Hello Friends! Thanks so much for stopping by! The market was less than exciting today with double-digit declines in the Dow and NASDAQ...but I continue to scan the top movers looking for new names to discuss in this Blog. As always, please remember that I am an AMATEUR investor, so please discuss with your PROFESSIONAL investment advisors any investment ideas you may glean from this website!

I came across Anika Therapeutics (ANIK) today while scanning the lists of greatest percentage gainers. I do NOT have any shares of Anika nor do I own any options or other leveraged positions. ANIK had a great day today closing at $16.01, up $1.90 or 13.47% on the day. According to the CBS Marketwatch Profile Anika's "...principal activities are to develop, manufacture and distribute therapeutic products and devices.

I came across Anika Therapeutics (ANIK) today while scanning the lists of greatest percentage gainers. I do NOT have any shares of Anika nor do I own any options or other leveraged positions. ANIK had a great day today closing at $16.01, up $1.90 or 13.47% on the day. According to the CBS Marketwatch Profile Anika's "...principal activities are to develop, manufacture and distribute therapeutic products and devices. The products promote the protection of bone, cartilage and soft tissue....The Group also manufactures AMVISC (r) and AMVISC (r) Plus for Bausch & Lomb, which are used as viscoelastic supplements in ophthalmic surgery."

The products promote the protection of bone, cartilage and soft tissue....The Group also manufactures AMVISC (r) and AMVISC (r) Plus for Bausch & Lomb, which are used as viscoelastic supplements in ophthalmic surgery."On April 29, 2004, ANIK announced 1st quarter 2004 results. Total revenue for the quarter ended March 31, 2004, jumped 81% to $6.1 million from $3.4 million the prior year. Net earnings came in at $7.8 million or $.69/diluted share vs a net loss of $(313,000) or $(.03)/diluted share the prior year. These are certainly dynamic results!

How about longer term? Looking at Morningstar "5-Yr Restated" financials, we can see that revenue which grew to $16.3 million in 2000, dipped down to $11 million in 2001, and has been improving steadily since with $18.2 million in the trailing twelve months (TTM). Earnings have been erratic dipping to a loss of $(.68)/share in 2001, and have improved steadily since then with $.80/share reported in the TTM. Free cash flow has also been looking better recently with $(5) million in 2001, improving steadily to $22 million in the TTM.

How about longer term? Looking at Morningstar "5-Yr Restated" financials, we can see that revenue which grew to $16.3 million in 2000, dipped down to $11 million in 2001, and has been improving steadily since with $18.2 million in the trailing twelve months (TTM). Earnings have been erratic dipping to a loss of $(.68)/share in 2001, and have improved steadily since then with $.80/share reported in the TTM. Free cash flow has also been looking better recently with $(5) million in 2001, improving steadily to $22 million in the TTM. Morningstar reports ANIK with $34.8 million in CASH, more than enough to cover both the moderate short-term liabilities of $7.7 million AND the long-term liabilities of $19.3 million combined. In addition, ANIK has $8.1 million in OTHER current assets. This is a very nice balance sheet indeed!

Morningstar reports ANIK with $34.8 million in CASH, more than enough to cover both the moderate short-term liabilities of $7.7 million AND the long-term liabilities of $19.3 million combined. In addition, ANIK has $8.1 million in OTHER current assets. This is a very nice balance sheet indeed!What about valuation? Looking at "Key Statistics" on Yahoo for ANIK we can see that this is a very small company with a market cap of only $161.22 million. The trailing p/e isn't bad at 20.39, but somehow the forward p/e for 2005 is 32.02. No PEG is reported. I just don't think the analysts have gotten this all updated based on the latest quarterly report...unless I am just missing something (?).

Yahoo reports only 10.07 million shares outstanding with 6.20 million that float. Only 75,000 shares are reported out short as of 6/7/04...representing only 0.335 trading days. (the Short Ratio). No dividend is reported and no stock split is listed on Yahoo.

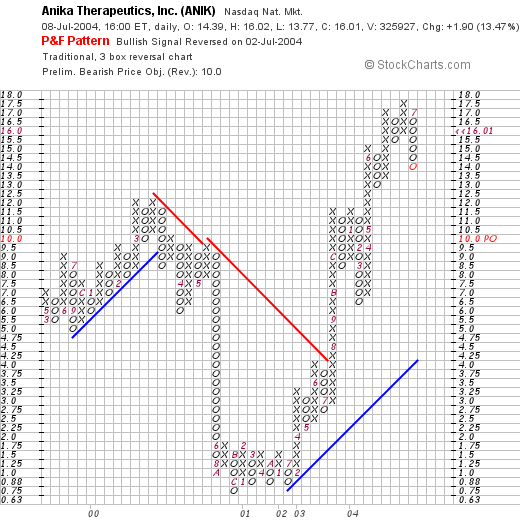

What about Technicals? If we look at a point & figure chart from stockcharts.com:

we can see that this stock pieaked in March, 2000, in the $12.00 range then dropped down to a low of $.75/share in January, 2001. Since then it has traded sharply higher to its current $14 to $17 range. The chart looks nice to me!

So what do I think? This is a tiny company with a great recent record of revenue and earnings growth with recent increasing profitability. The free cash flow is very impressive and the balance sheet is impeccable. Quite frankly, I like the stock just fine....it is just that I don't have any money to BUY anything! Will need to sell something at a GAIN first!

Thanks again for stopping by! If you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob