Hello Friends! I am delighted that you are taking the time to visit my blog, Stock Picks Bob's Advice! Always remember, even if I present a polished product for you to read, that I am an AMATEUR investor, and please consult with your professional investment advisors all investment ideas on this website to make sure they are appropriate and timely for you! Also, if you have any comments or questions, I would be delighted to hear from you and will try to answer your questions right on this blog. You can contact me at bobsadviceforstocks@lycos.com .

Well I finally made it to the NYSE Price % Gainers list. Williams-Sonoma (WSM) had a GREAT day today, closing at $34.64, up $3.14 or 9.97% on the day. I do not own any shares of this company nor do I own any options.

Well I finally made it to the NYSE Price % Gainers list. Williams-Sonoma (WSM) had a GREAT day today, closing at $34.64, up $3.14 or 9.97% on the day. I do not own any shares of this company nor do I own any options.  And you guessed it, what drove this stock higher? EARNINGS. Earnings are such an important ingredient in the successful investment strategy! This morning, before the open of trading, WSM announced 2nd quarter 2004 results. Revenues for the second quarter ended August 1, 2004, increased 18.8% over the second quarter of 2003. Diluted earnings per share for the second quarter increased 53.3% over prior year results to $.23/share, $.03 above the high end of guidance provided by the company in May, 2004.

And you guessed it, what drove this stock higher? EARNINGS. Earnings are such an important ingredient in the successful investment strategy! This morning, before the open of trading, WSM announced 2nd quarter 2004 results. Revenues for the second quarter ended August 1, 2004, increased 18.8% over the second quarter of 2003. Diluted earnings per share for the second quarter increased 53.3% over prior year results to $.23/share, $.03 above the high end of guidance provided by the company in May, 2004.On a comparable store basis, sales increased 5.0%. The Pottery Barn stores were strongest with 10.2% same store sales increases, while the flagship Williams-Sonoma stores were actually the weakest with a (1.6%) decrease in same store sales. Interestingly, this parallels the Ann Taylor story, a stock I do own and have discussed elsewhere, where the Rack stores are growing much stronger than THEIR flagship stores. Go figure.

How about longer-term? Looking at the "5-Yr Restated" financials on Morningstar.com, we can see the pretty picture of revenue growth with $1.5 billion in 2000, increasing each year to the $2.9 billion in the trailing twelve months (TTM). Earnings per share, while dropping slightly to $.50 from $.58 in 2001, have otherwise grown steadily to $1.39 in the TTM. Free cash flow, which dropped to $(3) million in 2004 has otherwise increased from $49 million in 2002 to $66 million in the TTM.

How about the balance sheet? Looking at Morningstar.com, we can see $74.6 million in cash and $556.5 million in other current assets as compared to $367.0 million in current liabilities and only $227.4 million in long-term debt. Williams-Sonoma seems to have ample cash and current assets to easily cover the current liabilities and could pay off most of its long-term liabilities as well without much of a stretch.

How about the balance sheet? Looking at Morningstar.com, we can see $74.6 million in cash and $556.5 million in other current assets as compared to $367.0 million in current liabilities and only $227.4 million in long-term debt. Williams-Sonoma seems to have ample cash and current assets to easily cover the current liabilities and could pay off most of its long-term liabilities as well without much of a stretch.How about "valuation"? I like to use "Key Statistics" on Yahoo to help me look at this question. If we use a range of $500 million to $3.0 billion in market cap for a mid cap stock, we find WSM a Large Cap stock with a market cap of 44.03 billion. The trailing p/e isn't too bad (imho) at 25.19, the forward p/e is even nicer at 18.72 (fye 1-Feb-06). Based on "5 yr expected" earnings, Yahoo shows the PEG at 0.97. I love it whenever it is below 1.0! Price/sales also moderate at 1.28.

Yahoo reports 116.25 million shares outstanding with 73.20 million of them that float. They also report that as of 7/8/04, there are 5.68 million shares out short (up from 4.10 million the prior month). Using a 3 day supply as a cut-off for significance (just one of those things I like to do), we find that WSM has 6.286 trading days of shorts. With that many short sellers, you can see why the stock really "popped" today on good news as some of the short sellers must have been scrambline to buy shares to cover their "shorts".

Yahoo reports no cash dividend, and the last stock split was a 2:1 split in May, 2002.

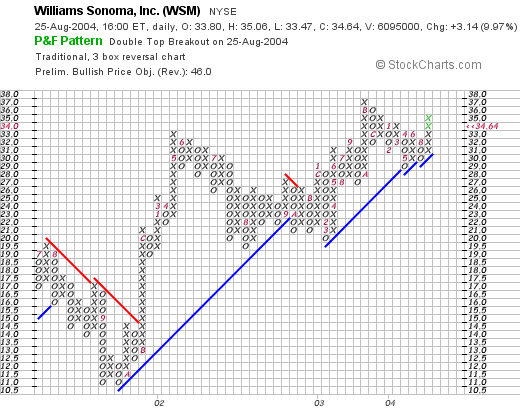

How about "technicals"? If we look at a Point and Figure chart from Stockcharts.com:

we can see that while WSM was trading lower in late 2001, bottoming at about $11/share, the stock turned higher in November, 2001, and has moved higher steadily since then with a small pause in October 2002. The graph looks strong to me!

So what do I think? Well, the earnings look very nice with strong and steady revenue growth. Quite frankly the only thing that disturbs me was the slowdown in sales at the flagship stores, however, with the Pottery Barn and Outlets included, same stores were up a solid 5%.

Valuation looks nice, the balance sheet is just fine, and the technicals look nice. Looks like a nice stock to have in the portfolio! As for me, well I am stil sitting on my hands, waiting to sell a portion of one of my positions at a gain!

Thanks so much for stopping by! Again, email me at bobsadviceforstocks@lycos.com if you have any questions or comments.

Bob