CLICK HERE FOR MY PODCAST ON CHRISTOPHER & BANKS

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

With the market trading a little better, I thought I would see if I couldn't find something to discuss this afternoon. Looking through the list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Christopher & Banks (CBK), which, as I write, is trading at $29.44, up $1.30 or 4.62% on the day. I do not own any shares of this stock, nor do I own any options or other futures related to this company.

I say this is an "old favorite" because I have reviewed this stock previously on the blog. In fact, I first reviewed Christopher & Banks on Stock Picks Bob's Advice on June 5, 2003, when the stock was trading at $33.45. CBK had one stock split since that post on August 28, 2003, when the stock split 3:2. This results in an effective pick price for me of $22.30. Thus, with today's current stock price of $29.45, this means an effective appreciation of $7.15/share or 32.1% since posting.

And what does Christopher & Banks do? According to the Yahoo "Profile" on CBK, the company

"... operates retail specialty stores that sell women’s specialty apparel in the United States. It operates its retail stores under the Christopher & Banks, C.J. Banks, and Acorn names. Christopher & Banks stores offer fashions featuring co-ordinated assortments of sportswear and sweaters in sizes 4 to 16. C.J. Banks stores offer similar assortments of women’s specialty apparel in sizes 14W and up."

What drove the stock higher today, was the announcement of the 'all-important' same-store sales figures for July. When looking at retail companies like CBK, the same-store figure gives the investor a feeling for the 'organic' growth of the company; that is, by examining the performance of stores that have been open at least a year, we can take out the effect of opening new stores on the underlying growth results of the firm. This number can be considered a 'truer' criterion in examining sales results imho.

Basically, total sales for the five-week period ended July 29, 2006 "...increase 21% to $49.6 million from $41.1 million last year. July same-store sales rose 10%." In my expereience, anytime a retail firm can come in with high single-digit or low double-digit same-store sales increases, we have a great result. In addition, since same-store sales figures were a healthy 8% increase for the five month period ending July 29, 2006, this means that we are observing at least a short-term acceleration of sales growth. This report exceeded expectations according to the CEO Joe Pennington, and the company went ahead and raised guidance for the quarter ending August 26, 2006, to $.19 to $.20/diluted share, up from prior guidance of $.17 to $.19/share. This "trifecta" of sales reports----strong sales growth, exceeding expectations, and raising guidance, was enough to fire-up investors and get them to push the price of this stock higher.

And how about the latest quarterly result?

On June 20, 2006, CBK announced first quarter earnings results. As reported:

"Net sales in the first quarter increased 16% to $142.5 million, from $122.7 million in the prior year period, while same-store sales increased 7%. Net income for the first quarter increased 57% to $14.6 million, or $0.39 per diluted share, compared with $9.3 million, or $0.26 per diluted share, in the year ago period."

This was a very nice earnings report imho.

And longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials, we find that revenue, which was $276 million in 2002, has increased steadily to $490.5 million in 2006 and $510.4 million in the trailing twelve months (TTM).

Earnings have been a bit more erratic, climbing from $.83/share in 2002 to $1.01/share in 2004. However, they dropped to $.73/share in 2005, but have increased steadily since to $.97/share in the TTM. As an added plus, the company initiated dividends in 2004 with $.08/share paid. They have subsequently increased this to $.16/share in 2005 and since. the number of shares outstanding has been very stable with 37 million in 2002 and 37 million in the TTM.

Free cash flow appears quite healthy with $33 million in 2004, increasing to $39 million in the TTM.

CBK's balance sheet appears solid with $112.6 million in cash and $54.2 million in other current assets. The cash alone is enough to cover both the $41.5 million in current liabilities and the $33.8 million in long-term liabilities combined. Adding the cash and current assets together, gives us a sum of $166.8 million, which, when compared to the $41.5 million in current liabilities, yields a 'current ratio' of 4.02. Generally, anything 1.5 or higher is relatively 'healthy'.

How about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Christopher & Banks, we find that this is a mid-cap stock with a market capitalization of $1.10 billion. The trailing p/e is a moderate 30.02, with a forward (fye 25-Feb-08) p/e of 22.12. The PEG (5 yr expected) works out to a reasonable 1.14.

Looking at the Fidelity.com eresearch website, we can see that CBK is in the "Apparel Stores" industrial group and has a Price/Sales ratio of 2, near the top the retailers. Topping this group is Chicos Fas (CHS) with a ratio of 2.7, followed by Christopher & Banks (CBK) at 2 along with American Eagle (AEOS) at 2. Further down the list is Abercrombie & Fitch (ANF) at 1.7, Limited (LTD) at 1 and PacSun (PSUN) at 0.9.

Looking at profitability, we find Christopher & Banks at the bottom of the list of "return on equity" (ROE) with an 18.5% ROE. Topping the list is ANF at 37.6%, LTD at 31.9%, AEOS at 26.4%, CHS at 26% and PSUN at 23.1%. Thus, from these parameters, the company is relatively richly priced and is relatively less profitable than some of these other retailers.

Returning to Yahoo for some additional numbers, we see that there are 37.41 million shares outstanding and 36.41 million that float. Currently (as of 7/11/06) there are 2.54 million shares out short, representing 7% of the float or 4.4 trading days of average volume (the short ratio). This looks a little significant based on my own 3 day short interest 'rule'.

The company, as noted, pays a small $.16/share dividend yielding 0.60%. The last stock split, also as reported above, was August 28, 2003, when a 3:2 split was declared.

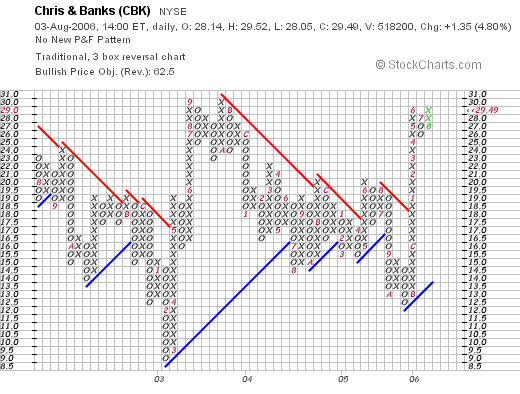

And what does the chart look like?

If we review a "Point & Figure" chart on CBK from StockCharts.com:

We can see that the stock has been trading sideways for the greater part of the past four years. Recently, the stock has moved back to historic highs and is poised to move into higher territory, as long as the underlying market allows. The graph is relatively neutral imho, and certainly doesn't look way over-priced.

So what do I think? Reviewing some of the above points on CBK, the company reported strong same store sales today in the low double-digit range and raised guidance for the current quarter. The latest quarterly results were solid with growing revenue and earnings. Morningstar.com looks strong as well except for a dip in earnings a few years ago, the company is free cash flow positive and has a nice balance sheet with lots of cash. Valuation wise, the p/e is a tad rich but the PEG is just over 1.1. The Price/Sales figures are a bit rich for the group and the profitability as measured by ROE is a tad low ...not my favorite combination of measurements. Finally, the graph is neutral and more recently appears to be moving higher.

In summary, I like the sales and earnings momentum on this company. Especially the same-store sales results. The other numbers are also supportive. While there is a premium being paid as indicated by the relatively rich price/sales ratio, the latest numbers certainly suggest the premium is well worth it!

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also visit my Stock Picks Bob's Advice podcast site where I also talk about , in addition to writing about, my various stock market ideas!

Bob

Updated: Thursday, 3 August 2006 11:18 PM CDT