Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It has been a few weeks since my last portfolio review. On August 5, 2006, I reviewed my Morningstar holding on this blog. With the many sales I have had in my trading portfolio, I am now down to 11 positions, and going alphabetically through my portfolio, I am up to Quality Systems (QSII) which happens to be my most successful investment in my account.

I currently own 88 shares of Quality Systems (QSII) which closed at $39.51 on August 25, 2006. These shares were purchased with a cost basis of $7.75/share, acquired on 7/28/03. Thus, I have an unrealized gain of $31.76/share or 409.8% since purchase. As has been my practice, I have been selling portions of QSII as the stock has been appreciating. I have sold portions on 8/19/03, 8/22/03, 1/21/04, 2/1/05, 3/4/05, 4/21/05, 8/16/05, 10/3/05 and 11/22/05. These nine sales represent sales at 30%, 60%, 90%, 120%, 180%, 240%, 300%, 360%, and 450% appreciation levels. Thus, on the upside, my next targeted gain is at a 540% level which works out to 6.40 x $7.75 = $49.60. On the downside, my strategy dictates a sale at 50% of the highest appreciation point or at a 225% gain level = 3.25 x 7.75 = $25.19. Unfortunately, many of my earlier sales were 25% of my remaining position causing my position to diminish in size. I am now at a 1/6th of the remaining position at each targeted gain, and hopefully this position will continue to grow in size as the stock appreciates.

Let's take a closer look at this stock and see if it still deserves to be on this blog:

1. What does this company do?

According to the Yahoo "Profile" on QSII, this company

"... and its subsidiary NextGen Healthcare Information Systems, Inc. engage in the development and marketing of healthcare information systems that automate medical and dental practices, physician hospital organizations and management service organizations, ambulatory care centers, community health centers, and medical and dental schools."

2. How did they do in the latest quarter?

On August 3, 2006, Quality Systems reported results for first quarter 2007. Net revenues came in at $36.1 million, up 32% from $27.4 million in the same quarter the prior year. Net income worked out to $7.7 million, up 51% over the net income of $5.1 million in the prior year same period. Fully diluted earnings were $.28/share, up 47% from the $.19/share reported last year. This exceeded analysts' expectations of $.24/share.

3. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on QSII, we can see the beautiful picture of steady revenue growth with revenue of $44.4 million in 2002, growing to $119.3 million in 2006 and $127.9 million in the trailing twelve months (TTM).

Earnings have also steadily grown from $.21/share in 2002 to $.85/share in 2006 and $.94/share in the trailing twelve months. The company stqarted paying dividends in 2005 with $.75/share paid. This was increased to $.88/share in 2006. The company has slightly increased its outstanding shares from 24 million in 2002 to 27 million in the TTM. This 10% increase in shares during a period in which the company almost tripled its revenue and quadrupled its earnings is quite tolerable :).

The picture of free cash flow has also been very nice with $16 million in 2004 increasing to $28 million in 2006 and $32 million in the TTM.

The balance sheet is solid with $67 million in cash, more than enough by itself to pay off both the $50.2 million in current liabilities and the $3.5 million in long-term liabilities combined. Calculating the 'current ratio' we can see that QSII has a combined $112.5 million in total current assets, which, when compared to the $50.2 million in current liabilities yields a current ratio of 2.24. (Anything over 1.5 is generally considered 'healthy').

4. What about some 'valuation numbers' on this stock?

Taking a look at the Yahoo "Key Statistics" on QSII we see that this is a mid-cap stock with a market capitalization of $1.06 billion. The trailing p/e is a bit rich at 41.81, but the forward p/e (fye 31-Mar-08) is a bit nicer at 27.06. But then again, this is going out to 2008! However, analysts appear to be expecting continued rapid growth in earnings as the PEG on this stock is a very nice 0.98.

According to the Fidelity.com eresearch website, QSII is in the "Healthcare Information Services" industrial group. Within this group, Quality Systems is the 'priciest' of the group with a Price/Sales ratio of 8.4. Following QSII is Merge Technologies (MRGE) at 3.4, Cerner (CERN) at 2.9, Emdeon (HLTH) at 2.5, Eclipsys (ECLP at 2 and Trizetto Group (TZIX) at 1.8.

Fortunately, QSII is also the most profitable of the group with a Return on Equity (ROE) of 32.9%. Following Quality Systems is Trizetto at 23.1%, Cerner at 12.7%, Emdeon at 7.2%, Eclipsys at 2.1% and Merge at 0.3%.

Returning to Yahoo, we find that there are 26.74 million shares outstanding with 16.85 million that float. Of these, there were 3.49 million shares out short as of 7/11/06, representing 20.7% of the float or 11.7 trading days of volume (the short ratio). Using my own 3 day rule on short interest, I find that this large level of short interest may well support this stock in the event of any good news with a 'squeeze' of the shorts possible.

The company has a trailing dividend of $.88/share yielding 2.20%. The last stock split was a 2:1 stock split on 3/27/06.

5. What does the chart look like?

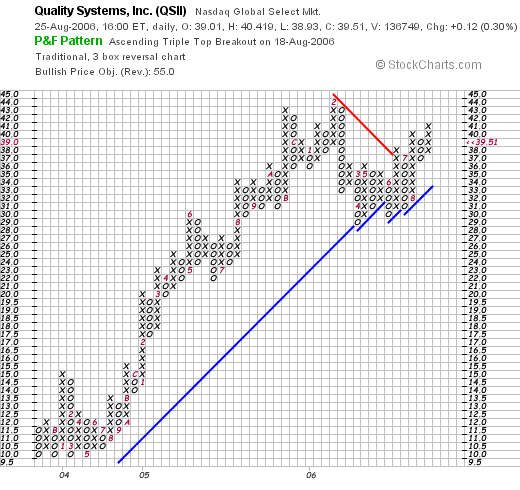

If we examine the "Point & Figure" chart on QSII from StockCharts.com, we can see that the stock moved strongly higher from $10/share in late 2003, (about the time I purchased shares) to a high of $44/share in February, 2006. The stock pulled back to the $30 level in April, 2006, and has been finding support at this level before breaking through resistance and moving near the old highs. The stock looks strong to me!

6. Summary: what do I think about this stock?

First of all, I own this stock have watched the stock price quadruple over the last three years. So certainly I am biased! And there is of course no guarantee that the stock price will continue to rise! THAT is why I have and shall continue to take small portions of my investment off the table as this and any of my stocks appreciate!

However, the last quarter's earnings report is solid. The company is in the EMR (electronic medical record) field, and is at the cutting edge of the transition from paper records in the medical field to electronic records. Thus the "story" is compelling as well as the numbers. The Morningstar.com report is beautiful without even a blemish with steady revenue, earnings, and free cash flow growth. The balance sheet is solid with lots of cash. Valuation-wise, the p/e is certainly rich above 40, but the PEG is under 1.0 making the valuation seem reasonable. The Price/Sales ratio is rich compared to other stocks in its group, but the company is also the most profitable in terms of the ROE figure of its group. Interestingly, there are lots of short-sellers out there who have borrowed shares to sell this stock and now may have to scramble to find shares to cover their sales if the stock should continue to rise on any good news.

Even the chart looks nice, as the stock has now consolidated for a few months and now appears to be once again moving higher. There is little, imho, to discourage me on this particular stock, but I always remain poised to sell my shares on fundamental negative news or on negative price performance.

Thanks so much for stopping by and visiting. Once again I apologize for my absence from this website, but if I get a chance, I shall have to share with you my vacation experience. In any case, if you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and feel welcome to visit and listen to me on my Stock Picks Podcast Site!

Bob