Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Satyam (SAY) is what I would have to call an 'old favorite' of mine.

In fact, this is what I had to say about Satyam (SAY) when I blogged about it on December 15, 2005:

"So what do I think? The stock is certainly showing strong fundamental and technical strength with a superb quarterly report which also raised guidance, a solid Morningstar.com "5-Yr Restated" financials, including growing free cash flow and a solid balance sheet. Valuation-wise, the PEG being just a bit over 1.0 is encouraging. However, the Price/Sales appears very rich at 6.1, way ahead of other stocks in the same business."

I was sold on the numbers. And yet were the numbers actually safe to believe?

On April 19, 2008, I "revisited" Satyam on this blog. The 'numbers' once again caught my attention.

This time I wrote:

"The latest quarter was strong and the company raised guidance. The longer-term view is equally impressive with steady revenue growth, earnings growth, and even dividend growth! Outstanding shares have been relatively quite stable and free cash flow is positive. The balance sheet is solid.

Valuation-wise, the company sells at a modest p/e with a great PEG ratio reported. Price/Sales is a bit rich but the company is more profitable than its peers as judged by the Return on Equity and Return on Assets ratios.

Finally, the chart looks satisfactory with the price undergoing a recent period of price consolidation and with the chart on the verge of 'breaking out' assuming the rest of the market holds up.

In other words this is my kind of stock! Now, if only I had been able to hang on to the shares I have owned in the past."

No I do not currently own any shares. In the past, I actually purchased shares in April, 2007, only to sell the same shares in August, 2007, with an (8.15)% loss. I wrote about this trade here.

If you have been following the financial news, you will be aware of what has been called India's Enron. The 'cooking of the books' that has led to the collapse of Satyam stock and the arrest of B. Ramalinga Raju, Satyam's former Chairman and founder and his brother B. Rama Rajku, a co-founder of the company.

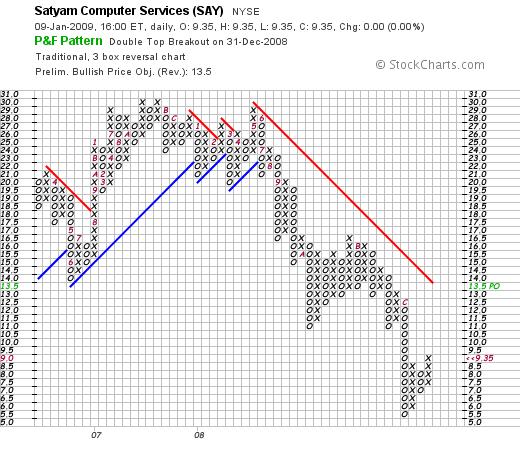

If we examine a 'point & figure' chart on Satyam (SAY), we can see that the breakdown in the stock price actually became apparent in July, 2008. For me, my own discipline of limiting losses saved me from even larger financial damage. This once again shows the potential problems of depending purely on 'value' and ignoring the decline in stock prices that may well be indicating greater problems, either with the equity itself or the market as a whole.

I was fooled along with other investors in Satyam (SAY). I read the basic news from Yahoo, saw the Morningstar reports and like what I read. I even bought shares in the stock and got 'stopped-out' with a loss.

Perhaps the most important lesson is to be aware that there is a leap of faith with every investment we make. That we need to not fall in love with any holding, pull the plug when the stock price deteriorates regardless of the news or numbers, and diversify adequately to protect ourselves from implosions of this sort that may well be totally unexpected.

I continue to learn from every investment and every blog entry that I make. As always, as I write over and over, I must let you know that I am an amateur. Please do check with your professional advisers who may also be unable to know what nobody has the power of knowing---that from time to time there are those who report information that they know is incorrect.

I trust that what I read from the best sources is true and reliable. Reality fails us from time to time in meeting even these basic expectations.

Yours in investing,

Bob

Updated: Friday, 9 January 2009 10:58 PM CST