Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have missed another 'Weekend Review'. We shall get to it next week. But while looking through my past entries during the week of May 15, 2006, I came across an entry that I wrote back at that time which seemed to be a difficult trading environment. What I wrote then still holds true. Here is that entry:

Wednesday, 17 May 2006Maintaining Trading Discipline in a Declining Market

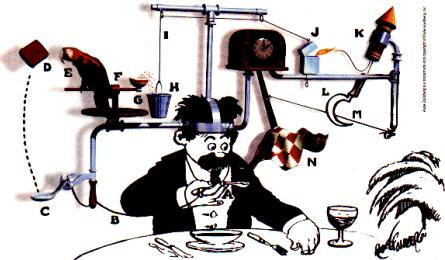

One of my greatest challenges as an investor is knowing how to deal with market declines and investment losses. One would like to have something automatic like this Rube Goldberg machine.

In other words, to have a trading system that will diminish your losses in a bear market and maximize your gains in a bull market.

Too often we find our emotions working against our own best interests. When investments decline we rationalize the losses and defer the realization implicit in a sale of holdings at a price below their cost. This exposes our investments to greater losses and delays the eventual 'day of reckoning'.

In the same fashion, as stocks move higher, our greed overcomes our rational thoughts and we delay realizing some of the gains by selling a portion of the holding, and instead allow our dreams of larger and greater profits override our need to 'lock-in' some gains with a sale.

Within every successful trading system there should be a method of avoiding the problem of compounding one's losses while at the same time encouraging the compounding of gains. In other words, when investments within a portfolio develop losses, they should be sold at a predetermined price point and the proceeds from such sales should not be re-invested; instead, the proceeds should be kept in cash to be re-invested when an appropriate buy signal occurs.

In the same fashion, when stocks are sold on 'good news' events, such as price appreciation, this should also be considered a bullish indicator and the proceeds from such good news sales should be re-invested in a new stock position.

I have expressed this strategy as being hardest on declining stocks that are sold completely and quickly on developing losses, and easiest on gaining stocks which are on the other hand sold slowly and partially as they appreciate in price. This bias will also select for the strongest stocks within your portfolio.

A strategy with pre-determined sale points both on the upside and downside reduces trading stress as one simply needs to review the stock price to determine one's action. It is the requirement for arbitrary decisions that may lead to over-trading as well as under-trading of one's holdings.

No system can respond quickly enough to avoid all losses and lock in all gains. However, having a system that can move one's holdings back and forth from equities to cash and back again, should be helpful in the long-run in building one's assets by maximizing gains and minimizing losses.

Wishing my readers the very best of luck in dealing with the difficult investing environment we are all facing!

Bob

I dont know how the market is going to trade tomorrow. Certainly the Asian markets have been 'taking it on the chin' this evening. But where will the Dow close tomorrow? I simply don't know.

What I do know is that my stocks have predetermined sale points on the upside and the downside. And that I shall stay as much 'put' as possible before implementing any trades. I shall try to let my own portfolio dictate my trading and not my fears or hopes regarding stocks.

Wish me luck! Thanks again for dropping by! Good-luck trading tomorrow!

Bob