Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

With the market moving higher today, several stocks showed up on the momentum lists (top % gainers on the NASDAQ) that appear to fit my criteria for inclusion here.

With the market moving higher today, several stocks showed up on the momentum lists (top % gainers on the NASDAQ) that appear to fit my criteria for inclusion here.As I write, MICROS (MCRS) is trading at $45.82, up $3.71 or 8.81% on the day. According to the Yahoo "Profile" on MICROS, the company "...engages in designing, manufacturing, marketing, and servicing enterprise information solutions for the hospitality and specialty retail industries worldswide." I do not own any shares nor do I have any options on this company.

Trying to avoid sounding like a 'broken record', what drove the stock higher today, was the announcementof 1st quarter 2006 results. Sales for the quarter ended September 30, 2005, grew 17% to $152 million and net income of $12.4 million or $.30/share up from $9.7 million or $.25/share last year.

Looking at the Morningstar.com "5-Yr Restated" financials, we can see that revenue for this company has been steadily growing from $332.2 million in 2001 to $597.3 million in the trailing twelve months (TTM).

In addition, earnings have also steadily grown, increasing from a loss of $(.02)/share in 2001 to $1.35 in the TTM. Recently, free cash flow has improved from $35 million in 2003 to $80 million in the TTM.

The balance sheet looks solid with $153.5 million in cash and $213.9 million in other current assets. This is plenty to cover both the $177.0 million in current liabilities and the $25.1 million in long-term liabilities, almost two times over.

Looking at some "Key Statistics" on MCRS from Yahoo, we find that this is a mid-cap stock with a market capitalization of $1.76 billion. The trailing p/e is a moderate 34.02, and the forward p/e (fye 30-Jun-07) is more reasonable at 23.76. The PEG is still a bit rich at 1.37.

Using the Fidelity.com eresearch website for a look at valuation in regards to the Price/Sales figures, we find that MCRS is quite reasonably priced within the "Technical System/Software" Industrial Group. Heading this list is INFOSYS (INFY) at 9.7 Price/Sales, Autodesk (ADSK) at 8.0, Mercury Interactive (MERQE) at 4.4, MANHATTAN ASSOC (MANH) at 3.0, and MICROS (MCRS) at 2.8. Take-Two Interactive Software finished the list with a Price/Sales ratio of 1.0.

Looking back at Yahoo for some additional statistics, we find that there are 38.44 million shares outstanding and of these, 2.04 million or 5.305 of the float, are out short. This appears significant to me with 7.3 trading days of volume involved.

No cash dividend is reported and the last stock split was a 2:1 split 2/2/05.

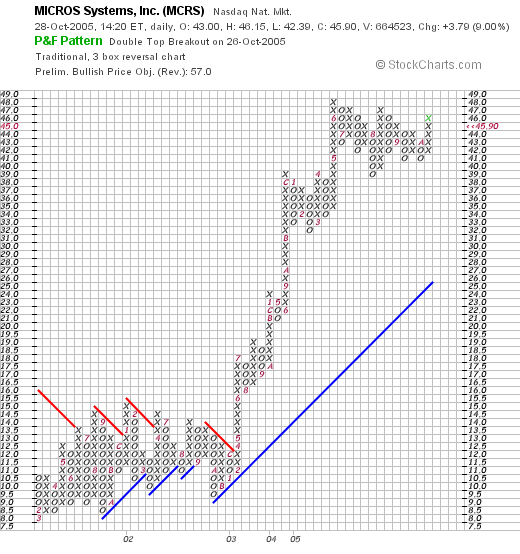

What about a chart? Taking a look at a "Point & Figure" chart on MCRS from Stockcharts.com:

We can see that the chart shows the stock moving sideways between 2001 and late 2002, between the rant fo $7.50 and $14.00. The stock broke through resistance at around $12 in March, 2003, and has moved sharply higher since then. The chart overall looks quite strong, if not a bit ahead of itself.

So what do I think? Well, the latest quarter was solid, the Morningstar.com report looks encouraging, with steady revenue and earnings growth alongside free cash flow and a nice balance sheet. Valuation is o.k. with a bit of a rich p/e and PEG, but the Price/Sales is reasonable within the assigned group on Fidelity. All-in-all an attractive investment imho. Now, if only I could be buying stock :(.

Thanks so much for stopping by! If you have any questions, or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob