Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to point out on many of my entries on this blog, I am trying to do several things simultaneously on this website. First of all, I like to discuss stocks that I am interested in; stocks that meet my criteria for investment. In addition, I write about my actual trades and my actual trading portfolio. I do this for transparency, to let you know what I actually own and what I am doing with my holdings. I share with you my accomplishments and my failures.

As I like to point out on many of my entries on this blog, I am trying to do several things simultaneously on this website. First of all, I like to discuss stocks that I am interested in; stocks that meet my criteria for investment. In addition, I write about my actual trades and my actual trading portfolio. I do this for transparency, to let you know what I actually own and what I am doing with my holdings. I share with you my accomplishments and my failures. Finally, on weekends, when I get around to it :), I like to review my trading portfolio, going alphabetically through my positions so that I may actually review these currently 22 holdings approximately twice a year. Also, on weekends, I try to review my stock picks from the prior year on a trailing 52 week (now up to about 60) basis. This particular post is about one of my actual holdings, Cal Dive (CDIS) which is currently in my trading portfolio.

On November 3, 2004, I came across Cal Dive (CDIS) on the list of top % gainers. Having just sold some shares at a gain, I had a permission slip to buy a new position and went ahead and purchased 200 shares at $38.16 and immediately posted my trade on Stock Picks Bob's Advice. Later that day I did a more complete review of Cal Dive on Stock Picks Bob's Advice.

On November 3, 2004, I came across Cal Dive (CDIS) on the list of top % gainers. Having just sold some shares at a gain, I had a permission slip to buy a new position and went ahead and purchased 200 shares at $38.16 and immediately posted my trade on Stock Picks Bob's Advice. Later that day I did a more complete review of Cal Dive on Stock Picks Bob's Advice.I currently own 142 shares of CDIS with a cost basis of $19.10. The stock had a 2:1 split on 12/9/05. CDIS closed at $36.75 on 2/24/06, giving me a gain of $17.65 or 92.4% on my remaining shares since my purchase a little over a year ago. I have now portions of CDIS four times, selling 50 shares on 2/25/05 at a price of $49.87, for a gain of $11.67 (pre-split) or 30.5%. My second sale was for 37 shares on 8/1/05 at a price of $60.84 for a gain of $22.64 or 59.3%. My third sale was for 28 shares on 11/22/05 at a price of $73.01, for a gain of $34.81 or 91.1%. Finally, I sold 28 shares after the stock split at a price of $41.82 for a gain of $22.72 or 119% on a post-split basis.

Since I have sold portions of my holdings four times, my next stock split would be at a 180% gain on the upside or 2.80 x $19.10 = $53.48 or on the downside, I would sell all remaining shares if the stock traces back to 50% of its highest sale point (120% x .5 = 60%), or 1.60 x $19.10 = $30.56.

Let's take a closer look at Cal Dive (CDIS). First of all, according to the Yahoo "Profile" on Cal Dive, the company

Let's take a closer look at Cal Dive (CDIS). First of all, according to the Yahoo "Profile" on Cal Dive, the company"...operates as an energy services company in the Gulf of Mexico, and in the North Sea and the Asia/Pacific regions. It offers a range of marine contracting services, such as marine construction, robotic services, manned diving, and decommissioning services. CDI, with its fleet of 22 vessels and 26 remotely operated vehicles and trencher systems, performs various services that support drilling, well completion, intervention, construction, and decommissioning projects. It also acquires and operates mature and noncore offshore oil and gas properties, as well as related production facilities."What about the latest quarterly report? Actually, the company is scheduled to report earnings this Wednesday, March 1, 2006. But let's take a look at the previous quarter for some idea about how the company is doing.

On November 1, 2005, Cal Dive reported 3rd quarter 2005 results. Revenue was up dramatically to $209 million, from $132 million in the same quarter the previous year. Earnings climbed 78% to $45.7 million from $22.8 million last year or $1.05/diluted share up from $.59/diluted share. This was a very strong quarter for the company. Recently, the stock pulled back in price after the company the acquisition of Remington Oil and Gas for $1.4 billion. (listed on "investor news" on the company website.

And how about longer-term results? Reviewing the "5-Yr Restated" financials on CDIS from Morningstar.com, we can first of all see the beautiful progression in revenue growth from $181 million in 2000 to $543.4 million in 2004 and $698.4 million in the trailing twelve months (TTM).

And how about longer-term results? Reviewing the "5-Yr Restated" financials on CDIS from Morningstar.com, we can first of all see the beautiful progression in revenue growth from $181 million in 2000 to $543.4 million in 2004 and $698.4 million in the trailing twelve months (TTM).Earnings have grown nicely, if not as consistently, from 4.36/share in 2000, to $1.03 in 2004 and $1.50 in the TTM. The company has expanded its shares slightly from 63 million in 2000 to 76 million in 2004 and 78 million in the TTM.

Free cash flow has been erratic with $(95) million in 2002 improving to $177 million by 2004. With the apparent $343 million acquisition of Remington, this resulted in a drop to $(63) million in free cash flow in the TTM.

The balance sheet is adequate with $150.5 million in cash and $218.2 million in other current assets, enough to cover the $198.0 million in current liabilities more than 1.5x over. (Giving us a 'current ratio' of over 1.5). The company does have a significant long-term liabilities load of $798.4 million. This does not appear to be a problem for this rapidly growing company.

And how about some valuation numbers on this stock?

And how about some valuation numbers on this stock?Reviewing Yahoo "Key Statistics" on Cal Dive, we can see first that this is still a 'mid-cap' stock with a market capitalization of $2.86 billion (using a $3 billion cut-off for large cap status). The trailing p/e is a reasonable 24.40 and the forward p/e (fye 31-Dec-06) is downright cheap at 12.42. Thus, the (5 yr expected) PEG is only 0.59. Generally stocks with PEG's of 1.5 or less are reasonably priced.

According to the Fidelity.com "eResearch" website, CDIS is in the "Oil & Gas Equipment/Services" industrial group.

On a relative Price/Sales ratio comparison, Cal Dive is relatively richly valued with a Price/Sales ratio of 4.3. This is topped only by Schlumberger (SLB) at 5.1, and followed by Baker Hughes (BHI) at 3.5, BJ Services (BJS) at 3.2, Pride International (PDE) at 2.9 and Halliburton (HAL) at 1.8.

Going back to Yahoo for a few more numbers, we can see that there are 77.85 million shares outstanding and 72.30 million of them that float. Of those shares that float, 5.41 million of them are out short representing 7.20% of the float or 4.4 trading days of volume (the short ratio). Using my 3 day arbitrary cut-off, this is a bit of a large short interest and may be a bullish influence in the face of good news, especially if the earnings coming out on Wednesday are reasonably upbeat.

There is no cash dividend, and as I noted above, the company last split its stock in the form of a 2:1 split on 12/9/05.

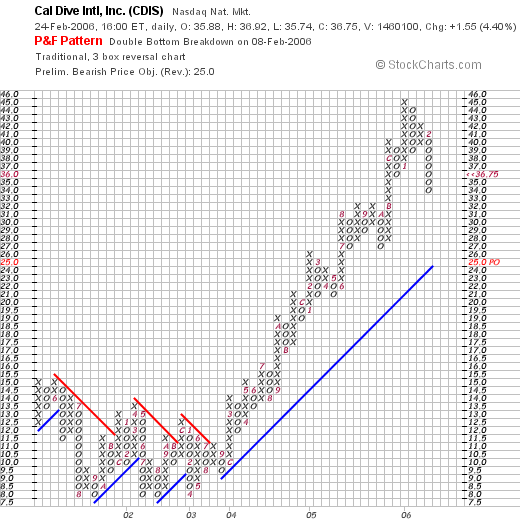

What about a chart? Looking at a "Point & Figure" chart on CDIS from StockCharts.com, we can see that the stock was trading sideways from May, 2001, when it was at $15, until October, 2004, when it broke through resistance at around $11.50, and has climbed steadily and strongly since. Recently the stock has pulled back from heights around $45 to the current $36.75 level. The stock rise appears intact, with the support level below the current stock price.

So what do I think? Well this stock has been a great performer for me with four partial sales already at the 30, 60, 90 and 120% gain levels. The stock has pulled back to a 90% appreciation point, but I do not think the stock rise is over yet. However, much of the price movement on this stock will be in association with the oil price, making it subject to all sorts of geopolitical events.

Underlying numbers on this stock are solid with steadily appreciating revenue and earnings, free cash flow, which except for the recent acquisition, has been positive and growing. The p/e is reasonable and the PEG is under 1.0. Price/Sales-wise the stock is richly valued, but not the highest or even second-highest within its group. The chart looks nice. Overall, if the company can come in with a reasonable earnings report this Wednesday, I wouldn't be surprised to see this stock moving higher once again. On the other hand, a disappointment, could easily drop this stock to my next sale point on the downside, about $36 and if so, I shall be unloading all of my shares. We will know more later this week!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob