Stock Picks Bob's Advice

Tuesday, 12 June 2007

A Reader Writes "I was wondering, if you were in a situation like this...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had another nice letter from Eric N. who apparently also has dabbled in The Eastern Company (EML), but this time in reality, and not a virtual or simulated portfolio, and is also incurring some losses on this investment. Eric writes:

I had another nice letter from Eric N. who apparently also has dabbled in The Eastern Company (EML), but this time in reality, and not a virtual or simulated portfolio, and is also incurring some losses on this investment. Eric writes:

"Hi Bob,

EML hit -8.42% for me. I missed the sale on this at the -8% mark before the end of the trading day.

I was wondering, if you were in a situation like this and you missed the -8% sale point and the stock opened above the -8% level, would you sell at the open of the next day or hold on to it until it hit the -8% level again?

I know you are very disciplined and you have a series of rules that you follow, but would this be a situation for a judgment call depending on the relative strength of the company based on the research?

This makes me think of MTOX. It fell to below -8% and you sold it off. When you sold it you said something like, 'I don't understand why it fell 8%, the company is doing so well.' It is now at +41.47% since you posted the company (+49.47 since you sold the stock).

And finally, what made you decide to use an 8% (opposed to 7% or 6%) drop in price to be the signal for you to sell all and not look back?

Thanks for your thoughts.

Eric

P.S. I enjoyed reading your blog when you talked about some of the things that you were up to in your personal life."

First of all, thank you so much for writing. As you can see there is nothing magical about any of the stocks that I write up. Overall, I think they will do great long-term, but then again, each one is likely to respond to multiple influences, especially the overall market tone which has been recently anything but encouraging.

What should you do if you miss a sale point? That certainly is up to you and as your MTOX example demonstrates, you may well come to a different conclusion than I do, and you may end up making a better decision as well. Since personally I do all of this manually, as it sounds you do as well, I have also missed sale points both on the upside and the downside. If the stock recovers before I get a chance to sell or find out about the drop, then I do not sell the stock at all. However, if the stock is still in a sell-range, then I do what I am supposed to do, which is to sell the stock either on the upside or the downside depending on what the price change is.

You asked about the 8% loss level. That particular level is adopted from the CANSLIM technique that I have commented on elsewhere popularized by William O'Neil of the Investor's Business Daily.

As the IBD website states:

"The first rule is sell any stock that falls 8% below your purchase price. Why 8%? Because research shows stocks showing all the right fundamental and technical factors in place and bought at precisely the proper buy point (which is explained fully in the "Using Stock Charts To Round Out Stock Selection" lesson of the stock buying course) rarely will retreat 8%. If they do, there's something wrong with them."

Thus this rule isn't something I created. I have borrowed this one from one of the brightest minds in the investing world. I accepted that I needed to place a limit to my losses somewhere, and the 8% loss seemed reasonable to me.

You may choose to have a 10% or a 12% loss limit. It doesn't matter. Whatever you do, stick to your rules that you establish. If you are a value investor and don't want any rules about stock price declines, then don't have rules. But decide ahead of time what your own particular trading parameters are. Write them down if you need to. You can even start a blog :). But whatever it is, stick to it.

Let me know how everything works out. The market is at best choppy and my own investments are getting tossed and turned. In fact, my MLAB stock was at a (7.99)% loss, and I was waiting for a .01% decline to unload my position today only to have the stock rally from that level to close above the sale point. So it is always hard to predict stock price movements from day to day.

Thanks for your kind comments on my personal commentary. I enjoy sharing with all of my readers some personal experiences and things going on in my life. I suspect most of my readers are more interested in the stocks but then again, it helps knowing people are just people no matter how or what they blog. :).

Bob

Posted by bobsadviceforstocks at 8:52 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 12 June 2007 8:53 PM CDT

Stock Picks Bob's Advice on "Guzzo the Contrarian" Website!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! Please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was delighted to learn that this blog was the subject of a flattering review on Guzzo the Contrarian. You can find the review here. Michael Guzzo, a pharmacist explains his blog:

"Guzzo the Contrarian is the personal finance, investing, and stock market weblog of that insightful individual investor and wryly skeptical pharmacist, Michael Guzzo. I use this blog to convey my financial thoughts, ideas and opinions, in my “Quest To Conquer The Markets”."

Do drop by and visit Michael's blog and say a big 'thank-you' for me for his kind words as a fellow blogger and fellow healthcare profesional who is also examining the world of investing that we all strive to understand!

Bob

BobsAdvice on Covestor and SocialPicks

I was invited earlier today to participate in Covestor. This is a third party website that verifies actual brokerage accounts and holding. Even though I already share with you my actual holdings, I believe this is an opportunity for verification of what I purport to be my holdings, trades, and performance. I am not sure how this will work out but you are willing to visit and explore my account on Covestor. I hope this is useful and will be of interest to my readers as well.

I was invited earlier today to participate in Covestor. This is a third party website that verifies actual brokerage accounts and holding. Even though I already share with you my actual holdings, I believe this is an opportunity for verification of what I purport to be my holdings, trades, and performance. I am not sure how this will work out but you are willing to visit and explore my account on Covestor. I hope this is useful and will be of interest to my readers as well.

There was a great article by David Jackson on Seeking Alpha about Covestor and VesTopia. These are both what are called peer to peer investment sites. VesTopia is a bit more selective, and I haven't been invited to participate there. In fact, everyone is welcome to join in the Covestor website. So check it out. Meanwhile, if you are interested in another website where my 'picks' are judged and evaluated by a third party, you may have noticed the link to SocialPicks on my blog.

There was a great article by David Jackson on Seeking Alpha about Covestor and VesTopia. These are both what are called peer to peer investment sites. VesTopia is a bit more selective, and I haven't been invited to participate there. In fact, everyone is welcome to join in the Covestor website. So check it out. Meanwhile, if you are interested in another website where my 'picks' are judged and evaluated by a third party, you may have noticed the link to SocialPicks on my blog.

You can view a summary and review and ranking of my stock picking activity on my homepage on SocialPicks. I hope all of this is helpful to all of you. I am not sure my activity is worth all of this attention, but these third party websites help me find out how things are working and let you know how both my actual stock selections and purchases are working out.

You can view a summary and review and ranking of my stock picking activity on my homepage on SocialPicks. I hope all of this is helpful to all of you. I am not sure my activity is worth all of this attention, but these third party websites help me find out how things are working and let you know how both my actual stock selections and purchases are working out.

Let's see how this works long-term!

If you have any comments or questions, like always please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com! Have a great week trading everyone.

Bob

Posted by bobsadviceforstocks at 7:27 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 12 June 2007 7:51 PM CDT

Monday, 11 June 2007

A Reader Writes "Its not been a good day on the market for EML...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

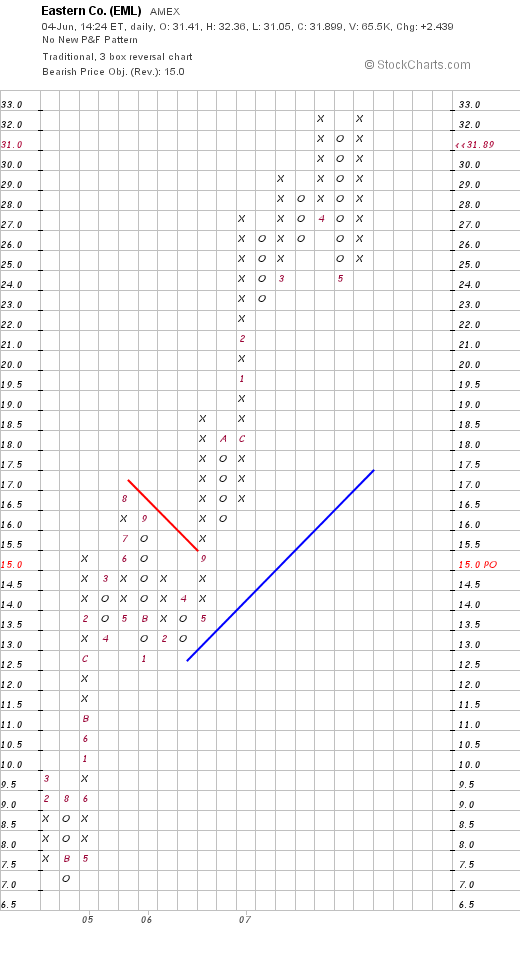

I had a nice letter from Jason C. who once again wrote about Eastern Co. (EML) which I wrote up here on Stock Picks on June 4, 2007, when the stock was trading at $31.90. Jason apparently is building a 'virtual' portfolio, which I believe is part of a trading game.

I had a nice letter from Jason C. who once again wrote about Eastern Co. (EML) which I wrote up here on Stock Picks on June 4, 2007, when the stock was trading at $31.90. Jason apparently is building a 'virtual' portfolio, which I believe is part of a trading game.

Jason wrote:

"Dear Bob,

Its not been a good day on the market for EML again lol. my other 2 stocks BP and EBAY went up a bit, but EML has just pulling me down.

i bought it at 33.23 and now its worth 30.60 and i've got 2500 shares. do i hold on to it? i've lost $6500.

Kind regards,

Jason C."

Jason, you are correct. The Eastern Company (EML) has been trading poorly the last few days. But then again, the market has been a bit rocky with some rather large swings from losses into profits and back again.

For the record EML closed today at $30.39, down $1.10 or (3.49)% on the day. If indeed you purchased shares at $33.23, and the stock closed at $30.39, that means you would have incurred a loss of $(2.84) or (8.5)% on the trade, which as I understand is in some sort of a virtual account.

I cannot tell you what you should do with any particular trade or investment whether real or imaginary. I am not qualified to do this. However, in my own portfolio strategy, I limit my losses to 8% and do not look back. What you should do in this particular case is really up to you. But this does highlight the need for trading rules for any investment. Nobody has a Midas touch in the market. Every idea you may come up with, whether original or borrowed, has a large element of risk. You need to have your own idea of when you are going to exit a stock, whether with a gain or a loss before it actually happens.

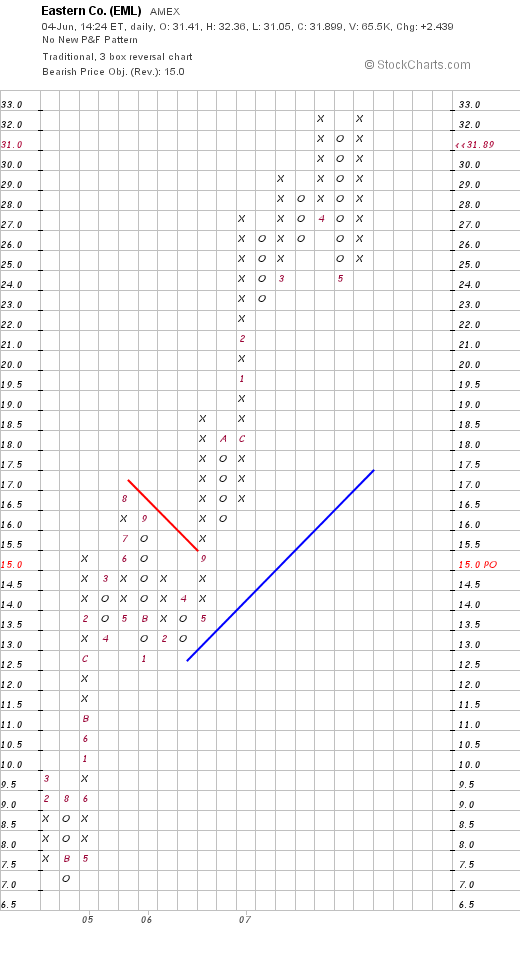

My investment strategy is not about anything magical. I am presenting what I consider to be candidates for purchase for my own portfolio. I do not see anything particularly wrong about EML, except that technically it may have been 'overextended' when I wrote it up. Here is the latest

chart on EML from StockCharts.com:

Now that the stock has pulled back a couple of points, does the chart look like it has broken down to you?

You will need to decide what to do with each of your investments. I cannot help you with that question whether the stocks selected are real purchases or simulated portfolios. My strongest suggestion is that you develop your own thoughts about what to do with each stock at the same time that you purchase it. It really makes thing easier.

We buy groups of stocks because no particular stock is guaranteed to do anything. But if we can develop a strategy of investing that works overall, and if we limit our losses to small losses then we may have a chance, however small it is or large as the case may be, to have a successful portfolio of stocks. However, it is not simply about picking stocks. It is about managing your investments, understanding your own ideas about holding stocks, and knowing when to sell both on good and bad news.

You are learning about investing, and I wish that it were an easier process. Let me know what you decide to do, explain to me why you chose the other stocks in your portfolio as well, and what your own strategy is on selling stocks.

There isn't any right answer on this one. But you should be consistent so that as your own strategy develops, it will be something useful for you that you can utilize with other investments at other times.

Bob

Posted by bobsadviceforstocks at 9:23 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 11 June 2007 9:25 PM CDT

Saturday, 9 June 2007

West Pharmaceutical Services (WST)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This is a stock I have been trying to write up since Friday! It is graduation party time around this town. While I don't have any high schoolers graduating this year, we do have a lot of friends with sons and daughters that do. In fact, it isn't very good for my diet either, but that is a whole different story :). Anyhow, it is now early Sunday morning and it is very quiet around my house so I could get on the computer undisturbed and maybe finish this one up!

This is a stock I have been trying to write up since Friday! It is graduation party time around this town. While I don't have any high schoolers graduating this year, we do have a lot of friends with sons and daughters that do. In fact, it isn't very good for my diet either, but that is a whole different story :). Anyhow, it is now early Sunday morning and it is very quiet around my house so I could get on the computer undisturbed and maybe finish this one up!

I always get a lot of questions about how I go about picking stocks. This method that I use is something I am quite willing to share with all of my readers. There isn't anything magical about this technique. But it does seem to work to identify lots of great companies.

First of all, I start out with the top % gainers list. In this case, West (WST) had a nice day, and made the list of top % gainers on the NYSE. WST closed at $50.77, up $2.05 or 4.21% on June 8, 2007. I like to use the lists of top % gainers to start out my search. I have linked to the current Money.CNN.com web page where all of these top % gainers from the NYSE are listed. You will note at the top of the page that there are links to the top % gainers on the NASDAQ and AMEX as well.

There are many different ways to identify great stocks for my investment. This is my own peculiar strategy. It isn't necessarily the best way. It isn't necessarily a way that will work long-term. Currently, I have found it successful, so I continue to use this strategy. As I have written many times on this blog, I have been inspired by William O'Neil, the publisher of the Investor's Business Daily, who wrote about he CAN SLIM method of investing. O'Neil suggest scanning the list of New Highs for candidates for inclusion. Instead of new highs, I have chosen to look at the list of stock gainers. This difference may appear to be nuanced. However, from my perspective, I am more interested in buying stocks today with strong price momentum, rather than the fact that they are now trading in new high territory. It isn't that what O'Neil is doing is wrong or even less helpful than what I am doing. It is just that it is different.

I do not own any shares or options in West Pharmaceutical Services (WST). Because of the fundamental information discussed in the following review,

WEST PHARMACEUTICAL SERVICES (WST) IS RATED A BUY

Let me continue this discussion while explaining in a little more than usual detail my methodology in selection of stocks. After scanning the list of top % gainers for stocks over $10 (I have occasionally written up and purchased stocks under $10, but due to my 8% loss limit---another technique also shared by the CAN SLIM technique---I have often found myself "shaken-out" of investments that otherwise are of good quality), I am interested in finding out the latest quarter results. Again, this latest quarterly result was inspired by CAN SLIM (I am happy to credit others for those ideas that I have also found helpful). This is the "C" in CANSLIM for "current quarterly results".

What exactly does this company do?

According to the Yahoo "Profile" on West Pharmaceutical, this company

"...manufactures components and systems for injectable drug delivery and plastic packaging, and delivery system components. It operates in two segments, Pharmaceutical Systems and Tech Group."

"...manufactures components and systems for injectable drug delivery and plastic packaging, and delivery system components. It operates in two segments, Pharmaceutical Systems and Tech Group."

How did this company do in the latest quarter?

On April 26, 2007, West Pharmaceutical reported 1st quarter 2007 results. The company's consolidated sales grew 15.6% to $257.6 million from $222.8 million in the first quarter of 2006. Earnings were even stronger, with $.77share reported, up $.34, or greater than 75% from the $.43/share reported last year.

The company maintained full year sales guidance of approximately $1 billion, but went ahead and raised guidance on earnings to between $2.27 to $2.37/share, from prior guidance of $2.20 to $2.35/share.

Besides raising guidance, as WST did, the other thing an earnings report can do to attract investors is to exceed guidance. In fact, as noted in another news report, the two analysts reporting to Thompson Financial had expected profit of $.65/share. The company beat expectations handily coming in at $.77/share.

As I go through the headlines on West, I can see that I haven't discovered this stock before other "wiser investors" :). I do not mind this. You can see that The Street.com likes West. If you don't know the connection, Jim Cramer was a co-founder of TheStreet.com giving this stock a big B-BOOYAH. :). The bottom line of any stock selection, is that while it is truly good to be early with any idea, it is helpful knowing that an idea has other 'sponsors' behind it. And certainly finding a stock that Jim Cramer likes isn't a bad thing.

How about longer-term?

Again, this is one place where my strategy coincides with CANSLIM. The "A" in CANSLIM is the annual earnings. I have taken this a bit further, using the Morningstar.com website for a bit more information. In particular, I would like to take a closer look at the Morningstar.com "5-Yr Restated" financals page on West Pharmaceutical Services (WST).

Here we can see that revenue has steadily been increasing from $412.8 million in 2002 to $913.3 million in 2006 and $948.1 million in the trailing twelve months (TTM).

Earnings have been a bit erratic, although profitable, with $.65/share in 2002, increasing to $1.11 in 2003, but dipping to $.65/share in 2004. However, in 2005, the company rebounded with $1.42/share in earnings, increased it to $2.00/share in 2006 and $2.22/share in the TTM. I don't know what happened in 2004, but the company quickly rebounded as if that dip never occurred.

While dividends are not critical to me. I am attracted by companies that can do everything. Why not? If you can find a great company with superb revenue and earnings growth AND it pays a dividend, well, to avoid being too chauvinistic, this is like meeting a wonderful girl (or guy) with a great personality AND they are drop-dead gorgeous as well.

So if they do pay a dividend and they can also raise that dividend regularly, well I am practically smitten if not in love :).

West paid $.39/share in dividends in 2002, and has raised that dividend every year with $.49/share paid in 2006 and $.50/share paid in the trailing twelve months (TTM). Is that beautiful or what?

I like to see a company that increases its shares very minimally if at all, and West, which had 29 million shares in 2002, increased to 32 million in 2006 and 33 million in the TTM. This 14% increase in outstanding shares, occurred during a time in which revenue increased me than 100%, and earnings were up more than 200%. I can live with these types of increases!

What about free cash flow? I have been around plenty long :) and remember the tech bubble in the 90's when the burn rate was discussed. These were companies that had recent IPO's. They had loads of cash but weren't making any money. In fact, they were consuming their funds and this was the 'burn rate' that was calculated. People were calculating how long they had to start making money before they ran out! I have chosen to find companies to discuss that are not only profitable but are generating money, thus the positive and hopefully growing free cash flow!

In West's case, they reported $24 million in free cash flow in 2004, $32 million in 2005, $49 million in 2006 and $40 million in the TTM. While not perfectly linear, the trend is positive and the results are positive.

Looking at the balance sheet on Morningstar.com, I like to see a few basic things (I am not an accounting kind of person and approach this with an amateur perspective as I do the rest of the information). Simply put, I want to see more cash and other current assets than current liabilities. This ratio of current assets to current liabilities is called the current ratio. I have found that a minimum of 1.25 is acceptable, but more knowledgeable sources suggest that a current ratio closer to 2.0 or higher is what we should be looking for.

Think of your current assets as the cash and other things you own that could be turned into cash within the next twelve months (like CD's coming due), and your current liabilities are your stack of bills to be paid that are due within the next twelve months. Obviously, we would all prefer to have an abundance of cash and current assets and a paucity of bills to be paid.

In West's case, per Morningstar.com, the company has $156.6 million in cash and $275.6 million in other current assets for a total of $432.2 million in total current assets, which when compared to the $153.3 million in current liabilities yields a current ratio of 2.82. By anyone's definition, this is a healthy and encouraging statistic.

What about some valuation numbers?

Reviewing the information on Yahoo "Key Statistics" on West, we find that this company is a mid cap stock with a market capitalization of $1.68 billion.

The trailing p/e is only 22.77 with a forward p/e (fye 31-Dec-08) estimated at 18.53. Trying to determine how 'rich' or 'lean' this valuation really is, it is helpful to look at the PEG ratio. Simply put, this is a comparison between the price/earnings ratio and the growth rate in earnings. In general investors are willing to pay a premium in stock price if earnings are expected to be much higher in the future. As with other investors, I prefer to have a stock trading with a PEG ratio between 1.0 to 1.5 if not lower.

West Pharmaceutical Services (WST) sells with a PEG ratio of 1.33, quite acceptable to me.

Another ratio to consider is the Price/Sales ratio. Paul Sturm, who writes for Smart Money Magazine (a great magazine for amateur investors like myself!), wrote a wondereful article on the importance of Price/Sales ratios and comparing them to similar companies in the same industry. I have been using the Fidelity website for this information.

According to the Fidelity.com eresearch website, WST has a Price/Sales (TTM) of 1.75, well under the industry average of 4.97. In terms of profitability, the company is nearly at the industry average of 18.98% Return on Equity (TTM), coming in at 18.33%. Thus, West is profitable as the average company in its industry but sells at a sharp discount in terms of price relative to sales.

Finishing up with Yahoo, we can find that there are 32.99 million shares outstanding with 28.77 million that float. As of May 10, 2007, there were 2.49 million shares out short representing 7.8% of the float or 8.6 trading days of average volume (the short ratio). Using my own arbitrary '3 day rule' for the short ratio, I find this to be a significant factor, that is likely bullish for the stock, and has the potential to involve this stock in a short squeeze. (Of course that is only my amateur assessment, looking at stocks with large short interest and yet what appears to me to be strong underlying fundamentals and earnings is encouraging to me!)

As I noted above, the company dos pay a dividend, with $.52 the 'forward annual rate' yielding 1.10%. The company last split its stock, according to Yahoo, on September 30, 2004, when it had a 2:1 stock split.

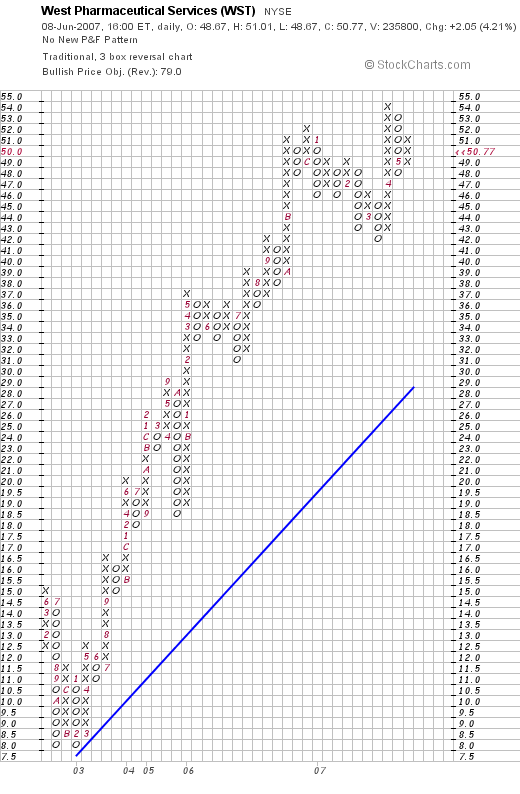

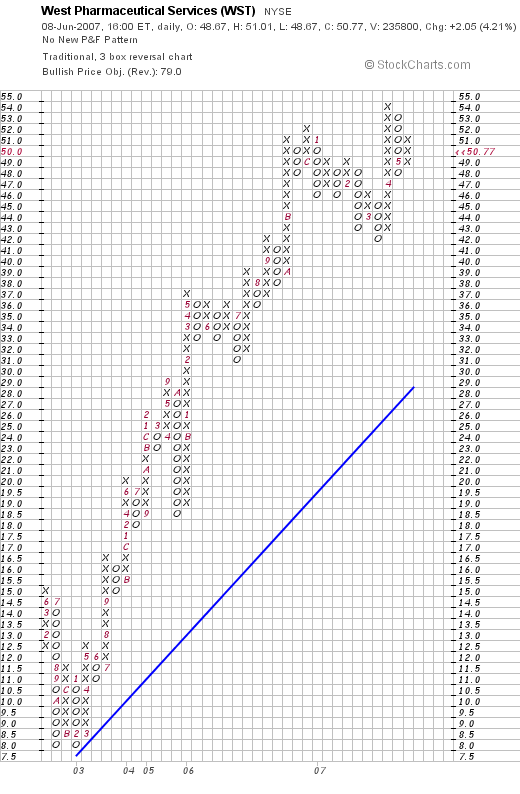

What does the chart look like?

Like everything else, I am an amateur when it comes to looking at charts. After multiple presentations to my own stock club by a great broker and technician who presented Point & Figure charts at meeting after meeting, I started appreciating the 'ebb and flow' of the price movement so well demonstrated by these graphs. Since 2003, when I started this blog, I have been posting these great charts from StockCharts.com for which I am grateful.

Looking at the "Point & Figure" chart on WST, we can see that this stock, after dipping from $15 to $8.00 between June, 2002, and February, 2003, has been rising strongly without any evidence of significant weakness to its current level of $50.77. The chart looks very strong to me.

Summary: What do I think?

I really like this stock! Let me try to touch on some of the highlights of this little more extensive review. First of all the stock moved strongly higher Friday making the top % gainers list. They had a great quarterly report which came out about six weeks ago, with strong earnings and revenue growth. They beat expectations of analysts and raised guidance.

Longer-term, they have been raising revenue the past 5 years, increasing earnings (except for one down year), and they pay a dividend which they have been regularly increasing. They have maintained their share number with only moderate increase in outstanding shares and they are generating ample free cash flow. Their balance sheet is solid with lots of current assets and moderate current liabilities.

Valuation-wise, they are cheap on a PEG and Price/Sales ratio basis. Their profitability is reasonable in terms of return on equity, and their absolute p/e is only in the low 20's. There are lots of shares out short suggesting the potential of a squeeze, and the graph looks very strong.

Bottom-line, this is my kind of stock and if I were buying shares today, this would be the stock I would be buying. However, I don't have a 'signal' to buy anything and am already at my maximum of 20 positions. Meanwhile, I shall keep this in my vocabulary and monitor this stock!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Website where you can hear me discuss some of the many stocks I write about on the blog.

Have a great weekend everyone!

Bob

Friday, 8 June 2007

A Reader Writes "I'm hoping you'll give me a few tips...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I received a very nice email from Jason C. who is starting out in picking stocks and working with a simulated portfolio to practice. Jason wrote:

I received a very nice email from Jason C. who is starting out in picking stocks and working with a simulated portfolio to practice. Jason wrote:

"Hi Bob,

i recently discovered your blog on the Internet through google.

I'm a second year student at Aston University in England studying International Business and Management.

My friends and i recently started a VSE game and I've not had much luck on it

Reading your blog, i bought 2500 shares in EML and after yesterdays fall I'm down $4,000+

I'm sure you understand that I'm playing VSE to gain experience before i start using my own money.

I'm hoping you'll give me a few tips on noticing profitable shares and perhaps which books to read.

The shares i have right now are

BP - 700 (bought at 66.66)

EML 2500 (bought at 33.23)

Ebay 1900 (bought at 31.75)

I admire your knowledge and really hope that you'll email me back with some advice on how to win on the stock market and which books to read. It would really motivate me.

I admire your knowledge and really hope that you'll email me back with some advice on how to win on the stock market and which books to read. It would really motivate me.

I really want to do this as a profession when i finish university and it would be great to hear from a professional like you.

Looking forward to hearing from you.

Kind regards,

Jason"

Jason, thank you so much for writing and sharing with me your plans on developing a simulated portfolio of stocks. Good-luck with your learning process. I took the liberty of posting a picture of Aston next to your letter. It looks like a beautiful University and I congratulate you for your accomplishments already!

Before I answer your question, let me point out that I am also an amateur and not a professional, so be sure to seek the advice of professionals in the field as well. You are right about not doing well in the market recently. Especially the last three days (except today!). The market is in a bit of a correction, and all shares have been declining except for the rare exception. This points out the simple observation that the largest factor affecting stock price movement, at least over the short-term, is simply the overall market itself. Eastern (EML) closed at $31.49, up $.01 today. BP closed at $66.97, so you are up a little on that one. And ebay closed at $31.42, so you are a bit under on that holding as well. Of these stocks EML is really the TINIEST of companies, so we can well accept greater volatility, the so-called "BETA" in investing, in companies with smaller float, and thus less liquidity as they respond to market forces. I am still optimistic about EML, but I do not own any shares.

Over the longer-term, I believe that the market rewards stocks with superior earnings and revenue growth. I have based my blog on that simple assumption. And I do a little work in conjunction with this as well.

After 40 years of investing in the market, I am still working at perfecting my own approach at "winning" in the market. That is what this blog is all about. I would suggest that you go way back to the beginning entries and scan through the entries about philosophy or methods of investing. I have written up several of those, interspersed throughout the many other entries. The blog is rather cumbersome, but I feel it is loaded with lots of gems of information. At least I hope so.

There are several books that I am rather fond of for investing. And I will share these with you as well as a link to Amazon.com where these books can be purchased, often used, just for a few American Dollars (and fewer Euros).

One of the first books I ever read about the market was by Louis Engel,

How to Buy Stocks. This is an older book and was updated in 1994, but many of the important basics are there. You can pick up a used copy. I think you would enjoy it.

The next book to consider is

How to Make Money in Stocks by William O'Neil. O'Neil is the publisher if the Investor's Business Daily, known as the IBD in America. His CANSLIM system is a good start for identifying possible stocks for investment. I learned a lot from this book but do not practice CANSLIM.

Another of my favorite books was by Gene Walden, "

The 100 Best Stocks to Own in America". This is a 1999 edition that is a bit dated as well. However, the concept of identifying stocks by scoring them by certain attributes is also a good way to think about stock selection.

Going through my list of favorites, I enjoyed reading "

How to Make $1,000,00 in the Stock Market Automatically" by Robert Lichello. Lichello got me thinking about portfolio management. The need to automatically adjust one's holding into and out of equities from cash. I have adapted his strategy with my own portfolio management approach. I have written about that elsewhere.

These are just a few of the many books I have read and perused that have affected my own thinking and helped me develop my own philosophy on selection and the buying and selling of stocks.

In selecting stocks, one of the most important ideas I would like to leave you with is that you need to start developing your own "profile" of a winning stock. That is try to identify not so much WHAT they do but HOW they do it. What are the CHARACTERISTICS of stocks that are going to appreciate. You may come to different conclusions than I do, but you may come up with a better answer as well!

For me stocks that are likely to appreciate are those stocks that are doing well. They have recently reported good earnings, with increasing revenue and earnings numbers. They may have beaten expectations and possibly even raised guidance.

Longer-term, they have been increasing their revenue steadily, growing their earnings similarly, they may or may not be paying a dividend, and if so, may even be regularly increasing it. Shares outstanding are relatively stable, free cash flow is positive and hopefully growing, and the balance sheet looks nice with ample current assets and minimal current liabilities. Valuation should be good with a p/e not too high and hopefully the PEG is 1.0 to 1.5 or not much more. Price/sales should be at or under the industry average, and the Return on Equity should be at or higher than industry.

Finally, the stock chart should look like it has been moving higher and shows no evidence of breaking that trend.

It really isn't rocket science. But it is the consistency and the disciplined application of these strategies that will lead you to success.

Good-luck and keep me posted. Maybe together we can all learn how to successfully select stocks and manage a portfolio regardless of the market environment.

Bob

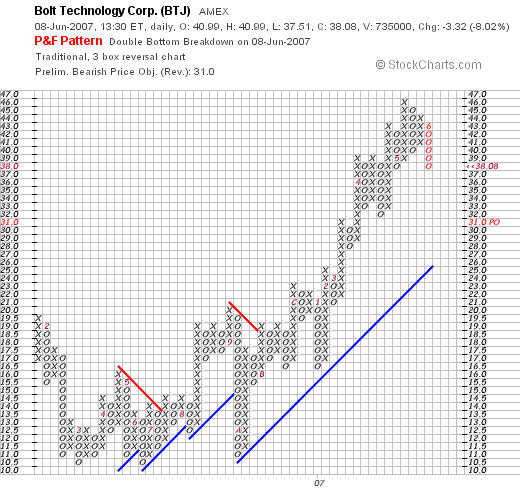

Bolt (BTJ) "Dealing with a sharp price decline"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Bolt (BTJ) is having a lousy day in an otherwise up market.

In fact, as I write, Bolt is trading at $38.01, down $(3.40) or 8.21% on the day. But why? The Yahoo Message Boards are busy, with apparent short-sellers trying to talk down the share price. The word according to these unconfirmed rumor-mongerers is that BTJ will be listed at a lower level on the IBD 100 listing that comes out each Monday in the Investor's Business Daily. But I don't see any confirmation of that either.

In fact, the latest quarterly report. Bolt's 3rd quarter 2007 results, showed the company with a 51% increase in revenue, and a 118% increase in net income of $.50/diluted share, up from $.23/diluted hsare last year. Now THAT is a great report!

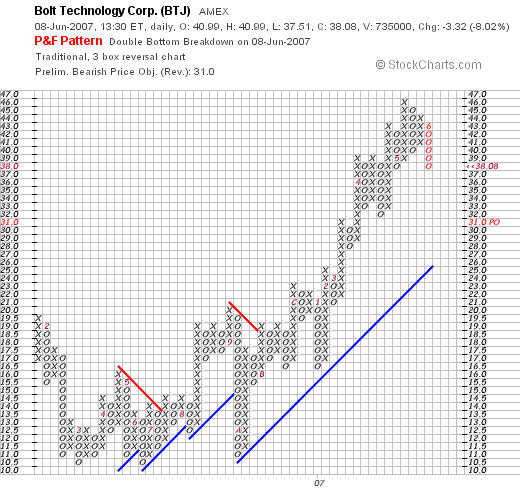

And if we look at a "Point & Figure" chart on BTJ, to get a bit more perspective, we see that the upward move in this stock is far from interrupted.

What we do see is that the stock has moved strongly higher (as we know) and that it is rather over-extended from the support line (blue line) below. Similar declines have occurred including a sharp decline from $20 to $11 in September, 2006, a decline from $21 to $17 in January, 2007, and a decline from $38 to $31 in April, 2007. These declines can be identified by the columns of "o's" on the chart indicating declines in the stock price.

In each case thus far, the stock has rebounded.

In any case, I have sold Bolt (BTJ) four times as it has rapidly appreciated in price, at 30, 60, 90 and 120% appreciation levels. Should the stock decline to a 60% appreciation (1.6 x $17.44 = $27.90), then I would unload all of my remaining shares. Bolt has a long way to go to do that and is in fact recovering even as I write.

So with a plan in mind, I can shrug off the message board posters and others who seem to be intent on manipulating the stock price with rumors and inuendos, and instead start to build a great portfolio of great stocks.

Bob

Thursday, 7 June 2007

"Trading Portfolio Update" June 7, 2007

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

With the market selling off the last few days, I thought this was as good a time as any to update my current Trading Portfolio for all of you. I know I have had some questions/comments about whether any of my stocks had hit sale points yet. If the selling continues, I am sure that several will be sold. But I shall wait until stock price targets are hit before selling anything.

I am still at my maximum of 20 positions in my portfolio. As many of you realize, I have very strictly defined sale points. I sell all of my shares if a stock hits an 8% decline after a first purchase, hits break-even if the shares have hit an appreciation target of 30% and then declined, and otherwise sell all of my shares if the stock should drop to 1/2 of its highest appreciation target. That is if I have sold portions of a holding three times, at 30, 60, and 90% appreciation levels, then I would unload all of the shares if the stock should decline to a 45% (1/2 of my 90% appreciation target) on the downside.

On the upside, I am still planning on selling 1/7th of my holding at appreciation targets as follows: 30, 60, 90, and 120% appreciation, then 180, 240, 300, 360 and 450% appreciation targets, then 540, 630, 720 and 810% appreciation levels, etc.

In addition, my portfolio is designed to respond to internal signals. That is, if under my maximum of 20 positions, I am 'entitled' to add a new position if one of my existing holdings hits a sale at a gain. However, I sit on my hands on sales on declines which I call "bad news" unless I am at my minimum equity exposure level which is 1/2 of 1/2 of the maximum, or in this case, at 5 positions.

These are my current holdings listed as name, symbol, number of shares, date of purchase, price of purchase, latest price (6/7/07), and percentage gain (loss).

Baldor Electric (BEZ), 140 shares, 5/22/07, $47.19, $45.25, (4.11)%

Bolt Technology (BTJ), 150 shares, 1/12/07, $17.44, $41.40, 137.43%

Cerner Corp (CERN), 120 shares, 2/2/07, $49.76, $55.21, 10.95%

Coach (COH), 61 shares, 2/25/03, $8.33, $47.86, 474.46%

Covance (CVD), 119 shares, 4/9/07, $62.61, $65.38, 4.42%

Gildan Activewear (GIL), 210 shares, 5/21/07, $36.13, $34.44, (4.68)%

Hologic (HOLX), 120 shares, 1/31/07, $55.58, $54.36, (2.20)%

Harris (HRS), 120 shares, 1/31/07, $50.05, $50.79, 1.48%

Kyphon (KYPH), 125 shares, 5/20/05, $29.21, $46.40, 58.82%

Mesa Labs (MLAB), 210 shares, 5/23/07, $24.05, $23.68, (1.55)%

Morningstar (MORN), 140 shares, 11/22/05, $32.57, $47.00, 44.28%

Precision Castparts (PCP), 86 shares, 10/24/06, $69.05, $115.78, 67.67%

Quality Systems (QSII), 88 shares, 7/28/03, $7.75, $41.00, 429.11%

ResMed (RMD), 150 shares, 2/4/05, $29.87, $43.80, 46.64%

Satyam Computer (SAY), 210 shares, 4/20/07, $25.55, $24.59, (3.77)%

Starbucks (SBUX), 50 shares, 1/24/03, $11.40, $27.44, 140.60%

Universal Electronics (UEIC), 155 shares, 2/23/07, $25.24, $31.89, 26.34%

Meridian Bioscience (VIVO), 270 shares, 4/21/05, $7.42, $21.54, 190.34%

Ventana Medical Systems (VMSI), 162 shares, 4/16/04, $23.47, $50.75, 116.23%

Wolverine World Wide (WWW), 200 shares, 4/19/06, $23.55, $27.43, 16.50%

As of 6/7/07, the account had total holdings of $118,210.31, and $66,205.55 of margin balance giving the total account value of $52,004.76.

The account has an unrealized gain of $30,067.81, and realized total gains of $12,309.61 in 2007, from a net short-term gain of $3,062.06, and a net long-term gain of $9,247.55. The account as of 6/7/07 had a margin equity percentage of 45.01%.

Please let me know if you have any comments or questions about this. If you like, leave your comments on the blog or email me at bobsadviceforstocks@lycos.com. I have been fortunate to do well in the market the past few years. I shall be sticking to my disciplined approach through this correction and any ensuing bull market as well.

Bob

Posted by bobsadviceforstocks at 11:27 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 7 June 2007 11:33 PM CDT

A Reader Writes "...do you think hw is a buy?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my favorite things about blogging is getting feedback from my readers. This sometimes comes in the form of comments on entries and other times comes in as questions or comments in emails. If you would like to leave a comment on anything I have written, please feel free to do so. I shall delete spamming and commerical comments but otherwise I am pretty accommodating to other ideas. You can contact me by email at bobsadviceforstocks@lycos.com. I read all of my emails, but can only comment on or respond to just a few of them. Please do leave your first name and your general location when you write.

A few days ago I received a nice email from Tony who wrote:

A few days ago I received a nice email from Tony who wrote:

"hello, i hope you are still active i am following hw and i only found your blog online, do you think hw is a buy at these prices or do you see it trending lower a stock club i'm in has recently started buying GD i don't know if you are interested in that stock but you may want to check into it. if you can email me and let me know what you think of hw. thanks and have a great day. tony"

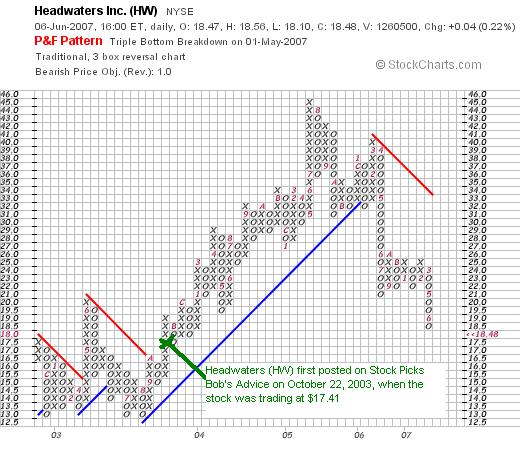

Tony, first of all thanks for writing. I am not currently following Headwaters, Inc. (HW) but did write about it way back on October 22, 2003, when the stock was trading at $17.41. For reference, Headwaters closed yesterday, June 6, 2007, nearly four years later at $18.48/share, which is $1.07 higher than my post or a gain of 6.1% since writing up the stock. I do not own any shares or have options on this company.

Let's take a look at a few basic things on this stock to see whether I can still suggest it deserves a place on this website: the latest quarter, the Morningstar.com report, and the chart.

First of all the earnings:

Headwaters (HW) announced 2nd quarter 2007 results on May 1, 2007. Total revenue for the quarter ended March 31, 2007, came in at $274.1 million, up 2% from $269.7 million in the same quarter last year. Net income for the quarter came in at $27.2 million or $.59/diluted share, up 48% from $18.4 million or $.40/diluted share last year. So far so good.

What about the Morningstar report?

Checking the Morningstar.com "5-Yr Restated" financials on Headwaters, we can see the nice rise in revenue from $119 million in 2002 to $1.12 billion in the trailing twelve months (TTM). However, earnings, which peaked at $2.79/share in 2005, dropped to $2.19/share in 2006 and $2.15/share in the TTM. We know that the latest quarter was quite good, but the last couple of years prior to that weren't.

The company has increased its shares significantly from 24 million in 2002 to 42 million in the TTM. However, during this period, revenue is up over 800% and earnings are up over 100%, so this dilution isn't excessive.

Free cash flow is positive and the balance sheet is acceptable.

What about the chart?

Reviewing the "Point & Figure" chart from StockCharts.com on Headwaters, we can see how the stock climbed strongly from the $17.50 level in 2003 when I first wrote it up to peak at $45/share in August, 2005. Since that time the stock has been trading very weakly and has broken through "support levels" (the 'blue line') and well below "resistance levels" (the 'red line'). It does not look encouraging at all, although I am certainly not qualified as a technician.

Thus, because of the excellent latest quarter, I would not place this as a "sell", but because of the mediocre last couple of years on Morningstar.com and the poor appearance of the chart,

HEADWATERS (HW) IS RATED A HOLD

I haven't looked at General Dynamics (GD) recently, so I haven't any comments on that stock at this time. Thanks so much for stopping by, visiting, and writing. I hope my comments are helpful.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website.

Bob

Posted by bobsadviceforstocks at 8:43 AM CDT

|

Post Comment |

Permalink

Updated: Thursday, 7 June 2007 9:56 AM CDT

Monday, 4 June 2007

The Eastern Company (EML)

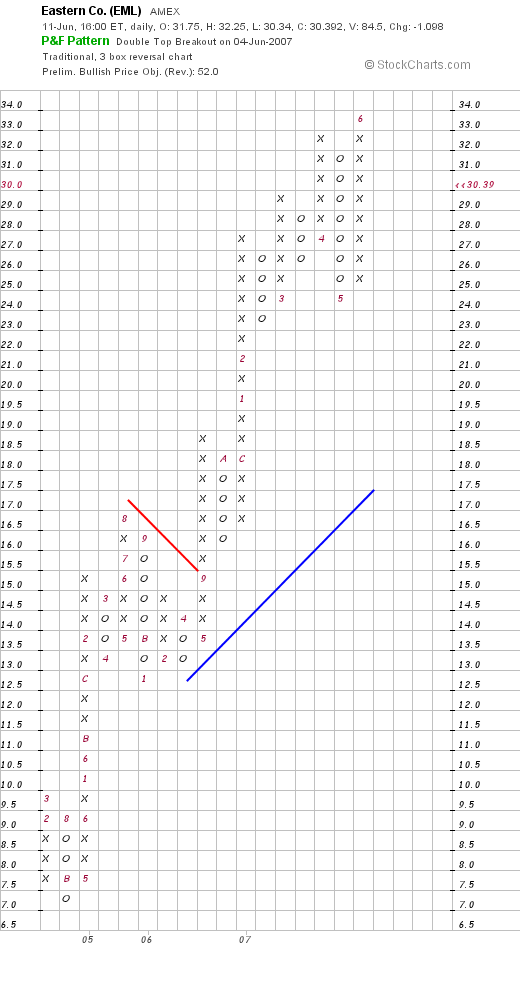

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website. I was looking through the list of top % gainers on the AMEX today and came across The Eastern Company which is trading at $31.90, up $2.44 or 8.28% on the day. I do not own any shares of this stock nor do I havew any options.

I wanted to jot down a quick note and explain why

THE EASTERN COMPANY (EML) IS RATED A BUY

What exactly does this company do?

What exactly does this company do?

According to the Yahoo "Profile" on EML, the company

"...manufactures and sells industrial hardware, security products, and metal products primarily in North America. It operates in three segments: Industrial Hardware, Security Products, and Metal Products."

"...manufactures and sells industrial hardware, security products, and metal products primarily in North America. It operates in three segments: Industrial Hardware, Security Products, and Metal Products."

How did they do in the latest quarter?

On April 25, 2007, The Eastern Company (EML) reported 1st quarter 2007 results. Sales for the quarter came in at $52.3 million, up 88% over last year's $27.9 million for the same quarter. Net income was $6.8 million or $1.14/diluted share, up 491% from $1.1 million or $.20/diluted share in the same period in 2006.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" on EML, we can see a perfect picture of revenue growth with EML reporting revenue of $81 million in 2002, $88 million in 2003, $100 million in 2004, $109 million in 2005, $138 million in 2006 and $163 million in the trailing twelve months.

Earnings have also steadily increased from $.59/share in 2002 to $1.67/share in 2006 and $2.61/share in the TTM. The company also even pays a dividend (!) and has increased it recently with $.29/share reported in 2002, $.31/share in 2006 and $.32/share in the TTM.

During this time, the company has maintained its float with 5 million shares outstanding in 2002 increasing to 6 million in the TTM. This 20% increase in shares has been accompanied by a 100% increase in sales and a 400% increase in earnings. This is an acceptable dilution from my perspective.

Free cash flow has been small but positive with $3 million in 2004, $1 million in 2006, and $4 million in the TTM.

The balance sheet is solid with $5.6 million in cash reported on Morningstar.com and $58.1 million in other current assets. This total of $63.7 million in total current assets, when compared to the $19.5 million in current liabilities yields a healthy current ratio of 3.27. The company has an additional $26.2 million in long-term liabilities which can easily be covered by the current assets as well.

What about valuation?

Looking at Yahoo "Key Statistics" we can see that this is a TINY company (relatively speaking) with a market capitalization of only $177.94 million. The trailing p/e is a very nice 12.16, and no forward p/e or PEG is reported (probably due to the lack of any analysts covering this stock with estimates.)

According to the Fidelity.com eresearch website, the company sports a Price/Sales ratio of .99, well under the industry average of 1.48. The company is also more profitable than similar companies with a Return on Equity (TTM) of 30.15%, compared to the industry average of 23.07%.

Finishing up with Yahoo, we can see that there are 5.58 million shares outstanding with 4.80 million that float. Of these, 16,500 shares are out short as of 5/10/07, representing 0.4 trading days of volume--an insignificant level imho.

The company pays a forward dividend of $.32/share yielding 1.10%. And the company last split its stock 3:2 on October 18, 2006.

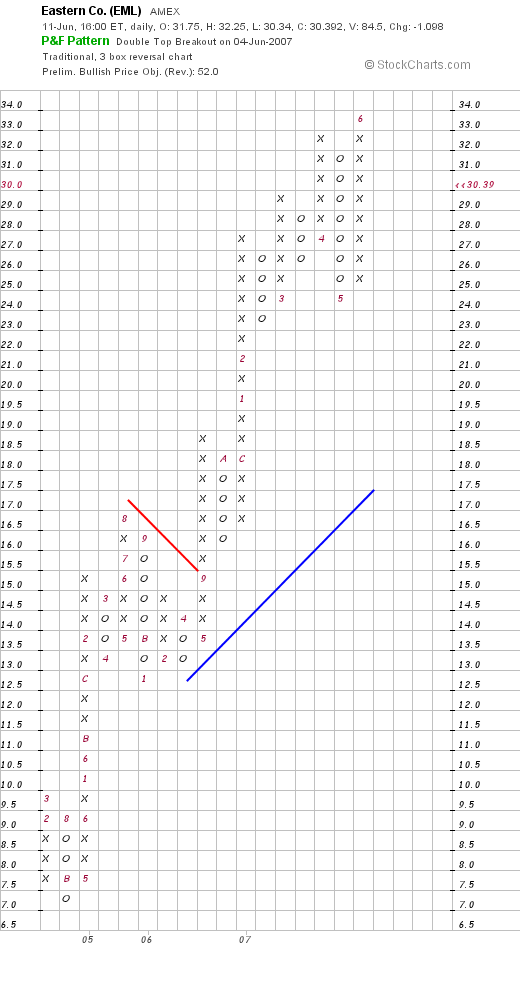

What does the chart look like?

Taking a look at a "Point & Figure" chart on Eastern from StockCharts.com, all I can say is WOW! The stock chart is quite strong and doesn't appear to be quitting any time soon. Of course anything is possible, but the chart does appear quite good to me.

Summary: What do I think?

O.K. if it isn't love, it is certainly infatuation :). Sometimes we find these incredible companies like Bolt (BTJ) or Flotek (FTK) on the AMEX where they seem to get overlooked by the vast majority of investors. Or is it something I am missing?

The company had a nice move today, had an incredible earnings report, is cheap with a p/e under 12, Price/Sales below similar companies, and a Return on Equity ahead of its competitors. On top of this, they have steadily been increasing their revenue the last five years, increasing their earnings, paying a dividend and now increasing it, generating free cash flow, keeping the number of shares stable, and have a great balance sheet, and a great chart. WOW.

I still am not buying any shares. I am at 20 and holding. But I would if I could.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

I had another nice letter from Eric N. who apparently also has dabbled in The Eastern Company (EML), but this time in reality, and not a virtual or simulated portfolio, and is also incurring some losses on this investment. Eric writes:

I had another nice letter from Eric N. who apparently also has dabbled in The Eastern Company (EML), but this time in reality, and not a virtual or simulated portfolio, and is also incurring some losses on this investment. Eric writes:

I was invited earlier today to participate in

I was invited earlier today to participate in  There was a great

There was a great  You can view a summary and review and ranking of my stock picking activity on my

You can view a summary and review and ranking of my stock picking activity on my

This is a stock I have been trying to write up since Friday! It is graduation party time around this town. While I don't have any high schoolers graduating this year, we do have a lot of friends with sons and daughters that do. In fact, it isn't very good for my diet either, but that is a whole different story :). Anyhow, it is now early Sunday morning and it is very quiet around my house so I could get on the computer undisturbed and maybe finish this one up!

This is a stock I have been trying to write up since Friday! It is graduation party time around this town. While I don't have any high schoolers graduating this year, we do have a lot of friends with sons and daughters that do. In fact, it isn't very good for my diet either, but that is a whole different story :). Anyhow, it is now early Sunday morning and it is very quiet around my house so I could get on the computer undisturbed and maybe finish this one up! "...manufactures components and systems for injectable drug delivery and plastic packaging, and delivery system components. It operates in two segments, Pharmaceutical Systems and Tech Group."

"...manufactures components and systems for injectable drug delivery and plastic packaging, and delivery system components. It operates in two segments, Pharmaceutical Systems and Tech Group."

I admire your knowledge and really hope that you'll email me back with some advice on how to win on the stock market and which books to read. It would really motivate me.

I admire your knowledge and really hope that you'll email me back with some advice on how to win on the stock market and which books to read. It would really motivate me.

What exactly does this company do?

What exactly does this company do?