Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to check with your professional investment advisors prior to making any decisions based on information on this website.

Overall the market is behaving poorly this morning. The Dow and the NASDAQ are down and oil is flirting with $60/barrel. In my own trading account, my Kyphon (KYPH) is also flirting with an 8% loss, and I shall be letting that one go if it does break down to that level. This is actually the second time in the past few years that I have tried to make Kyphon work for me. Hopefully, things turn around a bit, but the market will dictate my own action.

Overall the market is behaving poorly this morning. The Dow and the NASDAQ are down and oil is flirting with $60/barrel. In my own trading account, my Kyphon (KYPH) is also flirting with an 8% loss, and I shall be letting that one go if it does break down to that level. This is actually the second time in the past few years that I have tried to make Kyphon work for me. Hopefully, things turn around a bit, but the market will dictate my own action.I was looking through the list of top % gainers on the NASDAQ this morning and came across Molecular Devices (MDCC). As I write, MDCC is trading at $21.20, up $1.90 or 9.84% on the day. I have looked at this stock in the past, and I believe I used to own some shares of this, but I do not currently own any shares or options in MDCC.

According to the Yahoo "Profile" on MDCC, this company "...engages in the design, development, manufacture, sale, and servicing of bioanalytical measurement systems for drug discovery and other life sciences research."

According to the Yahoo "Profile" on MDCC, this company "...engages in the design, development, manufacture, sale, and servicing of bioanalytical measurement systems for drug discovery and other life sciences research."One of my first "stops" in reviewing a stock is to check the latest quarterly report. I am looking for growth both in revenue and earnings.

On April 28, 2005, Molecular Devices announced 1st quarter 2005 earnings results. For the quarter ended March 31, 2005, revenues grew 43% to $39.1 million, up from $27.3 million in the prior year same period. Net income increased 50% to $2.2 million from $1.4 million last year. On a per share fully diluted basis, earnings increased 30% to $.13/share up from $.10/share last year. These were solid results imho.

My next step in looking at a stock is to take a longer perspective. It is my view, that like a physics theorem, that things in motion tend to stay in motion :). This really an earnings momentum view. In other words, a stock of a company that has been posting excellent results for the last several years and the latest quarter is more likely to continue to post good results than a company with a more inconsistent record. I don't believe that earnings and revenue growth are random events. They are a product of an outstanding management team in conjunction with an outstanding product or service.

For this longer-term view, I find the analysis on Morningstar.com very helpful. In fact the "5-Yr Restated" financials on MDCC give us quite a bit of useful information. First of all, revenue growth has not been perfect, yet it is very impressive. Morningstar does show a dip in revenue from 2000 when MDCC reported $96.0 million, to $92.2 million in 2001. However, since 2001, the revenue has steadily increased to $160.3 million in the trailing twelve months (TTM).

For this longer-term view, I find the analysis on Morningstar.com very helpful. In fact the "5-Yr Restated" financials on MDCC give us quite a bit of useful information. First of all, revenue growth has not been perfect, yet it is very impressive. Morningstar does show a dip in revenue from 2000 when MDCC reported $96.0 million, to $92.2 million in 2001. However, since 2001, the revenue has steadily increased to $160.3 million in the trailing twelve months (TTM).Looking at earnings, we can see that the company was losing money in both 2000 and 2001, when they posted $(.32)/share earnings. Since that time, MDCC has impressively been improving its earnings picture each year, posting $1.07/share in the trailing twelve months (TTM).

Free cash flow has been positive and steady (but not really growing) with $13 million posted in 2002 and $14 million in the TTM.

The Morningstar balance sheet results also look solid with $74.1 million in "other current assets" along with $8.3 million in cash, balanced against $30.9 million in current liabilities and $6.7 in long-term liabilities.

There are many ways of investing. I like to be "eclectic" and draw from different strategies. The underlying philosophy that drives my trading remains "momentum" but still, I do not close my eyes to technical, or valuation issues.

There are many ways of investing. I like to be "eclectic" and draw from different strategies. The underlying philosophy that drives my trading remains "momentum" but still, I do not close my eyes to technical, or valuation issues.For valuation, I like to look at Yahoo "Key Statistics" and I also use my Fidelity online site for questions about comparative valuation. Looking at Yahoo "Key Statistics" on MDCC, we can see that this is a small cap stock with a market capitalization of only $359.95 million.

The trailing p/e is very nice (imho) at 20.32, with a forward p/e (fye 31-Dec-06) of only 19.34. The (5 yr expected) PEG is 0.93, making it very attractive (under 1.0) on a valuation basis.

MDCC sports a Price/Sales ratio of 2.04. MDCC, according to my Fidelity source, is in the "Scientific/Tech Instruments" industry. This Price/Sales is fairly reasonable compared to the other companies in this group. Garmin (GRMN) tops this group at 6.1 Price/Sales, Flir (FLIR) is just under that at 4.3, Applied Biosystems (ABI) is at 2.4, followed by MDCC at 2, Beckman Coulter (BEC) at 1.7, and Agilent (A) at 1.7. Thus, even with this parameter as well, MDCC looks like a good value!

Other statistics on Yahoo show that MDCC has 16.92 million shares outstanding. 15.91 million of them float. There are currently 893,550 shares out short (5/10/05) representing 5.5 trading days of volume. Over the 3.0 day trading day, (my own level of "significance") this only adds to the bullish activity in this stock.

Yahoo does not report any stock dividends nor any cash dividends.

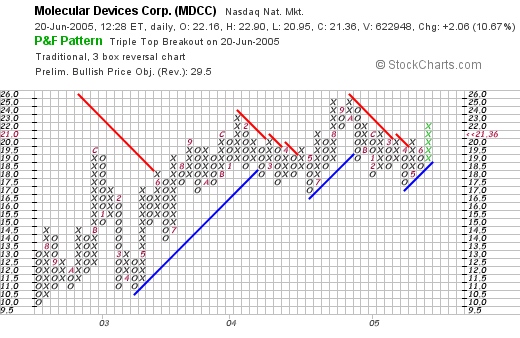

What about "technicals"? Does the chart look encouraging? For this I like to use Stockcharts.com, and looking at the "Point & Figure" chart from Stockcharts.com on MDCC:

We can see that this stock broke through a resistance level at $18 in June, 2003, after climbing from a low of $10 in July, 2002. However, the stock has basically traded sideways since that time. It currently has broken through resistance at $20, and is trading higher. It is certainly not what I would call overextended, going along with its excellent valuation.

So what do I think about all of this? Let's review. The stock is making a nice move today, last quarter's results were solid with both impressive revenue and earnings growth, the last five years have also been terrific, with except for one down year in revenue four yeasrs ago, the company has been growing revenue steadily, turned profitable from a loss, and has been spinning off steady amounts of free cash. The balance sheet is solid, and valuation looks great with a p/e just over 20, a PEG under 1.0, a Price/Sales in the lower part of its industry group. There is even a significant number of shares out short that need to be covered, adding to buying pressure. The graph doesn't look overwhelming bullish, but the stock has been consolidating and appears to be moving higher. On the chart, I would love to see the stock break past its previous high of around $25, to confirm the move higher.

Now, if I only had money or a reason to be buying a stock. I shall be sitting on my hands until I sell a position at a gain, and have less than 25 positions in my trading portfolio. Meanwhile, I can just keep this one on the back burner for a future date!

Thanks again for stopping by and visiting! If you have any questions, comments, or words of encouragement, please feel free to post them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob