Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on this website.

Over the nearly seven years of blogging on this website, I have continued to focus on those stocks that I believed deserved inclusion on this blog and possibly inclusion in my portfolio. Until recently, I could depend on momentum investments, identifying companies that could generate greater and greater earnings on increasing revenue while hitting new highs in the market.

Over the nearly seven years of blogging on this website, I have continued to focus on those stocks that I believed deserved inclusion on this blog and possibly inclusion in my portfolio. Until recently, I could depend on momentum investments, identifying companies that could generate greater and greater earnings on increasing revenue while hitting new highs in the market.

Those kind of stocks are difficult to identify although I continue to look for this same pattern of financial results.

More recently I have shifted my holdings into more of a 'widows and orphans' investing approach, looking for value in investing, looking for stocks with growth potential yet showing reasonable valuation (GARP investing) and searching for stocks that might also pay a dividend. In short, as each year passes, I find that I am investing more and more like my father did, looking at dividends, stable and well-recognized names of stocks and their products and enjoying the relative lack of volatility that these 'quality' companies provided.

It is amazing what a good bear market can do to an investor's perspective!

I believe that The Hershey Company (HSY) fits my requirements and I wanted to share with you some of the things that make me believe it may well be a timely and attractive investment at this particular time. Hershey (HSC) closed today (3/31/10) at $42.81, down $(.24) or (.56)% on the day. I do not own any shares of this company at this time.

While Hershey (HSC) is well-known for its chocolate it has a wider range of products. As the Yahoo "Profile" on Hershey explains, the company

While Hershey (HSC) is well-known for its chocolate it has a wider range of products. As the Yahoo "Profile" on Hershey explains, the company

"...offers chocolate and confectionery products, including high-cacao dark chocolate products, such as chocolate bars, tasting squares, home baking products, and professional chocolate and cocoa items; and natural and organic chocolate products consisting of chocolate bars, drinking chocolate, and baking products. The company provides snack products comprising snack mix, granola bars, and macadamia snack nuts and cookies in various varieties; and a line of refreshment products, such as mints, chewing gum, and bubble gum, as well as pantry items consisting of baking ingredients, toppings, and beverages."

Recently Kraft (KFT) purchased Hershey competitor Cadbury for $19.5 billion, making Kraft the world's largest chocolate producer. While Hershey remains the dominant producer of chocolate in North America, this merger may be challenging as Hershey's continues to seek global sales growth.

On February 2, 2010, The Hershey Company (HSY) reported 4th quarter results. After removing one-time charges, the company reported that earnings for the period ended December 31, 2009, came in at $.63/share. This was ahead of expectations of $.60/share of analysts polled by Thomson Reuters. Sales for the quarter increased 2% to $1.41 billion, slightly under expectations of $1.42 billion in revenue by analysts.

For the full year, profits came in at $436 million or $1.90/share, nicely ahead of the prior year's $311.4 million or $1.36/share. Full-year sales also grew 3% to $5.3 billion from $5.13 billion.

They announced expectations the profit should grow 6 to 8% and that sales were anticipated to increase 3-5%. This worked out to an earnings range of $2.30 to $2.34/share ahead of analysts current expectations of $2.28/share. Revenue guidance was essentially in line with the analysts' expectations.

The company also went ahead and raised its quarterly dividend by 2.25 cents to 32 cents.

Looking at Morningstar.com for the "5-Yr Restated" financials on HSY, we can see that revenue has slowly grown from $4.8 billion in 2005 to $5.3 billionin 2009. Earnings have been erratic during this period, increasing from $1.97/share in 2005 to $.2.34/share in 2006. However, after dipping to $.93/share in 2007, they have steadily increased to $1.36/share in 2008 and $1.90/share in 2009.

Outstanding shares have decreased from 248 million in 2005 to 229 million in 2009 as the company retired shares with buy-backs.

Free cash flow after dipping from $589 million in 2007 to $257 million in 2008 has also rebounded strongly in 2009 to $939 million. The balance sheet appears adequately solid with $254 million in cash and $1,132 million in other current assets. This total of $1,386 million, when compared to the $910.6 million in current liabilities yields a healthy current ratio of 1.52.

Looking at valuation, using the Yahoo "Key Statistics" on HSY, we can see that this is a large cap stock with a market capitalization of $9.76 billion. The trailing p/e is a tad rich at 22.48 with a forward p/e (fye 31-Dec-11) estimated at 17.26. With the previously noted single-digit growth rate in earnings estimated by Hershey management, this results in a PEG ratio of 2.86, a bit rich by my standards as I prefer to invest in companies with PEG's between 1.0 and 1.5.

Yahoo reports that the company has 227.9 million shares outstanding with 227.6 million that float. The company trades an average volume of 1.9 million shares. With 5.93 million shares out short as of 3/15/09, this works out to a short interest ratio of 3.3 a bit higher than my arbitrary '3 day rule' for significance.

The company pays a nice dividend of $1.28 (going forward), with a forward annual dividend yield of 3.0%. The company does pay a good chunk of its earnings on its dividend with a payout ratio of 63%. The last stock split was a 2:1 split in June, 2004.

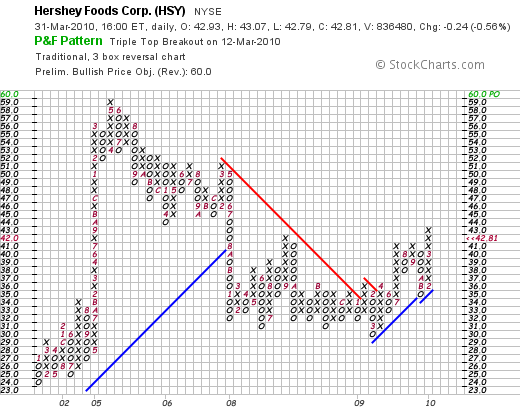

Examining the 'Point & Figure' chart on HSY from StockCharts.com, we can see that the company has really been trading sideways since dipping from $51 to a low of $31 in January, 2008. Recently, the stock appears to be technically breaking through resistance and slogging higher with higher lows and higher highs over the short-term.

In summary, They Hershey Company represents a company with core confectionary brands that are identifiable and well-respected in the United States and in a lesser fashion worldwide. The stock has found support at the $30-$31 level where it has traded for the past two years and only in the past six months has the price started to move higher. While not cheap in terms of absolute p/e or PEG analysis, the company does pay a solid dividend of 3% and has also managed to regularly raise that dividend over the past five years and longer. Recent earnings have been reasonably strong, the company has a growing free cash flow and a solid balance sheet.

This company may just be the sweet investment that I have been looking for! And that doesn't even count the many health benefits of chocolate!

In my own trading account I am still looking for solid companies with well-recognized products or services and appreciate receiving a dividend that has a track record of regularly being raised.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob