CLICK HERE FOR MY STOCK PICKS PODCAST ENTRY ON MOODY'S

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before I get to my main entry, I wanted to share with you a very nice email that I received the other day from Robert D. who wrote:

Before I get to my main entry, I wanted to share with you a very nice email that I received the other day from Robert D. who wrote:

"Bob, I love your site, your up-to-date research is very helpful, and I learned a lot about a lot of companies.

I'm not sure if you have it (maybe I did not see it), but it would be very useful as an organizational too, to include either a "search" feature on your site, where we can find your research on a given stock (since you have done quite a few now!), or a list of the companies covered with links to the appropriate research page.

I know I have a hard time finding old articles your wrote about a specific company, just thought it might help!

Keep up the great work, and best of luck in the market!"

Robert, I believe I have fixed the problem. I loaded up a "PICO SEARCH" which, although I am not sure all of my readers are familiar with this, should be able to search through the blog to find entries that you may be looking for. Give it a try and let me know what you think!

I was looking through the list of top % gainers on the NYSE today and came across Moody's, a stock that I first discussed on Stock Picks Bob's Advice on August 22, 2005, a bit more than a year ago when it was trading at $49.37. I still do not own any shares of Moody's (MCO) nor do I have any options. Moody's closed at $65.38 today, up $2.41 or 3.83% on the day. The stock is higher by $16.01 or 32.4% since I posted it about 13 months ago here on the blog.

I was looking through the list of top % gainers on the NYSE today and came across Moody's, a stock that I first discussed on Stock Picks Bob's Advice on August 22, 2005, a bit more than a year ago when it was trading at $49.37. I still do not own any shares of Moody's (MCO) nor do I have any options. Moody's closed at $65.38 today, up $2.41 or 3.83% on the day. The stock is higher by $16.01 or 32.4% since I posted it about 13 months ago here on the blog.

Let's take another look at this company and I shall share with you my thinking about why the stock is still worthy of consideration.

1. What exactly does this company do?

According to the Yahoo "Profile" on Moody's, the company

"...through its subsidiaries, provides credit ratings, and research and analysis services for capital markets worldwide. The company also offers credit training services, credit risk assessment products and services, and credit processing software for banks, corporations, and investors."

2. Was there any news to explain today's move higher?

Looking through the Yahoo "Headlines" on Moody's, I found a story that suggested that new legislation signed into law today by President Bush, gave authority to the SEC for new credit rating agencies. Apparently, they must be designated as "nationally recognized" agencies, giving Moody's, Standard and Poor's and the Fitch Ratings an edge over new credit rating firms. In any case, it appears the 'street' liked this development and the stock moved higher.

3. How did the company do in the latest reported quarter?

On August 2, 2006, Moody's reported 2nd quarter 2006 results. for the quarter ended June 30, 2006, the company reported revenue of $511.4 million, a 14% increase over the prior year's $446.8 million. Earnings came in at $172.1 million or $.59/share, up from $145.4 million or $.47/share in the prior year same period. According to the same report, analysts at Thomson First Call had expected revenue of $485.8 million and earnings of $.56/share. Thus, the company grew its revenue and earnings, and also exceeded expectations on both revenue and earnings. The company finished off this 'trifecta-plus' earnings report by raising guidance for its earlier profit forecast for 2006.

4. How about longer-term financial results?

If we review the Morningstar.com "5-Yr Restated" financials on Moody's (MCO), we can see that revenue has steadily increased from $.8 billion in 2001 to $1.7 billion in 2005 and $1.8 billion in the trailing twelve months (TTM).

During this same period, earnings have steadily increased (without a miss!) from $.66/share in 2001 to $1.84/share in 2005 and $2.05/share in the TTM.

An added 'bonus' is the fact that MCO does pay a dividend, which while unchanged between 2001 and 2003 at $.09/share, was raised to $.15/share in 2004, $.18/share in 2005 and has been $.25/share in the TTM. While not a 'requirement' of mine on this blog, the presence of a dividend that has also been steadily increasing is an added 'plus' to any stock evaluation.

While I like to see a steady or only a slowly-growing number of shares outstanding, it is rare to see a company that has been steadily decreasing its outstanding shares. Moody's has accomplished this with 314 million shares outstanding in 2001, steadily declining to 298 million in 2005 and 282 million in the TTM. This decrease in the number of shares has occurred while the company has more than doubled its revenue and tripled its earnings!

Free cash flow has been strong recently with $449 million reported in 2003, increasing to $677 million in 2005 and $652 million in the trailing twelve months.

The balance sheet, as reported on Morningstar.com appears satisfactory with $230.3 million in cash and $449.5 million in other current assets. When this total of $679.8 million in current assets is compared to the $527.1 million in current liabilities, we are left with a current ratio of 1.29. This appears adequate, especially with the strong free cash flow, but in general, ratios closer to 2.0 or higher are preferable to lower ratios closer to 1.0.

5. What about some valuation numbers for this company?

If we review the Yahoo "Key Statistics" on Moody's, we find that the market cap is a large cap $18.43 billion. The trailing p/e is a moderately rich 31.94 with a forward p/e (fye 31-Dec-07) estimated at 27.59. The PEG also suggests a rich valuation at 1.97.

Reviewing the Fidelity.com eResearch website on Moody's, we find that this stock is in the "Credit Services" industrial group. Moody's is relatively reasonably priced (imho) when examined from the perspective of the Price/Sales ratio. Leading this group is CapitalSource (CSE) with a ratio of 4, following CSE is Moody's (MCO) at 1.9, then Alliance Data Systems (ADS) at 0.9, American Express (AXP) at 0.8, Fannie Mae (FNM) at 0.7, and Capital One Financial (COF) at 0.3.

Comparing relative profitability, through the perspective of the return on equity (ROE), Moody's leads the pack with a whopping return of 203.3%. Following Moody's is Fannie Mae at 43.7%, American Express at 33.4%, Alliance Data Systems at 17.4%, Capital One at 15.7%, and CapitalSource at 14.2%.

Returning to Yahoo for a few more numbers, we find that there are 281.90 million shares outstanding and 281.62 million that float. Of these, 4.85 million (as of 9/12/06, down from 4.91 million the prior month) are out short, representing 1.70% of the float. This represents 4.6 trading days of volume (the short ratio). Using my arbitrary 3 day rule of short interest, this appears somewhat significant, meaning that I believe that this short interest may start creating an upward pressure (or short squeeze) on the stock price if there is continued release of 'good news' from the company.

As I noted above, the company pays a small dividend estimated at $.28/share in the upcoming 12 months which would represent a yield of 0.4%. The last stock split was as recently as May 19, 2005, when the stock split 2:1.

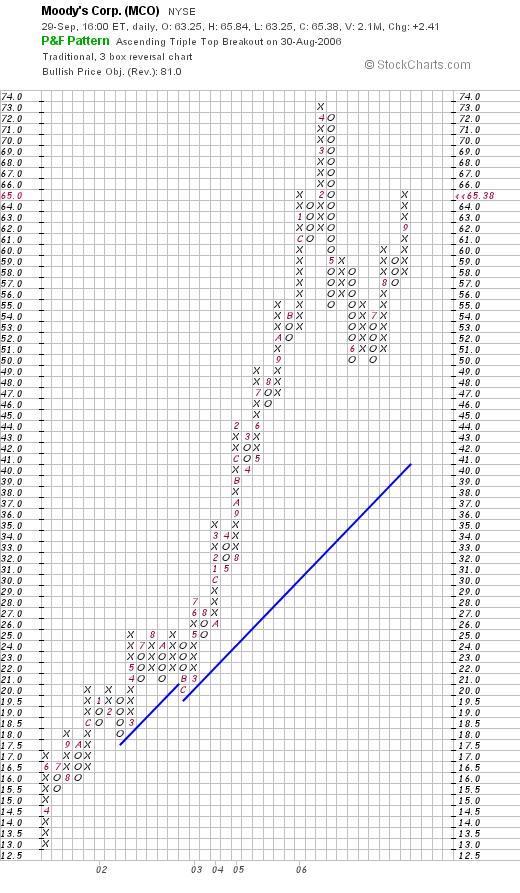

6. What does the chart look like?

If we examine the "Point & Figure" chart on Moody's from StockCharts.com, we can see that the stock moved steadily higher from a low of $13/share in March, 2001, to a high of $73/share in April, 2006. The stock has pulled back rather sharply this year to a low (a double-bottom as seen on the chart) of $50/share. The stock is now apparently moving higher again, above its support line (the blue 45 degree upward line). The chart looks pretty strong to me!

7. Summary: What do I think about this stock?

To summarize, the stock Moody's, the well-known rating agency, made a nice move higher on some additional laws that will insulate them from competition. This would be a reinforcement of the 'moat' concept, so well explained by the Morningstar analysts and advanced by Warren Buffett.

Their latest quarterly report was superb imho, with strong earnings and revenue growth. The company added the icing to the announcement by beating expectations on both revenue and earnings and by raising guidance. This was my favorite kind of earnings report!

Longer-term, the Morningstar.com report was gorgeous. Several points on that report that caught my attention were the consistency of the revenue and earnings growth, the presence of a dividend, and the recent steady increase in the dividend payment. Topping it off was the steady decrease in the outstanding shares which by itself adds value to an existing shareholder!

Free cash flow was solidly positive. On a slightly negative (but not critical imho) note, the company had a relatively low current ratio with a significant current liabilities account. I can overlook this fact in light of the strong free cash flow reported.

Other parameters included the Price/Sales ratio which was fairly average for the group and the very strong return on equities figure that outpaced the other companies in the same industrial group. The p/e, however, was a bit rich and the PEG wasn't any better being just under 2.0. Finally, the stock did have a significant number of short-sellers, which could be considered a 'bullish' statistic. Looking at the graph, the company has had a very steady price appreciation, which, it appears, only suffered by getting ahead of itself earlier this year. The stock price appears to be appreciating once again.

Anyhow, if I were to be buying shares this might be the kind of stock I would be buying. I prefer to invest in more mid cap sized companies just from the perspective of the potential growth, which I believe can be more dynamic for the investor.

Thanks again for stopping by and visiting! If you have any additional comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com. Please check out that Pico Search that I have now placed along the left side of the blog which can locate past discussions on this growing, and difficult to manage website! While you are at it, please be sure to drop by and visit my Stock Picks Bob's Advice podcast website, where I get the opportunity of discussing many of the same stocks that I write about on the blog!

Bob

Updated: Saturday, 30 September 2006 11:26 PM CDT