Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Once again it is the weekend! And that means that is time for me to review some of the past stock picks from this website. Since I have missed some of these weekend reviews, the 'looking back a year' part, really ought to read 'looking back 1 1/2 years!'. Because I am now about 18 months out from our reviews. Whatever.

As I have pointed out more than once, these reviews assume a 'buy and hold' approach to investing. I do this for the ease of analysis. In reality I advocate and practice a disciplined portfolio management strategy that requires me to sell my losing stocks quickly and completely and my gaining stocks slowly and partially. Certainly this difference in strategy would lead to different returns for an investor.

Last weekend I reviewed all of the stocks selected from the week of March 13, 2006. Let's move ahead a week and look at this blog during the week of March 20, 2006.

On March 21, 2006, I posted Phillips-Van Heusen (PVH) on Stock Picks Bob's Advice when it was trading at $38.51. PVH closed at $54.06 on September 7, 2007, for a gain of $15.55 or 40.4% since posting.

On March 21, 2006, I posted Phillips-Van Heusen (PVH) on Stock Picks Bob's Advice when it was trading at $38.51. PVH closed at $54.06 on September 7, 2007, for a gain of $15.55 or 40.4% since posting.

On August 22, 2007, Phillips-Van Heusen reported 2nd quarter 2007 results. For the quarter ended August 5, 2007, total revenue came in at $522.4  million, up from $458.9 million in the same quarter last year. Net income was $39.1 million or $.68/share, beating its own guidance by $.07/share. This was a 28% increase over second quarter 2006 'non-GAAP' earnings per share of $.53. (Second quarter GAAP net income was reported at $29.0 million or $.33/share). In the same report the company also raised guidance for 2007 earnings to a range of $3.15 to $3.17/share from the previous guidance of $3.06 to $3.10.

million, up from $458.9 million in the same quarter last year. Net income was $39.1 million or $.68/share, beating its own guidance by $.07/share. This was a 28% increase over second quarter 2006 'non-GAAP' earnings per share of $.53. (Second quarter GAAP net income was reported at $29.0 million or $.33/share). In the same report the company also raised guidance for 2007 earnings to a range of $3.15 to $3.17/share from the previous guidance of $3.06 to $3.10.

The Morningstar.com "5-Yr Restated" financials on PVH are intact.

PHILLIPS-VAN HEUSEN (PVH) IS RATED A BUY

The 'point & figure' chart on PVH from StockCharts.com shows the strength of the price chart even with the recent volatility in the stock market.

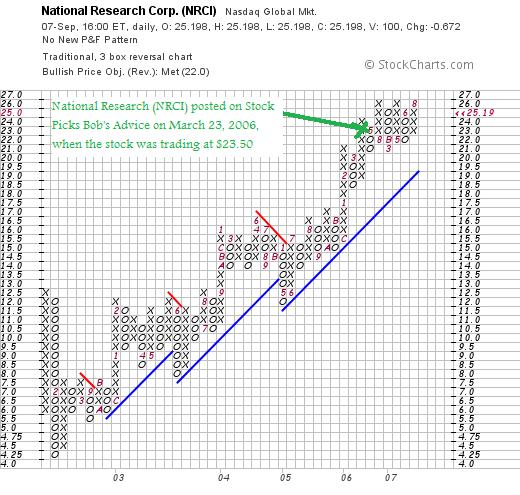

On March 23, 2006, I posted National Research Corp (NRCI) on Stock Picks Bob's Advice when the stock was trading at $23.50/share. NRCI closed at $25.20 on September 7, 2007, for a gain of $1.70 or 7.2% since posting.

On August 7, 2007, National Research Corporation reported 2nd quarter  2007 results. For the quarter ended June 30, 2007, revenue increased 12% to $11.9 million from $10.7 million last year. Net income climbed 24% to $1.6 million from $1.3 million last year. Diluted earnings per share were up 21% to $.23 from $.19/diluted share the prior year.

2007 results. For the quarter ended June 30, 2007, revenue increased 12% to $11.9 million from $10.7 million last year. Net income climbed 24% to $1.6 million from $1.3 million last year. Diluted earnings per share were up 21% to $.23 from $.19/diluted share the prior year.

Except for a slight excess of Current Liabilities over Total Current Assets, the Morningstar.com "5-Yr Restated" financials on NRCI are intact.

NATIONAL RESEARCH CORPORATION (NRCI) IS RATED A BUY

Examining the "point & figure" chart on NRCI from StockCharts.com, we can see the rather impressive trading history of this company with little weakness evidenced since dipping to $4.25 in February, 2002.

Summary: How did I do with the stock picks from the week of March 20, 2006? In a word, great! Only two stocks were selected, and in spite of the recent weakness in the market, these stocks both represent appreciation from their 'pick price' for an average gain of 23.8%. I did not buy or own shares in either of these companies. Please remember that past performance is no guarantee of future price appreciation.

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast website where I discuss many of the same stocks I write about here on the blog. In addition, check out my Covestor Page where Covestor monitors my actual Trading Portfolio so you can see what I actually own and how I am doing. Covestor has been only up and in business since about June, 2007, so there are only a few months represented on the site.

In addition, I am happy to be participating in SocialPicks and if you visit my SocialPicks page, you will see what that website says about my picking skills. They keep track of every one of my selections (since about January, 2007), and determine my performance as well.

There, THAT should keep you busy :).

Have a great week trading everyone.

Bob

Updated: Sunday, 9 September 2007 4:01 PM CDT