Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday I wrote about my sale of Greif (GEF) on an 8% loss. As I reminded my readers, my portfolio management strategy demands that I unload shares that hit pre-specified losses. After an initial purchase, stocks that dip 8% are sold. This limits my losses and enables me to preserve my gains.

Yesterday I wrote about my sale of Greif (GEF) on an 8% loss. As I reminded my readers, my portfolio management strategy demands that I unload shares that hit pre-specified losses. After an initial purchase, stocks that dip 8% are sold. This limits my losses and enables me to preserve my gains.

Also, I commented once again about the other part of my portfolio management strategy, that while not actually trying to 'time' the market, is designed to respond to market influences by shifting either into or out of cash and equities depending on the performance of my own holdings in my portfolio.

To accomplish this, my portfolio is planned to shift between 5 and 20 positions. When I sell a stock on 'good news' (which for me means a partial sale on reaching an appreciation target), I interpret this transaction as an indication that something is 'right' about the market, and give myself a 'buy signal' to be adding a new position to the portfolio. I do this as long as I am under my 20 position maximum. At the maximum number of holdings, I plan on ignoring this sale and placing the proceeds into cash (or paying down any margin!)

On the other hand, I also use sales of stocks on 'bad news' (either fundamental news that is negative or a sale on a decline in the price of a stock as I did with Greif when it reached an (8)% loss) as a signal that something is 'wrong' with the market and that leaving the proceeds of that sale in cash would be the correct approach. I utilize this strategy as long as my holdings are above 5 positions. At the minimum level (which I was at yesterday), a sale of a position would result in only 4 positions and in this particular situation a 'buy' signal is generated to get me back to 5 holdings.

Yesterday no stocks came up on my 'radar' and I sat on my hands with the proceeds. Today, however, with the atmosphere a little more optimistic that a 'bail-out' or 'rescue' of the financial companies might well pass the House of Representatives (?), stocks are moving higher with the Dow, as I write, is trading at 10,673 up 190, and the S&P is at 1,140.95, up 26.

Starting my usual search routing, I checked the list of top % gainers and came across Global Payments (GPN), an old favorite of mine (trading at $47.87, up $6.81 or 16.59% as I write), and with 'permission slip' in hand, went ahead and purchased 140 shares at $48.2395 in my account. (You can see that the stock has already dipped about $.40/share since my purchase).

GLOBAL PAYMENTS (GPN) IS RATED A BUY

Let me share with you briefly a few of the things that led me to this decision today.

First of all,

What exactly does this company do?

According to the Yahoo "Profile" on Global Payments (GPN), the company

"...provides payment processing and consumer money transfer services worldwide. The company�s Merchant Services segment provides credit and debit card transaction processing services, including processing Visa, MasterCard, Discover credit cards, and cards issued by other card associations; and check-related services comprising check verification, guarantee, and recovery services. This segment also offers proprietary software products to establish revolving check cashing limits for the casinos customers in the gaming industry. In addition, it sells, installs, and services automated teller machine and point of sale terminals; and provides authorization, electronic draft capture, and file transfer services, as well as offers merchant accounting and various back office services."

What about the latest quarterly result?

As is often the case (when the market appears to be functioning somewhat normally), it was the announcement of earnings yesterday after the close of trading that resulted in the sharp rise in the stock price today.

On October 2, 2008, Global Payment announced first quarter 2009 results. For the quarter ended August 31, 2008, sales climbed 30% to $405.8 million, up from $311 million last year. Earnings came in at $57.5 million or $.71/share, up from $43.6 million or $.54/share last year.

O.K. this was a nice result, so what makes it so special? From my perspective, results must always be evaluated in the context of what the street was expecting! In this case, analysts polled by Thomson Financial had been expecting sales of $395.7 million (the company beat expectations) and profit of $.60/share (again the company beat expectations!)

Furthermore, to add some icing on this great cake of results, (now that is an awful image don't you think?), the company raised guidance for fiscal 2009 to revenue of $1.64-$1.68 billion, compared to the $1.27 billion in revenue in fiscal 2008. Earnings estimates were also raised to a range of $2.37 to $2.45 from the $1.98 in 2008.

I cannot over-emphasize the importance of doing better than what everyone was expecting and to top off the announcement, to raise future expectations and estimates as well! Needless to say, in the context of a market already rebounding today, this gave this stock the extra momentum to make a very nice move---and move higher it did!

What about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials, you can see why this has been a stock that has been a 'favorite' of mine for literally years!

Let me explain. First of all, revenue has steadily improved from $629 million in 2004 to $1.27 billion in the trailing twelve months (TTM). Earnings have also not 'missed a beat' increasing from $.80/share in 2004 to $2.01 in 2008. The company has been paying a dividend of $.08/share, but unfortunately, has not been in the habit of raising it.

Total shares have been very stable with 75 million in 2004, increasing to only 78 million in 2008.

Free cash flow has been positive and relatively stable at $210 million in 2006 and $227 million in 2008. The balance sheet is solid with $456 million in cash and $161 million in other current assets, easily covering the $217.8 million in current liabilities yielding a current ratio of almost 3.0.

The company has a nominal amount of long-term debt reported at $101.3 million. What this means is that this company could easily 'write a check' with available cash and pay off ALL short-term and long-term liabilities almost 2x over! We don't get to see this kind of balance sheet too often!

What about some valuation numbers?

According to the Yahoo "Key Statistics" on GPN, the company has a market cap of $3.86 billion, making it a mid cap stock. The trailing p/e isn't bad at 24.12 (from my perspective), with a forward p/e (fye 31-May-10) of only 18.51. With the rapid growth in earnings estimated (and estimates are still moving higher--see above), the PEG works out to a very acceptable 1.22 level.

As I noted earlier, there are 79.66 million shares outstanding and currently (as of 9/10/08) there are 3.61 million shares out short, yielding a short ratio of 5.2 trading days (above my own '3 day rule'). Thus, this is significant imho.

Also as noted, the company pays a small dividend of $.08/share yielding 0.2%. The last stock split was a 2:1 split back on October 31, 2005.

And the Chart?

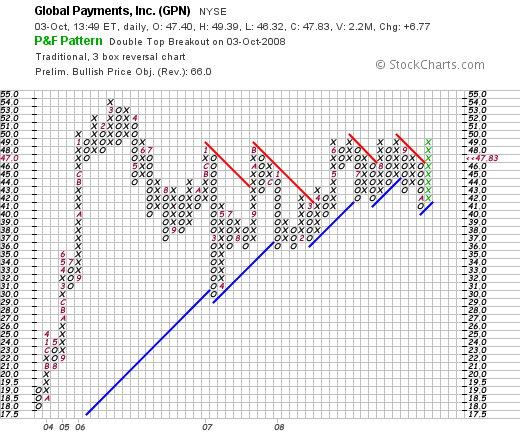

If we look at a 'point & figure' on Global Payments (GPN) from StockCharts.com, we can see that the stock, which moved sharply higher from $18 in September, 2003, to a peak of $54 in March, 2006, dipped down to a low of $29 in March, 2007, and has been 'working hard' to build a slowly increasing base. The company just broke through resistance in its current move higher. It doesn't appear to be over-extended and appears to have some suppport at current levels.

Summary: What do I think?

Well obviously, I liked this stock enough to buy some shares :). But seriously, if it weren't for the terrible volatility in the current market, the uncertainty regarding the success of the 'bailout' and the difficult credit crisis, this stock ought to be flying higher.

The reported a great quarter last night which beat expectations, they raised guidance, and they have a record of steady financial results for the past five years (or more!). Their fundamentals also appear solid with plenty of free cash flow and a great balance sheet.

Their chart appears to be solid, and hopefully ready to move higher. Wish me luck! Of course, like any investment, I shall sell even shares of this great company should they decline (8)%! And I shall start selling on the upside (1/7th of my holding) should the stock instead appreciate and move higher!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page, my SocialPicks page, and my Podcast Page.

Yours in investing,

Bob