Hello Friends! Thanks so much for stopping by! Just trying to catch up with some of my earlier brief posts. I hope some of my longer posts recently have helped clarify my investment strategy for you. Please remember that I am an amateur investor, so that means you must do your own investigation of all stocks mentioned on this website and consult with your professional investment advisors to make sure they are appropriate for you!

I came acrosse Navarre Corp. (NAVR) earlier today while looking through the lists of greates percentage gainers today. I do NOT own any shares nor do I have any options on this stock. NAVR closed at $14.39 today, up $.84 or 6.20% on the day. According to the Yahoo "profile", NAVR "...is a provider of distribution, fulfillment and marketing services for a broad range of home entertainment and multimedia products, including personal computer (PC) software, audio and video titles, and interactive games."

I came acrosse Navarre Corp. (NAVR) earlier today while looking through the lists of greates percentage gainers today. I do NOT own any shares nor do I have any options on this stock. NAVR closed at $14.39 today, up $.84 or 6.20% on the day. According to the Yahoo "profile", NAVR "...is a provider of distribution, fulfillment and marketing services for a broad range of home entertainment and multimedia products, including personal computer (PC) software, audio and video titles, and interactive games."On May 26, 2004, NAVR reported 4th quarter 2004 results. Net sales for the quarter ended March 31, 2004, increased 70% to $142.6 million from $83.6 million the prior year. Net income for the quarter increased 641% to $3.3 million or $.12/diluted share vs. $442,000 or $.02/diluted share in the prior year. The company ALSO announced estimates for 2005 with revenue in the $550 to $580 million range, and earnings in the $.69 to $.77/share range.

Looking at the Morningstar "5-Yr Restated" financials, we can see the steady revenue growth from $210.4 million in 1999 to $416.3 milllion in the TTM. It is interesting that even though revenue dipped slightly in 2002 it more than made up for it to maintain the trent in the 2003 year.

During this period, earnings have also fairly steadily improved from a loss of $(4.41) in 1999 to the first profit of $.12/share in 2002, and $.26/share in the trailing twelve months. From the latest quarter results mentioned above, the company is anticipating earnings of about $.70/share in 2005. This also looks nice!

Free cash flow has been less than exciting with $9 million in 2001 dropping to $0 in 2003. The balance sheet is just fine with $14.2 million in cash and $125.7 million in other current assets, enough to easily cover the $110.3 million in current liabilities and the $0 in long-term liabilities.

What about valuation? Looking at "Key Statistics" on Yahoo.com, we can see that the market cap is a small $368.86 million. The trailing p/e is rich at 55.35, but the forward p/e (fye 31-Mar-05) is downright cheap at 15.99. This is due to the RAPID growth expected. This leaves us with a PEG of 0.80 (anything under 1.0 is great in my humble opinion), and a Price/Sales of 0.83.

Yahoo reports 25.68 million shares outstanding with 21.80 million of them that float. Of these, 8.58% or 1.87 million are out short representing only 1.87 trading days as of 6/7/04. No cash dividend is paid and the last stock split was a 2:1, according to Yahoo, in June, 1996.

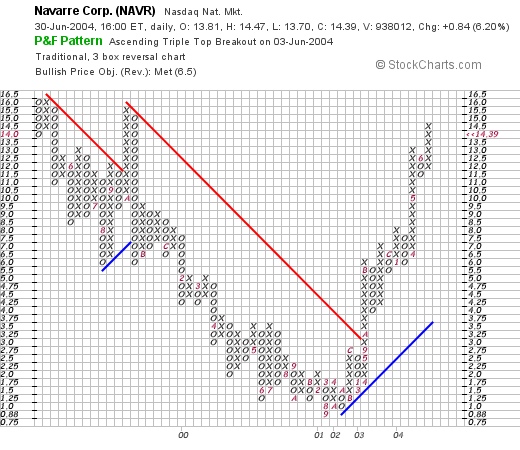

How about technicals? Taking a look at a "Point & Figure" chart from Stockcharts.com, we can see:

This stock traded steadily lower between May, 1999, from $16/share to a low of $.88 in September, 2001. It has since that time traded steadily higher, and in my humble opinion, the graph looks strong if a bit extended from its support line.

What do I think? I like this stock. If I had some available cash I might just buy a few shares! The revenue and earnings growth looks nice. The free cash flow is marginal...but the balance sheet is just fine. Valuation-wise, the p/e is a bit high, but the company IS growing so fast that the PEG is actually under 1.0. Technically, the chart looks just fine to me.

Anyhow, THAT's NAVR. Thanks so much for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Updated: Wednesday, 30 June 2004 10:10 PM CDT