Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers this afternoon and came across an 'old favorite' of mine, Charles River Laboratories (CRL) which closed strongly higher at $64.00/share, up $6.08 or 10.5% on the day.

I was looking through the list of top % gainers this afternoon and came across an 'old favorite' of mine, Charles River Laboratories (CRL) which closed strongly higher at $64.00/share, up $6.08 or 10.5% on the day.

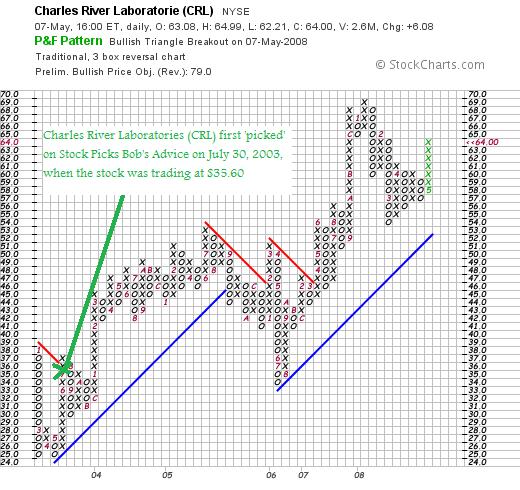

I use the term 'old favorite' because this was a prior stock pick of mine going all of the way back to July 30, 2003, when I 'picked' Charles River Laboratories for Stock Picks Bob's Advice when the stock was trading at $35.60. With the stock closing at $64.00, this represents a gain of $28.40 or 79.8% since posting this stock almost five years ago! I do not own any shares nor do I have any options on this stock.

Let's take a closer look at this company and I will explain why

CHARLES RIVER LABORATORIES (CRL) IS RATED A BUY

First of all,

What does this company do?

According to the Yahoo "Profile" on Charles River Laboratories, the company

"...together with its subsidiaries, provides solutions that advance the drug discovery and development process, including research models and associated services, and outsourced preclinical services worldwide. The company operates in two segments, Research Models and Services (RMS) and Preclinical Services (PCS). The RMS segment involves in the commercial production and sale of research models, principally purpose-bred rats, mice, and other rodents for use by researchers. It also offers new and proprietary, disease-specific rat models used to find new treatments for diseases, such as diabetes, obesity, cardiovascular, and kidney disease. In addition, this segment provides research models services comprising transgenic services, research animal diagnostics, consulting and staffing services, and discovery services. Further, it provides vaccine support and in vitro technology products for the testing of medical devices and injectable drugs for endotoxin contamination. The PCS segment engages in the discovery and development of new drugs, devices, and therapies. It offers toxicology studies; pathology services; bioanalysis, pharmacokinetics, and drug metabolism services; discovery support; biopharmaceuticals services; and clinical services, including Phase I trials in healthy normal and special populations."

How about the latest quarterly result?

As is often the case, it was the announcement of 1st quarter 2008 results after the close of trading yesterday that drove the stock higher today, in spite of the overall week market tone. For the quarter, net sales increased 16% to $337.7 million from $291.2 million in the same quarter in 2007. Net income for the quarter came in at $45.2 million or $.64/diluted share, up from $36.8 million or $.54/diluted share during the same period in 2007. Non-GAAP results (what analysts estimate), amounted to a profit of $50.8 million or $.72/share, up from $43.2 million or $.64/share last year.

These results exceeded expectations of analysts polled by Thomson Financial, which were for a profit of $.69/share on $325.2 million in revenue. The company reaffirmed guidance in line with analysts' expectations for the balance of 2008.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on CRL, we can see the steady record of revenue growth from $599 million in 2003 to $1.23 billion in 2007. Earnings during this period have grown, albeit somewhat erratically, from $1.64/share in 2003 to $2.25/share in 2007 (after posting a loss of $(.80)/share in 2006).

The company does not pay any dividends and has maintained outstanding shares fairly stable with 54 million in 2003, and 67 million in 2007. Free cash flow has also been a bit irregular dropping from $122 million in 2005 to a negative $(6) million in 2006 before rebounding to $61 million in 2007.

The balance sheet appears strong with $225 million in cash and $382 million in other current assets reported on Morningstar.com, compared to $302.5 million in current liabilities and $642.5 million in long-term liabilities. This works out to a current ratio of 2.01.

What about some valuation numbers?

Looking at Yahoo "Key Statistics" on CRL, we can see that the company is a mid cap stock with a market capitalization of $4.36 billion. The trailing p/e is a moderate 28.5 with a forward p/e (fye 29-Dec-09) estimated at 18.93. The PEG ratio comes in at an acceptable 1.43.

Utilizing the Fidelity.com eresearch website, CRL has a Price/Sales (TTM) of 3.09, vs. an industry average of 6.69. In terms of profitability, CRL has a Return on Equity (TTM) of 9.06% compared to an industry average of 10.60%.

Finishing up with Yahoo, there are 68.18 million shares outstanding with 65.51 million that float. As of 4/10/08, there were 4.5 million shares out short representing 9.5 trading days of volume (well above my '3 day rule' for short interest significance.) No dividends and no stock splits are reported on Yahoo.

What does the chart look like?

Examining the 'point & figure' chart on CRL from StockCharts.com, we can see the fairly steady price appreciation, with the dip in 2006 correlated with the short-term drop in the company's prospects. The price has moved from $25/share in March, 2003, to a recent high of $69 in January, 2008. The stock has been trading above the support levels for the past two years but does not appear over-extended to me.

Summary: What do I think about this stock?

Avoiding the issues of 'animal rights', I like the stock and its performance. They reported a great quarter, beat expectations on both earnings and revenue and confirmed guidance. Valuation is reasonable with a PEG under 1.5 and a Price/Sales below the industry average. Return on Equity did come in a slight bit light.

After a dip in 2006, the company has rebounded in an impressive pattern of growth. I do believe the opportunities for theis company are great with the continued demand for new drugs and therapeutic interventions to improve all of our quality of life. Finally the chart looks strong as well.

Now, if I just had a signal to be buying some shares. Meanwhile, I shall continue to 'sit on my hands' in the face of this tumultuous market.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can monitor my actual trading account, my SocialPicks Page where you can view my latest stock picks and the results of past stock market investment ideas. Also, visit my Stock Picks Podcast Page where you can download some mp3's on some of the many stocks I write about here on the blog.

Have a great 'rest-of-the-week' in traidng and investing!

Yours in investing,

Bob