Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I posted a PODCAST ON SYSCO (SYY). Usually I write up an entry first and then follow with a podcast. Tonight I did it the other way around :).

A few moments ago I posted a PODCAST ON SYSCO (SYY). Usually I write up an entry first and then follow with a podcast. Tonight I did it the other way around :).

We live in difficult times! I don't really need to tell you about the growing unemployment, the latest bank failures, or what the New York Fed reported on manufacturing. These are things that everyone knows.

What is harder is trying to some reasonable place to park one's funds. I would like to suggest that an investment in Sysco (SYY) might be a place to find some value and potential growth while waiting for the eventual economic recovery.

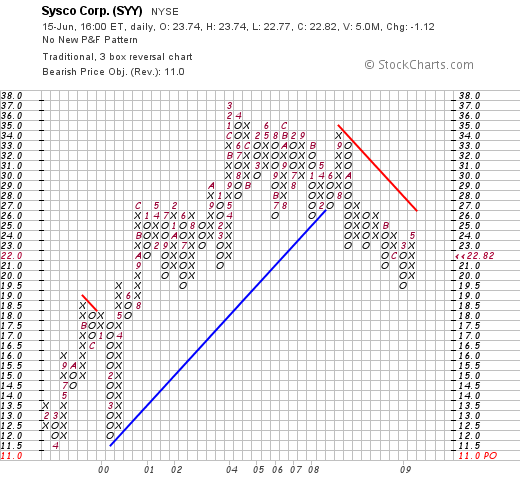

Sysco (SYY) closed today at $22.82, down $(1.12) or (4.68)% on the day. I do not own any shares of this stock but have owned it in the past and would consider buying shares once again in the future.

Looking at a few of the things I like to review, the latest quarterly report was fair. They met expectations on earnings which did decline slightly and came in a little light on revenue. Longer term, looking at the Morningstar.com '5-Yr restated' we see that the company has a record of steadily growing its revenue, increasing its earnings---both of which did recently take a slight dip--paying a nice dividend and increasing it (the company now yields 4%), buying back its shares, increasing free cash flow, and maintaining a solid balance sheet.

Valuation-wise, looking at Yahoo "Key Statistics" on SYY, the company has a modes p/e of only 12.74 (trailing) with a PEG estimated at only 1.14. The last split was over 8 years ago.

Certainly, the 'point & figure' chart from StockCharts.com is somewhat less than inspiring. I am not sure I agree with the bearish objective of $11/share, but we don't see much in the way of technical support on this particular chart!

In some ways this type of 'pick' is out of my usual momentum play. But then again, my own philosophy is being tempered by the difficult environment we are experiencing and the fact that little of the usual momentum type investment is apparent. I would characterize this sort of stock as more of a GARP pick. It shares many of the important characteristics that I look for in a company: the steady growth in revenue, earnings, dividends, and free cash flow. It has been buying back its own shares and carries a solid balance sheet. I even can see evidence of its business with its many shiny trucks on the road right where I work!

Anyhow, that's my idea of a 'comfort stock' in these uncomfortable times! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob