotion into the equation. For me if a stock declines, that doesn't make it a better stock...sort of a better value. It makes it a worse stock.

For me, stocks that appreciate in price are good stocks and stocks that go the other way are bad stocks.

Pretty simple huh?

My other basic philosophy is to sell losers quickly, and winners slowly. In fact, I never sell enough of a winner to get it much below the value of the holding when I first purchased it. That is why I sell 1/4 position with a 30% gain. If you look at it with fractions, 1/4 of 4/3 is 1/3, leaving 3/3. You can see the pattern.

I like to describe this method as sort of like the guy that goes to Vegas with a pile of quarters and puts all of his winning in his left pocket and the quarters he wishes to gamble with in the right. That way, the winnings aren't touched.

It isn't exactly the same, but I think you can get the idea.

I simply am not smart enough to make all of the right decisions all of the time. Thus, if I use the stock price movement itself to dictate my action, I will always know what to do and when.

I hope that is helpful. Meanwhile, I am falling asleep at my keyboard....so niters everyone!

Bob

June 16, 2005 Alliance Data Systems (ADS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today, I purchased some Alliance Data Systems stock (ADS) for my trading account, and I wanted to briefly go over my thinking. It is very late here and I want to get right to the point....so bear with me.

ADS made the list of top % gainers on the NYSE today, closing at $39.00, up $2.16 or 5.86% on the day. I purchased some shares this afternoon, after selling shares of HIBB that had hit a 300% gain mark (!).

Yahoo "Profile": The company "...provides transaction services, credit services, and marketing services in North America."

1st quarter 2005 earnings: Revenues rose 20% to $375.9 million from $312 million. Earnings jumped to $37.2 million or $.43/share from $32.3 million or $.39/share last year.

"5-Yr Restated" financials from Morningstar.com: Revenue has grown steadily from $0.7 billion in 2000 to $1.3 billion in the trailing twelve months (TTM).

Earnings have climbed from $.31/share in 2002 to $1.26/share in the TTM.

Free cash flow looks nice with $80 million reported in 2002, expanding to $345 million in the TTM.

Balance sheet is o.k. with $156.7 million in cash and $461.9 million in other current assets, enough to cover the $485.1 million in current liabilities, but not enough to cover all of the $778.2 million in long-term liabilities as well.

Yahoo "Key Statistics": Large cap stock with a market cap of $3.25 Billion. Trailing p/e moderate at 30.81, but the forward p/e is much nicer (fye 31-Dec-06) at 17.89; thus, the PEG comes in at 1.14.

The Price/Sales ratio is 2.32. This doesn't look bad in the context of the "Information/Delivery Svcs" industry. Jupitermedia (JUPM) is at 7.6, FactSet (FDS) at 5.5, ADS at 2.5, Proquest at 2.0 and DST (DST) at 1.6.

Other statistics: 83.37 million shares outstanding with 68.87 million of them that float. Of these, as of 5/10/05, there were 2.35 million shares out short, representing 2.90% of the float or 2.5 trading days of volume. No cash dividend and no stock dividends are reported.

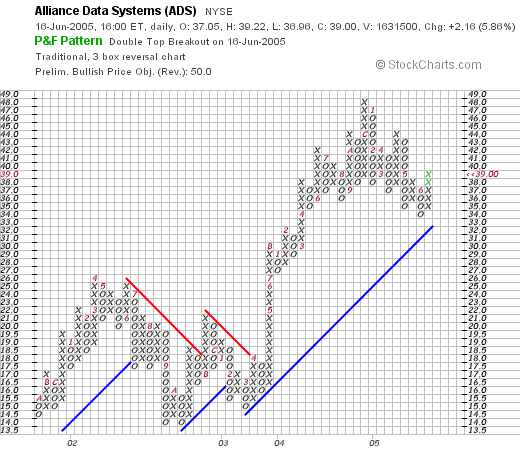

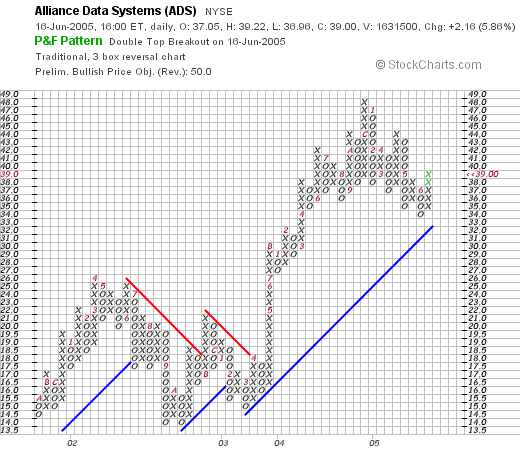

The

"Point & Figure" chart from Stockcharts.com:

After moving sideways from 2002 through 2003, this price chart broke through resistance in April, 2003, at $18, and has moved strongly higher since. The chart looks nice to me.

So what do I think? Well, I liked it enough to buy some shares! The latest quarter was strong, the last five years look nice, with growing free cash flow. The balance sheet is adequate, and valuation looks reasonable. Finally, the stock chart looks nice as well.

Thanks again for visiting. If you have any questions or comments, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 16 June 2005

June 16, 2005 Progress Software (PRGS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As I always point out, and I mean it, I am truly an amateur investor, so PLEASE consult with your professional investment advisors prior to acting on any information on this website!

Earlier today, my Coach Stock (COH) which has been a fabulous investment, hit one of my sale points. If you are new to what I write, I believe in selling losers quickly at an 8% loss, and selling winners slowly at different sale points on gains. In other words, I sell 1/4 of my remaining position at gains of 30, 60, 90, 120, 180, 240, and 300% gain levels! After that, I shall sell at 360%, then by 90% increments x 4 etc.

Anyhow, I actually hit TWO 300% gain points today. First, my Coach stock hit 300%, and I sold 1/4 of my position. Then my Hibbett also hit 300% (!) and I sold 1/4 of my remaining shares. Unfortunately, since I purchased these stocks a couple of years ago, my initial purchase was not as big as my current buys. Nevertheless, this gave me "permission" to add two new positions, actually filling my "quota" of 25 positions in my trading account.

Hopefully, the market continues relatively strong, and I can start applying my partial sales to paying off my neverending margin :).

Back to the sale. So sellling a portion of Coach entitled me to add position # 24. Looking through the

list of top % gainers on the NASDAQ today, I came across Progress Software (PRGS) which closed at $30.33, up $2.13 or 7.55% on the day. Actually, as the market turned around and moved higher late in the afternoon, PRGS was no longer on the top 50 gainers, but my purchase of 240 shares at $30.96, was already made :).

According to the

Yahoo "Profile" on PRGS, the company "...engages in the development, marketing and distribution of software and services for the development, deployment, integration, and management of business applications deployed in a distributed, Web-based or client/server environment."

What drove the stock higher today was the

2nd quarter 2005 earnings announcement this morning. PRGS reported that revenue climbed 10% to $100.2 million from $90.8 million last year, and net income rose 54% to $14.4 million or $.35/share from $9.4 million or $.24/share for the same quarter last year.

Looking at the

"5-Yr Restated" financials from Morningstar.com, we can see that while revenue dropped from $273.1 million in 2000 to $263.6 million in 2001, it has climbed steadily since with $374.0 million in the trailing twelve months (TTM).

Earnings also dropped from $.85 in 2000 to $.46/share in 2001, but since 2001 have climbed steadily to $.93/share in the TTM.

Free cash flow the last few years has grown steadily from $38 million in 2002 to $62 million in the TTM.

The balance sheet also looks solid with $204.7 million in cash, more than enough to cover both the $178.2 million in current liabilities and the $8.8 million in long-term liabilities. In addition, Morningstar reports that Progress has an additional $95.4 million in other current assets.

Looking at

"Key Statistics" from Yahoo on Progress, we can see that the market cap is at $1.13 billion making this a mid-cap stock. The trailing p/e is a bit rich at 32.33, but the forward p/e (fye 30-Nov-06) is a bit better at 21.36, and estimates suggest a PEG of 1.51, making this not exactly a bargain, but not that expensive either.

This is a Poster by Marc Chagall, another of my favorite artists!

Yahoo shows the Price/Sales ratio at 2.81. Using this measurement of valuation, with data from the Fidelity website, we find that Progress is in the "Application Software" industry and its Price/Sales ratio is actually quite reasonable relative to other members of the same industry group. Microsoft (MSFT) tops the list with a Price/Sales of 7.0, Oracle (ORCL) next at 5.9, Veritas (VRTS) at 4.9, Cognos (COGN) at 3.8, and Siebel (SEBL) at 3.5. Progress is the cheapest with its 2.8 Price/Sales ratio.

Going back to Yahoo, we can see that there are 37.23 million shares outstanding with 35.97 million of them that float. Of these, there were 1.07 million shares out short as of 5/10/05. This amounts to 3.00% of the float, or 4.3 trading days, making this somewhat significant using my arbitrary 3 day cut off on short interest ratios.

Yahoo shows no cash dividend paid and the last stock split was a 2:1 split in January, 2000.

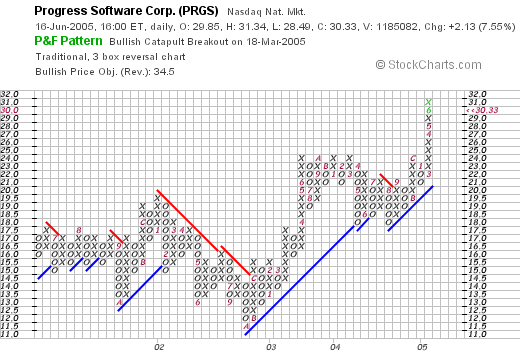

How about a graph? If we look at a "Point & Figure" chart on Progress from Stockcharts.com:

we can see that the stock was actually trading lower between late 2001 and into late 2002, when in October, 2002, it broke through resistance at $14, and has traded higher since. Recently, PRGS has shown significant strength moving rapidly higher. The stock looks bullish, and not really over-extended to me!

So what do I think? Well, I liked it enough that I bought some shares earlier today. Reviewing: the stock moved strongly higher today on a very solid earnings report. The last four, if not five, years have been steadily growing earnings and revenue for PRGS. The free cash flow is positive and growing and the balance sheet is quite pretty. Valuation wise, the PEG is 1.5, but the Price/Sales at 2.8 is the lowest in its group. Finally, the chart looks great.

Thanks again for stopping by! Your visits are appreciated by me and for those who stop to comment or email me a note, thanks again ahead of time! It makes it all worthwhile. If you have any questions or comments, please feel free to leave them here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 7:57 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 16 June 2005 11:42 PM CDT

"Trading Transparency" Alliance Data Systems (ADS)

Hello Friends! Well I hit 25 positions earlier today. Now I shall try to sit on my hands :). After selling my partial position in HIBB as I wrote up earlier, this was a signal to add a new position (being at 24, with a goal of 25).

Scanning through the lists of top % gainers, and reviewing Morningstar.com, I came across Alliance Data Systems (ADS) that I do not believe I have reviewed here on Stock Picks....will try to get that in later or tomorrow as well.

Anyhow, I bought 200 shares of ADS at $39.06, shortly before the close of trading. Wish me good luck! Anyway, with future sales, I shall be applying the proceeds to the margin balance, unless I drop down to 24 with a sale on bad news, in which case I will wait for a sale on "good" news, prior to going back to 25. I hope you follow.

Will I ever get over 25? Well, never say never :). If I pay off my margin, I will be thinking about indications for adding a new position. Maybe THAT will be the trigger?

Anyhow,

Thanks so much for stopping by. I hope that my chatter is helpful to you. Remember that I truly am just an amateur investor who loves to write about stocks, so please consult with your investment advisors who are professionals!

Bob

"Trading Transparency" HIBB

Hello Friends! Just a quick note to update you. Another of my stocks hit a sell point, Hibbett Sporting Goods (HIBB), which I first purchased 3/6/03 at a cost basis of $9.74, hit the 300% gain point as well, and I sold 1/4 of my 98 shares (24 shares) at $39.18 a few moments ago.

That represents a gain of $29.44/share or 302.3%. WOW! Anyhow, I am now "entitled" to purchase position #25. Probably not enough time to go fishing this afternoon for a position, but I can feel that last nickel burning a hole in my pocket!

Bob

"Trading Transparency" Progress Software (PRGS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Just to keep you posted. That "nickel" was burning a hole in my pocket as soon as it got there. Since I just sold a portion of my COH stock at a gain (see the prior post), this entitled me to add a new position to my portfolio. (since I am under my 25 position goal).

Looking through the lists of top % gainers today, I came across Progress Software (PRGS). It appears to fulfill my "criteria" to purchase, and I just picked up 240 shares at $30.96. As I write this post, PRGS is trading at $31, up $2.80 on the day or 9.93%. I will try to write up this stock later on if I get a chance :).

Regards!

Bob

"Trading Transparency" COH

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, my investment in Coach (COH) in my Trading Account hit a sale point, and I sold 1/4 of my position of 136 shares (34 shares), at $33.25/share. Coach has been the strongest stock in my portfolio, which I purchased at a cost basis of $8.33/share on 2/25/03. Thus, this represented a gain of $24.92/share or 299.2%. This was my seventh (!) partial sale of Coach, having sold portions at 30%, 60%, 90%, 120%, 180%, 240%, and now at 300% gains (!). My next sale target will be either at a 360% gain on the upside, or failing any particular bad news which might trigger a sale, I shall allow the stock to drift back to a 150% gain level prior to selling on the downside. This would represent a 50% retracement of my highest sale target.

In any case, that frees me up to purchase a new position, which would be position #24 in my trading account with my goal of 25 positions. After reaching 25 positions, I shall be using any proceeds to at long last pay down that margin!

Thanks so much for stopping by. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or just plain leave a message here on the blog.

Bob

Newer | Latest | Older

According to the Yahoo "Profile" on Somanetics, the company "...engages in the development, manufacture, and marketing of medical devices primarily in the United States. Its INVOS Cerebral Oximeter, a noninvasive patient monitoring system, provides continuous information about changes in the blood oxygen level in the brain."

According to the Yahoo "Profile" on Somanetics, the company "...engages in the development, manufacture, and marketing of medical devices primarily in the United States. Its INVOS Cerebral Oximeter, a noninvasive patient monitoring system, provides continuous information about changes in the blood oxygen level in the brain." Earnings during this period have improved consistently from a loss of ($.57)/share to $.79/share in the TTM.

Earnings during this period have improved consistently from a loss of ($.57)/share to $.79/share in the TTM. Going back to the Yahoo information, we can see that there are 10.18 million shares outstanding with 9.63 million that float. Currently there are 314,260 shares out short representing 3.2% of the float or 6 trading days. This is significant (imho), with my own cut-off of 3 trading days that I use to look at stocks. Thus, this adds to the buying pressure.

Going back to the Yahoo information, we can see that there are 10.18 million shares outstanding with 9.63 million that float. Currently there are 314,260 shares out short representing 3.2% of the float or 6 trading days. This is significant (imho), with my own cut-off of 3 trading days that I use to look at stocks. Thus, this adds to the buying pressure.

Overall the market is behaving poorly this morning. The Dow and the NASDAQ are down and oil is flirting with $60/barrel. In my own trading account, my Kyphon (KYPH) is also flirting with an 8% loss, and I shall be letting that one go if it does break down to that level. This is actually the second time in the past few years that I have tried to make Kyphon work for me. Hopefully, things turn around a bit, but the market will dictate my own action.

Overall the market is behaving poorly this morning. The Dow and the NASDAQ are down and oil is flirting with $60/barrel. In my own trading account, my Kyphon (KYPH) is also flirting with an 8% loss, and I shall be letting that one go if it does break down to that level. This is actually the second time in the past few years that I have tried to make Kyphon work for me. Hopefully, things turn around a bit, but the market will dictate my own action. According to the

According to the  For this longer-term view, I find the analysis on Morningstar.com very helpful. In fact the

For this longer-term view, I find the analysis on Morningstar.com very helpful. In fact the  There are many ways of investing. I like to be "eclectic" and draw from different strategies. The underlying philosophy that drives my trading remains "momentum" but still, I do not close my eyes to technical, or valuation issues.

There are many ways of investing. I like to be "eclectic" and draw from different strategies. The underlying philosophy that drives my trading remains "momentum" but still, I do not close my eyes to technical, or valuation issues.

On April 28, 2004, I

On April 28, 2004, I  On April 21, 2005, TRMB

On April 21, 2005, TRMB  On April 29, 2004, I

On April 29, 2004, I  On May 9, 2005,

On May 9, 2005,  On April 29, 2004, I

On April 29, 2004, I  My last stock pick, Intuitive Surgical (ISRG) was

My last stock pick, Intuitive Surgical (ISRG) was  Earlier today, I purchased some Alliance Data Systems stock (ADS) for my trading account, and I wanted to briefly go over my thinking. It is very late here and I want to get right to the point....so bear with me.

Earlier today, I purchased some Alliance Data Systems stock (ADS) for my trading account, and I wanted to briefly go over my thinking. It is very late here and I want to get right to the point....so bear with me.

Earlier today, my Coach Stock (COH) which has been a fabulous investment, hit one of my sale points. If you are new to what I write, I believe in selling losers quickly at an 8% loss, and selling winners slowly at different sale points on gains. In other words, I sell 1/4 of my remaining position at gains of 30, 60, 90, 120, 180, 240, and 300% gain levels! After that, I shall sell at 360%, then by 90% increments x 4 etc.

Earlier today, my Coach Stock (COH) which has been a fabulous investment, hit one of my sale points. If you are new to what I write, I believe in selling losers quickly at an 8% loss, and selling winners slowly at different sale points on gains. In other words, I sell 1/4 of my remaining position at gains of 30, 60, 90, 120, 180, 240, and 300% gain levels! After that, I shall sell at 360%, then by 90% increments x 4 etc.