Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of my occasional weekend functions on the blog, I like to go through my actual holdings and review their performance and underlying fundamentals. Going alphabetically, I last reviewed Cerner (CERN) on September 2, 2007. Copart (CPRT) is actually next in line, but since it was a recent purchase, I shall move past that one to Covance (CVD) which I acquired 4/9/07 and currently own 119 shares. These shares were purchased at a price of $62.61. CVD closed at $78.68 on 10/5/07, for a gain of $16.07 or 25.7% since being acquired.

At what price would I sell shares?

On the upside, since I have yet to sell any shares, the first targeted sale would be at a 30% appreciation target or 1.30 x $62.61 = $81.39. At that point, my plan would be to sell 1/7th of 119 or 17 shares. On the downside, since I have yet to sell any shares on the upside, the (8)% loss would still be my targeted sale point or .92 x $62.61 = $57.60. At that point, all shares of my holding would be sold. Of course, I reserve the right to sell shares based on any fundamental information outstanding.

How did they do in the latest quarter?

On July 25, 2007, Covance reported 2nd quarter 2007 results. 'Net revenue' increased 13.7% to $381.1 million in 2007 from $335.2 million in the same quarter in 2006. Net income climbed 18.5% to $41.5 million from $35.0 million. On a diluted per share basis the increase was 18.9% to $.64/share from $.54/share in the same quarter in 2006.

The company met expectations of analysts polled by Thomson Financial who had expected earnings of $.64/share but beat estimates on the revenue side coming in at $381.1 million when expectations were for $373 million.

What about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials on CVD, we can see that the steadily increasing revenue is intact, earnings are also continuing to steadily increase, and shares outstanding are fairly stable. Free cash flow while a bit erratic, has increased recently. Finally, the balance sheet is solid.

What does the chart look like?

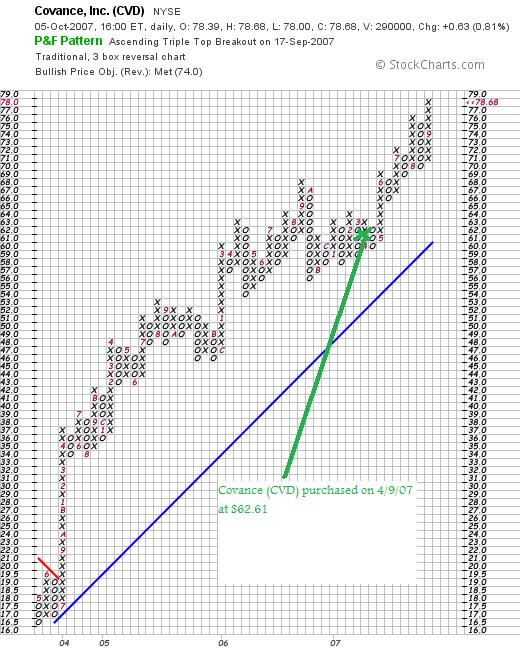

Looking at the StockCharts.com "point & figure" chart on Covance, we can see a very strong upward move for this stock that started in July, 2003, when the stock moved strongly from $17 to $36 over a period of nine months. Since then the stock has steadily moved higher without even testing the support levels.

In light of the solid earnings report, the strong Morningstar.com numbers, and the steady stock price chart,

COVANCE (CVD) IS RATED A BUY

Summary: What do I think?

Needless to say, I am still satisfied with the financial performance of the company. Hopefully with a bit of luck I shall be hitting my first stock sale on the upside and shall be entitled to purchase a new position!

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please feel free to visit my Stock Picks Podcast Website where I have been discussing a few of the same stocks I write up on the blog. In addition, don't forget the Covestor Page where my actual trading portfolio is monitored and its performance is recorded, and my SocialPicks page where my picks since the first of the year have been evaluated.

If you still have time, consider visiting Prosper.com where if you sign up before the end of the year and enter into person-to-person loans you can also receive $25, (and I shall also receive credit for your registration!). If you do decide to make any loans, be sure to make small loans to a lot of borrowers to spread the risk which can be considerable. Be sure to investigate the entire process before proceeding. I currently have $200 out in loans of $50 each. I shall keep you posted on my success with this website.

Thanks so much for all of your loyalty and for your visit here to my blog!

Bob