Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It is getting a little late but I really wanted to get around to posting one of my favorite stocks that finally made it to the blog. Fastenal (FAST) closed at $38.27, up $3.32 or 9.5% on the day, enough to make the list of top % gainers on the NASDAQ today. I do not own any Fastenal shares directly, but my stock club does have a position in this stock.

It is getting a little late but I really wanted to get around to posting one of my favorite stocks that finally made it to the blog. Fastenal (FAST) closed at $38.27, up $3.32 or 9.5% on the day, enough to make the list of top % gainers on the NASDAQ today. I do not own any Fastenal shares directly, but my stock club does have a position in this stock.

FASTENAL (FAST) IS RATED A BUY

Let's take a closer look at this company and I will try to share with you why I believe it deserves a place in this blog, to be part of my 'vocabulary' of investable stocks!

What exactly does this company do?

According to the Yahoo "Profile" on Fastenal, the company

"...together with its subsidiaries, engages in the sale of industrial and construction supplies. The company offers threaded fasteners, such as bolts, nuts, screws, studs, and related washers, as well as miscellaneous supplies, such as paints, various pins and machinery keys, concrete anchors, batteries, sealants, metal framing systems, wire ropes, struts, private-label stud anchors, rivets, and related accessories."

How did the company do in the latest quarter?

In fact, it was the announcement of 1st quarter 2007 results this morning that drove the stock higher today. Net sales for the quarter ended March 31, 2007, came in at $489.2 million, up 13.3% over $431.7 million in the same period last year. Net earnings increased from $47.9 million in the first quarter of 2006 to $54.0 million in the same quarter in 2007. Basic and diluted earnings per share increased from $.32/share in 2006 to $.36/share in the 2007 quarter.

The company continues to show strong sales growth as demonstrated by same store sales growth at all locations of 12.6% in January, 2007, 11.8% in February, 2007, and 15.5% in March, 2007.

The company beat analysts' expectations of $.35/share in earnings but missed revenue expectations of $493 million.

Even though this doesn't appear to be a fabulous report, apparently the street was expecting Fastenal to miss expectations. These "whisper numbers" were less than what was reported. As related:

The results surprised the market, Morgan Keegan analyst Brent Rakers said.

"The Street was overly pessimistic ... there was a whisper sent out there that the numbers were actually short of expectations," he said by phone.As this story demonstrates, actual results are not as important as what people are actually expecting and how the resuts differ from expectations!

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Fastenal, we can see that the revenue of this company has been steadily increasing with $905 million in 2002 increasing to $1.8 billion in 2006.

Earnings have increased steadily from $.50/share in 2002 to $1.32/share in 2006. As an added 'plus' the company has been paying a dividend that has been regularly increased with $.03/share paid in 2002, increasing to $.31/share in 2005 and $.40/share in 2006. Meanwhile, as revenue was doubling, earnings were almost tripling, and dividends were up 13x, the outstanding shares barely budged with 150 million shares reported in 2003, increasing by 2006 to 151 million, less than a 1% increase in shares outstanding!

Free cash flow has been positive, increasing from $5 million in 2004 to $56 million in 2005 and $20 million in 2006.

The balance sheet is solid with $30.2 million in cash and $737.6 million in other current assets. This total of $767.8 million, when compared to the $103.9 million in current liabilities, yields a 'current ratio' of 7.39. In general, current ratios of 1.25 or higher are considered 'healthy'. FAST has an additional, relatively insignificant, $13 million in long-term liabilities on the balance sheet reported.

What about some valuation numbers?

Looking at the Yahoo "Key Statistics" on FAST, we see that this is a mid-cap stock with a market capitalization of $5.79 billion. The trailing p/e is moderate at 29.06, with a forward (fye 31-Dec-08) p/e estimated at 21.50. With the solid growth in earnings predicted, the PEG comes in under 1.5 at 1.44 which is reasonable in my view.

Checking the Fidelity.com eresearch website, we can see that Fastenal has a bit of a rich Price/Sales (TTM) reported at 2.92, with an industry average of 1.46. In terms of profitability, at least as measured by the Return on Equity (ROE) (TTM), Fastenal is a bit more profitable than other companies in the same industry. FAST has a ROE (TTM) of 23.10%, vs. the industry average of 17.42%.

Returning back to the Yahoo "Key Statistics" we find that there are 151.21 million shares outstanding with 125.73 million that float. As of 3/12/07, there were 11.16 million shares out short representing 8.9 trading days of volume. This is greater than my 3 day rule for short interest. Today, on the back of the better than "whispered" earnings results, the volume expanded to 4.99 million shares, almost quadruple the average volume of 1.3 million. I cannot help but wonder whether the sharp increase in share price in the face of relatively unremarkable earnings essentially in line with the analysts isn't the result of a squeeze of these many short-sellers. In any case, there well be millions of shares out short remaining to be covered if the stock continues to move higher.

As noted, the company pays a forward dividend of $.42/share yielding 1.2%. The last stock split was a 2:1 split on November 14, 2005.

What does the chart look like?

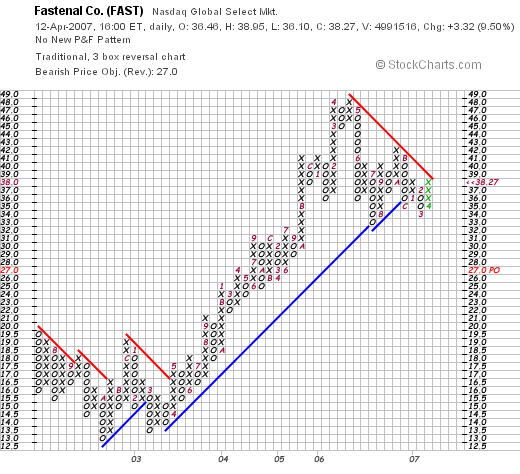

If we examine a "Point & Figure" chart on Fastenal from StockCharts.com, we can see how short-sellers might interpret the chart as showing that the stock rise from a low of $13 in October, 2002, to a high of $48 in April, 2006, had 'rolled-over' breaking through the support lines on the chart. In fact, I would like to see the stock rally past the $39 level to break past the "resistance line" as illustrated by the downward red line on the chart. I am not much of a technician, but the chart certainly does offer some concerns.

Summary: What do I think?

Well I like this stock. Enough to support it being in my own stock club although I do not personally own any shares. The company reported a solid earnings report today with growth in both revenue and earnings. They beat the 'whisper numbers' although it was a mixed bag in terms of the analysts published expectations. The Morningstar.com report is solid with steady revenue and earnings growth as well as dividend growth with a very stable outstanding number of shares. Free cash flow is positive and the balance sheet is very strong.

Valuation-wise the p/e is in the high 20's but the PEG is under 1.5, the Price/Sales is a bit rich compared to companies in the same industry, but profitability-wise, Fastenal has stronger Return on Equity (ROE) numbers than similar companies in the same industry. Finally there are lots of shares out short which likely led to a 'squeeze' of the short-sellers today. This buying demand waiting to be implemented may well provide additional support to the stock price going forward.

Fastenal is regarded in mythologic proportions in this portion of Wisconsin as Winona is just a hop-skip-and-a-jump from here. Many local investors have done very well with this stock over the years. But they have done well not because the nuts and bolts the company sellls are particularly unusual. Rather, because of the powerful management that has been able to consistently report outstanding results like they did today. The stock price has followed this fundamental progress of the company!

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where I talk about many of the same stocks I write about here on the blog!

Bob