Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions

I continue to work my strategy even in the face of this volatile market that was screaming higher at the close. The Dow closed at 9,065.12, up 889.35, and the Nasdaq moved up 143.57 to close at 1,649.47. The S&P also participated, moving up 91.59 to close at 940.51. I cannot guess when the market shall be moving higher or correcting sharply.

All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares.

All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares.

Earlier today, before the last hour climb in the Dow, I sold my 210 shares of National Oilwell Varco (NOV) at $23.55/share. This stock has been travelling lower in synch with the price of oil. And no matter how pretty the numbers on this company, the price has been relentlessly declining since my purchase. These shares were purchased literally just days ago on 10/17/08, at a cost of $28.83/share. Thus I had a loss of $(5.28) or (18.3)% since purchase.

No way around this, it had passed my 16% limit for a loss and was sold. Ironically, this stock rebounded later in the day to close at $25.49, up $1.99 or 8.47% today----but I hate that analysis. It is far more important to make decisions in the market than to kick yourself about decisions that might have worked out some other way.

Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

I went to the list of top % gainers and identified WMS Industries (WMS) which seemed to fit my own requirements and purchased 96 shares at $20.04. Even though I missed the rise in NOV, I now paricipated in WMS which closed today at $22.44, up $4.34 or 23.98% on the day. My own gain on WMS (a paper profit that can disappear as fast as it appeared), amounted to $2.40/share, or 12% since purchase. (Most of this gain could disappear as WMS is trading at $20.56, down $(1.88) or (8.38)% in after-hours trading!)

Let's take a little closer look at WMS.

First of all, what does this company do?

According to the Yahoo "Profile" on WMS, the company

"...engages in the design, manufacture, and distribution of gaming machines and video lottery terminals (VLTs) for customers in gaming jurisdictions worldwide. The company�s products consist of video gaming machines, mechanical reel gaming machines, and video poker gaming machines. It also sells spare parts, conversion kits, amusement-with-prize gaming machines, and used gaming machines, as well as equipment manufactured under original equipment manufacturing agreements to casinos and other licensed gaming machine operators."

And the latest quarter?

Yesterday after the close of trading, WMS reported 1st quarter 2009 results. Earnings camne in at $15.7 million or $.27/share, up from $11.1 million or $.19/share the prior year. This result exceeded expectations from analysts polled by Thomson Reuters who were looking for earnings of $.25/share. Revenue came in at $151.4 million, up 14% from last year's $132.5 million result. Again, this revenue figure exceeded expectations by analysts.

The company reaffirmed fiscal 2009 guidance.

Longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see the steady revenue growth, the steady earnings growth, and the relatively stable outstanding shares. Free cash is solidly positive and the balance sheet is strong.

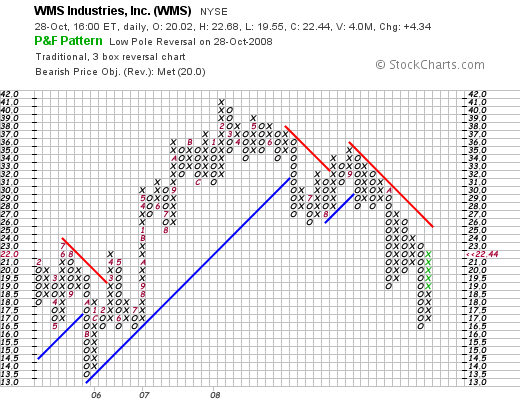

And what about the chart?

Looking at the "point & figure" chart on WMS from StockCharts.com, we can see what looks like a rather dismal chart to me! The stock failed to move higher in September, 2008, at the $36 level and has been trading under the 'resistance line' since. I would like to see this stock break through the $27 level to reaffirm the change in price momentum.

Summary:

The market has been tossing me wildly like a ship in the midst of a storm. I am learning to adapt---giving my last 5 holdings a larger leash before selling, and I am reducing the size of my replacement positions without changing my underlying strategy. I hope this works.

I sold my National Oilwell Varco stock (NOV) and replaced that fifth position with WMS Industries (WMS), a gambling machine stock. I did so because of a strong quarter which exceeded expectations on revenue and earnings, a solid Morningstar.com report, and reasonable valuation. The chart however looks awful. I hope this approach works out!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadvicefortocks@lycos.com.

Yours in investing,

Bob

Updated: Tuesday, 28 October 2008 4:41 PM CDT