Hello Friends! Was pretty busy today and finally towards the end of the day got around to working the lists of greatest percentage gainers. I sold 75 shares of CYTC thinking that was my SECOND sale...approaching the 60% gain level...but when writing it up realized it was my THIRD sale....so I shall skip the 90% sell point and look forward to a solid 120% gain before making the next sale. Anyway, I still worry about anyone thinking I am giving out investment advice for THEM...so PLEASE remember to do your own investigation of all stocks discussed on this blog as I am an AMATEUR investor....and you need to discuss these investments with YOUR professional investment advisors before taking any action on the equities discussed.

Hello Friends! Was pretty busy today and finally towards the end of the day got around to working the lists of greatest percentage gainers. I sold 75 shares of CYTC thinking that was my SECOND sale...approaching the 60% gain level...but when writing it up realized it was my THIRD sale....so I shall skip the 90% sell point and look forward to a solid 120% gain before making the next sale. Anyway, I still worry about anyone thinking I am giving out investment advice for THEM...so PLEASE remember to do your own investigation of all stocks discussed on this blog as I am an AMATEUR investor....and you need to discuss these investments with YOUR professional investment advisors before taking any action on the equities discussed.I came across Micronetics (NOIZ) which was having a GREAT day today, and in fact closed at $9.33, up $2.04 or 27.98% on the day! I DID purchase 400 shares of NOIZ just before the close of trading at $9.40, so I am actually DOWN $.07/share already! I generally AVOID stocks under $10 as the % volatility almost always causes me to sell at an 8% loss fairly quickly....but the numbers looked nice, and I decided to give them a try! According to the Yahoo "Business Summary", NOIZ "...manufactures microwave and radio frequency (RF) components and integrated subassemblies used in a variety of commercial wireless and defense and aerospace products, including satellite communications, electronic warfare and electronic counter-measures."

This morning, just before the open, NOIZ reported 4th quarter and year 2004 results. For the quarter ended March 31, 2004, net sales came in at $13.8 million, an increase of $3.2 million or 29.6% from $10.7 million the prior year same quarter. For the 4th quarter, net income came in at $480,275 or $.11/diluted share compared to net income the prior year of $223,241 or $.05/dilued share, an increase of 115%. The "street" liked the report and thus the nice price move.

Looking at the Morningstar.com "5-Yr Restated" financials, we can see the fairly steady revenue growth from $4.5 million in 1999 to $12.7 million in the trailing twelve months.

Earnings, while slightly erratic, have increased from $.08/share in 1999, to $.28/share in the trailing twelve months. Extrapolating the latest quarter gets us to a level of $.44/share.

There has unfortunately been negligible free cash flow with $0 reported in 2001, $(1) million in 2002, and $0 million in 2003.

Balance-sheet-wise, the company looks fine with $1.4 million in cash and $6.2 million in other current assets balanced against $1.5 million in current liabilities and $1.0 million in long-term liabilities.

Looking at "Key Statistics" from Yahoo, we can see that this is a TINY company, truly a "micro-cap" stock with a market cap of $39.50 million. The trailing p/e is 33.93, but NO PEG is reported, and the Price/sales ratio came in at 2.44.

There are only 4.23 million shares outstanding with 3.00 million of them that float. Currently there are only 17,000 shares out short as of 5/10/04, representing 1 trading day or 0.57% of the float.

No cash dividend is paid, and no stock dividend is reported on Yahoo.

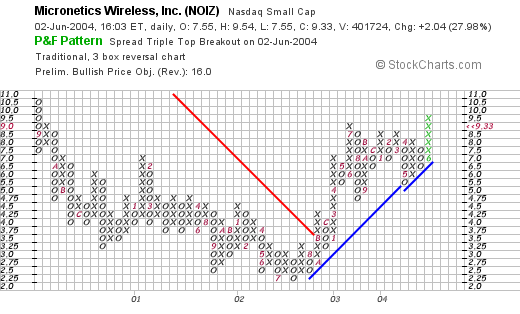

How does the graph look?

Looking at a Point & Figure chart from Stockcharts.com, we can see that NOIZ actually traded LOWER through much of 2000, through September, 2003, when it broke through a resistance level at about $3.50. The stock has traded higher since that time...and looks strong technically to me.

What do I think? Well THIS one I liked enough to actually BUY some shares...I sold some CYTC shares to allow me to add a position. (And I HONESTLY thought that was a SECOND sale!). What I don't like is that this is a micro-cap stock under $10/share, and I will likely see this stock retrace some of its great gains tomorrow...unless we can get a bit of a cushion on this purchase...there is a significant chance I get stopped out around 8%. The earnings were impressive, the balance sheet is fine, and frankly, the valuation doesn't look bad.

Thanks so much for stopping by! Please drop me a line at bobsadviceforstocks@lycos.com if you have any comments, questions, or words of encouragement! Have a great evening everyone!

Bob

Updated: Wednesday, 2 June 2004 3:50 PM CDT