Stock Picks Bob's Advice

Tuesday, 15 January 2008

"Uffdah"

In this section of the United States, there is no better word to explain my feelings towards the stock market today and the last several weeks.

As this 'Minnesotan' blog explains

"UFFDAH!: @($#@#!&!!

It's the PG-rated version of what you'd really like to say but can't in front of the kids or whomever. Example: You go out to your car and see a tire is flat and you exclaim, "Uffdah!""

This Norwegian expression says it all.

I am long this market. That is, I remain an optimist while my stocks mostly decline and head in the opposite direction than my preferred outcome.

How do I deal with these declines?

As I have written many times over, I have not built a portfolio management system that is designed just for good times. Anyone can do that. My portfolio strategy is to respond to market activity instead of anticipating the future direction. Frankly, I don't know how stocks are going to move tomorrow, next week, next month or next year. However, if my stocks decline to sale points, they shall be sold. If I sell positions, I shall be 'sitting on my hands' with the proceeds, continuing to 'pull in my horns' so to speak, or pull in my head and legs like a turtle.

My own portfolio can drift between 5 and 20 positions. This 'posture' of my own investments is in response to these sales on bad new or sales on good news. They give me the permission slip to add postions or direct me to stay away from the market. I don't know if this is the best process, or even if this strategy will work! But I shall be sticking with it and reporting back to you.

Currently I am at 11 positions--having recently added Graham (GHM) on a signalled purchase by my partial sale of Meridian (VIVO) at a targeted gain. I like all the stocks I own. I like lots of other stocks as well. But more than owning stocks of great companies, I have a strategy of when to be 'holding' and when to be 'folding'. This, I hope, will give me an edge.

Wishing you all a better trading day tomorrow.

Meanwhile,

"uffdah" is the best way to put my own reaction to the day's trading.

Bob

Sunday, 13 January 2008

A Reader Writes: "Do you have an 'About Me' site?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I approach my fifth anniversary blogging here, I am most grateful to some of my loyal readers who provide me with the encouragement to continue to write and explore the world of investing. I shall always be the first to tell you that I don't know everything, that I am not sure that my methodology will work over the long haul, and that there are many wiser minds and writers out there. I have a load of links to some of the blogs I have learned to appreciate over the years. Be sure and visit those websites.

But one of my favorite things about blogging is to hear from a reader who perhaps appreciates my efforts and maybe has learned something about investing that he or she didn't know. I haven't heard from Tony for awhile, but Tony dropped me a line today that truly warmed my heart. I hope that I can be helpful.

But one of my favorite things about blogging is to hear from a reader who perhaps appreciates my efforts and maybe has learned something about investing that he or she didn't know. I haven't heard from Tony for awhile, but Tony dropped me a line today that truly warmed my heart. I hope that I can be helpful.

Tony wrote:

"This is Tony, I was the person who wanted to start a website online and have your articles posted on there. However, I was unable to fully spend time in building the site so I decided to focus on my studies more.

My question to you today is... Do you have an "About Me" site? I wanted to know how you got to do what you do and learn the things you do and how you make your pick selections. I want so bad to learn more about Stocks that I've decided to Major in economics with hopes of gaining sufficient knowledge.

I'm currently Subscribed to Americanbulls.com and take their day/weekly picks and recommendation signs to make a little here and there as a student. I would, however, love to learn your style of trading and I think the best way is just to follow your every move and report on the particular companies your have recommended. As a student I dont exactly have a great amount to work with but Americanbulls.com has helped a little to build a little something based on nothing but caddlestick signals.

Respectfully,

Tony T.

P.S. I really like your style.. Sometimes I wish school could teach real things like trading and Technical analysis. Every think about teaching? I'd be first in line!"

Thank you so much for your very generous assessment of my writing and content here. I try very hard to explain everything the best I can and I am sure if you read through the blog, most of your answers will be answered.

If you would like to know more 'about me' and my philosophy, I have been fortunate to have been interviewed by Wall Street Transcript through my Covestor relationship. You can read my interview here.

Also Gannon on Investing interviewed me here.

I think these should explain my philosophy, background, etc.

In a nutshell, I try to identify what I call the highest quality stocks. I measure quality by persistence of good and improving results, with stable outstanding shares, positive free cash flow, a solid balance sheet, and a positive appearing price chart. If I can get good value as well, I am even more interested in that investment.

The other part of my strategy is my aggressive sales of stocks on declines and partial sales of gaining stocks as they reach appreciation targets.

Furthermore, I use these sales, both on the upside and downside, as signals to give me "permission" to be adding new holdings. Within this context, I have set my maximum size of my portfolio at 20 and float between 5 and 20 depending on market conditions as directed by my own holdings.

I hope that is helpful to you.

If you have other questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Good luck with your Economics studies! We certainly are living in interesting times.

Other sites you might wish to visit include my Covestor Page where my holdings in my Trading Account are reviewed and analyzed, my SocialPicks page where my stocks picks from 2007 and more recent are covered, and my Podcast Page where if you have the time, you might want to download some of my mp3's where I discuss some of the individual stocks and answer some of the questions you are raising.

Again, thank you for your kind words. If I ever have the opportunity to teach, I certainly would love to share any wisdom with you that I might have! Now, if I can find someone out there that would like to hire me :).

Bob

Posted by bobsadviceforstocks at 9:05 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 13 January 2008 9:36 PM CST

"Looking Back One Year" A review of stock picks from the week of July 10, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend and it has been a relief to get through this trading week intact if not a bit bruised!

I like to take advantage of the weekend to look back at picks from a bit over a year ago from this blog. These reviews assume a buy and hold approach to investing. In fact, I advocate a disciplined stock management approach that requires me to sell my losing stocks quickly at small declines and sell my gaining stocks slowly and partially at targeted appreciation points. I utilize the 'buy and hold' analysis because it is easy for me to do, however, the difference in strategies would certainly affect the results in practice.

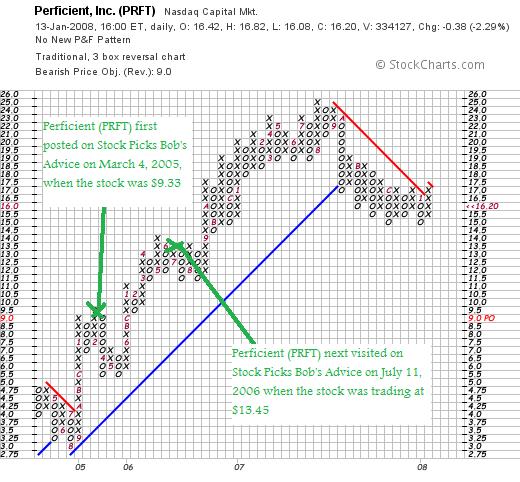

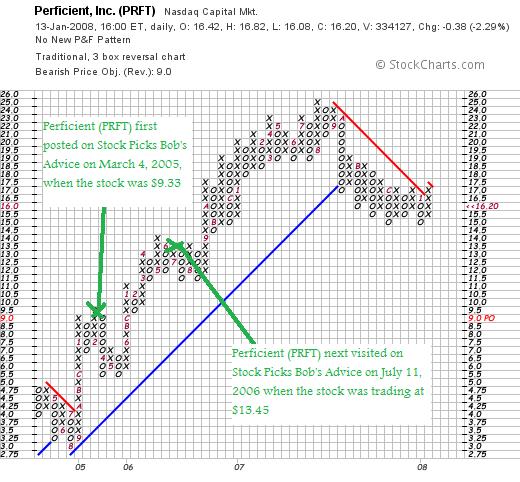

On July 11, 2006, I posted Perficient (PRFT) on Stock Picks Bob's Advice when the stock was trading at $13.45. This was a 'revisit' as I had first actually looked at Perficient on March 4, 2005, when the stock was trading at $9.33. Perficient closed at $16.20 on January 11, 2008, for a gain of $2.75 or 20.4% since posting last year.

On July 11, 2006, I posted Perficient (PRFT) on Stock Picks Bob's Advice when the stock was trading at $13.45. This was a 'revisit' as I had first actually looked at Perficient on March 4, 2005, when the stock was trading at $9.33. Perficient closed at $16.20 on January 11, 2008, for a gain of $2.75 or 20.4% since posting last year.

Looking at the "point and figure" chart from StockCharts.com on PRFT, we can see the shapr rise in price from $3.00/share in August, 2004, to a recent high at $25.00/share in August, 2007. The stock has recently been under pressure but appears to have found support at $15 and may possibly be moving higher once again.

Let's take a closer look at some of the fundamentals on this stock before determining a 'rating'.

First of all the latest quarter--on November 8, 2007, Perficient reported 3rd quarter 2007 results. Revenue climbed 20% to $53.1 million from $44.3 million last year. Earnings per share climbed 50% to $.15/share from $.10/share the prior year. Net income climbed 60% to $4.5 million from $2.8 million last year. Non-GAAP earnings were $.21/share.

The company beat expectations of earnings of $.20/share and came in slightly light on revenue which had been expected to come in at $55.1 million. More recently the company raised guidance on 4th quarter revenue figures to $61.2 to $62.7 million in sales from prior forecast of $56.3 to $62.1 million.

Examining the Morningstar.com '5-Yr Restated' financials, we can see that revenue is continuing to grow steadily, earnings expanding, shares are relatively stable, free cash flow is positive and growing, and the balance sheet appears solid.

Thus,

PERFICIENT (PRFT) IS RATED A BUY

Let's take a look at the other stock posted that week back in 2006: Kinetic Concepts (KCI), a stock that I have also recently owned in my own Trading Portfolio--but currently do not own any shares.

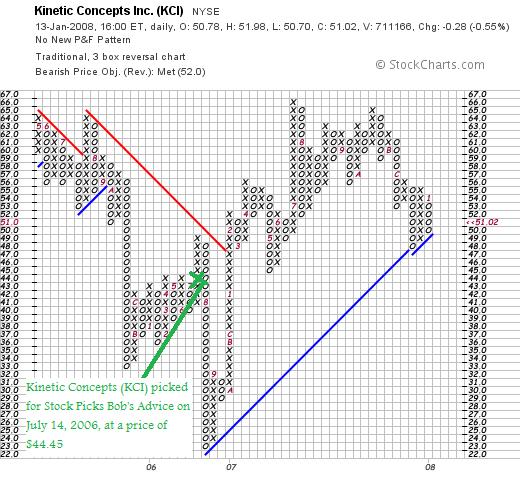

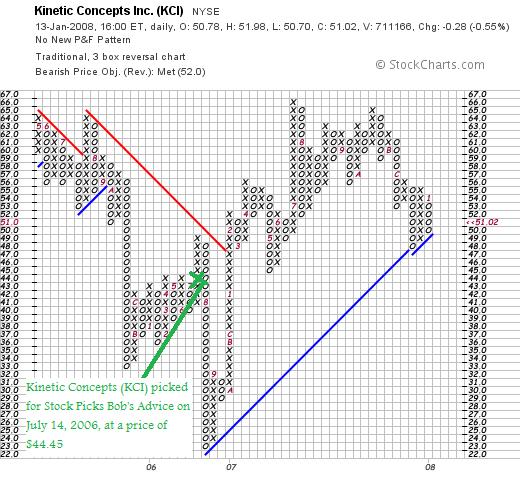

On July 14, 2006, I posted Kinetic Concepts (KCI) on Stock Picks Bob's Advice when it was trading at $44.45. Kinetic Concepts (KCI) closed at $51.02 on January 11, 2008, for a gain of $6.57 or 14.8% since posting.

On July 14, 2006, I posted Kinetic Concepts (KCI) on Stock Picks Bob's Advice when it was trading at $44.45. Kinetic Concepts (KCI) closed at $51.02 on January 11, 2008, for a gain of $6.57 or 14.8% since posting.

Looking at the 'point & figure' chart on KCI from StockCharts.com, we can see the stock trading in what I would call a volatile fashion with wide swings of the stock price from a $64 level in April, 2005, to a low of $23 in August, 2006, only to turn around and climb to a high of $66 in July, 2007. The stock has sold off since November, 2007, to a low of $47 and is seeming to be forming a new are of support---possibly for a continued move higher (?).

Let's take a look at the latest quarterly report.

On October 23, 2007, Kinetic Concepts (KCI) reported 3rd quarter 2007 results. Revenue climbed 17% to $410.9 million from $350.9 million last year beating expectations of $406.7 million according to analysts polled by Thomson Financial. Earnngs increased to $59 million or $.82/share from $49 million or $.67/share in 2006. This also beat expectations of $.79/share according to Thomson Financial.

The company also raised guidance for full year 2007 results to $3.20 to $3.30 per share from prior guidance of $3.10 to $3.20/share. They also raised revenue guidance to between $1.58 and $1.60 billion from prior guidance of $1.56 to $1.59 billion.

Finally, looking longer-term, the Morningstar.com "5-Yr Restated" financials appears intact. Revenue is continuing its uninterrupted rise, earnings, after a dip in 2004 and 2005 have resumed their steady climb, total shares are very stable, free cash flow is positive and growing and the balance sheet is solid.

With all of these findings,

KINETIC CONCEPTS (KCI) IS RATED A BUY

So how did I do with these two stock picks? Actually pretty good. Both had gains and the average of the two works out to an average gain of 17.6%. I can live with that :).

Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual trading account is reviewed and analyzed, my SocialPicks page where my many picks from the blog over the past year are recorded and also monitored, and my Podcast Page where you can download some mp3's of me discussing some of the many stocks I write about here on the blog.

I hope next week works out well for you. And that 2008 is a good year both financially and personally for all of my readers!

Bob

Posted by bobsadviceforstocks at 1:08 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 13 January 2008 2:35 PM CST

Thursday, 10 January 2008

Graham Corp (GHM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With my partial sale of Meridian (VIVO), I now had a 'permission slip' to be looking for another position to add to my trading account. Especially at just 10 positions, I use a sale of a portion of an existing position within the account as a signal that moves me towards the 20 position maximum. My minimum holdings number 5 but I haven't gotten that close to that level yet. In that case, even with a sale on bad news, I would be entitled to add a new position as long as it 'qualified.'

With that nickel burning a hole in my pocket, I went right away to the top % gainers list. Lately, I have been starting with the list of top % gainers on the AMEX where I found Graham (GHM) trading strongly higher. Graham stayed on the list all day and closed at $47.35, up $3.00 or 6.76% on the day. I purchased 210 shares of GHM at $46.2699 earlier today for my account. (I buy strange numbers of shares like 210 because they are easily divisibly by 7 my portion of sales at gains).

I did a complete review of Graham (GHM) on October 27, 2007, after my loyal reader, Doug S. wrote me and suggested I ought to take a look at it.

I liked Graham then and even bought some shares which I held for a short period. Graham had just announced a very strong second quarter 2008 result, as well as a 5:4 stock split and an increase in the dividend. The Morningstar.com '5-Yr restated' appears intact and the 'point & figure' chart on StockCharts.com appears to be strong with the stock having recently pulled back from an over-extended position but staying well above support lines.

GRAHAM CORP (GHM) IS RATED A BUY

Anyhow, it was enough for me and I really appreciate seeing a name that I am already familiar with on the top % lists when I have the 'permission slip' to be buying! I bought shares. Wish me luck!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 4:28 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 10 January 2008 4:29 PM CST

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Shortly after selling my Harris Stock I was pleased to see that not all of my stocks were 'falling out of bed' today and that Meridian Bioscience, one of my most successful of holdings had moved higher to another appreciation target. Thus, I sold 1/7th of my 199 shares or 28 shares of VIVO at $34.43/share. Meridian (VIVO) was purchased almost 3 years ago on 4/21/05 with a cost basis of $7.42/share (!) giving me a gain of $27.01/share or a 364% appreciation on these shares.

This was my eighth partial sale of Meridian in my account having previously sold portions at 30, 60, 90, 120, 180, 240, 300, and now 360% appreciation levels. When would I sell next? On the upside, after four 60% intervals, I shall be using 90% intervals and shall wait for a 450% appreciation level for another 1/7th sale. This would work out to 5.5 x $7.42 = $40.81 before triggering another sale.

On the downside, after multiple sales, unless there is some fundamental reason to sell sooner, I plan on selling if the stock retraces to 1/2 of its highest appreciation sale point which would mean instead of a 360% gain level, 1/2 of that would work out to a 180% appreciation level or 2.80 x $7.42 = $20.78.

Furthermore, with only 10 positions in my account (after my sale of Harris), this sale at a gain gave me a 'buy signal' which allowed me to go looking for another stock to buy. And I found a great prospect in Graham (GHM), a recent favorite of mine. More in the next entry :).

Meanwhile, since I am selling my Meridian shares on 'good news', my rating is unchanged:

MERIDIAN BIOSCIENCE (VIVO) IS RATED A BUY

Thanks again for stopping by and visiting my blog! If you have any comments or questions please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

Bob

Harris Corp (HRS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday I demonstrated my ability to act in an undisciplined fashion. Today was different. Harris Corporation (HRS) declined sharply and actually closed at $49.82 on the day down $(5.99) or (10.73)% on the day. I do not see any news that would explain the drop in the stock price. I am sure there is something somewhere that somebody will point out but it doesn't really matter to me.

The point is that this stock in which I have previously sold a portion at a 30% appreciation target moved against me into a loss position. These 103 shares that I held in this account were purchased about a year ago on 1/31/07 with a cost basis of $50.05. On 11/7/07 I had sold 17 shares of my 120 share original position at $65.16 which was my 30% appreciation target.

What this means for me is that if I own a position in which I have sold once at a 30% gain, my next sale on the downside is at break-even. With Harris trading just under break-even, I sold my 103 shares today at $49.67, just under my cost. I didn't hesitate, second-guess, or buy a load of shares to justify my holding. I just sold the shares.

This didn't give me a 'permission-slip' to do anything but sit on my hands with the proceeds.

With this sale of my own shares, I am reducing my rating on Harris:

HARRIS (HRS) IS RATED A HOLD

Thanks so much for stopping by and visiting. Please feel free to leave a comment on the blog or email me at bobsadviceforstocks@lycos.com if you have any questions.

Bob

Wednesday, 9 January 2008

Universal Electronics (UEIC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In order to demonstrate what a total amateur investor I really am, and I am NOT kidding, I probably should explain to you the series of really amateur mistakes I made today with my Universal Electronics Stock (UEIC). I am really getting ready to stick to my rules and stop all the short-term trades. While the rest of the market moved higher today, my own account dipped.

Earlier today, I saw that my UEIC stock was taking a nosedive for no particular reason.

Rule #1. Don't try to figure out the reason. Just respond to market action.

I didn't.

I tried.

And I lost.

I figured since the drop was outrageous and the stock was gorgeous, I was smarter than the market and ought to buy some shares. And buy I did. I purchased an additional 800 shares of UEIC at approximately $26.95/share early on. In the face (!) of a declining stock. After all, I had the one position to 'trade' didn't I?

But the stock kept dropping. Just like trying to catch that falling knife, I started to feel the pain. And now with a really large position! So I sold 455 of my shares at around $45.50 and then sold the rest of my shares with the stock still in the $25.50 range closing out my entire position.

I haven't calculated my loss, but it was well over $1,000.

Stupid, stupid, stupid.

But at least the rest of my account was moving higher dampening out the effect of my folly.

Have I learned my lesson?

I don't know. I know I really burnt my fingers on this one. There are totally different skills between trading the short moves and investing for the long run. I am pretty darn good at the latter and a total hack at the former.

I apologize to myself and to all of you for acting so foolishly in public.

But learning to invest is a lifelong process. I have been doing this a long time and have learned a thing or two, but trading is something totally different.

If you would like to read about and learn more about 'trading' instead of investing, visit Timothy Sykes, a fellow Covestor fan and terrific trader. Stick around here to learn more about investing. Let me make a few of these dumb mistakes and maybe you won't do the same.

Meanwhile,

UNIVERSAL ELECTRONICS (UEIC) IS RATED A HOLD

down from a "buy".

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 7 January 2008

Dolby (DLB)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I have written many times, there are probably two broad processes that are required to invest successfully. The first is identifying the stocks that belong in a successful investment account and the second is managing those stocks. I spend most of the entries discussing my ideas about the first and also share with you my success at implementing the second. I hope that you all find this helpful.

While some investment letters seem to pull names out of the air, I try very hard to explain my own philosophy and how I arrived at these stocks. Time will tell if this approach will be successful. If any of you use similar strategies, or if any of you have utilized my perspective in developing your own portfolios, I would greatly appreciate hearing how it has been working out for you and any changes that you have implemented. There isn't anything magical or mysterious about the names that I write about on the blog, they simply represent stocks of companies that I view as the highest of quality. For me quality is about consistency of good results reported with a background of underlying financial strength.

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

DOLBY (DLB) IS RATED A BUY

First of all, I do not own any shares nor do I have any options on Dolby. But it is a stock that I would hope to have the opportunity of adding to my portfolio in the future, and if I did have a 'buy signal', it would be the kind of stock I would be buying today.

Dolby caught my eye when it made the list of top % gainers on the NYSE today, closing at $49.21, up $3.68 or 8.08% on the day. Scanning manually through the lists of top % gainers is the place that virtually all of my stock 'picks' originate.

What exactly does Dolby (DLB) do?

According to the Yahoo "Profile" on Dolby, the company

According to the Yahoo "Profile" on Dolby, the company

"...engages in the development and delivery of products and technologies for the entertainment industry worldwide. The company offers products comprising traditional cinema processors, digital cinema products, digital 3D products, digital media adapters, broadcast products, and live sound products, which are used in content creation, distribution, and playback. It also licenses a range of technologies, which are used in DVD players and personal computer DVD playback software; digital televisions and portable electronic devices; and consumer electronic products, such as gaming systems and audio/video receivers."

Is there any news to explain today's move?

The Consumer Electronics Show is being held this week in Las Vegas. Dolby has announced audio and image technologies that are being favorably received.

How did they do in the latest quarter?

On November 8, 2007, Dolby reported fiscal 4th quarter results. For the quarter ended September 28, 2007, revenue climbed 26% to $129 million from $102.1 million in the same period last year. Earnings climbed 75% to $44.2 million or $.39/share from $25.2 million or $.22/share last year.

These results beat expectations of $120.6 million in revenue and $.25/share in earnings. The company also raised guidance on fiscal 2008 to earnings of $1.27 to $1.37/share on revenue of $560 to $600 million. Analysts polled by Thomson Financial had been expecting profits of $1.23/share on revenue of $536.6 million.

In other words, this was a gorgeous earnings report imho.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Dolby (DLB), we can see that revenue has been steadily increasing from $217 million in 2003 to $482 million in 2007. Earnings have also steadily increased from $.36/share in 2003 to $1.26/share in 2007. No dividends have been paid. Shares outstanding have increased somewhat from 86 million in 2003 to 114 million in 2007. This represents an approximately 30% increase in shares during which time the revenue grew by over 100% and the earnings increased by over 200%. This is an 'acceptable' level of dilution imho.

Free cash flow has been positive and growing with $66 million reported in 2005 increasing to $124 million in 2006 and $152 million in 2007.

The balance sheet as reported by Morningstar.com appears quite solid with $368.0 million in cash which by itself is adequate to cover both the $143.2 million in current liabilities and the $51.3 million in long-term liabilities combined. Calculating the current ratio, there are a total of $733 million in total current assets which when compared to the current liabilities of $143.2 million yields an extremely strong ratio of 5.12. (Generally ratios of 1.25 or higher are 'healthy').

In other words the Morningstar.com report is fabulous.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" we can see that this is a large cap stock with a market capitalization of $5.43 billion. The trailing p/e is rich at 39.12 with a forward p/e (fye 28-Sep-09) estimated at 29.82. The PEG ratio is also a bit rich at 1.83.

Examining the Fidelity.com eresearch website, we find that in terms of Price/Sales (TTM), Dolby is reasonably priced with a Price/Sales (TTM) ratio of 10.33 compared to the industry average of 36.84. Also on Fidelity, DLB compares favorably when profitability is examined, at least as measured by Return on Equity (TTM), Dolby comes in at 19.81% compared to the industry average of 6.10%.

Finishing up with Yahoo, there are 110.39 million shares outstanding while only 49.22 million of them float. As of 12/11/07, there were only 652,790 shares out short representing a short ratio of 1, and only 0.6% of the float. There aren't a lot of investors willing to 'bet' against this stock!

No dividends are reported on Yahoo and no stock splits are recorded either.

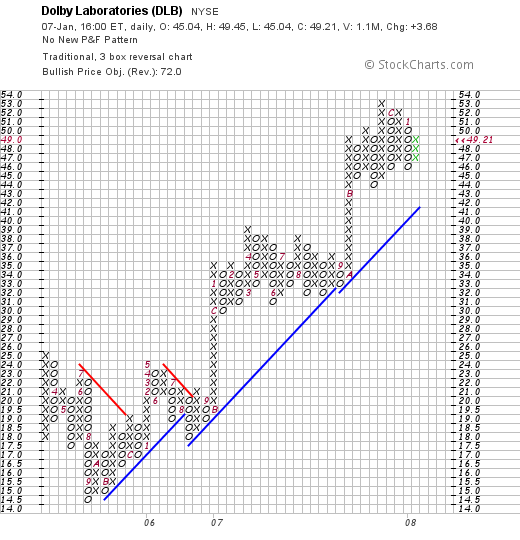

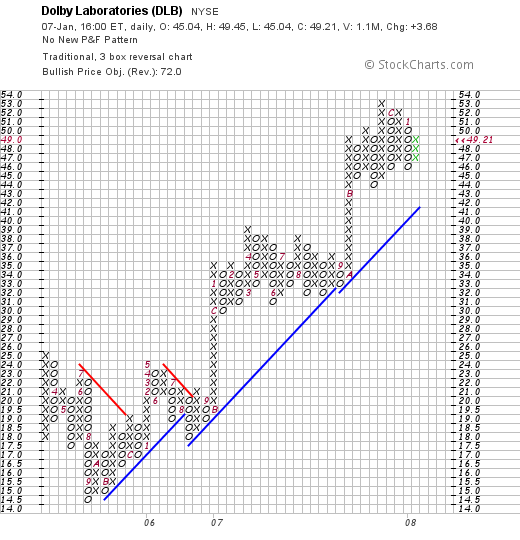

What about the chart?

If we review the "point & figure" chart on Dolby from StockCharts.com, we can see that the company last experienced technical weakness between March, 2005 when the stock traded at $25 until the end of September, 2005, when the stock bottomed at around $14.50. Since that bottom, the stock has stayed fairly true to the support line moving the stock nicely higher to the current level of $49.21, under the November, 2007 high of $53. The stock chart looks strong and not overextended to me.

Summary: What do I think?

As you know, I wouldn't be writing up this stock unless I liked it :), and I really like Dolby a lot. If only the market environment was a bit better and my portfolio generated a 'buy signal', this is a stock I would love to own.

To review, the stock moved sharply higher with some publicity surrounding a consumer electronics show in Las Vegas this week. Their latest quarter had everything I look for in a stock: strong revenue and earnings growth, beating expectations on both, and raising guidance! What I would call a 'trifecta plus'!

Longer-term, the picture is just as nice with steadily increasing revenues and earnings, relatively slower growth in outstanding shares, and nice positive and growing free cash flow. Finally the balance sheet is quite strong with enough cash on hand to pay off all of its liabilities--both short-term and long-term combined!

Valuation-wise, the p/e is certainly rich as is the PEG ratio. However, the Price/Sales per Yahoo is reasonable relative to similar companies and the Return on Equity is also stronger than the industry averages. There aren't a lot of short-sellers out there. Finally the chart looks strong.

On a 'Peter Lynch style of investing', I can recall my fascination with Dolby noise reduction in cassette players years ago. This is a picture of a 1982 cassette boom box by Hitachi with Dolby noise reduction:

But of course that was a long time ago :).

Finally, the chart is quite strong but not over-extended from my amateur perspective. There really isn't much I don't like about this stock except that I don't own any shares :(.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com. I read all of my email but cannot answer every letter I receive.

If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is analyzed and compared to both other investors as well as the many trading indices. On SocialPicks you can also find out about the many other stock picks I have made during 2007 and 2008 and how they have all turned out. And if you still have time, please feel free to visit my Podcast Page where my mp3's are waiting to be downloaded to your iPod or mp3 player so that you can listen to me discuss many of the same stocks I write about here on the blog.

If you are interested in an intriguing website started by the e-Loan founder, and wish to find out more about person-to-person lending, visit Prosper.com and if you sign up through this link, both you and I will earn $25. (Full disclosure, I have earned a total of $25 through referrals up to this time which went towards loans on Prosper.) Please be aware of the great risk involved in these unsecured loans, but hopefully I shall be successful by limiting my exposure to the highest risk or lowest credit-rated borrowers. Even that may or may not be successful....so be sure and do your homework but I am sure if you visit, you will get hooked as I was when my nephew Ryan showed me the website!

Have a great week trading!

Bob

FMC Technologies (FTI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my remaining 100 shares in FMC Technologies (FTI) at $62.90/share. These shares were purchased 1/3/08 at $63.52/share. They were part of a larger lot which was purchased and sold the same day. I left 100 shares as I was happy with the stock and it met my criteria. I do believe that I shall be implementing this strategy of selling most of a "trade" in my one position arbitrary 'trade' strategy, and leaving behind enough for a regular position if it is successful. I haven't blogged much about this as this whole process is evolving. Anyhow, since I had sold the stock 'once' for a gain, with the stock now moving past break-even into a slight loss, it is time to unload the remaining shares.

I am not convinced of the depth of the current rally which for me suggests a bounce in an 'oversold' market.

Anyhow, with my own sale of FTI, I am reducing my rating on the stock:

FMC TECHNOLOGIES (FTI) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 6 January 2008

"Looking Back One Year" A review of stock picks from the week of July 3, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I don't need to repeat myself and complain about how awful a trading week we just had. At least for those of us who are going long on investments.

The weeks do seem to fly by as once again I am back at my keyboard typing away about a weekend review. These reviews are my own attempt at some sort of 'quality control' or review to assess the success and failures of my investment selection process and to encourage some of you to dig into the blog where there are literally hundreds of stocks that I have reviewed over the past four, almost five years.

Anyhow, last week I reviewed the selection(s) from the week of June 26, 2006, so let's move ahead a week and see how things worked out for the stock(s) selected the following week, the week of July 3, 2006. My reviews assume a 'buy and hold' strategy for investment. In practice, I advocate and follow a very disciplined (?) investment strategy which demands of me to sell my losing stocks quickly and completely and sell my gaining stocks slowly and partially at targeted appreciation levels. This difference in strategy would certainly affect performance, but for the ease of analysis, I have always been assuming a 'buy and hold' strategy for these weekend reviews.

On July 3, 2006, I posted Sirenza Microdevices (SMDI) on Stock Picks Bob's Advice when the stock was trading at $13.52.

On July 3, 2006, I posted Sirenza Microdevices (SMDI) on Stock Picks Bob's Advice when the stock was trading at $13.52.

Sirenza was acquired by RF Micro Devices (RFMD); the acquisition was completed on November 21, 2007. As reported:

"

Thus, the stock pick has an appreciation of $3.28 or 24.3% since it was "picked".

As the stock is no longer traded, I do not have a rating on this company.

Thus, for the only stock picked that week in July, 2006, the stock appreciated 24.3% until being acquired. A very acceptable performance in light of the current difficulty the market is facing.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is monitored, analyzed and compared to other investors and indices. Also, my SocialPicks page may interest you as they have been monitoring my blog for all of my stock picks since the first of 2007. And if you have any time left, drop by and visit my Podcast Page where I have been storing some radio shows about various stocks I write about here on the website.

Wishing you a better week starting Monday! Be well!

Bob

Newer | Latest | Older

But one of my favorite things about blogging is to hear from a reader who perhaps appreciates my efforts and maybe has learned something about investing that he or she didn't know. I haven't heard from Tony for awhile, but Tony dropped me a line today that truly warmed my heart. I hope that I can be helpful.

But one of my favorite things about blogging is to hear from a reader who perhaps appreciates my efforts and maybe has learned something about investing that he or she didn't know. I haven't heard from Tony for awhile, but Tony dropped me a line today that truly warmed my heart. I hope that I can be helpful.

On July 11, 2006, I

On July 11, 2006, I

On July 14, 2006, I

On July 14, 2006, I

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why According to the

According to the

On July 3, 2006, I

On July 3, 2006, I