Hello Friends! Thanks so much for stopping by! The market is having a nice day...at least up to now...and our stocks are moving ahead nicely as well! Please remember that I am an AMATEUR investor and that you should do your own investigation of all investments discussed on this website and PLEASE consult with your investment advisors to make sure any stock market ideas are appropriate, timely, and even likely to be profitable for you!

I came across Coldwater Creek (CWTR) while scanning the lists of greatest percentage gainers. CWTR, as I write, is trading at $25.40 up $2.11 on the day or 9.06%. According to Yahoo, CWTR "...is a retailer of women's apparel, jewelry, footwear, gift items and home merchandise." The company has a traditional catalog business as well as a more actively growing base of full-line retail stores throughout the United States.

I came across Coldwater Creek (CWTR) while scanning the lists of greatest percentage gainers. CWTR, as I write, is trading at $25.40 up $2.11 on the day or 9.06%. According to Yahoo, CWTR "...is a retailer of women's apparel, jewelry, footwear, gift items and home merchandise." The company has a traditional catalog business as well as a more actively growing base of full-line retail stores throughout the United States.On May 19, 2004, six days ago, CWTR announced 1st quarter 2004 results. Net sales for the quarter ended May 1, 2004, increased 8.0% to $124.5 million from $115.2 million in the fiscal 2003 first quarter. Net income increased $3.5 million or 185.0% to $5.5 million, or $.22/diluted share, compared to $1.9 million, or $.08/diluted share for the same period last year.

Looking at Morningstar.com "5-Yr Restated" financials, we can see the steady revenue growth from $356 million in 1999 to $473 million in 2003. Earnings have been a bit erratic, peaking at $.60/share in 2000, dropping to $.08/share in 2002 and back up strongly to $.39/share in 2003. The latest quarter report also adds to the current recovery in earnings.

Free cash flow has improved nicely from a negative $(7) million in 2001, to $20 million in 2003.

The balance sheet as reported on Morningstar.com looks solid with $15.4 million in cash and $90 million in other current assets, plenty to cover both the $66.7 million in current liabilities AND the $14.6 million in long-term liabilities.

What about valuation? If we look at "Key Statistics" from Yahoo, we can see that this is a Small Cap stock (under $1 billion capitalization) at $615.7 million market cap. The trailing p/e is a bit rich at 39.29, but with the rapid anticipated growth, the forward p/e (fye 31-Jan-06) is 23.76. Looking out 5 yrs, we have a PEG at 0.69 suggesting a very reasonable valuation on the stock. In addition, the price/sales ratio, an important figure as I understand it especially for retail ventures is also reasonable, in my opinion, at 1.07. Both the PEG and the Price/sales are, in my opinion, good numbers when they are close to or under 1.0.

Yahoo reports 24.22 million shares outstanding with 12.30 million that float. Of these shares, 5.15% of the float is out short as of 4/7/04, representing a significant 5.916 trading days of volume to cover. Anything over 3.0 days is significant, in my opinion, and thus we may be witnessing a bit of a "squeeze" in this stock.

No dividend is reported and the stock DID split 3:2 last year in September, 2003.

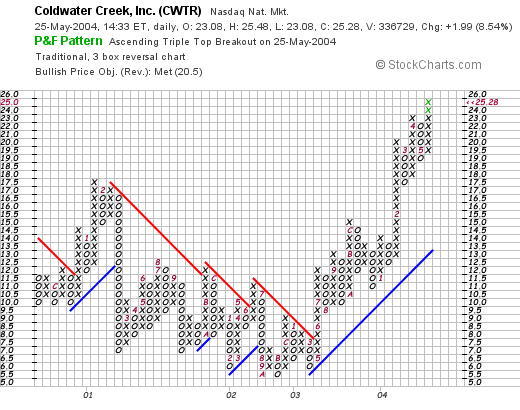

Taking a look at a chart on this stock:

We can see that this stock was actually trading lower steadily between early 2001 through May, 2003. In June, 2003, the stock broke through a resistance level at around $7.00/share and has headed higher since. The stock may be a little overexted technically, but overall the chart looks strong to me!

What do I think? I think this is an interesting investment opportunity with the transition of this retail firm from a purely catalog business to a more traditional "bricks & mortar" retail venture. The latest earnings report is nice, the free cash flow is good, the balance sheet is solid, and the valuation is also reasonable with a PEG and a price/sales close to 1.00. Unfortunately, I don't have any money available to buy any shares...you know my story....I am waiting to sell some shares at a gain before adding another position. My trading account is at 19 positions...with a maximum of 25 positions planned. I am still heavily margined with about a 45% equity in that account...so I shall sit on my hands!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com or leave your comments right here on the blog.

Bob