Stock Picks Bob's Advice

Saturday, 23 April 2005

"Looking Back One Year" A review of stock picks from the week of March 1, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks bob's Advice. l As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do on weekends, I shall try to review my stock picks that I made a bit over a year ago and see how they are currently doing. Unfortunately, last weekend I got caught up in other things and didn't post the review (did anyone notice?), so I am another week behind the trailing year, and am up to the week of March 1, 2004, a little over a year ago. Please note that this review assumes a buy and hold strategy. If you follow my posts, and my explanations, you will know that I do not actually practice that strategy. I like to sell my losing stocks quickly and then sell portions of my gaining stocks slowly as they appreciate. That one difference will certainly affect performance!

On March 2, 2004, I

posted Cantel Medical (CMN) on Stock Picks at a price of $18.40. I also subsequently purchased some shares and currently own some of those shares still! Cantel had a 3:2 stock split on 1/13/05 making my effective "pick price" only $12.27. CMN closed at $26.38 on 4/22/05, for a gain of $14.11 or 115%.

On March 2, 2005, CMN

announced 2nd quarter 2005 results. For the quarter ended January 31, 2005, sales were $49.5 million, up 21% from the sales of $41 million the prior year. Net income was $3.9 million, up 51% from $2.6 million, or on a per share basis, $.24/diluted share, up from $.17/diluted share the prior year. These were great results!

On March 4, 2004, I

posted Isco, Inc. (ISKO) on Stock Picks when it was trading at $12.12. On June 15, 2004, Teledyne (TDY)

announced an acquisition of ISKO at $16.00 cash/share. This would have given us a gain of $3.88/share or 32% from the stock pick price.

Finally, on March 5, 2004, I

posted Nutraceutical (NUTR) on Stock Picks at a price of $19.00. NUTR closed at $15.52 on 4/22/05, for a loss of $(3.48) or (18.3)%.

On December 3, 2004, NUTR

reported 4th quarter 2004 results. Revenue was slightly higher at $36.1 million, compared with $35.3 million the prior year. Net income was flat at $3.3 million in 2004, unchanged from $3.3 million in 2003 for the same quarter. On a per share fully diluted basis, however, this came in at $.28/diluted share in 2004, down from $.29/diluted share in the same quarter in 2003.

So overall, how did I do? Well I had one TERRIFIC stock pick (CMN), one stock that was acquired, and one moderately mediocre :(. Overall, because of Cantel especially, the average performance (averaging the percentage change for each of the three stocks reviewed that week last year), was a gain of 42.9% (!). Not too shabby at all!

Thanks again for stopping by! Remember that I am an amateur investor so please consult with your professional advisors! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 21 April 2005

"Revisiting a Stock Pick" Meridian Bioscience (VIVO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Yesterday, after selling some shares of QSII, my "portfolio management strategy" entitled me to purchase some shares in a new position. Meridian (VIVO) was moving up nicely on an earnings report and I purchased some shares. I promised that I would take another look at this company (I

first posted VIVO on Stock Picks on 4/22/04).

With the market again selling off today, and the Dow closing at 10157.71, down 60.89, and the NASDAQ closing at 1932.19, down 30.22, VIVO didn't follow through with yesterday's price move, but actually held up well, closing at $16.265 today, down $.245 (1.48%) on the day. As I have noted several times, I do have shares of VIVO that I purchased yesterday.

According to the

Yahoo "Profile" on VIVO, Meridian "...is a fully integrated life science company engaged in the development, manufacture, sale and distribution of diagnostic test kits, primarily for certain respiratory, gastrointestinal, viral and parasitic infectious diseases."

What drove the stock higher, and what I use as a key screening factor, is the latest quarterly report. Yesterday, prior to the open of trading, VIVO

reported 2nd quarter 2005 results. For the quarter ended March 31, 2005, net sales increased 13% to $23.7 million, compared with sales of $20.9 million the prior year. Net earnings in the quarter were $3.2 million or $.20/diluted share up 40% from the $2.3 million overall, and up 33% over the $.15/diluted share the prior year. In addition, the company reaffirmed optimistic 2005 results. The stock price responded with the nice price move yesterday, and I bought some shares.

How about "longer-term"? Taking a look at the

"5-Yr Restated" financials on Morningstar.com, we can see that revenue, except for a small dip in 2001, has steadily increased from $57.1 million in 2000 to $80.3 million in the trailing twelve months (TTM).

Earnings have been a bit more erratic, dropping from $.49/share in 2000 to a loss of $(.70) in 2001, but then steadily increasing since to $.62/share in the TTM.

Free cash flow has also improved somewhat and has been consistently positive, growing from $8 million in 2002 to $10 million in the TTM.

The balance sheet looks fine, with $5 million in cash and $33.9 million in other current assets, which is more than enough to cover both the current liabilities of $17.4 million, and the long-term liabilities of $17.4 million combined.

What about "valuation" questions? Taking a look at the

"Key Statistics" on Yahoo for VIVO, first we can see that this is a very small company, a small cap stock, with a market capitalization of only $254.56 million. The trailing p/e isn't bad at 24.31, and the forward p/e (fye 30-Sep-06) is better at 17.87. The PEG (5-Yr estimated) is 1.55, but then again, the latest quarter had a 40% earnings growth, so this would put the PEG well under 1.0 currently.

The Price/Sales ratio is 3.11 on Yahoo. As I have pointed out elsewhere, and as Paul Sturm nicely wrote, the Price/Sales is very industry-specific. That is, value is a function of an industry, and relative value must be determined by comparing a company to its peers. In this particular ratio, VIVO does well, with Price/Sales ratios in the "Diagnostic Substances" ranging from 1.7 for Dade Behring (DADE), to 367.8 for Human Genome Sciences (367.8). Thus VIVO has reasonable relative valuation within its "industry".

Other facts from Yahoo reveal that there are 15.65 million shares outstanding with 11.50 million of them that float. As of 3/8/05, there were 118,000 shares out short representing 2.07 trading days of volume or only 1.03% of the float. This does not look like an issue to me!

Interestingly, VIVO does (!) pay a dividend of $.48/share yielding 2.91% which is really significant in this low interest rate environment. While a dividend is not critical for me, it is just one more perk to consider owning the stock.

Yahoo reports the last stock dividend was declared on 10/3/95, when a 3:2 stock split was paid out.

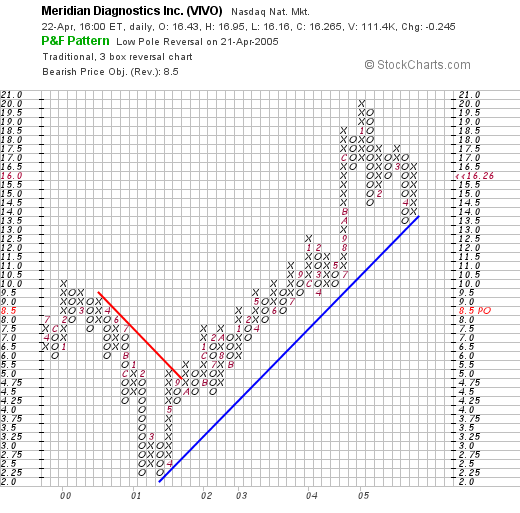

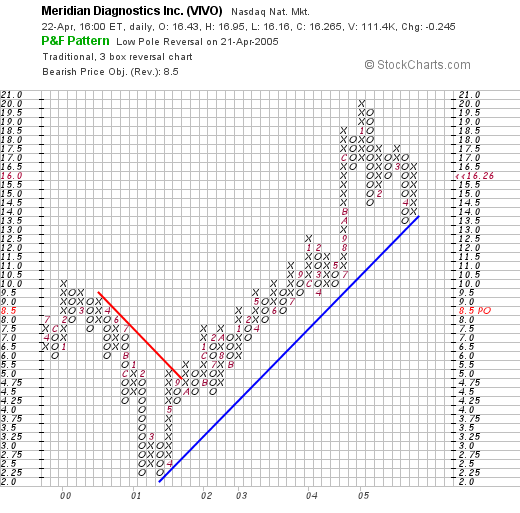

How about "technicals"? How does the chart look? I very much like the

"Point & Figure" chart for VIVO from Stockcharts.com. Here we can see the sell-off in the stock price from $10/share in March, 2000, to a low of $2.25/share (double-bottom) in February-March, 2001. Perhaps pertinently, this coincided with the year that VIVO reported a loss, and the revenue also had a dip!

Since that time, the stock has moved strongly higher, actually for the past four years, selling off a bit from $21, in January of this year, to the $14 level. The stock is now holding the support line and seems positioned well for additional advances. (or am I just expressing wishful thinking?)

Well, what do I think? Well, I like this stock enough to purchase some shares. I actually owned VIVO for a short time last year...but I believe I hit an 8% stop and out I went. The latest quarterly report is great, the revenue growth, except for 2001, is terrific. Earnings likewise. The free cash flow is solid. The balance sheet is nice. Valuation is reasonable within its industry. And the graph looks promising. I guess THAT is why I bought some shares. I mean, the stock even pays a significant dividend!

Thanks again for stopping by! I sure hope my discussion is helpful to you and look forward to your comments and questions! You can reach me by either leaving a comment right here on the blog, or email me at bobsadviceforstocks@lycos.com. Have a great weekend everyone.

And by the way, Happy Earth Day!

Bob

Posted by bobsadviceforstocks at 10:08 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 22 April 2005 6:45 PM CDT

"Trading Transparency" Meridian Biosciences (VIVO)

Hello Friends! That nickel was sure burning a hole in my pocket :). Anyhow, after selling 34 of my shares of QSII at a targeted gain, I was on the look-out for a new stock to invest in. I believe I had a few shares of this one in the past....

As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Anyhow, a few moments ago I purchased 400 shares of Meridian Biosciences (VIVO) in my trading account at a cost of $16.648/share. VIVO, as I write, made the top % gainers, trading currently at $16.62/share, up $2.12 or 14.63% on the day. I first posted VIVO on Stock Picks on 4/22/04 when it was trading at $11.22.

The stock recently had a nice earnings report and...well, I shall just have to take a "revisit" a little later today and give all of you the low-down on this one!

Thanks again for stopping by and visiting my blog,

Stock Picks Bob's Advice. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" QSII

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so PLEASE consult with your professional investment advisors prior to making any investment decisions based on information on this website. I cannot be responsible for any of your losses nor will I take credit and ask for any share of your gains!

One of my stocks in my trading portfolio, Quality Systems (QSII) is having a great day (as is the rest of the market!), and is trading at $52.74, up $3.03 or 6.10% on the day. I was approaching a sell-point on this stock, and earlier, I sold 1/4 of my position of 136 shares (34 shares), at $52.65.

I had purchased these shares 7/28/03 with a cost basis of $15.50/share (!), and thus had a gain of $37.15 or 239.7%. I had previously sold portions of my position on 8/19/03, 8/22/03, 1/21/04, 2/1/05, and 3/4/05. Thus, this was my sixth (!) sale of a 1/4 position, and my sale point goal was 240%. (30%, 60%, 90%, 120%, 180%, and 240%...). My next sale point will be a 300% gain (!), and thereafter at 90% intervals (390%...etc....will I ever get there?).

Anyhow, that nickel is burning a hole in my pocket already :) and I shall be on the lookout for a new position!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 20 April 2005

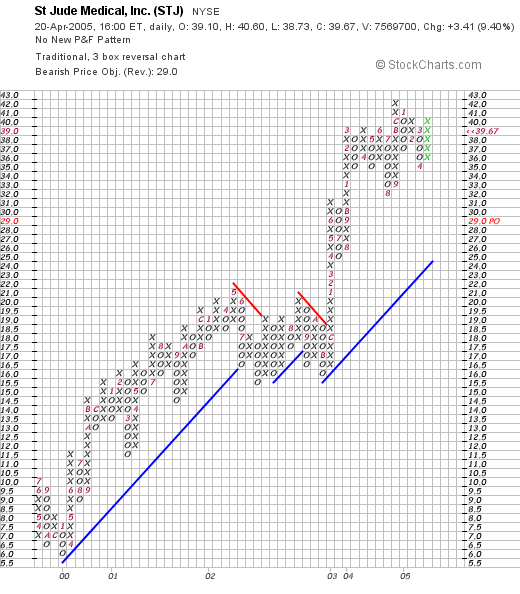

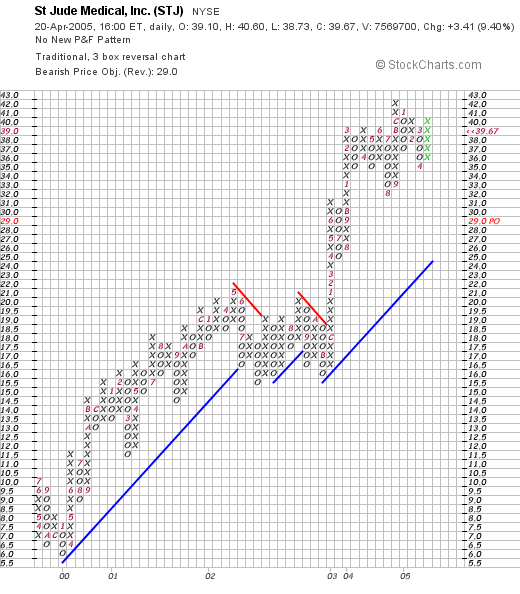

"Revisiting My First (!) Stock Pick" St Jude Medical (STJ)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any decisions based on information on this website! I cannot be responsible for any losses you incur and I shall not try to take any interest in any gains you might accrue.

This website is now almost two years ago. I have literally hundreds of posts on

Stock Picks, and it is often hard just trying to keep up with them! My very

first post on Stock Picks was St Jude (STJ) which I posted at $55.30 on 5/12/03. STJ underwent a 2:1 split on 11/23/04, making my effective "pick price" actually $27.65. I currently own 240 shares of STJ in my

"Trading Portfolio" that I purchased 10/15/03 at a cost basis of $28.90/share.

St Jude Medical (STJ) had a great day in an otherwise lackluster market, closing at $39.67, up $3.41 or 9.40% on the day! What pushed the stock higher today was the

1st quarter 2005 earnings report. STJ reported that sales jumped 21% to $663.9 million from $548.6 million. ($15 million was due to currency exchange effects). Earnings rose to $119.4 million or $.32/share up from $95.2 million, or $.26/share last year. The company also provided positive guidance for the second quarter, with $.35-$.37/share in earnings, ahead of analysts expectations of $.34/share for the upcoming quarter. With a great earnings report, and with raised guidance, the stock bucked the overall downward trend in the market today and moved sharply higher.

By the way, STJ, according to the

Yahoo "Profile" on St Jude, "...develops, manufactures and distributes cardiovascular medical devices for the global cardiac rhythm management (CRM), cardiac surgery (CS), and cardiology and vascular access (C/VA) therapy areas." They make pacemakers, and lately have been very successful marketing implantable cardioverter defibrillator (ICD) systems.

How about longer-term? For this, we can recheck the

Morningstar.com "5-Yr Restated" financials. Here we can see that revenue continues to grow steadily from $1.1 billion in 1999 to $2.2 billion in the trailing twelve months (TTM). Earnings have grown also steadily from $.07/share in 1999 to $1.03/share in the TTM.

Free cash flow has also been improving with $247 million reported in 2001, improving each year to $446 million in the TTM. The balance sheet is solid with $585.2 million in cash and $1.1 billion in other current assets, plenty to cover both the $553.7 million in current liabilities and the $360.2 million in long-term liabilities.

What about "valuation"? For this, I have been turning once again to

Yahoo "Key Statistics".

Here we can see that this is a large cap stock with a market capitalization of $14.32 billion. The trailing p/e is a bit rich at 35.90, but the forward p/e (fye 31-Dec-06) is a bit better at 24.34. The PEG is a bit rich at 1.57, and the Price/Sales is even steeper at 5.71.

As Paul Sturm has

written in SmartMoney.com, the improtance of a Price/Sales ratio is not its absolute value, but instead, the relative value compared to other companies in the same industry. Using my Fidelity account for research, I found that STJ was a bit on the high end at 5.7. However, only Edwards Lifesciences (EW) was significantly lower at 2.7, otherwise, Biomet (BMET) came in at 5.3, Medtronics (MDT) was higher at 6.2, and Zimmer (ZMH)was the steepest in price/sales ratio at 6.4. Thus the 5.7 of STJ is actually in the middle of the "pack" of stocks in this Medical Appliances/equipment industry.

Yahoo also shows that there are 361.06 million shares outstanding, 356.30 million of them floating with 2.76 million shares out short. These short shares represent 0.78% of the float or 1.869 trading days of volume. This doesn't look too significant to me.

No cash dividends are reported, and as I noted earlier on this post, the last stock split was a 2:1 split on 11/23/04.

How about "technicals"? In other words, how does the chart look?

The chart actually looks quite strong with a steady upward move between January, 2000 and June, 2002, when the stock appreciated from $6/share to a peack of $22 in May, 2002. However the stock then consolidated, trading between the $16 and $21 level between May, 2002 and October, 2002, when it once again broke out to the current $39.67 level now. In other words, the chart looks excellent! (imho).

So what do I think overall? Well, I like it enough to own the stock. But seriously, the latest quarter was superb and the company is raising estimates for the upcoming quarter. The past five years have seen an extremely impressive record of consistent earnings and revenue growth, the valuation isn't bad, although it isn't cheap at all, and the chart looks solid! Too bad the rest of the stocks have been so weak :(.

Thanks again for stopping by and visiting. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 18 April 2005

April 18, 2005 Too, Inc. (TOO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. I cannot be responsible for any losses generated by your own trading activity, nor shall I ask for any credit for any gains you may generate!

First of all, I should apologize for not posting my usual "Weekend Review". I shall be doing that next weekend hopefully. This blog is actually approaching the two year point, and I shall have to decide if reviewing stock picks from two years out is something I should be pursuing. Let me know if you have any thoughts on this at bobsadviceforstocks@lycos.com.

This morning, while looking through the

list of top % gainers on the NYSE, I came across Too, Inc. (TOO) which, as I write, is trading at $23.74, up $.95 or 4.17% on the day. I do not have any shares of Too, nor do I own any options or other leveraged positions.

According to the

Yahoo "Profile" on TOO, Too "...is a specialty retailer, operating two divisions that cater to "tween" (ages seven to 14) girls, Limited Too and Justice."

On February 16, 2005,

TOO reported 4th quarter 2004 results. Net sales for the quarter rose 13% to $206.8 million. Net income came in at $23.3 million or $.66/diluted share, up from $17.7 million in the fourth quarter 2003 or $.51/diluted share. Same store sales for the quarter increased 5% compared with a 6% decline in same store sales the prior year. In addition, the company provided optimistic guidance for the upcoming first quarter 2005 results, with earnings estimated at $.27/share, which would be a 42% increase over the prior year's results. The company also announced expected comparable store sales increases in the low to mid-single digit range for spring 2005.

How about longer-term results? Taking a look at the

"5-Yr Restated" financials on Morningstar.com for TOO, we can see that revenue growth has been steady, except for what I would call a "hiccup" in 2004, increasing from $450.4 million in 2000 to $651.8 million in the trailing twelve months (TTM).

Earnings also took a hit in 2004, increasing from $1.02/share in 2001 to a peack of $1.38/share in 2003 before dipping to $.65/share in 2004 and increasing now to $1.03/share in the TTM.

Free cash flow has improved smartly the past few years. Per Morningstar, free cash flow was $5 million in 2002, and increased yearly to the $52 million reported in the TTM.

The balance sheet is solid with $135.9 million in cash, more than enough to cover botht the $101.2 million in current liabilities and the $14.2 million in long-term debt combined. In addition, TOO has $112.7 million in other current assets.

How about "valuation"? Reviewing

"Key Statistics" on Yahoo for TOO, we can see that this company is a mid cap stock with a market capitalization of $827.06 million.

The trailing p/e is a bit rich at 42.50, but the company is growing so quickly that the forward p/e (fye 31-Jan-06) is downright cheap at 14.36. Thus, the "5 yr expected" PEG is 0.91, with imho anything under 1.0 being a great buy.

How about "Price/Sales" ratios? TOO comes in at 1.30. According to my

Fidelity Brokerage"research", the average P/S ratio for the industry is 1.06, making TOO a bit pricey. Some of the other competitors include ANF with a P/S of 2.4, AEOS at 2.1, PSUN at 1.5, and GPS at 1.1 and ANN at 0.9. Note that the faster growing companies, as expected, have a bit higher Price/Sales ratios and TOO doesn't come in too badly at all!

Yahoo reports 34.69 million shares outstanding with 34.60 million of them that float. Of these, there were 1.70 million shares out short as of 3/8/05, representing 4.92% of the float or 2.979 trading days of volume. With my "3 day cutoff" of short interest, this doesn't look too significant to me.

There are no cash dividends nor stock splits reported on Yahoo.

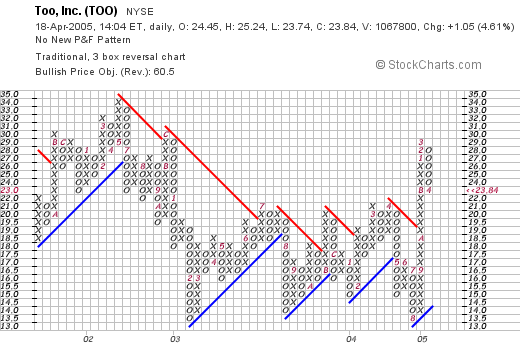

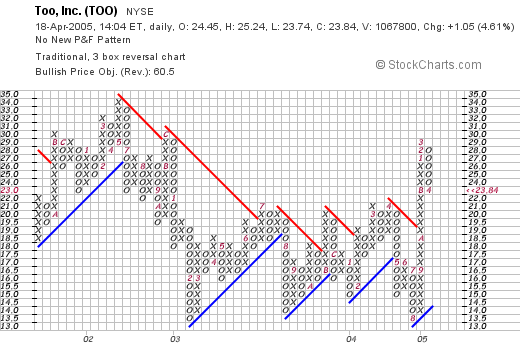

How about the chart? What do the "technicals" look like? Taking a look at a

TOO "Point & Figure Chart" from Stockcharts.com":

we can see that this stock actually peaked arount $34 in May, 2002, and has traded lower since then to a low of $13.50 in August, 2004. The stock has moved higher since, breaking through a resistance level (the red line moving lower at a 45 degree angle), and is now trading higher at the $24 range. The chart looks encouraging, certainly not over-extended, but not the strongest stock I have reviewed on this website!

So what do I think? Well, I think this company hit a weak spot in 2004, and the price of the stock suffered. However, the latest quarter was strong, same store sales growth have been steady, the last five years have overall been positive. Free cash flow is growing. The balance sheet is beautiful and valuation is reasonable with a PEG under 1.0. Overall I like this stock!

Now, if I just had some cash or at least a signal to buy shares...hmmmm. Anyhow, thanks so much for stopping by and visiting! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com. Remember that I AM truly an amateur, so please do your own investigations on all stocks discussed!

Bob

Friday, 15 April 2005

A Reader Writes 'How about an update on Mentor?'

Hello Friends! We sure had another downdraft today, with the Dow down 191.24 at 10087.51, and the NASDAQ down 38.56 at 1908.15! Anyway, thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I checked my email earlier and found that I had a nice letter from Brooks R. who wrote:

Hi Bob,

How about an update on this stock which had a huge gap up today?

> From reading the news and analyst comments, it sounds like the big jump,

which was fueled by the advisory panel approval of its implant product, may

not be approved by the full FDA. It also pointed out that the approval may

not have made sense when a similar product, slightly less dangerous, was

disapproved the same week.

Would be interested in your take on this.

Thank you.

Brooks

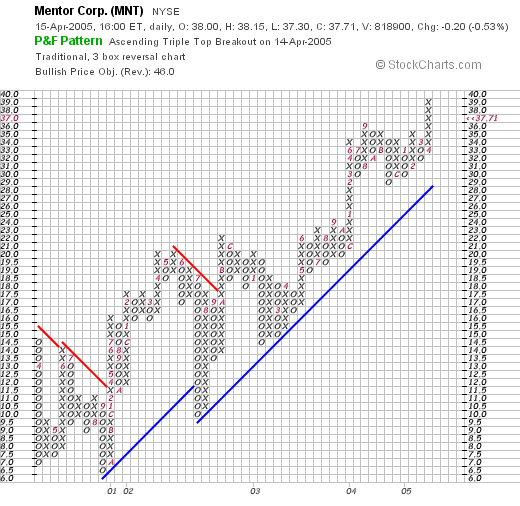

Brooks is referring to the

news on Mentor that the FDA advisory panel gave a positive recommendation that Mentor's breast implants be approved for sale. However the FDA itself must decide about final approval. As this article reports, this approval could add $62 million to Mentor's revenue next year and could increase earnings from $1.79/share to $2.05/share. As Brooks notes, the stock responded strongly to the news and gapped higher by several points.

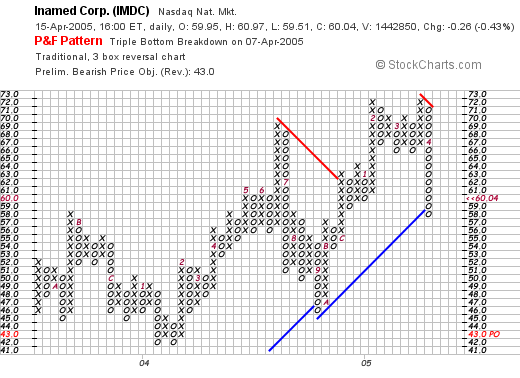

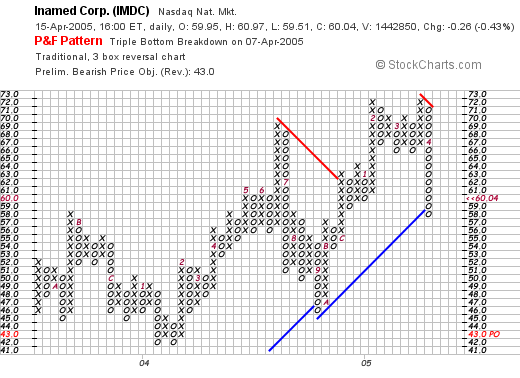

Inamed, however, another manufacturer of breast implants,

failed to get approval to bring them back to market just a day earlier.

We can see from the chart, that Inamed (IMDC) has sold off sharply since the FDA announcement:

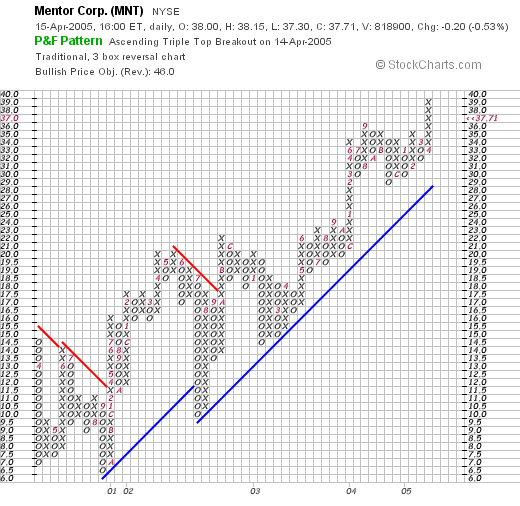

while Mentor (MNT) has continued its steady price appreciation that actually dates back to September, 2001

As you probably know, I have shares of Mentor in my "Trading Portfolio" and wrote up Mentor August 3, 2004, prior to my own purchase. I didn't write it up based on what the FDA might or might not due, but instead on a solid "5-Yr Restated" financials from Morningstar.com. On Morningstar, we can see the steady revenue growth the past five years, the fairly steady growth in earnings, the solid free cash flow, and the strong balance sheet. These were the factors that led me to write up MNT, and encouraged me to purchase some shares.

I agree that there is a high chance of disappointment with the FDA's potential to disapprove of MNT breast implants. This would be very negative for the stock, but not probably totally damaging (?). My own investment decisions on this and my other stocks will be based either on fundamental disappointments like actual earnings problems, or technical issues, like the stock dropping 8% after a purchase. Otherwise, I tend to go with the flow...:).

I hope that is helpful to you in your own evaluation of this and other stocks! If you or anyone else have additional questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 13 April 2005

April 13, 2005 LoJack (LOJN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It wasn't a very good day in the market today. Yesterday, we saw a big swing from negative to positive territory and today things stayed weak with the Dow down about 1% and the NASDAQ down about 1.5%. However, it is still possible to look at stocks and find candidates for investment.

For any of you who might be new to my strategy, my first place in identifying a possible investment candidate is to scan the

list of top % gainers on the NASDAQ. I prefer to stay with stocks over $10, and LoJack (LOJN) came to my attention. I do NOT own any shares of LOJN nor do I have any options.

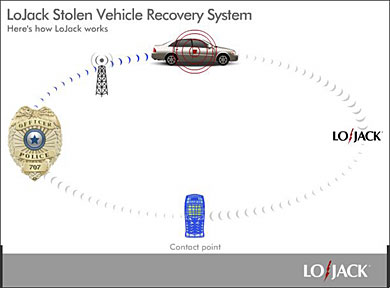

LOJN closed at $13.94, up $.94 or 7.23% on the day. According to the

Yahoo "Profile" on LOJN, LoJack "...is a provider of technology products and services for tracking and recovering mobile assets." LoJack is used to recover cars that have been stolen, in other words :).

My next step in reviewing a stock is to check the latest quarterly report. I am looking for increasing revenue AND earnings. On March 3, 2005, LOJN

reported 4th quarter 2004 results. Revenue for the quarter ended December 31, 2004, increased by 20% to $39.6 million compared to $33.0 million the prior year. Net income jumped by 26% to $3.1 million or $.18/diluted share, up from net income of $2.5 million or $.16/diluted share for the same quarter the prior year.

How about "longer-term"? In other words, is this just an atypical quarter, or has this company demonstrated consistent performance the past five years?

For this examination, I have been using Morningstar.com and in particular, the

"5-Yr Restated" financial statement on Morningstar. Here we can see that revenue growth has been steady, increasing from $83 million in 1999 to $139 million in the trailing twelve months (TTM).

Earnings, however, have NOT been as consistent, dropping from $.57/share in 1999 to $.12/share in 2002, before turning around and increasing steadily to $.62/share in the trailing twelve months.

Next thing I like to examine is "free cash flow", which again is on the same Morningstar page. Here we can see positive $8 million dropping to a negative $(1) million in 2002, but increasing to $6 million in the TTM.

The balance sheet, right under the free cash flow section shows $13.1 million in cash and $47.4 million in other current assets, plenty to cover both the $24 million in current liabilities and the $17.7 million in long-term liabilities combined...with assets left over. This looks just fine with current assets handily exceeding current liabilities.

What about "valuation"? Looking at

"Key Statistics" from Yahoo, we can see that this is a small cap stock with a market capitalization of only $231.9 million. The trailing p/e isn't bad at 21.95, and the forward p/e (fye 31-Dec-06) is nicer at 15.66. There is no calculated PEG.

The Price/Sales ratio is 1.48. Using the

Paul Sturm approach to Price/Sales ratios, and utilizing my

Fidelity.com research to get competitor P/S ratios, Fidelity has LoJack with a Price/Sales ratio of 1.5. This is comparable to a P/S ratio of 1.3 with Armor Holdings, 0.9 for Checkpoint Systems, 0.4 at Brink's, 0.4 at Compudyne and 1.5 for Integrated Alarm Svcs. Thus, it is not the cheapest in the group!

LOJN has 16.59 million shares outstanding with 16.10 million of them that "float". Currently there are 81,000 shares out short representing 0.50% of the float or only 0.587 trading days of volume as of 3/8/05. This is not much of a factor imho.

Yahoo does not show any cash dividend and no stock dividends are reported either.

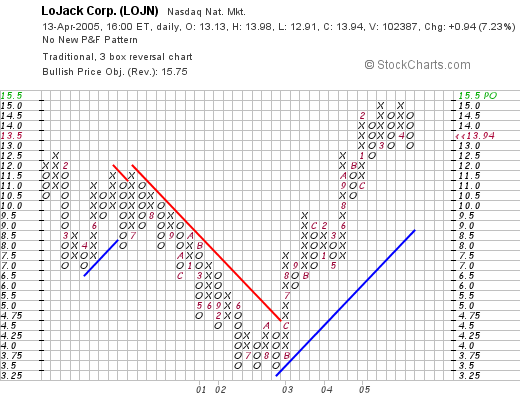

What about "technicals"? That is, how does the price chart look? For my reviews, I like to look at

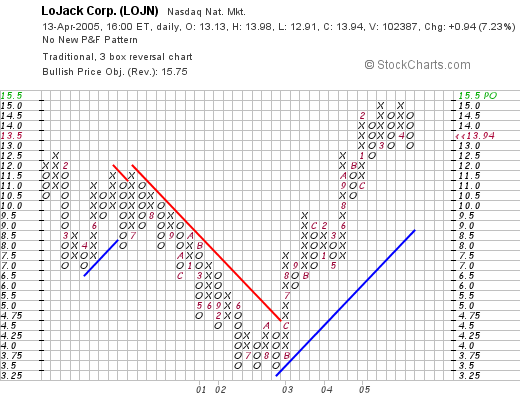

"Point & Figure" charts which I believe help show the overall forces both bullish and bearish driving a stock price. For LOJN, the

Stockcharts.com Point & Figure chart shows a weak stock price between June, 2000, when the stock was trading at $12.00/share until August, 2002, when the stock had declined all of the way to $3.50/share and actually appears to have hit this level three times (a "triple bottom"), and the stock subsequently recovered throughout 2003 and 2004 until its current price, closing just under $14/share.

So what do I think? Well actually, I think the stock is very interesting. I am not in the market to purchase any shares, but I am always on the "look-out" for interesting candidates so that when I am "eligible" to buy, I may recognize a stock that I have reviewed previously.

In summary, the stock made a nice move higher today in a very weak market. The last quarter was solid, the last five years has seen steady revenue growth. Earnings have been more erratic, but have been moving higher the last few years. The company is generating free cash and the balance sheet looks nice. Valuation issues look fine, however, in its group of security companies, this stock is a relatively pricey pick among its peers. Finally, the chart looks solid for the last few years. In fact, if I were buying a stock, well it might just be this one!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to leave your messages right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 11 April 2005

Paul Sturm: Nice Article on Price/Sales ratio

One of my favorite financial writers is Paul Sturm. He

wrote recently about the importance of revenue growth and price/sales ratios in determining relative valuation of a stock.

He points out how earnings can be manipulated in reporting a stock's results, but in general, it is more difficult to manipulate revenue numbers (but not unheard of!). Also, surprises on revenue numbers on the upside are important factors in a stock's price performance.

I shall have to look harder at those Price/Sales figures and work on getting some industry numbers for each stock. Meanwhile, read Paul's article and enjoy!

Bob

Sunday, 10 April 2005

"Looking Back One Year" A review of stock picks from the week of February 23, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. I cannot be responsible for any losses generated by your trading and shall not ask for any credit!

If you are new to this website, I am happy to welcome you and hope that you enjoy your visit. My blog performs two functions: looking at a variety of stock investment possibilities, and then actually building a real portfolio and following along with those investments. I do not buy every stock that I review, in fact, I currently own 20 stocks in my

"Trading Portfolio". This is a real investment portfolio and I try very hard to update my trading activity on this blog as events happen. However, at the same time I have reviewed literally hundreds of stocks since starting this blog almost two years ago. I also have a Xanga account which acts as a "mirror" site, but offers Xanga readers what I consider a more personalized website.

In order to determine how well the multitude of stock picks turned out, I use the weekend, when I get a chance, to review past stock picks with about a trailing one year period. Last weekend I reviewed stock picks from the week of February 16, 2004. This week, I shall be looking at picks from the week of February 23, 2004. Besides looking at the price performance, I also like to look at the latest quarterly result, which I believe gives us a good idea whether the stock is still a good investment at least from my perspective. If both revenue and earnings are positive, I give the stock a "thumbs-up", otherwise down goes the thumb!

By the way, this analysis, as I have pointed out previously, assumes a buy and hold strategy that I do NOT employ in practice. I practice selling my losing stocks quickly and then selling portions of my gaining stocks slowly at pre-determined sale points. That certainly would affect the performance of any portfolio that I actually owned!

On February 23, 2004, I

posted Escalon Medical (ESMC) on Stock Picks at $10.60. ESMC closed on 4/8/05 at $5.22, for a loss of $(5.38) or (50.8)%.

On February 14, 2005, ESMC

reported 2nd quarter 2005 results. For the quarter ended December 31, 2004, net revenue came in at $6.3 million, compared with $3.8 million the prior year. However, the company reported a net loss of $(422,625) or $(.072)/diluted share compared with net income of $820,961 or $.196/diluted share in the second quarter of 2004.

I

posted Mannatech (MTEX) on Stock Picks on February 24, 2004, at a price of $9.98. MTEX closed at $20.29 on 4/8/05, for a gain of $10.31 or 103%.

On March 9, 2005,

MTEX announced 4th quarter 2004 results. Net sales for the fourth quarter came in at $84.2 million, a 55.1% increase over the $29.9 million last year. Net income was $4.0 million or $.15/diluted share, a 21.9% increase over the fourth quarter of 2003.

On February 25, 2004, I

picked Lipman Electronic Engineering (LPMA) for Stock Picks at a price of $44.98. LPMA had a 2:1 split on 7/2/04, giving us an effective stock pick price of $22.49. LPMA closed at $29.12 on 4/8/05, for a gain of $6.63 or 29.5%.

On January 31, 2005, LPMA

reported 4th quarter 2004 results. Revenue grew strongly by 78% to $65.7 million from $36.9 million last year. However, while net income grew to $9.7 million from $9.6 million last year, due to an increased number of shares, this worked out to $.35/share down from $.44/share last year.

On February 27, 2004, I

posted ShuffleMaster (SHFL) on Stock Picks at a price of $41.45. SHFL has had two 3:2 splits since (4/04 and 1/05) and thus, the effective stock pick price works out to $18.42. SHFL closed at $28.15 on 4/8/05, for a gain of $9.73 or 52.8%.

On March 3, 2005, SHFL

reported 1st quarter 2005 results which were quite good! Revenue increased 63% to $25.4 million and diluted earnings per share increased 55% to $.17/share.

So how did I "do" for picking stock picks for that week in February, 2004? Well, actually quite well for these four selections. I had one big loser (ESMC) and four very strong gainers. Thus, the average percentage gain that week was 33.6%.

Thanks so much for stopping by! I hope that you have a very good week and that you visit here often. I enjoy hearing from readers and if you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com or just go ahead and leave your comments right here in the blog!

Bob

Newer | Latest | Older

On March 2, 2004, I posted Cantel Medical (CMN) on Stock Picks at a price of $18.40. I also subsequently purchased some shares and currently own some of those shares still! Cantel had a 3:2 stock split on 1/13/05 making my effective "pick price" only $12.27. CMN closed at $26.38 on 4/22/05, for a gain of $14.11 or 115%.

On March 2, 2004, I posted Cantel Medical (CMN) on Stock Picks at a price of $18.40. I also subsequently purchased some shares and currently own some of those shares still! Cantel had a 3:2 stock split on 1/13/05 making my effective "pick price" only $12.27. CMN closed at $26.38 on 4/22/05, for a gain of $14.11 or 115%. On March 2, 2005, CMN announced 2nd quarter 2005 results. For the quarter ended January 31, 2005, sales were $49.5 million, up 21% from the sales of $41 million the prior year. Net income was $3.9 million, up 51% from $2.6 million, or on a per share basis, $.24/diluted share, up from $.17/diluted share the prior year. These were great results!

On March 2, 2005, CMN announced 2nd quarter 2005 results. For the quarter ended January 31, 2005, sales were $49.5 million, up 21% from the sales of $41 million the prior year. Net income was $3.9 million, up 51% from $2.6 million, or on a per share basis, $.24/diluted share, up from $.17/diluted share the prior year. These were great results! On March 4, 2004, I posted Isco, Inc. (ISKO) on Stock Picks when it was trading at $12.12. On June 15, 2004, Teledyne (TDY) announced an acquisition of ISKO at $16.00 cash/share. This would have given us a gain of $3.88/share or 32% from the stock pick price.

On March 4, 2004, I posted Isco, Inc. (ISKO) on Stock Picks when it was trading at $12.12. On June 15, 2004, Teledyne (TDY) announced an acquisition of ISKO at $16.00 cash/share. This would have given us a gain of $3.88/share or 32% from the stock pick price.  Finally, on March 5, 2004, I posted Nutraceutical (NUTR) on Stock Picks at a price of $19.00. NUTR closed at $15.52 on 4/22/05, for a loss of $(3.48) or (18.3)%.

Finally, on March 5, 2004, I posted Nutraceutical (NUTR) on Stock Picks at a price of $19.00. NUTR closed at $15.52 on 4/22/05, for a loss of $(3.48) or (18.3)%.  On December 3, 2004, NUTR reported 4th quarter 2004 results. Revenue was slightly higher at $36.1 million, compared with $35.3 million the prior year. Net income was flat at $3.3 million in 2004, unchanged from $3.3 million in 2003 for the same quarter. On a per share fully diluted basis, however, this came in at $.28/diluted share in 2004, down from $.29/diluted share in the same quarter in 2003.

On December 3, 2004, NUTR reported 4th quarter 2004 results. Revenue was slightly higher at $36.1 million, compared with $35.3 million the prior year. Net income was flat at $3.3 million in 2004, unchanged from $3.3 million in 2003 for the same quarter. On a per share fully diluted basis, however, this came in at $.28/diluted share in 2004, down from $.29/diluted share in the same quarter in 2003.

Yesterday, after selling some shares of QSII, my "portfolio management strategy" entitled me to purchase some shares in a new position. Meridian (VIVO) was moving up nicely on an earnings report and I purchased some shares. I promised that I would take another look at this company (I

Yesterday, after selling some shares of QSII, my "portfolio management strategy" entitled me to purchase some shares in a new position. Meridian (VIVO) was moving up nicely on an earnings report and I purchased some shares. I promised that I would take another look at this company (I  With the market again selling off today, and the Dow closing at 10157.71, down 60.89, and the NASDAQ closing at 1932.19, down 30.22, VIVO didn't follow through with yesterday's price move, but actually held up well, closing at $16.265 today, down $.245 (1.48%) on the day. As I have noted several times, I do have shares of VIVO that I purchased yesterday.

With the market again selling off today, and the Dow closing at 10157.71, down 60.89, and the NASDAQ closing at 1932.19, down 30.22, VIVO didn't follow through with yesterday's price move, but actually held up well, closing at $16.265 today, down $.245 (1.48%) on the day. As I have noted several times, I do have shares of VIVO that I purchased yesterday. How about "longer-term"? Taking a look at the

How about "longer-term"? Taking a look at the  What about "valuation" questions? Taking a look at the

What about "valuation" questions? Taking a look at the

St Jude Medical (STJ) had a great day in an otherwise lackluster market, closing at $39.67, up $3.41 or 9.40% on the day! What pushed the stock higher today was the

St Jude Medical (STJ) had a great day in an otherwise lackluster market, closing at $39.67, up $3.41 or 9.40% on the day! What pushed the stock higher today was the  By the way, STJ, according to the

By the way, STJ, according to the  What about "valuation"? For this, I have been turning once again to

What about "valuation"? For this, I have been turning once again to  Yahoo also shows that there are 361.06 million shares outstanding, 356.30 million of them floating with 2.76 million shares out short. These short shares represent 0.78% of the float or 1.869 trading days of volume. This doesn't look too significant to me.

Yahoo also shows that there are 361.06 million shares outstanding, 356.30 million of them floating with 2.76 million shares out short. These short shares represent 0.78% of the float or 1.869 trading days of volume. This doesn't look too significant to me.

First of all, I should apologize for not posting my usual "Weekend Review". I shall be doing that next weekend hopefully. This blog is actually approaching the two year point, and I shall have to decide if reviewing stock picks from two years out is something I should be pursuing. Let me know if you have any thoughts on this at bobsadviceforstocks@lycos.com.

First of all, I should apologize for not posting my usual "Weekend Review". I shall be doing that next weekend hopefully. This blog is actually approaching the two year point, and I shall have to decide if reviewing stock picks from two years out is something I should be pursuing. Let me know if you have any thoughts on this at bobsadviceforstocks@lycos.com. According to the

According to the  How about "valuation"? Reviewing

How about "valuation"? Reviewing

For any of you who might be new to my strategy, my first place in identifying a possible investment candidate is to scan the

For any of you who might be new to my strategy, my first place in identifying a possible investment candidate is to scan the  LOJN closed at $13.94, up $.94 or 7.23% on the day. According to the

LOJN closed at $13.94, up $.94 or 7.23% on the day. According to the  Earnings, however, have NOT been as consistent, dropping from $.57/share in 1999 to $.12/share in 2002, before turning around and increasing steadily to $.62/share in the trailing twelve months.

Earnings, however, have NOT been as consistent, dropping from $.57/share in 1999 to $.12/share in 2002, before turning around and increasing steadily to $.62/share in the trailing twelve months. The Price/Sales ratio is 1.48. Using the

The Price/Sales ratio is 1.48. Using the

On February 23, 2004, I

On February 23, 2004, I  I

I  On February 25, 2004, I

On February 25, 2004, I  On February 27, 2004, I

On February 27, 2004, I