Hello Friends! Thanks so much for stopping by. It would not be fun for me to write if there wasn't a reader that was reading! I hope that the simple words I send out into cyberspace are somehow helpful to you. Please remember that I am an amateur investor, so please consult with your professional investment advisors to make sure that all investments discussed are appropriate, timely, and likely to be profitable for you. And if you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to get back to you either directly IN the blog, or by email!

Since so many people reading this blog are new to my methods let me review today's pick and then share with you my rationale. Generally, my first step in identifying a stock of interest is to scan the lists of "Top % Gainers". Lately, my bias is to avoid stocks under $10 and this narrows my list further. I also try to avoid re-reviewing stocks that I have listed already in Stock Picks Bob's Advice. Skimming through the list, I noted that the fist stock on the list is an old favorite of mine, Select Medical (SEM) that I have reviewed here in the past. They are being taken private by a management leveraged buy-out, so we will soon be unable to follow that company! A little further down the list I came across Diagnostic Products (DP) which I have not previously reviewed. (If you can believe it, I have looked at SO MANY stocks that I have to look through my own lists of stocks reviewed to make sure!)

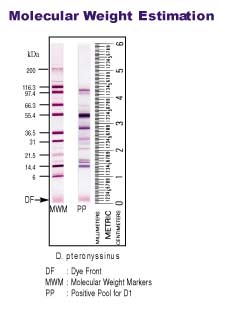

Since so many people reading this blog are new to my methods let me review today's pick and then share with you my rationale. Generally, my first step in identifying a stock of interest is to scan the lists of "Top % Gainers". Lately, my bias is to avoid stocks under $10 and this narrows my list further. I also try to avoid re-reviewing stocks that I have listed already in Stock Picks Bob's Advice. Skimming through the list, I noted that the fist stock on the list is an old favorite of mine, Select Medical (SEM) that I have reviewed here in the past. They are being taken private by a management leveraged buy-out, so we will soon be unable to follow that company! A little further down the list I came across Diagnostic Products (DP) which I have not previously reviewed. (If you can believe it, I have looked at SO MANY stocks that I have to look through my own lists of stocks reviewed to make sure!) Diagnostic Products (DP) is having a great day, trading as I write at $42.18, up $1.90 or 4.72% on the day. I do not own any shares of this stock nor do I have any options. According to the Yahoo "Profile", DP "...develops, manufactures and markets immunodiagnostic systems and immunochemistry kits used in hospital, reference and physicians' office laboratories and in veterinary, forensic and research facilities."

Diagnostic Products (DP) is having a great day, trading as I write at $42.18, up $1.90 or 4.72% on the day. I do not own any shares of this stock nor do I have any options. According to the Yahoo "Profile", DP "...develops, manufactures and markets immunodiagnostic systems and immunochemistry kits used in hospital, reference and physicians' office laboratories and in veterinary, forensic and research facilities."What is my next step? One thing I have learned from being a fan of the CANSLIM method proposed by William O'Neil, is to check the latest quarter results. I do not follow O'Neil's technique closely in evaluating stocks, but have learned much from reading the IBD and some of his writing. I look for significant growth in both revenue and earnings in the latest result. If that isn't present, I look no further!

On July 23, 2004, Diagnostic Products announced 2nd quarter 2004 results. Sales for the quarter were $110.5 million, a 15% increase over the same quarter last year, and earnings were $18.6 million, or $.62/diluted share, a 12% increase from the $16.6 million or $.56/diluted share in the second quarter of 2003. In my opinion, this was a solid earnings/revenue report from the company, and when I read it, I was still interested!

So what is my NEXT step? Well for me, I am looking for what I call "quality" companies. O.K., so you want to know what I call "quality". For me, consistency of results and a solid financial performance counts. Let me explain by discussing DP's "quality".

For this, I turn to the "5-Yr Restated" financials on Morningstar.com. The first thing on this sheet I like to see is a steady improvement in revenue over the past five years as demonstrated by progressively larger blue bars in the top graph. Here we see that revenue was $216.2 million in 1999, and then increased sequentially to $415.1 million in the trailing twelve months (TTM). This looks great!

For this, I turn to the "5-Yr Restated" financials on Morningstar.com. The first thing on this sheet I like to see is a steady improvement in revenue over the past five years as demonstrated by progressively larger blue bars in the top graph. Here we see that revenue was $216.2 million in 1999, and then increased sequentially to $415.1 million in the trailing twelve months (TTM). This looks great!Next, earnings. Again, this is a BEAUTIFUL report, showing earnings of $.75/share in 1999, increasing EACH AND EVERY YEAR to $2.23 in the TTM. Not too many companies have both--consistent revenue AND earnings growth! As an added treat, I look at dividends. Well the company is reporting $.24/share since 1999. Ideally, they might be INCREASING their dividend, but while you can't always get everything, no harm in inquiring!

A good Optometrist friend of mine got me thinking about Free Cash Flow; in fact he showed me how to look at this on Morningstar! When the tech bubble was running its course, I don't know if you remember but I recall lots of discussions about the "burn rate". This was the rate at which start-ups were burning up their available cash. Needless to say, CREATION of cash is more important in picking a stock than the DESTRUCTION of cash reserves!

For DP, this is found under the main group of numbers in the section called Cash Flow $Mil". Here we see in the bottom of each column, that in 2001, DP was $6 million free cash flow positive, this has improved to $25 million in 2002 and 2003 and up to $37 million in the TTM. Thus, not only is this company CREATING free cash, it is creating increasing amounts of free cash each year! I like this information a lot!

Finally, a quick look at the balance sheet. Now, I have said ZILLIONS of times, that I am not a professional investment person, so my understanding is based on simple examination of obvious numbers. I hope that is clear. What I like to see is lots of assets and little liabilities. Furthermore, I am concerned about current stuff more than long-term stuff. In other words, for DP, here we see that the company, according to Morningstar, has $65.2 million in cash AND $200.6 milllion in OTHER current assets. This is balanced against $81.6 million (I believe this 3:1 ratio is referred to as the current ratio); and shows a solid balance sheet. In addition, their long-term liabilities is what I would call a 'measly' $9.8 million. This ALSO looks great!

Finally, a little examination of 'valuation'. This information I usually retrieve from Yahoo "Key Statistics". Here we can get some 'parameters' of this stock. For instance, this is a "mid cap" stock with a market capitalization of $1.23 Billion. The trailing p/e is 18.90. (For me anything under 20 is usually reasonable). Furthermore, estimates for future earnings (fye 31-Dec-05) results in a future p/e or forward p/e of only 15.67. From this information we can get the PEG raio, which is a ratio of P/E to the Growth rate (Thus PEG). For DP, this comes in at 0.99, suggesting that not only are the numbers we have reviewed solid, but the valuation is reasonable! (This is sort of like a restaurant with great food at a great price...excuse the comparison but I am finishing up lunch as I write :)).

Yahoo reports 29.11 million shares outstanding with 21.30 million that float. Of these, 1.01 million are out short representing 4.75% of the float or 13.849 trading days of volume. That means, since it is more than my 3 day cut-off, that there are a lot of BORROWED shares that have been pre-sold, and there will be a lot of buying pressure if the stock moves higher from people scrambling to cover their short sales. In other words, this is in general a good number to see! (Although it does concern me that so many people are negative on this stock!)

As I reported, this sheet also shows the small $.28/share dividend (I guess they ARE raising it) yielding 0.70%. For completeness, it is interesting to note that the last stock split was in June, 1989, about 15 (!) years ago when they split 2:1. Maybe it is time for another split?

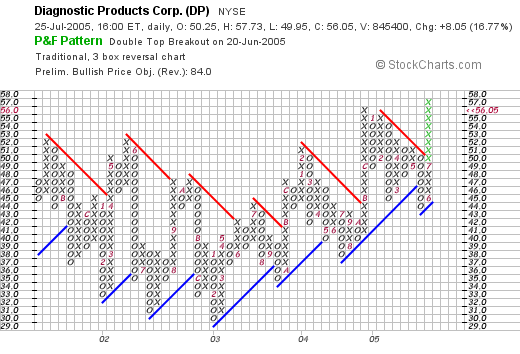

Finally, I like to look at what I call "technicals". For me, this is looking at a "Point & Figure" chart from Stockcharts.com:

If anything, this is a bit of a less-strong factor in this stock pick. The stock was moving strongly higher since late 2000, when it was trading at around $19.50. The price peaked and has had three episodes of bouncing against a high at around $52 and then turning lower, first in October, 2001, then May, 2002, and finally in February, 2004. I would like to see this stock trade strongly higher over $45 to break through its current resistance level before being confident about its upward course. But then again, I am not a pro at looking at stocks so I have it right here for you to review.

So what do I think? Well the stock is moving higher today, has a great recent earnings report, the Morningstar.com "5-Yr" looks solid with steady revenue and earnings growth, the free cash flow is positive and growing and they even pay a dividend. The balance sheet also looks nice with lots of assets and cash and only a small amount of current debt with very little long-term debt. In addition, valuation is reasonable, with a p/e in the teens, a PEG under 1.0, and lots of shares out short!

Why don't I buy some shares, you ask? Well, my own trading portfolio doesn't let me buy another position until I sell some of one of the ones I own at a gain. I built this into my trading methods to prevent me from buying into a declining market. So far it is working even though I do like this stock a lot!

Thanks so much for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com and come visit again!

Bob