Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NYSE and came across an old favorite of mine, Alliance Data Systems (ADS) which had a nice move higher today, closing at $60.43, up $4.43 or 7.91% on the day. I first reviewed ADS on Stock Picks Bob's Advice on August 1, 2003, when the stock was trading at $28.45. Today's close works out to a gain of $31.98 or 112.4% since my first posting.

I was looking through the list of top % gainers on the NYSE and came across an old favorite of mine, Alliance Data Systems (ADS) which had a nice move higher today, closing at $60.43, up $4.43 or 7.91% on the day. I first reviewed ADS on Stock Picks Bob's Advice on August 1, 2003, when the stock was trading at $28.45. Today's close works out to a gain of $31.98 or 112.4% since my first posting.

I "revisited" Alliance on January 29, 2004, when the stock was trading at $29.50. I also took another look at ADS and also took a position in the stock on June 16, 2005, when ADS was trading at $39.00. I sold these shares on October 25, 2005, after taking a small loss on this investment. This is one stock that unfortunately I didn't manage to hang onto, as the stock has moved significantly higher since my sale. However, I do believe the stock deserves to be in this blog, and I would like to take another look at this company with today's large move to the upside.

1. What exactly does this company do?

According to the Yahoo "Profile" on ADS, this company

"...and its subsidiaries provide transaction services, credit services, and marketing services in North America. The company facilitates and manages interactions between its clients and customers through multiple distribution channels, including instore, catalog, and online. Its transaction services comprise issuer services, such as card processing, billing and payment processing, and customer care; utility services consisting of customer information system hosting, customer care, and billing and payment processing; and merchant services, such as point-of-sale services and merchant bankcard services."

2. Was there any news to explain today's move higher?

Shares rose today after the company reported strong earnings yesterday after the close of trading.

3. How did they do in the latest reported quarter?

As I noted above, yesterday, October 18, 2006, the company reported 3rd quarter 2006 results. For the third quarter ended September 30, 2006, total revenue increased 32% to $506.6 million, up from $384.8 million in the same quarter the prior year. Net income increased 36% to $48.8 million in the quarter compared with $35.9 million in the same quarter last year. On a diluted per share basis this worked out to $.60/share, up 43% from $.48/share the prior year. In the same announcement, the company raised guidance for 2006 cash earnings/share to $3.00 to $3.05. The company also guided for 2007 with revenue expected to be at $2.1 billion, and earnings per share of "at least $3.50" peer diluted share.

As was reported on TheStreet.com, this 'cash-basis results' of $.81/share beat the expected $.67/share. The 2007 guidance was also ahead of Wall Street's forecast of $3.32/share in earnings on revenue of $2.14 billion.

Thus, the company managed to come in with what I call a "trifecta-plus" in a quarterly report: increased revenue, increased earnings, exceeding expectations, and raising guidance! The stock price responded accordingly!

4. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ADS, we find that revenue has been steadily increasing with $770 million in 2001 increasing to $1.5 billion in 2005 and $1.77 billion in the trailing twelve months (TTM).

Earnings have also steadily increased with $.31/share reported in 2002, increasing to $1.64/share in 2005 and $2.04 in the TTM.

The company has modestly increased its shares outstanding from 74 million in 2002 to 82 million in 2005, but has retired shares since with only 80 million shares reported outstanding in the TTM. No dividend is reported.

Free cash flow has been erratic with $70 million reported in 2003, $300 million in 2004, $43 million in 2005 and $133 million in the TTM.

The balance sheet is adequate if not overwhelming. The company is reported to have $151 million in cash, and $764.7 million in other current assets for a total of $915.7 million in total current assets. When compared to the $594.5 million in current liabilities this yields a current ratio of 1.54. In addition, the company has a significant $1.29 billion in long-term liabilities.

5. How about some valuation numbers on this stock?

Reviewing the Yahoo "Key Statistics" on ADS, we find that this is a large mid-cap stock with a market capitalization of $4.84 billion. The trailing p/e is a moderate 29.67 with a forward p/e (fye 31-Dec-07) of 18.20. With rapid growth expected over the next 5 years, the PEG works out to a very reasonable 1.07.

Checking the Fidelity.com eresearch website, we can see that this company is in the "Credit Services" industrial group. Within this group, ADS is reasonably priced with a Price/Sales ratio of 2.6. Leading this group is CapitalSource (CSE) with a ratio of 5. This is followed by American Express (AXP) at 2.8 and Alliance Data (ADS) at 2.6. Capital One Financial (COF) is at 1.8 and Fannie Mae comes in at 1.1.

Insofar as Return on Equity (ROE) is concerned, ADS is in the middle of the group with a ROE of 17.4%. Topping this group is Fannie Mae at 43.7%, American Express at 33.4%, then Alliance Data at 17.4%, Capital One Financial at 15.7% and CapitalSource (CSE) coming in at 14.2%.

Extracting some additional information from Yahoo, we can see that there are 80.11 million shares outstanding with 64.89 million that float. As of 9/12/06, there were 4.22 million shares out short representing 5.4% of the float or 5.8 trading days of volume. Using my "3 day rule" for the short ratio, this 5.8 days of short interest appears significant. Indeed, today's share move higher might well represent, at least in part, some of the short-sellers scrambline to limit their losses by purchasing shares of their pre-sold stocks. No cash dividend is paid and no stock splits are reported on Yahoo.

6. What does the chart look like?

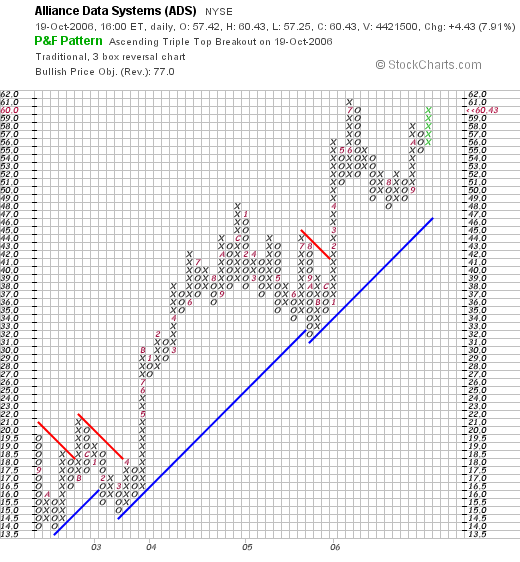

If we review a "Point & Figure" chart on ADS from StockCharts.com, we can see a really gorgeous chart with the stock, which was trading between $14 and $21 in late 2002, moving to the $48 level in December, 2004, before pulling back to a $32 level. The stock moved higher since then and appears to be on the upswing as I write.

7. Summary: What do I think about this stock?

Let's take a look at a few of the points I reviewed in this post. First of all the stock moved strongly higher today on the back of an outstanding earnings report with both revenue and earnings increasing in the mid-30% range! The earnings exceeded expectations, and the company raised guidance for the 2006 full year and established strong 2007 earnings guidance.

The Morningstar.com report is also strong with a very steady record of growing revenue and earnings with a slowly increasing number of shares. Free cash flow, while a bit erratic, is strongly positive. Finally, the balance sheet is adequate with sufficient current assets to cover current liabilities. However, the company does have a sizeable long-term debt level.

Valuation-wise, the p/e isn't too rich and the PEG is great---just over 1.0. Both Price/Sales and ROE ratios are average and shouldn't keep the stock price back nor shall they cause great demand lifting shares. Helping keep the stock moving higher is a significant level of short interest. Finally, the stock chart looks strong with a steady increase in price the past three years.

In conclusion, I like this stock enough to have written it up virtually every year this blog has been in existence! In many ways, this stock exemplifies many of the factors that I find attractive in picking stocks. This stock deserves to be in the investing vocabulary of this blog!

Thanks so much for stopping by and visiting. If you have any comments or questions please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure and visit my Stock Picks Podcast Site!

Bob