Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Besides reviewing stock picks on this blog, and discussing some general portfolio management techniques that I employ, I also like to share with you my actual trading portfolio. These are stocks that I currently own and with which I really do employ these stock picking and buying and selling strategies. My goal is to review one position (of my current 11 positions) every two weeks. Normally, with a full portfolio of 25 positions, this would be about once/year. However, with only 11 holdings, I shall continue this process and currently at this rate will be reviewing these stocks about once every 6 months.

Two weeks ago I reviewed my Starbucks holding on this blog. Going alphabetically (through the stock symbols), I am now up to Meridian Bioscience (VIVO). Let's take another look at my own trading history with this investment and see if it still deserves a place on this blog!

Currently, I own 210 shares of Meridian Bioscienc (VIVO) in my Trading Account. These shares were purchased April 21, 2005, with a cost basis of $11.13/share. I should note that this was not the first time I have owned Meridian in this account. Back on April 22, 2004, I purchased 400 shares of Meridian but only managed to hang on to these shares for a bit under a month before incurring a more than 8% loss, and selling the entire lot of shares on May 17, 2004. When the stock came up on the screens a year later, I went ahead and purchased my current holding.

Meridian closed October 6, 2006, at $23.56, down $(.47) or (1.98)% on the day. Thus, I have a current unrealized gain of $12.43 or 111.7% on these shares. As my trading strategy dictates, I have been selling portions of my holdings of Meridian at targeted appreciation levels. I have sold shares 7/25/05, 9/1/05, 10/3/05, and 1/6/06 at the 30, 60, 90, and 120% appreciation targets. Thus, my next targeted sale on the upside would be at a 180% gain or as calculated: 2.80 x $11.13 = $31.16. On the downside, with my last sale at a 120% appreciation target, allowing for a 50% retracement to a 60% appreciation level, would give me a sale target of 1.6 x $11.13 = $17.81. If the stock should drop to this level, I would be selling all of my shares, as opposed to my 1/6th remaining shares sale at positive appreciation targets.

But let's take a closer look at the stock itself and see how things 'stack up'!

1. What exactly does this company do?

Looking at the Yahoo "Profile" on VIVO, we find that the company

"...operates as an integrated research, development, manufacturing, marketing, and sales organization in the field of life science. It develops, manufactures, and distributes diagnostic test kits primarily for respiratory, gastrointestinal, viral, and parasitic infectious diseases; and bulk antigens, antibodies, and reagents used by researchers and other diagnostic manufacturers, as well as provides contract manufacturing service of proteins and other biologicals for use by biopharmaceutical and biotechnology companies that are engaged in research for new drugs and vaccines."

2. Is there any recent news that may be affecting the stock price?

Looking through the Headlines section on Yahoo, the only relatively recent news that I think is significant was the story on September 14, 2006, that MRO Software (MRO), which apparently was being acquired by IBM Corp., will be replaced in the Standard & Poor's SmallCap 600 index by Meridian (VIVO). For the S&P index, their SmallCap range is between $300 million and $2 billion. Since there are many investors and institutions that choose to make investments in vehicles that mirror these indices, this is a bullish news story for the company.

3. How did the company do in the most recent quarter?

On July 20, 2006, Meridian reported 3rd quarter 2006 results. Net sales for the quarter came in at $26.6 million, up 5% from $25.4 million in the same quarter the prior year. Net earnings were $4.86 million, up 39% from $3.50 million the prior year. Earnings per diluted share worked out to $.18/share, a 29% increase over the $.14/share reported the same quarter last year. In addition, in the announcement, they declared a regular quarterly dividend of $.115/share, with a $.46/share indicated annual rate, 44% higher than the regular quarterly rate of 2005. And also 'reaffirmed its recently increased guidance of net sales beteween $106 and $109 million (previously $103 to $107 million) and per share-diluted earnings between $.63 and $.66 (previously $.60 to $.63) for the fiscal year ending September 30, 2006.'

As good as this report sounds, the 'street' was a bit disappointed with the revenue report. As reported, the company did meet or exceed earnings results anticipated by analysts, they fell short of revenue estimates of $27.9 million and $26.8 million. Otherwise, the report was reasonably good especially with the continuing 'double-digit sales and earnings growth for fiscal 2007.'

4. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on VIVO, we can see that the revenue growth has been very steady, increasing from $57 million in 2001 to $93 million in 2005 and $105 million in the Trailing Twelve Months (TTM).

Earnings, which were at a loss of $(.47)/share in 2001, turned profitable at $.23/share in 2002, and have increased steadily since to $.52/share in 2005 and $.66/share in the TTM. The company has been a steady dividend payer and has been raising its dividend each year (another plus for many investors.) The company paid $.17/share in 2001, $.31/share in 2005, and $.39/share in the TTM. There has been a small increase in the number of shares outstanding with 22 million reported in 2001 and 23 million in 2005 but 26 million reported in the TTM.

Free cash flow has been positive and growing. $11 million in 2003 increasing to $16 million in 2005 and $18 million in the trailing twelve months.

The balance sheet is gorgeous. The company is reported by Morningstar.com to have $35.7 million in cash, more than enough to pay off the current liabilities more than twice over and actually enough to pay off both the current and long-term liabilities which total togeter $22.7 million. The current ratio, when we add the $39.3 million of other current assets to the cash yields a ratio of 4.52. Generally, ratios of 2 or higher are considered 'healthy' at least from this particular perspective.

All-in-all, the Morningstar.com report is a very pretty picture of a small, steadily growing company.

5. What do the valuation numbers on this stock look like?

Looking at the Yahoo "Key Statistics" on VIVO we find that this company is a small mid-cap stock with a market capitalization of $615.52 million. The trailing p/e is moderately rich at 35.76, and the forward p/e is a bit better (fye 30-Sep-07) estimated at 28.05. No PEG is reported.

Examining the Fidelity.com eresearch website, we find that Meridian is in the "Diagnostic Substances" industrial group. Within this group, VIVO is reasonably priced with a Price/Sales ratio of 2.2. Topping the group is Human Genome Sciences (HGSI) with a ratio of 55.3, followed by ADEZA (ADZA) at 6.7, Myriad Genetics (MYGN) with a ratio of 4, then Meridian (VIVO) at 2.2, DIGENE (DIGE) at 1.5, and Dade Behring (DADE) at 0.9.

In terms of profitability, VIVO has the highest return on equity (ROE) of the group at 19.7%. This is followed by Dade Behring at 17%, ADEZA at 9.9%, DIGENE at 5.9%, Myriad Genetics at (17.1)%, and Human Genome Sciences at (63.3)%.

Finishing with Yahoo, we can see that there are only 26.12 million shares outstanding with 21.51 million that float. There are quite a few short-sellers on this stock with 1.24 million shares out short as of 9/12/06, representing 5.7% of the float or 8.9 trading days of volume. Using my own 3 day rule on the short ratio, this is triple that level, and if the company has any positive reports, there may well be a squeeze of the shorts pushing the shares higher. However, if the shorts are seeing something I don't....well that would mean they could be right! In any case, these 1.24 million shares that are already sold will need to be repurchased in the future and can only help prop up the stock price when that is done.

As noted, the company also pays a nice dividend with a forward annual rate of $.46/share yielding 2%. The company last split its stock with a 3:2 split on September 6, 2005.

6. What does the chart look like?

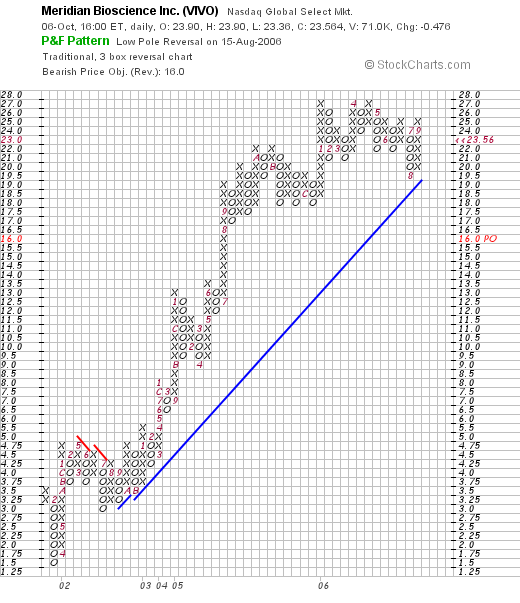

If we look at the Meridian Bioscience (VIVO) "Point & Figure" chart from StockCharts.com, we can see that this company has had a steady ride from $1.50 in February, 2001, when it last showed significant weakness, to its peak at $27 which it has hit three times in January, 2006, as well as in April, 2006. The stock has actually been trading sideways this year, but still appears to be above its support level. It does not appear over-extended to me, but I would like to see this stock, which is trading just under $24, to get through that $27 level to feel confident that it is on the upswing once again.

7. Summary: What do I think about this stock?

Let's take a look at a few things that I have commented on above. First of all, I own this stock so that is my own bias. However, the news of its inclusion in the SmallCap 600 is encouraging. The latest quarter was a tad soft on revenue growth with strong earnings and an increased dividend report. In addition, guidance appears to be reasonably bullish. I think the stock, if indeed we get a good next quarter, will resume its upward move. However, until then, we may have to wait while it 'treads water' so to speak.

The Morningstar report was very nice with a consistent growth in revenue, earnings and free cash flow. As "icing on the cake" the company pays a small dividend that it is regularly increasing. The balance sheet is solid. Valuation-wise, the p/e is a bit rich in the mid 30's. However, with the 30% plus earnings growth reported, even though we don't have a PEG, at least from this current quarter, I would expect that a PEG wouldn't be much above 1.5 if at all. But THAT is just my guess. Finally the chart looks nice. I think all it will take is another nice earnings report, and the stock price moves higher with the short-sellers scrambling to cover their bets that the stock price declines. Anyway, that's my view!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. When you get a chance, drop by and visit my Stock Picks Podcast Site where you can hear me talk about many of the same stocks I write about here on this website!

Bob