Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Please excuse my recent political digression. But I plan to share with you thoughts on other things besides stocks from time to time when I am so inspired. I look forward to your comments and responses! We certainly will not all agree about all things but I would encourage you to all provide links and supports to arguments. That is the wonder of the web.

Please excuse my recent political digression. But I plan to share with you thoughts on other things besides stocks from time to time when I am so inspired. I look forward to your comments and responses! We certainly will not all agree about all things but I would encourage you to all provide links and supports to arguments. That is the wonder of the web.

O.K. back to stocks!

As regular readers here probably know, I like to look for new names for stocks which thus become part of my "vocabulary" of investing. When the time is right, being familiar with many 'acceptable' names is helpful in determining where to invest your money!

My first step in identifying a new name is to check the list of top % gainers. This list of top % gainers often has names that may, I hope, move on to even higher levels. Certainly, just making a big move isn't enough to guarantee anything--but if we can identify those stocks moving higher that also have strong fundamentals, this is my basic thesis behind my investing strategy--perhaps we can develop portfolios of these kinds of stocks.

Baxter International (BAX) made the list of top % gainers today, closing at $59.58, up $4.28 or 7.74% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this company and I will explain why

BAXTER INTERNATIONAL (BAX) IS RATED A BUY

First of all,

What exactly does this company do?

According to the Yahoo "Profile" on BAX, the company

"...is a diversified medical products and services company. It provides medical devices, pharmaceuticals, and biotechnology for the treatment of hemophilia, immune disorders, cancer, infectious diseases, kidney disease, and trauma worldwide."

How did they do in the latest quarter?

As is so often the case on this blog, it was the announcement of earnings today that led to the big move in the Baxter stock. In fact, prior to the opening of trading today, Baxter (BAX) announced 3rd quarter 2007 results. For the quarter ended September 30, 2007, climbed 8% to $2.8 billion. Net income came in at $395 million, up 65 from $374 million in the same quarter in 2006. On a per diluted share basis, earnings were up 7% to $.61/share, from $.57/share last year.

Even though an 8% or a 7% increase in anything might not appear significant, it was the fact that the company beat expectations that moved the stock higher today! According to analysts surveyed by Thomson Financial, BAX was expected to come in at $.66/share (the company came in at $.70/share before one-time charges), on revenue of $2.68 billion (they came in at $2.8 billion). To top off this nice earnings result, the company went ahead and raised guidance, now guiding to $2.75 to $2.77 in 2007, up from prior guidance of $2.65 to $2.70/share.

What about longer-term results?

My search for stocks is not for a company that has a great quarter and moves higher from that event. But rather for companies that can consistently produce positive and improving financial results. This is my definition of quality in terms of growth stocks.

For this information, I have been utilizing the Morningstar.com data. The Morningstar.com "5-Yr Restated" financials for Baxter International (BAX) are strong. Since 2002, the company has increased revenue from $8.1 billion to $10.4 billion in 2006 and $10.8 billion in the trailing twelve months (TTM). Earnings did dip from $1.40/share in 2003 to $.60/share in 2004. However, since 2004, they have been increasing---coming in at $1.50/share in 2005, $2.10/share in 2006 and $2.50/share in the TTM.

During this same time dividends have been paid--$.60/share from 2002 through 2006 and increased to $1.10/share in the TTM. The outstanding shares have been relatively stable, increasing from 599 million shares in 2003 to 650 million in the TTM.

Free cash flow has been positive, strong, and growing. $822 million in 2004, $1.1 billion in 2005 and $1.7 billion in 2006.

This has resulted in a solid balance sheet with $7.2 billion of total current assets compared to $3.8 billion in current liabilities. This results in a current ratio of 2.06. The company has an additional $4.2 billion in long-term liabilities.

What about some valuation numbers on this stock?

I am not purely a momentum player. I also like to review technicals in a simple fashion as well as some basic value questions.

Using Yahoo "Key Statistics" on BAX, we can see that the Market Cap is a Large Cap sized $38.41 billion. The trailing p/e is a moderate 23.94. The '5-Yr expected' PEG works out to an acceptable 1.58.

In terms of the Price/Sales (TTM), according to the Fidelity.com eresearch website, BAX is reasonably priced with a ratio of 3.32 compared to the industry average of 5.33. Besides being a good value relative to sales, the Fidelity.com website also suggests that the company is more profitable than its peers with a Return on Equity (TTM) of 25.34%, compared to the industry average of 19.33%.

Finishing up with Yahoo, we can see that there are 644.7 million shares outstanding with 643.12 million that float. As of 9/11/07, there were 3.08 million shares out short, representing only 0.5% of the float or only 1 trading day of volume (the short ratio). Thus the short-sellers do not seem to be very significant at this time in terms of shares out short. (I use a 3 day 'rule' for significance in my own evaluations.)

As I noted, the company pays a forward dividend of $.67/share yielding 1.20%. The last stock split was a 2:1 split in May, 2001.

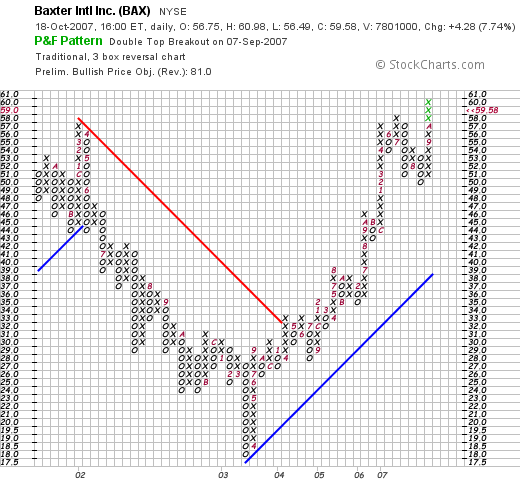

What does the chart look like?

Examining the 'point & figure' chart on BAX from StockCharts.com, we can see that the stock traded lower from $58/share in March, 2002, to a low of $18/share in March, 2003. The stock subsequently steadily moved higher to the current level of $59.58. The stock chart actually appears quite strong for the past 4 years.

Summary: What do I think?

Needless to say, I like this stock. It is a large cap growth stock with relatively modest but steady growth in revenue, earnings, and free cash flow. They beat expectations and raised guidance. They pay a dividend, have a reasonable Price/sales and a strong Return on Equity. They even have a product I understand and that I believe should be relatively recession-resistant. Diversified medical supplies. If I were buying a stock today, this is they type of stock I would be buying. Meanwhile, it is back into my 'vocabulary of stocks' along with the many other stocks on this blog.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, my Covestor Page where my actual holdings are analyzed and compared to other investors and the indices, and my Social Picks Page where all of my past stock picks are recorded from the first of 2007. (The blog dates back to 2003 and you can still refer to those older posts utilizing the date links along the left side of the blog.)

If you still have some time left, consider stopping by and visiting Prosper.com. If you sign up with Prosper before the end of the year, you shall receive $25 credit (and I shall also receive a credit if you go through this link). Be careful with this lending site and be aware of the extensive risks associated even with small parts of unsecured loans. However, this person-to-person lending program is rather amazing and the fact that it is combined in an Ebay fashion in a more or less Dutch Auction, is also a kick!

Thanks again for visiting! Hope you have a profitable week and a wonderful weekend!

Bob