Stock Picks Bob's Advice

Friday, 25 January 2008

Dolby (DLB), Under Armor (UA) and Varian Medical (VAR)--"Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am continuing to work on a strategy to trade stocks on very short-term basis and also manage my underlying trading account in response to market action. I have allowed myself a single position for a "trade" with the strategy of buying a large position, which for me might be $25,000 or so, compared to my average holding of about $6,000, and then selling most of that position should the stock appreciate or selling the entire position should the stock actually drop in price. I haven't set any firm sale points on either the upside of the downside--but that is my strategy.

Furthermore, after a single sale of a holding, including my 'trades', I move up my 'stop' to close to break-even, so that a position in which I have sold shares profitably doesn't turn into a losing venture.

This afternoon, after some rumors about Goldman Sachs, and perhpas just from 'trader fatigue', the market turned lower and brought all of my recent purchases along with it.

With my recent purchases of Dolby (DLB), Under Armor (UA), and Varian Medical (VAR), all moving into the 'red', I chose to sell all three of these positions even if the fundamentals remained intact. It has been my strategy all along to sell these shares should they break down and start losing me money, and sell I did.

1.) Dolby (DLB): I purchased 800 shares of Dolby this morning at $44.62. 400 of these shares were sold shortly thereafter at $45.5275 and then the remaining 400 shares were sold for a small loss at $44.4225. As I write, Dolby is holding this level and is trading at $44.48, up $3.18 or 7.70% on the day. With my own sale,

DOLBY (DLB) IS RATED A HOLD

2.) Under Armor was purchased 1/23/08 at a cost basis of $35.00/share. This was also part of a larger 'trade'. Earlier today, with the market under pressure, UA dipped into the 'red' and I sold my 150 shares at $34.14. UA is currently selling at $34.45, down $(1.21) or (3.39)% on the day.

UNDER ARMOR (UA) IS RATED A HOLD

3.) Shares of Varian Medical (VAR) were also purchased 1/24/08 and were part of a more complex 'trade'. They were purchased with a cost basis of $53 on 1/24/08. Today Varian sold off with the rest of the market. I sold my 100 shares at $52.1666. VAR is currently trading lower at $51.78, down $(1.79) or (3.34)% on the day. With my own sale of Varian Medical Systems,

VARIAN MEDICAL SYSTEMS (VAR) IS RATED A HOLD.

As you can see there is much I need to learn about making 'trades'.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks @lycos.com.

Bob

Dolby (DLB) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With Microsoft reporting earnings that passed estimates, it appeared this morning that the market might well head into a third strong day of trading. With that in mind, I was ready to dabble into a trade, hopefully ending up with a new position. This is rapidly becoming another way that I am growing my portfolio--through management of my existing positions and through trading stocks on the upswing that generally meet my same criteria for 'quality'.

Looking through the list of top % gainers on the NYSE today, I noted that Dolby (DLB) which had been under pressure recently, was moving sharply higher in early trading. As I write, Dolby is trading at $44.51, up $3.21 or 7.77% on the day. I purchased 800 shares of Dolby at $44.62, and later sold 400 of them at $45.5275, for a gain of $.9075 or 2.03% on the trade. This did represent a gain of $363. The other shares are now slightly 'underwater' so I shall me monitoring them closely. The market has pulled back slightly mid-morning, and I would anticipate these shares to move higher should the market move higher as well.

Dolby (DLB) is a recent "pick" for my blog, having written extensively about it on January 7, 2008.

As I stated then,

DOLBY (DLB) IS RATED A BUY

I don't have a set 'stop' for this trade, but am not interested in letting it turn into any significant loss for me. If the stock should move higher once again, I would plan on selling another 250 shares to leave 150 for my Trading Portfolio as a 'holding'.

Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 24 January 2008

Varian Medical Systems (VAR) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am incorrigible.

Back to a trade again. A few moments ago, with the market rally appearing to be strong out of the gate with what appears to be a continuation of yesterday's rally, I decided to see if I could add another trade to the portfolio.

Looking at the list of top % gainers on the NYSE, I came across Varian (VAR), an old favorite of mine, which closed at $53.57, up $4.47 or 9.10% on the day. I say 'old favorite' because I have written about Varian (VAR) on this blog previously--first writing it up on October 20, 2003, and then revisiting Varian on May 11, 2005.

Looking at the list of top % gainers on the NYSE, I came across Varian (VAR), an old favorite of mine, which closed at $53.57, up $4.47 or 9.10% on the day. I say 'old favorite' because I have written about Varian (VAR) on this blog previously--first writing it up on October 20, 2003, and then revisiting Varian on May 11, 2005.

With the market fluctuating and then moving higher after the 'stimulus package' was announced and the President offered comments, it seemed a good time to purchase some shares of Varian and I went ahead and purchased my usual 'over-sized' position of 600 shares at $52.9838 this morning. Early this afternoon, with the market higher and Varian struggling to move ahead, I took my small profit, leaving 100 shares of my original position to stay as part of my Trading Portfolio, selling 500 shares at $53.4054. This worked out to a gain of $.4215/share or .8% on the purchase. With the 500 shares traded, this was a profit of $210.75 on this trade.

Let's take a closer look at Varian and I will explain why

VARIAN MEDICAL SYSTEMS (VAR) IS RATED A BUY

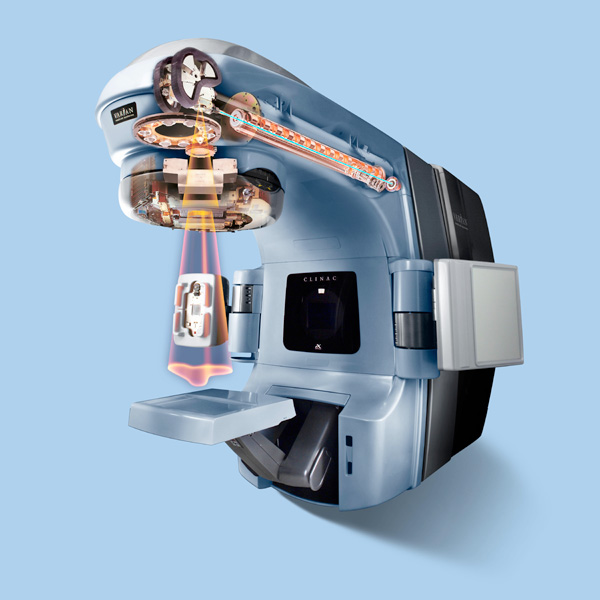

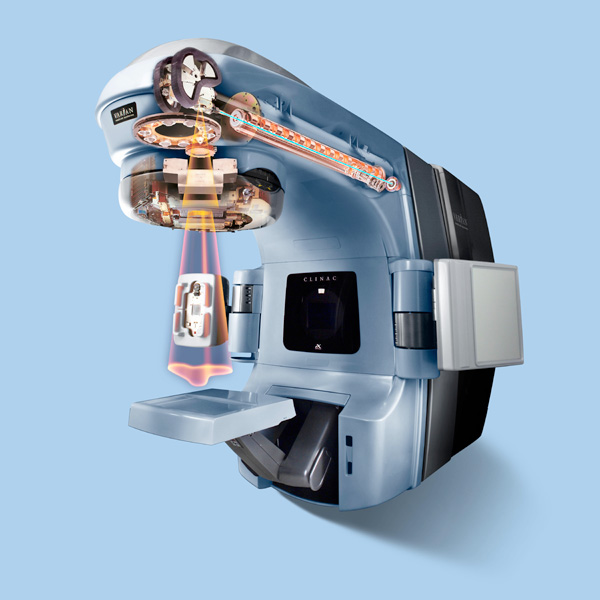

What exactly does Varian Medical do?

According to the Yahoo "Profile" on VAR, the company

According to the Yahoo "Profile" on VAR, the company

"...and its subsidiaries primarily provide cancer therapy systems worldwide. Its Oncology Systems segment designs, manufactures, sells , and services hardware and software products to treat cancer with radiation, including linear accelerators, treatment simulation and verification products, information management and treatment planning software, brachytherapy products and software, and other accessory products and services. It also offers conventional radiotherapy, intensity modulated radiation therapy, image guided radiation therapy, and stereotactic radiotherapy, as well as brachytherapy techniques."

Was there any news to explain today's move?

Varian was the subject of an analyst upgrade today. Leerink Swann upgraded the stock from 'Mkt Perform' to 'Outperform'. The company also jumped in response to the earnings report announced yesterday, after the close of trading.

How did they do in the latest quarterly report?

On January 23, 2008, Varian reported 1st quarter 2008 results. Revenues for the quarter ended December 28, 2007, came in at $459 million, up 18% from the first quarter last year. The backlog stood at $1.7 billion, up 22% from the end of the first quarter the prior year. Net earnings were $.43/diluted share up from $.37/diluted share in the year earlier period. Overall this was $55.5 million in net earnings up from $49.5 million last year.

This result exceeded analysts' expectations of $.40/share on revenue of $436 million according to Thomson Financial. The company raised guidance on the 2nd quarter to $.51/share and revenue growth of 14-16%. This is consistent with the mearn analyst estimate of $.51/share.

For the full year the company also raised guidance for earnings of $2.05 to $2.07 from prior guidance of $2.04 to $2.06, with revenue growth of 14%. Previously they had estimated revenue growth at 10 to 11%. Currently analysts are estimating earnings for 2008 of $2.05/share.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see a very pretty picture of steady revenue growth from $873 million in 2002 to $1.68 billion in the trailing twelve months (TTM), steady earnings from $.70/share in 2002 to $1.93/share in the TTM, and stable outstanding shares with actually a decrease in shares outstanding from 135 million in 2002 to 127 million as the company bought back shares from the public.

Free cash flow has been positive, if not growing, with $210 million reported in 2004, and $206 million in the TTM.

The balance sheet is solid with $288.8 million in cash and $825.6 in other current assets. This, when compared to the $644.9 million in current liabilities yields a current ratio of 1.73. (From my perspective, ratios above 1.25 are adequately 'healthy'). In addition, there is a relatively small amount of long-term liabilities reported at $81.6 million.

What about some valuation numbers?

Reviewing Yahoo "Key statistics" on VAR, we find that this is a large cap stock with a market capitalization of $6.7 billion. The trailing p/e seems reasonable at 29.23, with a forward p/e (fye 28-Sep--09) estimated at 22.70. The PEG is a tad rich at 1.60.

Checking the Fidelity.com eresearch website, we can see that the Price/Sales (TTM) ratio is reasonable at 3.51 compared to the industry average of 5.16. Also on Fidelity, we find that the Return on Equity (TTM) is more profitable than its peers at 29.55%, compared to the industry average of 25.63%.

Finishing up with Yahoo, we can see that there are 125.12 million shares outstanding with 124.52 million of them that float. As of 12/26/07, there were 3.65 million shares out short, representing a short ratio of 4 days of average trading volume. This is a bit heavier than my 3 day cut-off for significance, so there could well have been a bit of a short squeeze today as the stock climbed higher in the face of good news.

No dividend is paid and the last stock split reported on Yahoo was a 2:1 stock split on August 2, 2004.

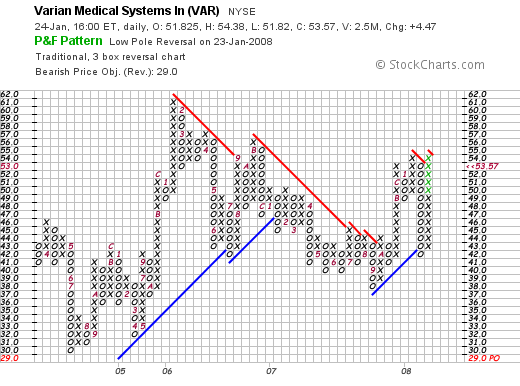

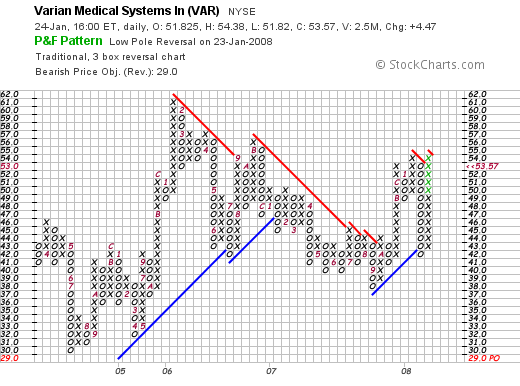

What does the chart look like?

Reviewing the 'point & figure' chart on Varian Medical Systems from Stockcharts.com, we can see that the stock which moved strongly ahead from early 2005 when it traded as low as $31, moved to a peak at $61 in January, 2006. Since then the stock has pulled back dropping as low as $38 in September, 2007. Since that dip, the stock appears to be moving higher developing a new area of support. This month, the stock has been under pressure, as have other stocks, but tentatively, the stock appears to be looking to break through resistance into new higher prices.

Summary: What do I think about Varian?

It is really a little hard to like any stock right now. Just as you think you know something about it, the market finds a reason to tear down your position in a quick and devastating fashion.

However, by all of the usual metrics, this is a great stock. Let's review some of the things I have noted above. First of all they reported a great earnings report that beat expectations and they went ahead and raised guidance. An analyst even gave it an upgrade today!

Longer-term, they have grown their revenue steadily, grown their earnings steadily, and have actually decreased their outstanding shares. Free cash flow is solidly positive (if not growing) and the balance sheet appears strong.

Valuation-wise, the p/e is under 30, the PEG is a tad over 1.5, price/sales is below similar companies and the Return on Equity exceeds its peers. There is a slightly significant number of short sellers and the chart appears a little encouraging.

With all of this in mind, I purchased a large position as a trade. As is my new custom, with a successful trade, I left behind a small position which shall enter my Trading Portfolio. Since I have already sold a portion of VAR once, I shall sell my remaining shares should it dip significantly below my cost.

Thanks again for stopping by and visiting! If you get a chance be sure and visit my Covestor Page where my actual holdings are reviews, my SocialPicks Page where my stock picks are tracked and my Podcast Page where you can download an mp3 of me discussing one of the many stocks reviewed on this website.

Regards again and hopefully continued strength in the market in the days ahead.

Bob

Posted by bobsadviceforstocks at 12:45 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 24 January 2008 6:26 PM CST

Wednesday, 23 January 2008

Under Armor (UA) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professsional investment advisers prior to making any investment decisions based on information on this website.

With the incredible volatility of the market (the Dow opened up down about 275 and closed up about 280 in the same day!), I decided not to sit with this sizeable position long-term. I sold 650 of my 800 shares, leaving 150 for a possibly longer-term holding, at $35.54/share. This was a gain of $.55/share or 1.6% since purchase minutes earlier. With a more-or-less successful trade, I shall keep the Under All shares in my Trading Account and treat them as a new position that has had one sale at a gain already. In other words, instead of waiting for a loss of 8% if the stock should decline, I shall be unloading my shares should the stock hit my purchase price or lower. In addition, I shall allow myself the opportunity of making another "trade" should the opportunity arise.

As background, Under Armor (UA) announced 3rd quarter 2007 results on October 30, 2007. Net revenues for the quarter incrfeased 46.3%, income climbed 53.8% and diluted earnings per share climbed 25% to $.40 from $.32/share last year. The company in the same announcement raised guidance on net revenues for 2007 to the $590 to $600 million range from the prior range of $580 to $590 million, and raised guidance for annual income to $81.5 to $83 million from prior guidance of $79 to $81.5 million.

The third quarter report easily beat expectations of analysts of $.34/share on revenue of $171 million.

More recently, the stock of Under Armor has been under pressure as it provided 1st half guidance well under expectations. The company announced expectations for first half of 2008 for $.03 to $.05/share. Analysts had been expecting $.26/share in the first quarter and $.13/share in the second quarter according to analysts polled by Thomson Financial. This guidance well below expectations had a deadly effect on the stock price and the stock price reflected this disappointment. Also driving the stock down strongly last week was the downgrade by Wachovia Capital Markets analyst John Rouleau.

Ironically, while the company was lowering guidance for the first half they were also raising guidance for the full year 2007 to $605 million, ahead of the above noted guidance as well as ahead of the 'street. They also reported expectations for $1.03 to $1.04/share in 2007 ahead of the $1.01 expected by Reuters.

Longer-term, the Morningstar.com "5-Yr Restated" financials page is strong if imperfect, with steady revenue growth, limited earnings results, free cash flow which more recently is negative at $(4)million, and a solid balance sheet.

Chartwise, the 'point & figure' chart on UA from Stockcharts.com looks quite week, with the stock breaking below support of $61 back in September, 2007, and heading lower since then.

With the mixed Morningstar report, the recent guidance below expectations, and the chart that looks less than strong, the best I can do is

UNDER ARMOR (UA) IS RATED A HOLD

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. For further information on my trading account and my overall performance, be sure and visit my Covestor Page. Also, visit my SocialPicks page if you would like to see how all of my 'picks' have been performing. And if you find the time, I am sure you would enjoy my Podcast Page where you can listen to me discuss some of the same stocks I write about here on the blog.

Bob

Under Armor (UA) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so pleae remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I exercised my prerogative to make a trade with one position in my account.

I did this because the market appeared to be over-sold over the short-term, and was rallying into the close. Under Armor Armor (UA) is trading at $35.76 as I write, up $4.48 or 14.31% on the day. I purchased 800 shares at $34.99 just minutes ago. Wish me luck.

Bob

Monday, 21 January 2008

Remembering Martin Luther King Jr.: Taking Stock In America!

Somehow I would be remiss on this blog if I didn't say something about Martin Luther King, Jr. on his Birthday.

Somehow I would be remiss on this blog if I didn't say something about Martin Luther King, Jr. on his Birthday.

Many of you readers find it strange that I could be a "liberal" and yet believe in the free market system of investments and stocks and the like. Yet is a fact.

We are facing a major decline in the stock market tomorrow. So 'What does this have to do with Reverend King?' I can hear you asking. Why should being a liberal or a conservative have anything to do with the stock market? And 'aren't liberals for more government and more taxes?' and 'wouldn't they be bad for the economy?'

But I would like to assert that what we have in Washington today is 'capitalism gone wild'. It is a wild west sort of place that has less to do with free markets and more to do with cronyism and incompetence.

Instead of dreaming about the possibilities of brotherhood and justice, this Administration turns back the clock on progress appointing 'originalist' Justices who threaten the basic rulings that the Civil Rights Movement itself is based on---rulings like 'Brown v. Board of Education' that outlawed 'separate but equal schools'. They claim to support education but then pass 'No Child Left Behind' that raises the requirements of students endlessly and when eventually those schools fail to meet those standards money is removed from them leaving them worse than ever.

And poor minority children are hurt by these policies.

Worrying more about the taxes paid by heirs and heiresses and hollering about "Death Taxes" they have worked to concentrate wealth into fewer and fewer hands decimating the ranks of the middle class and leaving the poor to fend for themselves.

Martin Luther King would still be dreaming.

When Katrina struck New Orleans, hundreds of thousands of jobs were lost, homes and businesses were destroyed, and schools were shut down.

Instead of lifting up those people, giving them hope for the possibility of the future, they bussed them out of the city with a modern form of ethnic cleansing of New Orleans with poor minorities sent to Houston and elsewhere to find new homes.

When hundreds of thousands of jobs were lost, this Administration failed America and failed the African-Americans who depended on them for help from the simplest assistance of water to the complex needs of rebuilding. Instead of telling this nation that thousands of jobs were lost but good news, 'there were thousands of jobs to be done.', this Administration failed us and created a 'tax incentive zone' and provided contracts to Blackwater instead.

Martin Luther King would still be dreaming.

When America was challenged by those who would destroy us, this Administration lifted its hand from the steady leadership that was required and went into the mud with our enemy, utilizing torture, rendition and 'shock and awe' starting a war that wasn't a just war, wasn't a war on someone who attacked us, but a pre-emptive war that has drained our Treasury's coffers.

Martin Luther King would ask us to dream of a better world.

So when we face the market tomorrow and watch the Dow dip by the 100's of points, let us remember what could be in America. What could happen with leadership that kept a responsible hand on the fiscal budget, leadership that provided education for those needing to learn, help to those who have suffered from the hardships of nature or the hardships of mankind, leadership that embraced science and knowledge instead of banning research, leadership that led the world in fighting the scourge of climate change instead of editing the very climate report with lobbyists in charge, and leadership that removed regulation from our banks and work place and now we find that the fox is eating the hens in the hen house.

And we don't have a chicken in every pot because we let the fox in.

So being liberal isn't contrary to being an investor.

An investor believes in the possible accomplishment of every person regardless of race, religion, creed, or sexual orientation. Investors believe in growth both in earnings and individual knowledge. Investors believe in value, whether it be of a stock or of a person. Investors believe in momentum, the momentum of history that challenges us to move ahead and not be left behind with outdated ideas and outdated policies that hold us back.

So yes I am an investor. I am a liberal. I love America. And I believe that so many of the things being done today are simply wrong. Simply un-American. Simply need to stop. Because I am a long-term investor in America. I am holding on to this nation for the long haul. I believe in what America can be and shall become. I am going to be there to reap the dividends of liberty for me and my posterity.

Bob

Saturday, 19 January 2008

Morningstar (MORN) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In the midst of this market 'meltdown', it is still business as usual on this blog. My portfolio investment strategy is kicking in as it has been for the last several weeks. As stocks decline, if they reach sale points they are sold and not replaced. I am now down to 9 positions and could conceivably drop to 5 positions (my minimum) well below the maximum of 5 positions.

I have attempted to accomplish several things on this blog simultaneously. For one, I have been listing many investment 'ideas' that I would find suitable for purchase. In addition, I have outlined my own ideas of portfolio management with targeted buys and sales and utilizing portfolio-generated signals to determine when to be buying or selling positions. Finally, I have been working hard in the name of transparency to share with you my thoughts on my own actual holdings. Now with my participation on Covestor, you all can monitor my activities virtually real-time without my needing even to blog.

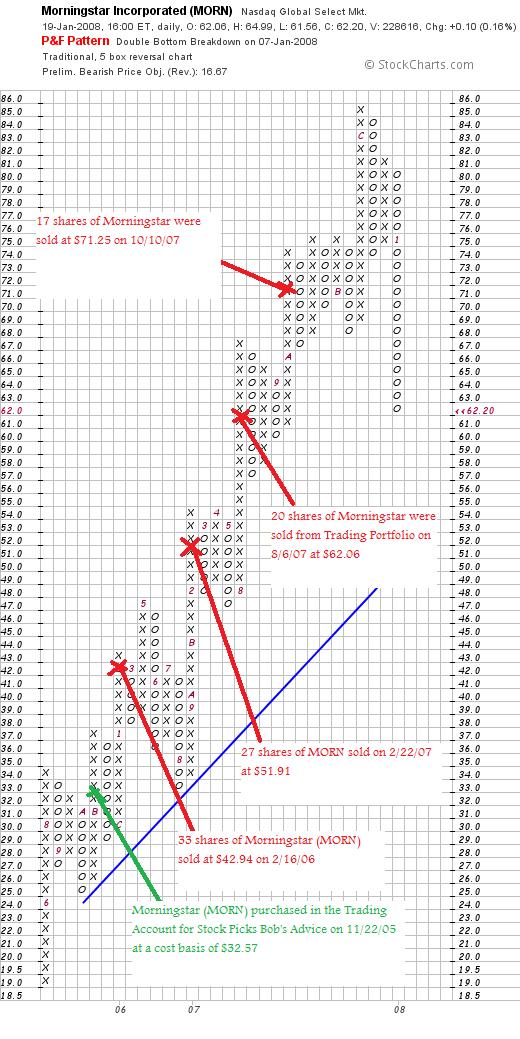

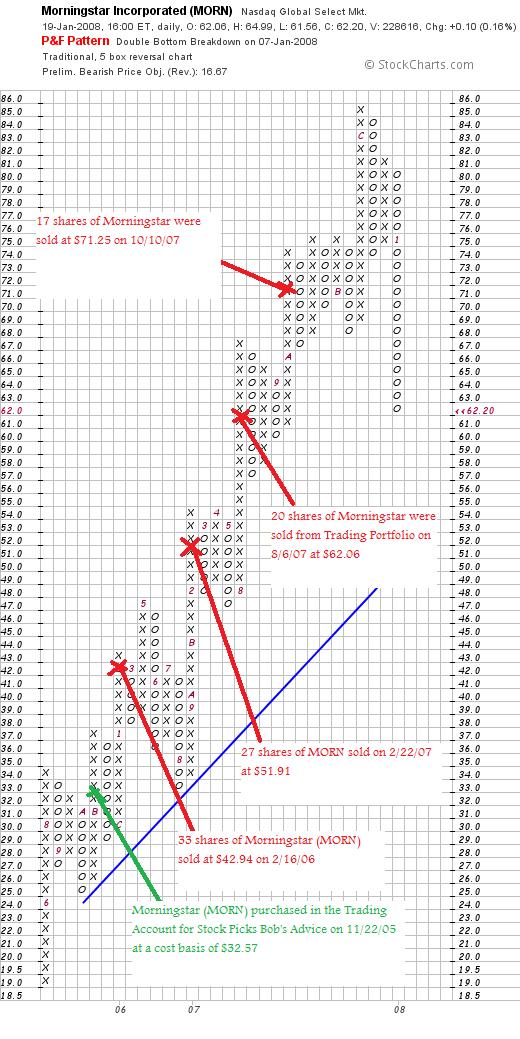

On December 23, 2007, I reviewed my holding in IHS (IHS). Going alphabetically through my shortened list of holdings, brings me to Morningstar (MORN). Besides utilizing Morningstar.com for much of my own research in this blog, I also own a small position in my trading account! I currently own 103 shares of Morningstar (MORN) which were purchased 11/22/05 at a cost basis of $32.57. Morningstar closed at $62.20 on January 18, 2008, for an unrealized gain of $29.63 or 91.0% since purchase.

On December 23, 2007, I reviewed my holding in IHS (IHS). Going alphabetically through my shortened list of holdings, brings me to Morningstar (MORN). Besides utilizing Morningstar.com for much of my own research in this blog, I also own a small position in my trading account! I currently own 103 shares of Morningstar (MORN) which were purchased 11/22/05 at a cost basis of $32.57. Morningstar closed at $62.20 on January 18, 2008, for an unrealized gain of $29.63 or 91.0% since purchase.

I have sold portions of Morningstar four times already. I sold 33 shares on 2/16/06 at a price of $42.94, representing a gain of $10.37 or 31.8%. Next I sold 27 shares of MORN at $51.91 on 2/22/07 for a gain of $19.34 or 59.4%, 20 shares of MORN were sold on 8/6/07 at $62.06, representing a gain of $29.49 or 90.5% since purchase. Finally, I sold 17 shares of MORN on 10/10/07 at a price of $71.25, representing a gain of $38.68 or 118.8% since purchase.

These sales demonstrate my current strategy of selling portions of a holding (currently 1/7th of my remaining shares) at targeted sale points of 30, 60, 90, and 120% appreciation points.

What does the chart look like?

Let's take a look at the "point & figure" chart on Morningstar (MORN) from StockCharts.com:

As you can see Morningstar (MORN) has come under considerable selling pressure since the first of the year as the stock dipped from a high of $85 in December, 2007, to its current price of $62.20. I think the sales of portions of Morningstar may well make more sense now in the face of the correction we are facing! The stock appears from this view to be well above the support area in terms of the long-term stock performance.

When do I plan to sell Morningstar next?

As you probably know, I have two points at which I sell a stock. On the upside I sell 1/7th of my remaining shares as a stock advances to targeted appreciation levels which I have arbitrarily set at 30, 60, 90, 120, then 180, 240, 300, 360, then 450% etc. appreciation points. Since I have already sold a portion of Morningstar four times with the last sale at the 120% level, my next level of sale would be 1/7th of my remaining shares at a 180% level of appreciation. This works out to 103/7 or 14 shares if the stock should appreciate to 2.80 x $32.57 = $91.20.

On the downside, unless there is some fundamental negative news that leads me to sell my shares, my sale point is at 1/2 of the highest appreciation sale level. For MORN, since I sold some shares four times, with the last being at the 120% appreciation level, my sale target is at a 60% appreciation level which works out to 1.6 x $32.57 = $52.11. If Morningstar should decline another $10 from here, I shall be selling all of my remaining shares regardless of my overall outlook on the company.

How did they do in the latest quarter?

On November 1, 2007, Morningstar (MORN) reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, revenue came in at $111.9 million up 36.7% from the prior year's result of $81.8 million. Consolidated operating income came in at $31.4 million up 53% from last year's $20.5 million. Net income was $19.9 million in the quarter or $.41/share compared with $13.5 million or $.29/diluted share in the same quarter last year.

The company beat expectations of $.39/share but came in slightly light on revenue which had been expected to come in at $112.5 million according to analysts polled by Thomson Financial.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on MORN, we can see an almost perfect report with steady revenue growth, steady earnings growth (except for a dip in 2003), fairly stable shares (about an 18% increase in shares between 2002 and 2006 during which time revenue climbed almost 200%, and earnings increased almost 1000%).

What do I think?

Well I like Morningstar a lot. I use the service in the blog and own shares. But I am prepared to sell if the stock should decline to a sale point as I have established. The latest quarter was great, and longer-term the company looks solid. Technically, the stock has shown recent weakness along with the market. Thus, even though the fundamentals are strong, the best I can do--

MORNINGSTAR (MORN) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the website, or email me at bobsadviceforstocks@lycos.com.

Be sure and visit my Covestor Page, my SocialPicks Page, and my Podcast Page!

Bob

"Looking Back One Year" A review of stock picks from the week of July 17, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Generally, I like to review my past stock picks in this place on the weekend. But I didn't 'pick' any stocks during the week of July 17th. So there is no review to be made today!

If I get a chance, I shall try to do a 'portfolio review' which I like to do about every three weekends looking at each of my holdings in my Trading Account.

If you get a chance, be sure and visit my Covestor Page where my trading account is reviewed and analyzed, my SocialPicks Page where my stock picks from the last year are monitored, and my Podcast Page where I have 'shows' about some of the many stocks I write up here on the blog.

Regards and have a great weekend.

Bob

Thursday, 17 January 2008

Precision Castparts (PCP) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This afternoon, when the selling pressure became more severe, my Precision Castparts stock, which was actually moving higher originally, turned lower and hit a sale point and was sold. I sold my 64 shares of PCP at $108.79. I had actually purchased these share on 10/24/06 at $69.05 so realized a gain of $39.74/share or 57.6% on these shares since purchase.

You might be asking the why of my sale. Why did I sell the stock NOW when the stock was ahead by 57.6% since purchase?

In fact, this sale was dictated by my own trading portfolio management system. That is, since I had sold shares four times previously at approximately 30, 60, 90 and 120% appreciation points, on the downside my sale price had been moved up to 1/2 of my highest appreciation sale or 1/2 of 120% = 60%. Breaching this 60% appreciation level, I went ahead and sold my own shares.

With this sale on 'bad news' I am once again 'sitting on my hands' and my own portfolio is now down to 9 positions. My 'system' is working, albeit slowly, to move me gradually out of equities and into cash as the market correction and possible bear market develops.

Since the latest quarterly report was strong, and the Morningstar.com report is also quite strong, I am reluctant to move the rating to a "sell", however, with my own sale of shares on what I would call technical reasons, I am reducing my rating of this stock:

PRECISION CASTPARTS (PCP) IS RATED A HOLD

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Furthermore, stop by and visit my Covestor Page where my own trading portfolio is analyzed, and my SocialPicks page where all of my past picks can be monitored from 2007 on. And if you get a chance, drop by and visit my Podcast Page where my own podcasts are posted.

Now you are surely exhausted :).

Hopefully, tomorrow will be a bit better for all of us.

Bob

Wednesday, 16 January 2008

Graham Corp (GHM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I found that my latest stock purchase, Graham Corp (GHM) had hit a sale point on the downside and I sold my 210 shares at $41.34. These shares had just been purchased on 1/10/08 at a price of $46.27. Thus, my loss on these shares worked out to $(4.93)/share or (10.7)% since purchase. My trading rules dictate me to implement sales as stocks hit (8)% losses. I am fairly 'old-fashioned' with these sales and monitor my stocks manually. With the fast-moving market, I probably should consider automatically setting up these transactions.

Since this stock sale is on 'bad news', I do not have any permission to replace this investment with another holding. Thus, I am now down to 10 holdings in my trading account, down from my maximum of 20 and above my minimum of 5. My portfolio keeps 'talking to me' and I am listening.

As is my practice, I shall be waiting for one of my positions to hit a sale at a targeted appreciation point to get that 'permission slip' to add another stock. Meanwhile, I am sitting on my hands. Hoping against hope that the market does not dictate another sale of a great company with a weak stock price.

With this sale of my own shares,

GRAHAM (GHM) IS RATED A HOLD

Thanks so much for visiting! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Looking at the list of top % gainers on the NYSE, I came across Varian (VAR), an old favorite of mine, which closed at $53.57, up $4.47 or 9.10% on the day. I say 'old favorite' because I have written about Varian (VAR) on this blog previously--first

Looking at the list of top % gainers on the NYSE, I came across Varian (VAR), an old favorite of mine, which closed at $53.57, up $4.47 or 9.10% on the day. I say 'old favorite' because I have written about Varian (VAR) on this blog previously--first

On December 23, 2007, I reviewed my holding in IHS (IHS). Going alphabetically through my shortened list of holdings, brings me to Morningstar (MORN). Besides utilizing Morningstar.com for much of my own research in this blog, I also own a small position in my trading account! I currently own 103 shares of Morningstar (MORN) which were purchased 11/22/05 at a cost basis of $32.57. Morningstar closed at $62.20 on January 18, 2008, for an unrealized gain of $29.63 or 91.0% since purchase.

On December 23, 2007, I reviewed my holding in IHS (IHS). Going alphabetically through my shortened list of holdings, brings me to Morningstar (MORN). Besides utilizing Morningstar.com for much of my own research in this blog, I also own a small position in my trading account! I currently own 103 shares of Morningstar (MORN) which were purchased 11/22/05 at a cost basis of $32.57. Morningstar closed at $62.20 on January 18, 2008, for an unrealized gain of $29.63 or 91.0% since purchase.