Hello Friends! Well, I came CLOSE to unloading that IGT stock this morning. I wasn't paying much attention during the day to the market yesterday and didn't see that big sell-off....well the stock went into the RED and since I have already sold a portion at a gain, well in my system that means I need to unload it before I lose any money on the remaining shares...but the stock rebounded and is trading at $34.65, up $1.20 on the day...so now above my cost.

Anyhow, I sure appreciate your visit to my blog. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to get back to you ASAP...usually with an entry on the blog itself. Remember, I am an AMATEUR investor, so do investigations on the stocks discussed yourself, and PLEASE consult with an investment advisor prior to making any decisions based on information on this website.

Greg Manning Auctions (GMAI) hit the lists today with a huge move of $3.50 to $15.70 representing a 28.69% gain on the day! I do NOT own any shares of this stock (unfortunately) nor do I own any options or leveraged positions. GMAI raised estimates today for its full year sales and earnings. They announced that they expect earnings for fiscal 2004 to range from $22 to $23 million up from an earlier forecast of $14 to $15 million. Revenue estimates jumped to $205 to $210 million, up from estimates of $170 to $175 million. It should be noted, that much of this growth is related to 11 acquisitions made over the past 10 months...but they are certainly doing a good job in managing these imho.

Greg Manning Auctions (GMAI) hit the lists today with a huge move of $3.50 to $15.70 representing a 28.69% gain on the day! I do NOT own any shares of this stock (unfortunately) nor do I own any options or leveraged positions. GMAI raised estimates today for its full year sales and earnings. They announced that they expect earnings for fiscal 2004 to range from $22 to $23 million up from an earlier forecast of $14 to $15 million. Revenue estimates jumped to $205 to $210 million, up from estimates of $170 to $175 million. It should be noted, that much of this growth is related to 11 acquisitions made over the past 10 months...but they are certainly doing a good job in managing these imho.According to the GMAI website, Greg Manning Auctions "...is a global collectibles merchant and aution house network, with operations in North America, Europe, Asia, and on the internet."

On May 6, 2004, Greg Manning Auctions announced 3rd quarter 2004 results. "Aggregate" sales rose 158% to $80.9 million from $31.3 million the prior year. Revenue rose 143% to $64.5 million from $26.6 million the prior year. Earnings per share were $.23/diluted share vs. $.16/diluted share in the prior year's same quarter.

Looking at Morningstar.com "5-Yr Restated" financials we can see that revenue has grown from $77 million in 1999 to $144 million in the trailing twelve months. Earnings have been a bit erratic, dropping from $.11/share in 1999 to a loss of $(1.58)/share in 2001, but improving steadily since then to $.60/share in the trailing twelve months.

Free cash flow has been negligible with $0 in 2001, $(1) million in 2002, $(1) million in 2003 and $0 in the trailing twelve months. I would like to see this improve as the company grows...but certainly, they are not at this time burning up their available cash resources.

Balance sheet wise, they have $9.3 million in cash and $60.3 million in other current assets vs. $29.2 million in current liabilities and only $5.8 million in long-term liabilities. This is heavily biased in favor of current assets...so it looks good to me.

How about valuation? If we review "Key Statistics" on Yahoo finance, we can see that the current market cap is only $418.26 million. The trailing p/e isn't bad at 23.25, but NO forward p/e is reported. Along with this, there is NO PEG reported....so it appears analysts do not have a good handle on the five year estimated growth....however, with the explosive current upward revisions, and the low current p/e, I suspect the PEG may very well be well under 1.0...but that is just MY opinion.

Yahoo reports 26.69 million shares outstanding with 12.30 million of them that float. Of these, 5.72% of them are out short as of 5/10/04 representing 3.043 trading days of volume. No cash dividend is reported and no stock split is noted on Yahoo either.

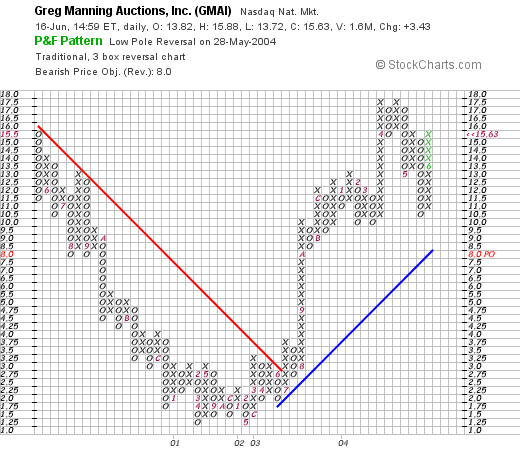

What about Technicals?

Looking at a "Point & Figure" chart from stockcharts.com, we can see that this stock really was trading UNDER a resistance level in a downward direction throught much of 2000 and 2001, and then in July, 2003, broke out of a resistance level of $3.25 and has been trading strongly higher above its support level since then. Looks fine to me!

So what do I think? I am a bit concerned about the large volume of acquisitions that is driving the numbers...I am not sure about the internal growth...one could say the "same store sales growth" if this was a retail stock. However, the growth is still coming down to the bottom line...they are managing their acquisitions well and growing the company, the earnings look great, the revenue growth is fantastic, the free cash flow is mediocre at best...but the balance sheet looks nice as does the technicals and valuation....so overall this is a pretty stock if perhaps a touch speculative imho. Unfortunately, I do NOT have any cash to spend...am still waiting on a sale of a current position at a gain....at least a portion of a stock lol...so you know THAT song!

Thanks again for stopping by! Please feel free to leave comments right here or email me at bobsadviceforstocks@lycos.com if you have any comments or questions.

Bob