Stock Picks Bob's Advice

Friday, 8 April 2005

April 8, 2005 The Buckle, Inc. (BKE)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market is correcting a bit today, but that doesn't mean we can't be looking for interesting stock investment ideas! Scanning the

list of top % gainers on the NYSE today, I came across "The Buckle", BKE, which as I write, is trading at $35.60, up $1.10 or 3.19% on the day. I do not own any shares of BKE nor do I own any options.

According to the

Yahoo "Profile" on BKE, The Buckle is "...a retailer of medium to better-priced casual apparel, footwear and accessories for fashion conscious young men and women."

What is helping the stock rise today, in the face of an overall weak equity trading day, was a

story released yesterday that same store sales had jumped 8% for the month of March. Overall sales increased 13.3% to $43.2 million from $38.1 million the prior year.

On March 3, 2005, BKE

reported 4th quarter 2004 results. Net sales for the fourt quarter ended January 29, 2005, jumped 8.6% to $145.6 million from $134.1 million the prior year. On a comparable store net sales basis this came in at a 3.7% increase for the period. Net income for the quarter was $17.1 million or $.79/share, up from $15.0 million or $.71/share.

Longer-term, looking at the

Morningstar.com "5-Yr Restated" financials, we can see a steady ramp-up of revenue growth from $375.5 million in 2000 to the $459.4 million in the trailing twelve months (TTM).

Earnings have been more erratic, dropping from $1.64/share in 2000 to $1.47/share in 2003, but increasing strongly since that time.

Free cash flow is solidly positive varying from $33 million in 2002 to $47 million in the trailing twelve months (TTM).

The balance sheet also looks nice with $150.1 million in cash, more than enough to pay off the $44.8 million in current liabilities as well as the $3.2 million in long-term liabilities, more than three times over! In addition, Morningstar reports that BKE has $102.6 million in other current assets.

What about "valuation"? Looking at

"Key Statistics" on BKE from Yahoo, we can see that this is a mid-cap stock with a market capitalization of $762.93 million. The trailing p/e is a moderate 24.75, with a more reasonable forward (fye 31-Jan-06) of 13.68. Yahoo has the peg (5 yr expected) at 1.34. Price/sales is moderate at 1.77.

Yahoo shows that there are 21.62 million shares outstanding with 8.60 million of them that float. Of these, 110,000 shares were out "short" as of 3/8/05. This represented 1.28% of the float, or 5.5 trading days of volume.

The Buckle pays a dividend, with $.48/share reported in Yahoo, yielding 1.39%. The last stock split was a 3:2 split reported in June, 1998.

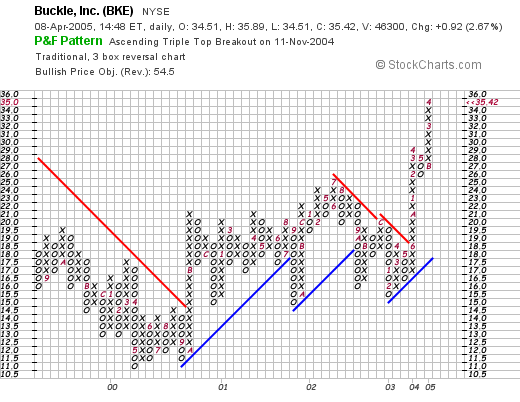

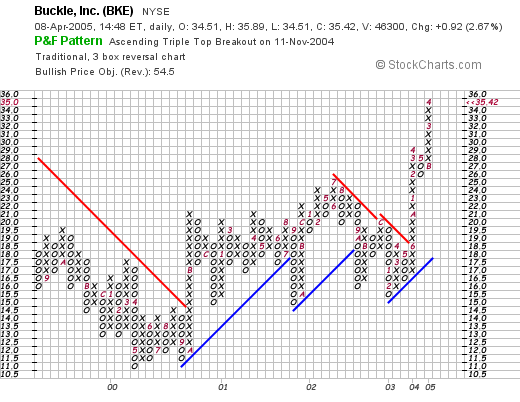

If we take a look at a chart, especially the

Stockcharts.com "Point & Figure" chart on BKE, we can see that this stock was trading lower from $19.50 in October, 2000, to a low at $11.00 in May, 2000. Since then it has been steadily higher, making a sharp break towards the upside in June, 2003. The chart looks strong if a bit over-extended over the short-term.

So what do I think? Well, I like this stock for the following reasons: retail sales are strong with same store sales the latest month showing even stronger growth than the last quarter's rate, earnings were positive along with earnings the latest quarter as well as for the past five years. Free cash flow is positive, the balance sheet is beautiful with loads of cash and very low liabilities, the valuation is reasonable and the chart looks encouraging.

As always, I am sitting on my hands, as I am waiting for one of my stocks to hit a sale point at a gain. I am fairly close with AMHC, but waiting until it actually hits its sale target!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me with your thoughts at bobsadviceforstocks@lycos.com. Hope you all have a wonderful weekend!

Bob

Thursday, 7 April 2005

April 7, 2005 Bed Bath & Beyond (BBBY)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. I cannot be responsible for any losses generated by your trading activity nor can I make any claim for any gains you generate trading stocks and investments!

I managed to scan the

list of top % gainers on the NASDAQ today, and came across Bed Bath & Beyond (BBBY). BBBY had a great day, closing at $40.80, up $4.06 or 11.05% on the day. I do not own any shares or options on this stock. In fact, I had to go through my list of

2003 Stock Picks,

2004 Stock Picks, and

2005 Stock Picks, because I was almost certain that I had reviewed this one before!

According to the

Yahoo "Profile" on BBBY, Bed Bath and Beyond "...operates specialty retail stores in the United States, including Bed Bath & Beyond stores (BBB), Harmon stores and Christmas Tree Shops stores (CTS)."

What drove the stock nicely higher today was a "better-than expected"

4th quarter 2004 earnings report. For the final quarter of 2004, sales increased 13.1% to $1.47 billion from $1.3 billion in the fourth quarter of 2003. Same-store-sales growth came in at 5.1% for stores open at least a year. Net income came in at $181 million or $.59/share up from $144.2 million or $.47/share last year. According to this report, analysts surveyed by Thomson Financial were "looking for the company to post earnings of $.55/share on sales of $1.45 billion.

Taking a look at the

Morningstar.com "5-Yr Restated" financials, we can see a beautiful ramp-up of revenue from $1.9 billion in 2000 to $5.0 billion in the trailing twelve months (TTM).

Earnings during this period have a perfect growth record with $.46/share reported in 2000, increasing to $1.53 in the TTM.

Free cash flow has also been solid with $216 million in 2002, increasing to $417 million in the TTM.

The balance sheet is also very nice with $968.8 million in cash, enough to almost cover both the $885.0 million in current liabilities and the $114.8 million in long-term liabilities combined. Besides the cash, Morningstar.com reports $1.3 billion in other current assets!

What about "valuation" questions? Taking a look at the

Yahoo "Key Statistics", we can see that this is a large cap stock with a market capitalization of $12.35 Billion. The trailing p/e is a moderate 24.76 with a forward p/e (fye 26-Feb-07) of 18.38, and thus a 5-yr estimated PEG of 0.86. Price/sales is moderate at 2.23.

Yahoo reports 302.61 million shares outstanding with 300.80 million of them that float. There were 6.00 million shares out short as of 3/8/05, representing only 1.99% of the float or 2.078 trading days of volume. No cash dividend is paid and the last stock split reported on Yahoo was a 2:1 split 8/14/00.

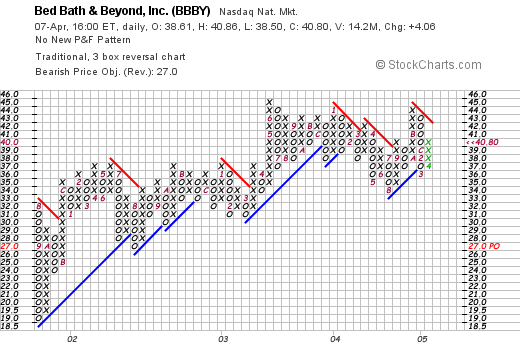

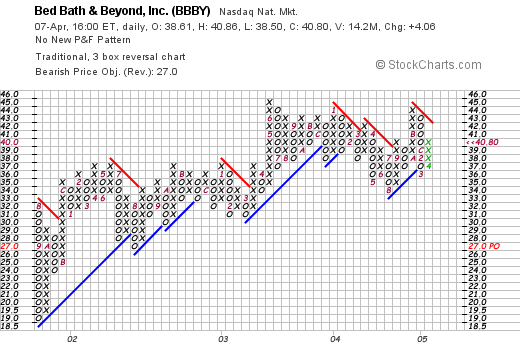

What does the price chart look like? How are the "technicals" on BBBY? Looking at a

"Point & Figure" chart from Stockcharts.com on BBBY, we can see that this stock has been showing modest price appreciation since trading at around $19.0 in September of 2001. The stock has hit resistance at the $45 level since hitting it in June, 2003, again in January, 2004, and again in October 2004. I don't think the stock price movement has gotten too far ahead of itself, but would like to see the price break above $45, which it coule do in the next couple of trading sessions.

So what do I think about all of this? Well, actually, I like this stock a lot. The latest quarter result was solid, with 5.1% same store sales growth as well. The past five years show a perfect record of increasing revenue and earnings growth. The company is spinning off 'gobs' of free cash flow contributing to a solid balance sheet. The valuation issues are reasonable and the graph looks adequate, appearing to have been consolidating in price for about a year now.

So what do I think about all of this? Well, actually, I like this stock a lot. The latest quarter result was solid, with 5.1% same store sales growth as well. The past five years show a perfect record of increasing revenue and earnings growth. The company is spinning off 'gobs' of free cash flow contributing to a solid balance sheet. The valuation issues are reasonable and the graph looks adequate, appearing to have been consolidating in price for about a year now.

If I had some money, and was going to purchase some stock, this one would be near the top of my list today. As you know, I wait for a buy signal generated by my own portfolio before jumping in! So I shall be sitting on my hands for now. Thanks so much again for stopping by and visiting. Please feel free to leave comments right here on my blog, or if you have any questions or comments, and would like to write, you can email me at bobsadviceforstocks@lycos.com!

Bob

Tuesday, 5 April 2005

"Trading Transparency" EXAC

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the stocks I have been watching has been Exactech (EXAC), an orthopedics device manufacturer that overall, has been a good performer for me in my portfolio. Today, EXAC

announced lower guidance for profit/revenues for the 1st quarter, and the stock took it 'on the chin', currently rebounding slightly at $15.39, down $(1.70) or (9.95)% on the day.

I had 135 shares remaining of EXAC with a cost basis of $10.78 acquired over two years ago on 1/2/03. I just sold my remaining shares a few moments ago at $15.331, for a gain of $4.551 or 42.2%. Since I had sold this stock three times previously on gains (!), at 30, 60, and 90% levels, crossing the 45% gain point on the downside triggered (manually) a sale point for me and out the shares went.

Unfortunately, I shall now be sitting on my hands once again, not replacing this stock, until such time as I sell a portion of an existing position at a gain! Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

April 5, 2005 Greif Inc. Cl. A (GEF)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. Use of this website implies your understanding that I cannot be responsible for any losses generated by your own trading activity and I shall not ask for any part of any profits that you might accrue.

Yesterday, I purchased some shares of Greif (GEF), and I wanted to go over the numbers and the information that I found on review of this company and why I thought it made a nice addition to my portfolio. Yesterday, GEF made the

list of top % gainers on the NYSE, and thus was in my list of stocks to consider purchasing in light of my recent sale of a portion of Cantel (CMN) and Ventana (VMSI) at gain targets.

Currently, as I am writing, GEF is trading at $74.06/share, up $.41 or .56% on the day today.

According to the

Yahoo "Profile" on GEF, Greif "...is a global producer of industrial packaging products with manufacturing facilities located in over 40 countries. The Company offers a line of industrial packaging products, such as steel, fiber and plastic drums; intermediate bulk containers, closure systems for industrial packaging products and polycarbonate water bottles, which are complemented by a variety of value-added services."

On March 2, 2005, Greif

reported 1st quarter 2005 results. Net sales for the quarter rose 24% to $582.6 million for the first quarter of 2005, up from $468.9 million for the same quarter last year. Net income was $15.1 million this year compared with a loss of $(3.4) million last year. Diluted earnings per share came in at $.52/share compared to a loss of $(.12)/share last year.

How about longer-term? Looking at the

Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown from $1.0 billion in 2000 to $2.3 billion in the trailing twelve months (TTM). Earnings have been more erratic, increasing to

$3.14/share in 2001, then dropping to $.34/share in 2003, but increasing since then to $2.30/share in the TTM.

Free cash flow has been solid, increasing from $90 million in 2002 to $175 million in the TTM.

The balance sheet is adequate if not overpowering. That is, cash of $56.1 million, combined with the $550.2 million in other current assets, is plenty to cover the $384 million in current liabilities and make a bit of a dent in the $761.2 million in long-term debt. I always prefer a bit more in the assets than liabilities.

What about "valuation"? Looking at

Yahoo "Key Statistics" on GEF, we can see that this is larger mid-cap stock with a market capitalization of $1.69 billion. The trailing p/e is moderate at 25.62, with a forward p/e (fye 31-Oct-06) of 16.89. Thus the PEG is at 1.19, demonstrating rather reasonable valuation. The Price/sales is nice at 0.72.

Yahoo reports 22.81 million shares outstanding with 16.20 million that float. Of these, as of 3/8/05, there were 418,000 shares out short representing a bit of a significant 5.359 trading days of volume, but only 2.58% of the float is actually out short.

This NYSE company does pay a small dividend of $.64/share yielding 0.87%. No stock dividends are reported on Yahoo.

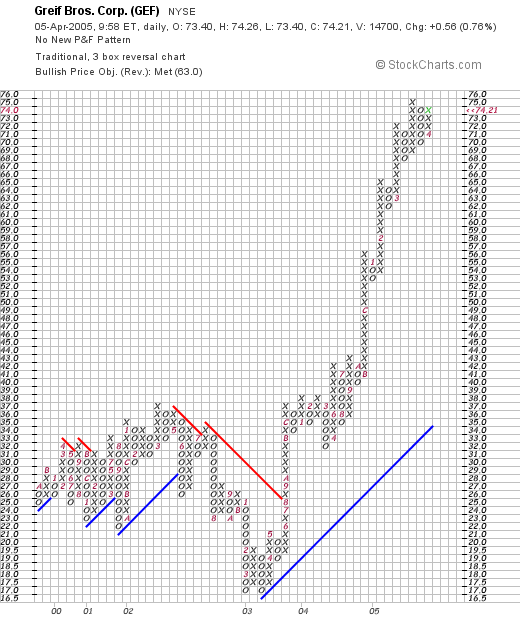

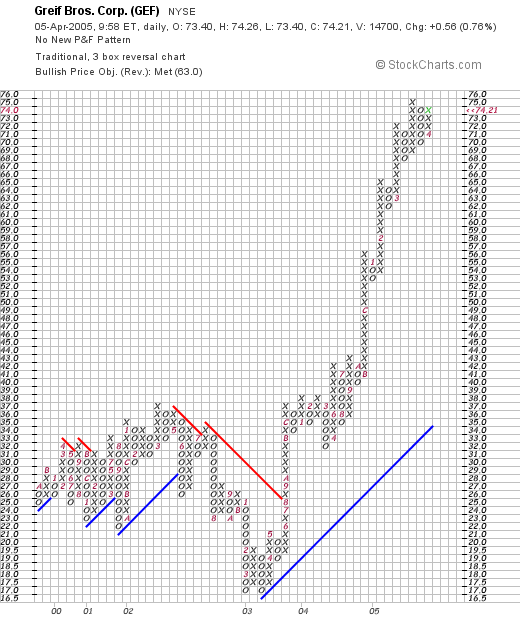

And how does the chart look like? Taking a look at a

"Point & Figure" chart on GEF from Stockcharts.com, we can see that this stock demonstrated what I would call a rather lackluster performance between late 2000 when in was trading in a range between $25 and $31, when it actually broke down in price to a low at $16.50. Starting in March, 2003, the stock has rallied strongly to its current $74 level. If anything the graph looks a bit overextened with the stock price significantly above its support level (the 45 degree blue line on this chart)

Well what do I think? Well, looking closer at the stock, I can see attractive things that got me to make a purchase decision. Usually, I take a quick look before making a purchase and think later (lol). The latest quarter is great. The revenue growth is strong. Earnings have been a bit erratic. Free cash flow is solid. The balance sheet is fine. Valuation is reasonable. And the graph is strong if a bit overextended.

The stock, in the packaging industry, is something different from my usualy holdings in my portfolio, and thus, I felt it would be a helpful addition. Time will tell. I shall be keeping a close watch on this as I do all of my stocks!

Thanks again for stopping by. Please feel free to email me at bobsadviceforstocks@lycos.com if you have any questions, comments, or words of encouragement!

Bob

Monday, 4 April 2005

"Revisiting a Stock Pick" Jos A. Bank (JOSB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

That nickel was really 'burning a hole' in my pocket today! Having sold a portion of Cantel (CMN) and Ventana (VMSI) today, I was "eligible" to purchase two additional positions. Looking through the

list of top % gainers on the NASDAQ, I came across Jos A. Bank (JOSB) which closed at $31.88, up $2.17 or 7.30% on the day. By the close of trading today, the stock was no longer on the list of top gainers which stopped with a 7.91% gain, but during the day it was there, and I made a purchase of shares on that basis. I actually posted JOSB on Stock Picks on 8/7/03, when it was trading for a split-adjusted $23.56.

According to the

Yahoo "Profile" On Jos A Bank (JOSB), the company "...is a designer, retailer and direct marketer, through stores, catalog and the Internet, of men's tailored and casual clothing and accessories."

What drove the stock higher today was a

preliminary 4th quarter 2004 earnings report. Sales for the fourth quarter 2004 increased 26.8% to $127.9 million compared with sales of $100.9 million in the prior year same period. More importantly, same store sales jumped 9.4% in the fourth quarter and 8.4% for the FY2004, while combined catalog and internet sales grew 31% for the quarter over the prior year. Net income for the quarter came in at $12.6 million, up from $9.6 million the prior year. On a diluted per share basis, this came in at $.88/share up from $.68/share the prior year. I especially like the same store sales growth in this report!

How about longer term? For this, I like to turn to the

Morningstar.com "5-Yr Restated" financials for JOSB. Here we can see the steady revenue growth from $193.5 million in 2000 to $345.5 million in the trailing twelve months (TTM).

Earnings/share have grown in an uninterrupted fashion from $.11/share in 2000 to $1.54/share in the TTM.

Free cash flow has been a bit erratic, but is at a positive $6 million in the TTM.

The balance sheet is solid with $1.3 million in cash and $153.4 million in other current assets, balanced against $65.4 million in current liabilities and $45.8 million in long-term debt.

What about "valuation"? For that I like to turn right back to Yahoo, for

"Key Statistics" on JOSB from Yahoo. First, this is a small cap stock with a market capitalization of only $427.03 million.

The trailing p/e is reasonable (imho) at 20.65, with a forward p/e (fye 31-Jan-06) of 15.40. Thus, the 5-yr estimated PEG is downright cheap at 0.72, and the Price/Sales raio is also low at 1/15.

Yahoo reports only 13.40 million shares outstanding with 11.80 million of them that float. As of 3/8/05, there were 6.03 million shares out short, representing 51.11% of the float and 17.583 trading days of average volume. This appears quite significant to me (anything over 3.0 days is suspect in my book), and we may be in the throes of a bit of a short "squeeze".

No dividend is paid and the last stock split was a 5:4 split on 8/19/04.

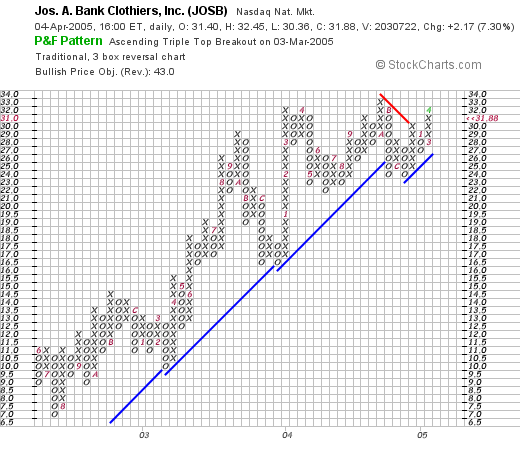

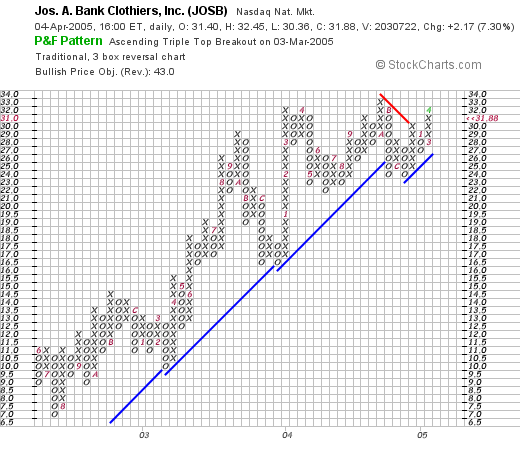

How about "technicals"? In other words, what does the chart look like? Taking a look at a

Stockchart.com "point & figure" chart on JOSB:

this chart actually looks fairly strong with an impressive move from $7.00 in July, 2002, to the $31.88 level where it closed today.

So what do I think? Well, I liked it enough to post it in August, 2003, and I still like it enough to buy some shares. The company is small but growing strongly with upper single-digit same store sales growth. Revenue and earnings growth have been very steady the past 5 years, company is free-cash-flow positive and has a nice balance sheet. Valuation is reasonable with a PEG under 1.0 and the large number of shares out short is just pent-up buying demand. Things look nice to me!

Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" JOSB, GEF

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so PLEASE consult with your professional investment advisors prior to making any decisions based on information on this website. I cannot be responsible for any losses you incur and I shall not make any claims on any gains you realize!

If you have been reading my posts, a few moments ago I wrote up my sales this mornings of portions of two different positions (CMN and VMSI) at gains. Thus, these sales at gains game me "permission" to add two new positions to my portfolio. If you know me, as you will if you read these posts (lol), then you would realize that I am not very good at sitting on my hands. Scanning through the lists of top % gainers today, I came across Jos A. Banks (JOSB), which I have reviewed previously on Stock Picks and a new one Greif (GEF) which I have not previously reviewed but appears to fit my "parameters" fairly well. I purchased 240 shares of JOSB at $31.865, and 120 shares of GEF at $72.27 a few moments ago.

I will try to review JOSB later as well as introduce GEF on this site soon. Just wanted to keep you posted regarding my real transactions in my trading account! Thanks again for visiting. If you have any questions or comment, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" CMN, VMSI

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was away from my computer last week, and this weekend, I realized that two of my stocks had actually hit sell points in spite of the relatively weak market overall, and this morning I sold 1/4 positions of each of these.

Cantel Medical (CMN) was acquired 6/4/04 with a cost basis of $13.36/share. I have already sold portions on 7/8/04, 12/20/04, and 2/3/05. (30%, 60%, 90% targets.) Earlier today, I sold 50 shares of CMN at $29.60 for a gain of $16.24 or 121.6%, for my fourth sale target (120% gain). This was a 1/4 position of my remaining 200 shares, and thus I now have 150 shares of Cantel. My next sale target on the upside would be at a 180% gain, or on the downside, allowing it to retrace 50% back to a 60% gain level.

The other partial position that was sold at a gain this morning was Ventana Medical Systems (VMSI). I acquired Ventana shares 4/16/04 for a cost basis of $23.47/share. I sold my first shares 11.29/04, at approximately a 30% gain, and now with VMSI trading this morning at $38.00, I sold 1/4 of my remaining shares (75 out of 300), for a gain of $14.53 or 61.9%, for my second targeted sale. My next sale will be at a 90% gain on the upside, or allowing it to retrace to a 30% gain on the downside.

Having sold two partial positions on good news (gains) this "entitles" me to add two new positions if any are appropriate for the portfolio. If a stock is sold at a loss...or two...prior to making these purchases, these will "cancel out" the buy signals....I hope you follow.

Thanks again for stopping by! If I make a purchase, I will keep you posted. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 3 April 2005

"Looking Back One Year" A review of stock picks from the week of February 16, 2004

Hello Friends! I was away from my computer for most of last week, and haven't had a chance to post too many new ideas. However, it is now Sunday and being back "on the job", I would like to review the selections on

Stock Picks Bob's Advice from the week of February 16, 2004.

As always, please remember that I am an amateur investor, so please consult with your professional investment advisor prior to making any investment decisions based on information on this website. The reviews on Stock Picks are calculated based on an assumed "buy and hold" strategy. The actual strategy on this blog is to sell losers quickly and completely and sell winners slowly and partially. Thus, actual performance using strategies employed by me would be different than those reported here.

On February 17, 2004, I

selected MarineMax (HZO) on Stock Picks at a price of $26.52. HZO closed at $30.80 on 4/1/05 for a gain of $4.28 or 16.1%.

On January 20, 2005, MarineMax

reported 1st quarter 2005 results. Revenue for the quarter ended December 31, 2004, increased 18% to $184.2 million. More importantly (imho), same-store sales jumped 17%. Net income was us 27% to $2.8 million or $.17/diluted share from net income of $2.2 million or $.14/diluted share the prior year. In addition, HZO raised guidance for fiscal 2005 to $1.80 to $1.85/diluted share from a prior $1.75-$1.80/diluted share previously estimated. All-in-all, this was a very nice report!

On February 18, 2004, I

selected Marine Products (MPX) on Stock Picks at a price of $20.00. MPX had a 3:2 stock split on 3/11/05, making out effective stock pick price $13.33. MPX closed at $16.25 on 4/1/05, for a gain of $2.92 or 21.9%.

On February 16, 2005, MPX

reported 4th quarter 2004 results. For the quarter ended December 31, 2004, net sales came in at $62.7 million, a 33.3% increase over the $47.0 million the prior year. Net income for the quarter was $5.5 million, a 22.4% increase over the $4.5 million the prior year. Diluted earnings per share came in at $.20, a 17.6% increase over the $.17/diluted share the prior year. In addition, the company announced a 3:2 stock split as well as a 50% increase in the dividend. These are all bullish for the stock price (imho).

On February 19, 2004, I

selected OmniVision Technologies (OVTI) for Stock Picks at a price of $29.45. OVTI closed at $15.08 on 4/1/05 for a loss of $(14.37) or (48.8)%.

On February 28, 2005, OVTI

reported 3rd quarter 2005 results. Revenue jumped to $101.8 million from $93.6 million the prior year. Net income was $21.1 million, or $.33/diluted share, up from $17.9 million, or $.29/diluted share the prior year. However, the stock slumped after this seemingly positive announcement due to

lowered 4th quarter guidance and growth in inventories, both negative factors for future performance.

My last pick that week was

UniFirst (UNF) which was picked for Stock Picks on February 21, 2004 at a price of $26.83. UNF closed at $40.98 on 4/1/05 for a gain of $14.15 or 52.7%.

On March 30, 2005,

UNV announced 2nd quarter 2005 results. Revenue for the 2nd quarter 2005 which ended February 26, 2005, came in at $190.7 million, a 7.5% increase over the $177.4 million in the same period the prior year. Net income was $10.1 million or $.52/diluted common share, a 52.7% increase over last year's $6.6 million or $.34/diluted common share.

So how did we do that week? Overall, it was a good week for picking stocks, with three gainers and one unfortunately signifact loser (OVTI). Averaging the percentage change for each of the four picks, gives us an average gain of 10.5%.

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to respond the best I can in my amateur way right here on the blog!

Bob

Saturday, 26 March 2005

"Looking Back One Year" A review of stock picks from the week of February 9, 2004

Hello Friends! Thanks for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to using any information on this website for any investment decisions!

I found this image on a

Japanese Website. There are a lot of funny ones there! (but not all in good taste nor politically correct...so consider yourself warned!) I hope all of you have a very happy Easter weekend!

As many of the regular readers know who stop by this blog, I like to pick stocks that I think might have the characteristics that might result in price appreciation...that is the stock price moves higher. I certainly do NOT bat 100%, but it helps to revisit old picks in a rather regular fashion and see what would have happened if we had really purchased these stocks. These reviews assume a buy and hold strategy which is NOT what I actually employ nor do I recommend for anyone to do that. In fact, I practice cutting my losses quickly and then selling my gainers slowly!

On February 10, 2004, I

posted Thor Industries (THO) on Stock Picks at a price of $33.86. THO closed at $30.32 on 3/24/05 for a loss of $(3.54) or (10.5)%.

On March 1, 2005, THO

announced 2nd quarter 2005 results. Revenue increased 26% to $537 million from $426.5 million last year. Quarterly income grew to $20.6 million or $.36/share up from $17.5 million or $.30/share the prior year. However, the "street" was looking for $.41/share in earnings, and the stock dropped after that announcement.

On February 11, 2004, I

posted Giant Industries (GI) on Stock Picks when it was trading at $15.94. Giant closed at $24.35 on 3/24/05, for a gain of $8.41 or 52.8%.

On March 15, 2005, GI

announced 4th quarter 2004 results. Revenue for the quarter rose 50% to $674.3 million from $449 million the prior year same quarter. Quarterly income, however, declined 55% to $729,000 or $.06/share from $1.6 million or $.18/share the prior year.

I

posted NetSmart (NTST) on Stock Picks on 2/11/04 when it was trading at $17.60/share. (NTST operated under its subsidiaries name "Creative Socio-Medics"). NTST closed at $9.36 on 3/24/05, for a loss of $(8.24) or (46.8)%.

On March 18, 2005, NTST

announced 4th quarter 2004 results. For the quarter ended December 31, 2004, revenue came in at $7.57 million, up from $7.36 million the prior year. Net income for the fourth quarter came in at $1.3 million (including a $.34 million deferred tax benefit) or $.24/diluted share up from $690,000, the prior year or $.13/diluted share. Even without the tax benefit, net income would still be up almost 50%.

On February 12, 2004, I

picked CyberGuard (CGFW) for Stock Picks when it was trading at $11.96. CGFW closed at $7.81 on 3/24/05 for a loss of $(4.15) or (34.7)%.

On January 25, 2005, CGFW

reported 2nd quarter 2005 results. Revenue for the quarter ended December 31, 2004, came in at $16.5 million, an increase of $5.3 million or 47% over revenues of $11.2 million for the corresponding quarter the prior year. Net income however, came in at $1.0 million or $.03/diluted share, compared with $2.3 million or $.08/diluted share the prior year.

Finally, on 2/15/04, I

posted The Sportsman's Guide (SGDE) on Stock Picks at a price of $21.64. SGDE closed at $25.40 on 3/24/05, for a gain of $3.76 or 17.4%.

On March 1, 2005, SGDE

announced 4th quarter 2004 results. Sales for the quarter ended December 31, 2004, came in at $92.5 million, a 29% increase over the $71.7 million for the same quarter the prior year. Net earnings came in at $4.6 million or $.85/diluted share up from $3.8 million or $.71/diluted share the prior year. In addition, the company announced a 3:2 stock split, in the form of a 50% stock dividend to be paid to shareholders of record on 3/25/05. This was a nice report from SGDE!

Overall, how did we do with selections that week? Not very good! In fact, we had two gainers and three losers, for an average performance of a loss of (4.36)%. This week's picks shows you a couple of things, but most of all, how the selections on this website

can lead to significant losses! So consult with your professional advisors!! And also, how important it is to keep your losses from growing! Thus, selling rather quickly on losses and avoiding selling too fast on gains!

Thanks again for stopping by! Wishing all of my friends a very Happy Easter holiday! If you have any questions or comments, or even words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 3:17 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 26 March 2005 7:38 PM CST

Friday, 25 March 2005

March 25, 2005 Aladdin Knowledge Systems (ALDN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

The markets are closed today since it is Good Friday, and I certainly wish all of my friends who celebrate Easter, a very Happy Easter!

For those of you who are new to this website, I like to look through stocks that are moving higher on any particular day, and see if there are any that might be worthy of consideration for addition into a portfolio. I use a few screens to assess the stocks and write up my findings. Of these many stocks, I do pick stocks to add to my own trading portfolio, and try to keep you posted when I do that. However, my timing of adding additional positions is based on the "bullish" activity within my own holdings. That is, I add a position, when I sell a portion of a holding at a targeted gain level. Otherwise, I try my hardest to just "sit on my hands". But I am still looking and thinking about new stocks virtually every day!

One of the first places I like to go when I start exploring for a new stock idea, is the

list of top % gainers on the NASDAQ. Yesterday (3/24/05), Aladdin Knowledge Systems LTD (ALDN), made the list, and closed at $23.26, up $1.81 on the day or 8.44%. I do NOT own any shares nor do I have any options on this company.

According to the

Yahoo "Profile" on ALDN, Aladdin "...is active in the digital security market, providing solutions for Software Digital Rights Management and Enterprise Security."

In my methodical fashion, I next check the latest earnings report...looking for positive revenue and positive earnings growth. On January 24, 2005,

Aladdin reported 4th quarter 2004 results. Revenues for the fourth quarter ended December 31, 2004, increased 24.7% to $18.8 million from $15.1 million for the same period the prior year. Net income for the fourth quarter jumped 121% to $2.6 million or $.20/diluted share up from $1.2 million or $.10/diluted share the prior year. These, imho, were very strong results!

O.K., they had a great quarter. But from my perspective it is the

persistence of these results that makes a great stock investment! For this consistency in performance, I like to review a longer-term assessment by looking at Morningstar. Within this website, are the "financials" and in particular the "5-Yr Restated" financials that I find personally so helpful. For ALDN, they are located

here.

First thing, looking at the series of bar graphs, we can see a nice 'ramp-up' of revenue growth from $44.3 million in 2000 the $54.7 million in the trailing twelve months.

Earnings have been a bit more erratic dropping from $.12/share in 2000 to a loss of $(1.32)/share in 2001, but has improved steadily since then, with the latest quarter showing a very strong result.

Next, free cash flow. Why do I think this is important? If you all were investing during the "dot-com" era, then you will recall all of the many start-ups that came to market without any real revenues and without any real earnings. In fact, they often talked about the "burn-rate" of these companies. What they were referring to, as I understand it, was the fact that these new ventures were consuming their cash, sort of burning it up, and had to start earning money before running out of their start-up money.

On the Morningstar section on the same page, we can see that ALDN had

negative free cash flow in 2001 at $(6) million. Howver, this has improved and is up to $5 million in the trailing twelve months (TTM).

Next, what about the balance sheet? From this, we can sort of get a financial 'check-up' on the company. That is, the more cash and assets a company has and the less the liabilities, well it is sort of obvious! Anyhow, ALDN has, according to Morningstar, $19.5 million in cash, which by itself is able to pay off both the current liabilities of $11.3 million and the $3.2 million of long-term liabilities combined. In addition, Morningsar shows that ALDN has $18.5 million of

other current assets. The financial health of this company looks just fine, thank you.

What do I check next? I like to get a handle on some "valuation" questions. I am not purely a momentum investor, a value investor, or a technician. I like to use a combination of everything :) to get a handle on a stock!

I have found the easiest place to find some value parameters is on Yahoo. In fact, for ALDN, the

Yahoo "Key Statistics" are quite helpful.

First, we can see that this is a very small company in the great big picture of things with a market capitalization of $266.98 million. This figure is determined by multiplying the price per share by the number of shares...sort of what it would cost to buy the whole company at the current price...

The trailing p/e is moderately high at 34.41. The forward p/e (based on fye 31-Dec-06 estimates) is nicer at 20.58. Thus, the PEG, which is a number telling us something about how the P/E relates to the growth rate, is at 1.00, saying it is, imho, reasonably valued.

Price/sales is a bit richer at 3.56.

Yahoo shows that there are only 11.48 million shares outstanding with 6.40 million that float. Of these, 351,000 shares are out "short" as of 2/8/05. This amounts to 5.48% of the float or 1.664 trading days of volume. From my perspective, this is not a very high level of short shares. (Short shares are shares that have been pre-sold by speculators betting that the stock will decline. Thus a high level of short sales means that there are a lot of shares that need to be purchased to cover these pre-sold shares as investors close out these trades. This pent-up demand for shares actually is bullish for a stock!)

Yahoo shows no cash dividend and the last stock split was a 3:2 on September 18, 1995. Almost ten years ago!

How about some technical issues? If you are a novice, that simply means, how does the chart look? Is the stock price climbing, declining, or doing something else? Do trends determine future price moves? I don't think so, but they can tell you something about whether people are tending to be accumulating a stock and buyers are willing to pay higher prices over time, or if the opposite is true.

Recently, I have found that "point & figure" charts are very helpful. They show columns of o's and x's which represent declining stock prices (o's) or climbing stock prices (x's). From my perspective, they give a nice "feel" for the stock price activity.

The

Stockcharts.com "point and figure" chart on ALDN shows a very strong price appreciation.

This stock bottomed out around $.88/share in October, 2003, and has been climbing since to the $23.26 level where it closed yesterday (3/24/05). The stock has consistently been trading higher than its "support" line represented by the blue 45 degree line that moves higher.

So what do I think? I actually like this stock a lot! The stock moved higher yesterday on an upgrade, the latest quarter was solid, the last few years have shown steady improvement of revenue, but a bit erratic on the earnings picture. Free cash flow is positive and growing, the balance sheet is gorgeous, valuation is reasonable and the chart looks very strong! Now, if I just had some cash, or at least a buy signal from my portfolio, I might be purchasing some shares :).

Thanks so much for stopping by and visiting. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

The market is correcting a bit today, but that doesn't mean we can't be looking for interesting stock investment ideas! Scanning the list of top % gainers on the NYSE today, I came across "The Buckle", BKE, which as I write, is trading at $35.60, up $1.10 or 3.19% on the day. I do not own any shares of BKE nor do I own any options.

The market is correcting a bit today, but that doesn't mean we can't be looking for interesting stock investment ideas! Scanning the list of top % gainers on the NYSE today, I came across "The Buckle", BKE, which as I write, is trading at $35.60, up $1.10 or 3.19% on the day. I do not own any shares of BKE nor do I own any options. According to the Yahoo "Profile" on BKE, The Buckle is "...a retailer of medium to better-priced casual apparel, footwear and accessories for fashion conscious young men and women."

According to the Yahoo "Profile" on BKE, The Buckle is "...a retailer of medium to better-priced casual apparel, footwear and accessories for fashion conscious young men and women." Longer-term, looking at the Morningstar.com "5-Yr Restated" financials, we can see a steady ramp-up of revenue growth from $375.5 million in 2000 to the $459.4 million in the trailing twelve months (TTM).

Longer-term, looking at the Morningstar.com "5-Yr Restated" financials, we can see a steady ramp-up of revenue growth from $375.5 million in 2000 to the $459.4 million in the trailing twelve months (TTM).

I managed to scan the

I managed to scan the  According to the

According to the  Taking a look at the

Taking a look at the  What about "valuation" questions? Taking a look at the

What about "valuation" questions? Taking a look at the

So what do I think about all of this? Well, actually, I like this stock a lot. The latest quarter result was solid, with 5.1% same store sales growth as well. The past five years show a perfect record of increasing revenue and earnings growth. The company is spinning off 'gobs' of free cash flow contributing to a solid balance sheet. The valuation issues are reasonable and the graph looks adequate, appearing to have been consolidating in price for about a year now.

So what do I think about all of this? Well, actually, I like this stock a lot. The latest quarter result was solid, with 5.1% same store sales growth as well. The past five years show a perfect record of increasing revenue and earnings growth. The company is spinning off 'gobs' of free cash flow contributing to a solid balance sheet. The valuation issues are reasonable and the graph looks adequate, appearing to have been consolidating in price for about a year now. Yesterday, I purchased some shares of Greif (GEF), and I wanted to go over the numbers and the information that I found on review of this company and why I thought it made a nice addition to my portfolio. Yesterday, GEF made the

Yesterday, I purchased some shares of Greif (GEF), and I wanted to go over the numbers and the information that I found on review of this company and why I thought it made a nice addition to my portfolio. Yesterday, GEF made the  Currently, as I am writing, GEF is trading at $74.06/share, up $.41 or .56% on the day today.

Currently, as I am writing, GEF is trading at $74.06/share, up $.41 or .56% on the day today.  On March 2, 2005, Greif

On March 2, 2005, Greif  What about "valuation"? Looking at

What about "valuation"? Looking at

That nickel was really 'burning a hole' in my pocket today! Having sold a portion of Cantel (CMN) and Ventana (VMSI) today, I was "eligible" to purchase two additional positions. Looking through the

That nickel was really 'burning a hole' in my pocket today! Having sold a portion of Cantel (CMN) and Ventana (VMSI) today, I was "eligible" to purchase two additional positions. Looking through the  According to the

According to the  How about longer term? For this, I like to turn to the

How about longer term? For this, I like to turn to the

Hello Friends! I was away from my computer for most of last week, and haven't had a chance to post too many new ideas. However, it is now Sunday and being back "on the job", I would like to review the selections on

Hello Friends! I was away from my computer for most of last week, and haven't had a chance to post too many new ideas. However, it is now Sunday and being back "on the job", I would like to review the selections on  On February 17, 2004, I

On February 17, 2004, I  On January 20, 2005, MarineMax

On January 20, 2005, MarineMax  On February 18, 2004, I

On February 18, 2004, I  On February 19, 2004, I

On February 19, 2004, I  My last pick that week was

My last pick that week was  On February 10, 2004, I

On February 10, 2004, I  On February 11, 2004, I

On February 11, 2004, I  On March 15, 2005, GI

On March 15, 2005, GI  I

I  On February 12, 2004, I

On February 12, 2004, I  Finally, on 2/15/04, I

Finally, on 2/15/04, I  Thanks again for stopping by! Wishing all of my friends a very Happy Easter holiday! If you have any questions or comments, or even words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com.

Thanks again for stopping by! Wishing all of my friends a very Happy Easter holiday! If you have any questions or comments, or even words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com. One of the first places I like to go when I start exploring for a new stock idea, is the

One of the first places I like to go when I start exploring for a new stock idea, is the  According to the

According to the  O.K., they had a great quarter. But from my perspective it is the persistence of these results that makes a great stock investment! For this consistency in performance, I like to review a longer-term assessment by looking at Morningstar. Within this website, are the "financials" and in particular the "5-Yr Restated" financials that I find personally so helpful. For ALDN, they are located

O.K., they had a great quarter. But from my perspective it is the persistence of these results that makes a great stock investment! For this consistency in performance, I like to review a longer-term assessment by looking at Morningstar. Within this website, are the "financials" and in particular the "5-Yr Restated" financials that I find personally so helpful. For ALDN, they are located  On the Morningstar section on the same page, we can see that ALDN had negative free cash flow in 2001 at $(6) million. Howver, this has improved and is up to $5 million in the trailing twelve months (TTM).

On the Morningstar section on the same page, we can see that ALDN had negative free cash flow in 2001 at $(6) million. Howver, this has improved and is up to $5 million in the trailing twelve months (TTM).