Hello Friends! Well it is another Thursday and another set of stocks to review. I hope you are all well and preparing yourself for Thanksgiving. As for me, I shall try to go a little easier on the stuffing this year. I have all the stuffing I need :).

Thanks so much for stopping by my blog, Stock Picks Bob's Advice. Please remember I am an amateur investor, so please do your own investigation on all stocks discussed and consult with your professional investment advisors to make sure that all stocks you select are appropriate, timely, and likely to be profitable for you! If you have any comments, questions, or would like to share with our readers your own thoughts on investing, please email me at bobsadviceforstocks@lycos.com or you can always click on the links below each post to leave your message.

I came across Genesco (GCO) this morning while scanning the list of top % gainers on the NYSE. I do not own any shares or options on this stock. According to the Yahoo "Profile", GCO "...is a retailer and wholesaler of branded footwear. The company operates four business segments: Journeys, consisting of Journeys and Journeys Kidz retail footwear chains; Underground Station?Jarman Group, consisting of the Underground Station and Jarman retail footwear chains; Johnston and Murphy, composed of Johnston and Murphy retail operations and whole sale distribution, and Dockers Footwear."

I came across Genesco (GCO) this morning while scanning the list of top % gainers on the NYSE. I do not own any shares or options on this stock. According to the Yahoo "Profile", GCO "...is a retailer and wholesaler of branded footwear. The company operates four business segments: Journeys, consisting of Journeys and Journeys Kidz retail footwear chains; Underground Station?Jarman Group, consisting of the Underground Station and Jarman retail footwear chains; Johnston and Murphy, composed of Johnston and Murphy retail operations and whole sale distribution, and Dockers Footwear."I recall Genesco from years ago when my father, who was the one instrumental in getting me interested in stocks, told me about this shoe company. I don't remember much about what he said, except he was impressed by the management. Anyhow, GCO is having a nice day today, trading at $28.35, up $1.60 on the day or 5.98% in an otherwise lackluster trading session this morning.

Like so many stocks on this blog, what pushed this stock higher was the announcement of 3rd quarter earnings. Net income rose to $12.1 million or $.54/share up from $9.4 million or $.42/share a year ago. Genesco also raised guidance for future sales and earnings. This was a bullish report! In a slightly more recent report, GCO detailed their revenue and reported that sales jumped 36% during the quarter.

Like so many stocks on this blog, what pushed this stock higher was the announcement of 3rd quarter earnings. Net income rose to $12.1 million or $.54/share up from $9.4 million or $.42/share a year ago. Genesco also raised guidance for future sales and earnings. This was a bullish report! In a slightly more recent report, GCO detailed their revenue and reported that sales jumped 36% during the quarter.  How about longer-term? Is this earnings and revenue growth a fluke? I believe it is the consistency in earnings and revenue growth that is the best prognosticator of an outstanding price appreciation in an investment. For this information, I like to turn to the "5-Yr Restated" Financials on Morningstar.com. Here we can see clearly illustrated the consistent growth in revenue from $553.0 million in 2000 to $837.4 million in 2004 and $936.6 million in revenue in the trailing twelve months (TTM).

How about longer-term? Is this earnings and revenue growth a fluke? I believe it is the consistency in earnings and revenue growth that is the best prognosticator of an outstanding price appreciation in an investment. For this information, I like to turn to the "5-Yr Restated" Financials on Morningstar.com. Here we can see clearly illustrated the consistent growth in revenue from $553.0 million in 2000 to $837.4 million in 2004 and $936.6 million in revenue in the trailing twelve months (TTM).Earnings have been less consistent, but have improved from $1.05 in 2000 to $1.66/share in the trailing twelve months.

Free cash flow which was a negative $(12) million in 2002, improved to $49 million in 2004, and has stayed positive at $20 million in the TTM.

The balance sheet is solid, with $15.3 million in cash and $305.2 million in other current assets compared with $169.5 million in current liabilities and $239.7 million in long-term liabilities.

What about valuation issues? First, using the Ameritrade definition of market capitalization, which places mid cap stocks between $500 million and $3 billion in market cap, this stock just makes the cut for a mid cap stock with a market cap of $640.16 million. The trailing p/e is nice at 17.24 (imho), and the forward p/e is nicer at 14.03.

What about valuation issues? First, using the Ameritrade definition of market capitalization, which places mid cap stocks between $500 million and $3 billion in market cap, this stock just makes the cut for a mid cap stock with a market cap of $640.16 million. The trailing p/e is nice at 17.24 (imho), and the forward p/e is nicer at 14.03. Yahoo reports only 22.04 million shares outstanding with 19.40 million of them that float. There are 2.0 million shares out short as of 10/8/04, representing 10.31% of the float or 9.804 trading days. This seems to be quite a few shares out short, which are now facing the current good news....with a stock price appreciation, these shares may need to be covered which is a bullish statistic on this stock.

This stock does not pay any dividend and no stock splits are reported on Yahoo.

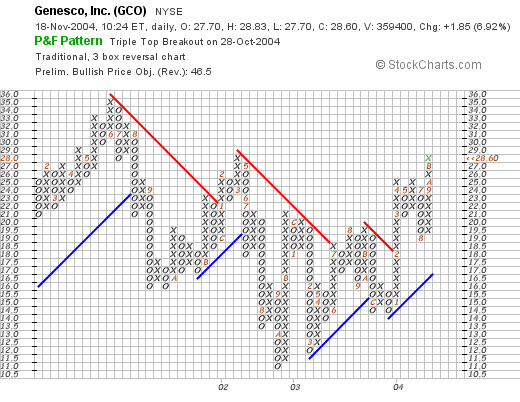

How about technicals? If we take a look at a point and figure graph from Stockcharts.com:

This stock appears to have been trading lower since June, 2001, when it peaked at $35.00/share, this trend appears to have been broken in mid-July, 2003, when it broke through a resistance level at $18/share, and then again more strongly in February, 2004, when it broke through a resistance level, again at $18/share. The stock appears to be heading higher and does not appear over-extended in my humble opinion. So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain!

So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain!

Thanks so much for stopping by. Please remember that I AM an AMATEUR, so do your own investigation of stocks, and consult liberally with your professional investment advisors. If you have any questions, please feel free to email me at bobsadviceforstocks@lycos.com .

Regards,

Bob