Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to acting on any information on this website.

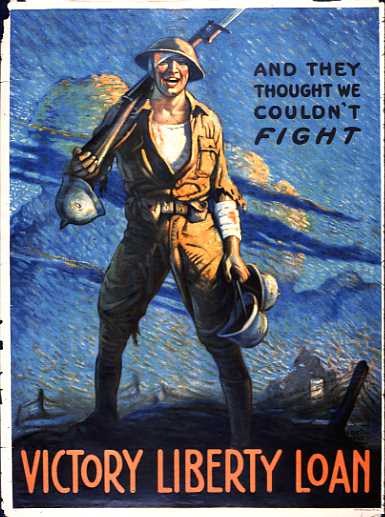

I came across this World War II vintage war poster on the Illinois State Museum website.

I hope you are all having a happy and healthy Memorial Day Weekend. We should all pause this weekend and remember all of the men and women who have served this country in our nation's history. And the many who are serving in harm's way even as I write!

Since it is the weekend, it is time to do a little reviewing around here. If you are new to this website, I like to pick lots of stocks, some of which I do add to my own portfolio, but most, I just present for consideration and my own observations as they fit many of the criteria that I use to pick stocks! In order to get a feeling for what actually happened to the many stocks mentioned here, I use the weekend to review my past stock ideas. I am a little more than a year out from my reviews.

This simple analysis depends on a "buy and hold" strategy. Simply put, I am assuming that I purchased each of the stocks I discussed at the mentioned price, and I am assuming I still hold those same stocks. In reality, I actually stop out of my stocks at an 8% loss on the downside and sell portions of my stocks on the upside as they make targeted gains. Thus, in practice, my own actual performance would be different than what I am now reviewing!

During the week of April 5, 2004, I posted two stocks: Juno Lighting on April 7, 2004, and ValueClick (VCLK) on April 8, 2004. JUNO was selected on April 7, 2004, at a price of $33.50. JUNO closed at $39.97 on 5/27/05, for a gain of $6.47 or 19.3%.

JUNO was selected on April 7, 2004, at a price of $33.50. JUNO closed at $39.97 on 5/27/05, for a gain of $6.47 or 19.3%. On March 24, 2005, JUNO reported 1st quarter 2005 results. For the three months ended February 28, 2005, revenue jumped 20% to $60.8 million from $50.9 million. The company earned $1.5 million or $.48/share, up from $493,000 or $.19/share the prior year. These were solid results with both strong revenue and earnings growth reported!

On March 24, 2005, JUNO reported 1st quarter 2005 results. For the three months ended February 28, 2005, revenue jumped 20% to $60.8 million from $50.9 million. The company earned $1.5 million or $.48/share, up from $493,000 or $.19/share the prior year. These were solid results with both strong revenue and earnings growth reported! I selected ValueClick for Stock Picks on April 8, 2004, when it was trading at $12.16. VCLK closed at $10.69 on 5/27/05, for a loss of $(1.47) or (12.1)%.

I selected ValueClick for Stock Picks on April 8, 2004, when it was trading at $12.16. VCLK closed at $10.69 on 5/27/05, for a loss of $(1.47) or (12.1)%. On May 4, 2005, VCLK reported 1st quarter 2005 results. Revenue grew nicely to $51.4 million from $38.7 million the prior year. However, earnings came in at $8.7 million, or $.10/share, down from $13.4 million or $.16/share the prior year.

On May 4, 2005, VCLK reported 1st quarter 2005 results. Revenue grew nicely to $51.4 million from $38.7 million the prior year. However, earnings came in at $8.7 million, or $.10/share, down from $13.4 million or $.16/share the prior year.

So how did we do with these two selections on Stock Picks? Juno was up 19.3% from the pick price, and ValueClick was down (12.1)% from the selection price, thus the average performance of these two was a gain of 3.6%.

I just haven't had much luck with those small dot-com stocks! Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Again, I am wishing all of you a happy and safe Memorial Day Weekend!

Bob