Stock Picks Bob's Advice

Saturday, 10 July 2004

"Looking Back one Year" A review of stock picks from the week of June 30, 2003

Hello Friends! Last weekend, I took a look at stock picks from the week of June 23, 2003. This weekend, let's review June 30, 2003, selections. As always, please remember that I am an amateur investor, thus am learning as I go as well, and that you should thus consult with your professional investment advisor before taking any action based on information on this website. Also, for review purposes, I assume a buy and hold strategy for investments. However, this website is clearly geared towards selling any stock that hits an 8% loss quickly, and then peeling off stocks that are gaining in a much slower fashion. These techniques would also affect real-life trading results.

I

posted TransMontaigne (TMG) on Stock Picks on 6/30/03 when it was trading at $6.48. TMG closed at $5.35 on 7/9/04 for a loss of $(1.13) or (17.4)%.

On May 12, 2004, TMG

announced 3rd quarter 2004 results. For the quarter ended March 31, 2004, revenue jumped to $3.1 billion from $2.3 billion. However, net earnings per basic share dropped to $.45/share from $.55/share the prior year.

I

posted ChoicePoint (CPS) on Stock Picks on 7/1/03 at a price of $36.14. CPS closed on 7/9/04 at $43.01 for a gain of $6.87/share or 19%.

On April 22, 2004, CPS

reported 1st quarter 2004 results. Revenue grew 11% to $217.2 million. Earnings per share grew 5% to $.37/share compared to $.35 in 2003.

Mid Atlantic Medicals Services (MME) was

posted on Stock Picks Bob's Advice on 7/2/03 at $55.56. On Octobert 27, 2003, UnitedHealth Group (UNH)

announced that it was acquiring MME for $18 in cash and 0.82 shares of UNH. UNH closed on 7/9/04 at $60.25, thus this deal currently values each former share of MME (now MAMSI) at $45.40 + $18.00 or $63.40. This would work out to a gain of $7.84/share or 14.1%.

I

posted Metrologic Instruments (MTLG) on 7/2/03 at $35.60. On July 3, 2003, MTLG had a 3:2 stock split reducing the pick price to $23.73. Again on 10/30/03, MTLG split its stock 2:1 reducing our pick price again this time to $11.87. MTLG closed at $17.65 on 7/9/04 for a gain of $5.78 or 48.7%.

On 4/22/04, MTLG

announced 1st quarter 2004 results. For the quarter ended March 31, 2004, sales increased 24.6% to $39.7 million. Net income was up more than 100% to 5.1 million compared to $1.9 million or $.22/share this year compared to $.11/share last year. These were very nice results!

Finally, Digital River (DRIV) was

selected for Stock Picks on 7/2/03 at a price of $21.69. DRIV closed at $28.50 on 7/9/04 for a gain of $6.81 over the past year or 31.4%.

So how did these stocks do from the week of June 30, 2003? Of these 5 stocks, one had a loss (TMG) of (17.4)%. The others had gains ranging from 14.1% to 48.7%, for an average gain of 19.16%. Not too bad a week for this blog at all!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Friday, 9 July 2004

July 9, 2004 Johnson Controls (JCI)

Hello Friends! TGIF...no not the STOCK....or the RESTAURANT...I mean THANK GOD IT IS FRIDAY! Get a couple of days off to catch up on things I guess. I sure do appreciate all of you who take the time to stop by here and visit. So please make yourself at home....but PLEASE remember that I am an AMATEUR investor...so PLEASE consult with your professional investment advisors before taking any action based on information on this website.

Scanning through the lists of greatest percentage gainers today, I didn't see much on the NASDAQ that really grabbed my attention. Johnson Controls (JCI) is having a fairly nice day today, trading at $53.24, up $1.97 or 3.84% on the day. I do NOT own any shares nor do I have any options or other leveraged positions in this stock. According to the

Yahoo "Profile", Johnson Controls (JCI) "...has two operating segments, the Automotive Group and the Controls Group. The Controls Group provides installed building control systems and technical and facility management services, including comfort, energy and security management for the non-residential buildings market....The Automotive Group designs and manufactures products for motorized vehicles."

On April 15, 2004, JCI

announced 2nd quarter 2004 results. Sales for the second quarter increased 20% to $6.6 billion from $5.5 billion last year. This involved both an increase in 23% in automotive revenues as well as an 11% rise in controls sales. Fully diluted earnings per share increased 17% to $.82/share from $.70/share last year. Not too shabby at all! In addition, they confirmed 2004 guidance for consolidated sales growth of 13-15% increase with "double-digit" increases in operating income and net income.

How about longer-term? If we take a look at the

"5-Yr Restated" financials from Morningstar.com, we can see that revenue has STEADILY increased from $16.1 billion in 1999 to $25.0 billion in the trailing twelve months (TTM). Earnings per share, while not quite as consistent, have also been growing from $2.57 in 1999, to $3.89/share in the TTM. This company has ALSO been paying a dividend....and increasing it each year (!) from $.50/share in 1999 to $.81/share in the TTM.

Free cash flow, while not consistent, has been solidly positive, with $367 million in 2001, and $245 million in the TTM.

The balance sheet is at least balanced with a touch more liabilities than I might like to see. There is $226.4 million in cash and $5.78 billion in current assets compared to $6.0 billion in current liabilities, and $3.4 billion in long-term liabilities. Certainly, this company has plenty of current assets to cover the current liabilities...and with the solid free cash flow performance, the long-term liabilities do not appear to be formidable imho.

How about Valuation? If we look at

"Key Statistics" on Yahoo, we can see that this is a large cap, $10.13 Billion company. The trailing p/e is very nice at 13.92, with a forward p/e of 11.32. The PEG is at 0.91 which is great under 1.0, and the Price/sales is also quite nice at 0.39.

JCI has 190 million shares outstanding with 185.6 million of them that float. There are currently 2.35 million shares out short as of 6/7/04, representing 1.27% of the float or 2.96 trading days...so the short interest is not that significant in my view. As noted above Johnson Controls does pay a dividend, currently at

$.90/share yielding 1.76%. Earlier this year, in January, 2004, JCI did have a 2:1 split.

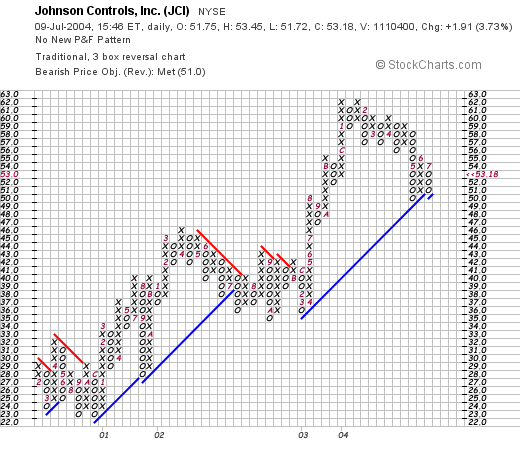

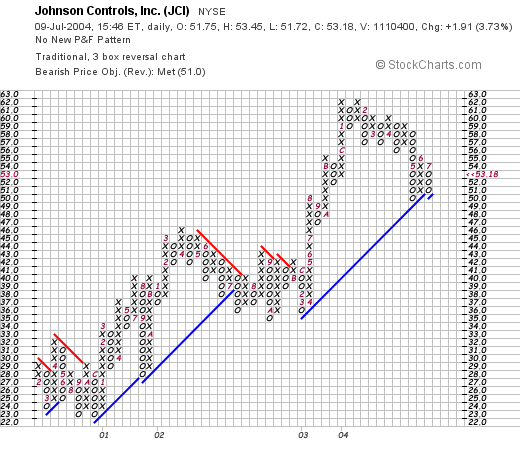

How do the technicals look? If we look at a stockcharts.com Point & Figure chart:

We can see a STEADY ascent from early 2000 from $23.00 to the current level of about $50/share. The company hesitated in August, 2002, while building a new level of suppport and then broke out once again. The stock is currently seeming to be building a new support level...and may be poised to move ahead from here (?).

So WHAT do I think? Hey I like this stock. If I had some money I might even BUY some shares! But you know the same old song....what do I like about this? Well, try steady earnings and revenue growth, solid free cash flow performance, satisfactory balance sheet, excellent valuation, and a nice chart to boot. Why this company even pays a reasonable dividend....am I getting old or what? And has been GROWING its dividend each year.

Anyhow, that's a wrap. Thanks again for stopping by and please feel free to email me with any comments, questions, or words of encouragement..at bobsadviceforstocks@lycos.com . Have a great weekend everyone....and I will be working at getting out that "Weekend Review" that I like to do each weekend....looking back a year now to see how stocks selected on this blog have performed!

Happy Friday!

Bob

Thursday, 8 July 2004

July 8, 2004 Anika Therapeutics (ANIK)

Hello Friends! Thanks so much for stopping by! The market was less than exciting today with double-digit declines in the Dow and NASDAQ...but I continue to scan the top movers looking for new names to discuss in this Blog. As always, please remember that I am an AMATEUR investor, so please discuss with your PROFESSIONAL investment advisors any investment ideas you may glean from this website!

I came across Anika Therapeutics (ANIK) today while scanning the

lists of greatest percentage gainers. I do NOT have any shares of Anika nor do I own any options or other leveraged positions. ANIK had a great day today closing at $16.01, up $1.90 or 13.47% on the day. According to the

CBS Marketwatch Profile Anika's "...principal activities are to develop, manufacture and distribute therapeutic products and devices.

The products promote the protection of bone, cartilage and soft tissue....The Group also manufactures AMVISC (r) and AMVISC (r) Plus for Bausch & Lomb, which are used as viscoelastic supplements in ophthalmic surgery."

On April 29, 2004, ANIK

announced 1st quarter 2004 results. Total revenue for the quarter ended March 31, 2004, jumped 81% to $6.1 million from $3.4 million the prior year. Net earnings came in at $7.8 million or $.69/diluted share vs a net loss of $(313,000) or $(.03)/diluted share the prior year. These are certainly dynamic results!

How about longer term? Looking at

Morningstar "5-Yr Restated" financials, we can see that revenue which grew to $16.3 million in 2000, dipped down to $11 million in 2001, and has been improving steadily since with $18.2 million in the trailing twelve months (TTM). Earnings have been erratic dipping to a loss of $(.68)/share in 2001, and have improved steadily since then with $.80/share reported in the TTM. Free cash flow has also been looking better recently with $(5) million in 2001, improving steadily to $22 million in the TTM.

Morningstar reports ANIK with $34.8 million in CASH, more than enough to cover both the moderate short-term liabilities of $7.7 million AND the long-term liabilities of $19.3 million combined. In addition, ANIK has $8.1 million in OTHER current assets. This is a very nice balance sheet indeed!

What about valuation? Looking at

"Key Statistics" on Yahoo for ANIK we can see that this is a very small company with a market cap of only $161.22 million. The trailing p/e isn't bad at 20.39, but somehow the forward p/e for 2005 is 32.02. No PEG is reported. I just don't think the analysts have gotten this all updated based on the latest quarterly report...unless I am just missing something (?).

Yahoo reports only 10.07 million shares outstanding with 6.20 million that float. Only 75,000 shares are reported out short as of 6/7/04...representing only 0.335 trading days. (the Short Ratio). No dividend is reported and no stock split is listed on Yahoo.

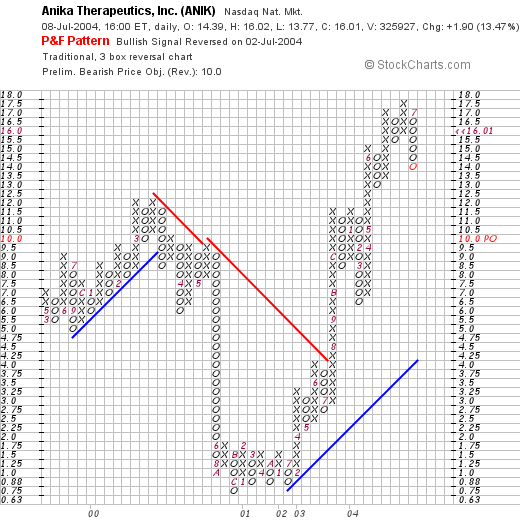

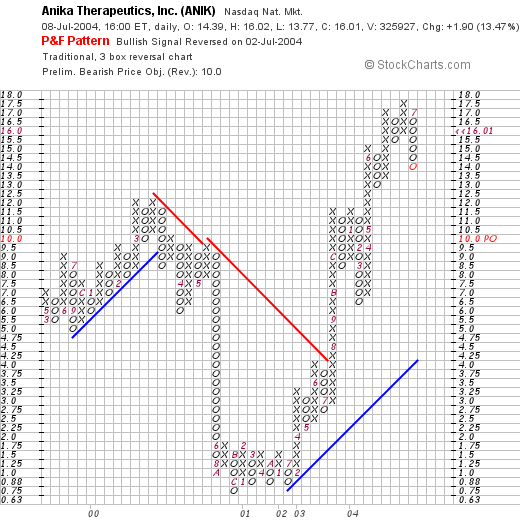

What about Technicals? If we look at a point & figure chart from stockcharts.com:

we can see that this stock pieaked in March, 2000, in the $12.00 range then dropped down to a low of $.75/share in January, 2001. Since then it has traded sharply higher to its current $14 to $17 range. The chart looks nice to me!

So what do I think? This is a tiny company with a great recent record of revenue and earnings growth with recent increasing profitability. The free cash flow is very impressive and the balance sheet is impeccable. Quite frankly, I like the stock just fine....it is just that I don't have any money to BUY anything! Will need to sell something at a GAIN first!

Thanks again for stopping by! If you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

"Trading Transparency" CALM

Hello Friends! Well I cannot tell you I didn't WARN you on this one. I don't know WHICH came first the CHICKEN or the EGG but I can tell you which was SOLD first....Cal-Maine (CALM) a stock with INTRIGUING numbers, hit my 8% loss limit in a pretty crummy market....and out it went. A few moments ago I sold my 150 shares at $14.82. I had JUST purchased these shares, and I mean JUST YESTERDAY...I really hate it when I get caught like that...at $16.16. That works out to a loss of $(1.34)/share or (8.3)%. But you have got to be proud of me, going ahead and sticking with the rules...when I really FELT like hanging on to the shares....

Oh well.

Bob

"Trading Transparency" CMN

Hello Friends! Well the market is struggling back from an earlier pull-back and my Cantel Stock (CMN) is continuing to charge ahead. Checking the trading account, I realized that CMN was getting close to its first sell point for a gain (and that Cal-Maine was trying to avoid a TOTAL sale at an 8% loss), so a few moments ago, I sold 75 shares of CMN at $25.31. I had purchased 300 shares on 6/4/04 at a cost of $20.04, so that was a gain of $5.27/share or 26.3%, a little shy of my 30% gain goal, but with the margin pushing ahead, well it seemed wise to take the first profit. Next sale point will be either 60% on the upside or break-even on a pull-back.

Watching CALM closely, thanks for stopping by, and please remember I am an AMATEUR investor, so please do your own investigation on all stocks discussed on this blog and PLEASE consult with your professional investment advisors!

If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Wednesday, 7 July 2004

"Trading Transparency" COO, CALM

Hello! Just a quick post to update my current trading account. Looking at my holdings and gains/losses, I realized I passed the 120% gain on Cooper (COO), and have sold portions three times. Well it is time for the 4th sale (30, 60, 90, 120% points), so owning now just 75 shares...I sold 15 shares at the market...for $60.67. These shares had been purchased 2/20/03 for $26.98 (!) so had a gain of $33.69/share or 125.7%. Thus, my next sale point will be at a 180% gain...or on the downside, if it slips back to a 60% gain, then should be sold to preserve the remaining profit.

Well then there is the question of WHAT to do now with the proceeds. I used some of the proceeds (and some margin) to pick up 150 shares of Cal-Maine (CALM) which I reviewed last night and impressed me sufficiently to have me buy some shares today! I purchased 150 shares of CALM at $16.11 a few moments ago!

Thanks so much for stopping by. Please remember that I am an AMATEUR investor so PLEASE consult with your professional investment advisor and do your own investigation of all stocks discussed on this blog before taking any action yourself.

If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com

p.s. I now have the CHICKEN (SAFM) and the EGG (CALM)...and the chicken came first! Also, am up to 24 positions, with my goal of 25!

Bob

Tuesday, 6 July 2004

July 6, 2004 Cal-Maine Foods (CALM)

Hello Friends! Thanks so much for stopping by!....please excuse the organization of this blog if you are a new visitor...I have hundreds of ideas to consider...but you will need to learn how to navigate around the website. Best place is to start here with recent posts and go backwards...if you like go to the

main website for Bob's Advice and along the left side you will see the links for the

"Current Trading Portfolio" and "Stock Picks 2003". Also, just below that you will find the link for

"Stock Picks 2004" where I have listed my picks for this year (2004)...and try to on occasion update current prices. If you find any particular stocks you wish to see the initial write-up, use those lists to get the date...I do NOT have it linked at this time, but then manually look at the lists of dates to the left side of this blog, and you can click on those dates and navigate that way....ok I hope that was helpful!

As always please remember that I am an amateur investor, I try to always share with you what I am doing and what I own, but please consult with your professional investment advisors prior to making any investment decisions. I CANNOT be responsible for the actions you take after reading what I write. There, I hope that disclaimer explains my thoughts on this website clearly!

Today, I was meeting with my "Investnut" buddies, and presented Cantel Medical (CMN). As you may realize, I

posted Cantel on March 2, 2004, when it was trading at $18.40. Cantel closed today at $24.68...so it has had a nice ride since my post. I also purchased some of these shares earlier this year....(6/4/04)...and have had a nice appreciation in share price as well!

I first heard about Cal-Maine (CALM) after it was mentioned in the Investors Business Daily (IBD)...some weeks ago. I believe it was in the "New America" section. I do NOT own any shares nor do I have any options on this stock. As close as I get to an EGG stock, lol, is Sanderson Farms (SAFM) that has been listed here, and I do own some shares of SAFM. Somehow, the old joke about which came first "the chicken or the egg"....well in my case, I have invested in chickens first but am ready for eggs now! I think much of the interest in these stocks is related to the ever-discussed "low-carb" phenomenon in which eggs which used to be "bad" are now "good" and "high-protein." This results in all of us who struggle with reducing carbohydrates, I confess I am among the many....taking another look at eggs (No yolk, I am serious!). sorry.

Excuse me for "scrambling" up this post....but CALM had a great day today closing at $15.09/share up $1.53 or 11.28% in an otherwise mediocre market.

According to the

Yahoo "Profile", Cal-Maine "...is primarily engaged in the production, cleaning, grading and packaging of fresh shell eggs for sale to shell egg retailers. The Company had sales of approximately 571 million dozen shell eggs during the fiscal year ended May 31, 2003." Now THAT is a LOT of french toast!

I found the 3rd quarter 2004 results on the

company website. These results were released March 29, 2004, and for the quarter ended February 28, 2004, net sales came in at $165.7 million compared with $106.8 million the prior year! Net income was $23.9 million or $1.98/basic share (?), compared with net income of $7.6 million or $.65/basic share the year earlier. CALM DID have a 2:1 split in April, 2004, shortly after this stock report, but STILL, the company earned, even adjusting for the split, nearly $1/share in a 3 month period. And the stock is currently trading at about $15/share. You do the math.

If we look longer-term at

"5-Yr Restated" financials on Morningstar.com, we can see that revenue came in at $288.0 million in 1999, was flat at $287.1 million in 2000, and then grew fairly steadily, with another pull-back in 2002, then to $533.4 million in the trailing twelve months.

Earnings have been very erratic, going from profits in 1999, to losses in 2000, profit in 2001, loss in 2002, and has improved subsequently. Consistency in earnings has NOT been a strength of this company! The company does pay a small dividend of $.03/share.

Free cash flow has also been a bit erratic dropping from $16 million in 2001 to $(15) million in 2002, back to $18 million in 2003, and now up to $73 million in the trailing twelve months. The balance sheet on Morningstar looks just fine with $55.1 million in cash and $84.1 million in other current assets, plenty to cover the $66.3 million in other current liabilities and to make a large "dent" in the $100.1 million of long-term liabilities.

What about Valuation? For this, I like to check

"Key Statistics" on Yahoo. Here we can see that this is a small cap company with a market cap of only $347.21 million. The trailing p/e is 6.85. No forward p/e is noted, and no PEG. You can just imagine what the p/e will do if the current results persist!

This stock HAS performed quite well and is actually up 393.09% the last 52 weeks! Are we late? That can only be told by what happens the NEXT 52 weeks...but we have missed out the portion of the rise that has already occurred.

There are 23.01 million shares outstanding and ONLY 4.00 million that float. There are 4.32 million shares out short representing 107.98% (!!) of the float. Or 11.306 trading days. With the stock moving UP today, I can only speculate that there are a LOT of short sellers scrambling, and I mean scrambling (no pun intended lol) to cover their shorts (before they LOSE their shorts!). Talking about a SQUEEZE!

The company as I noted does pay a small dividend yielding 0.37% and DID split 2:1 in April, 2004.

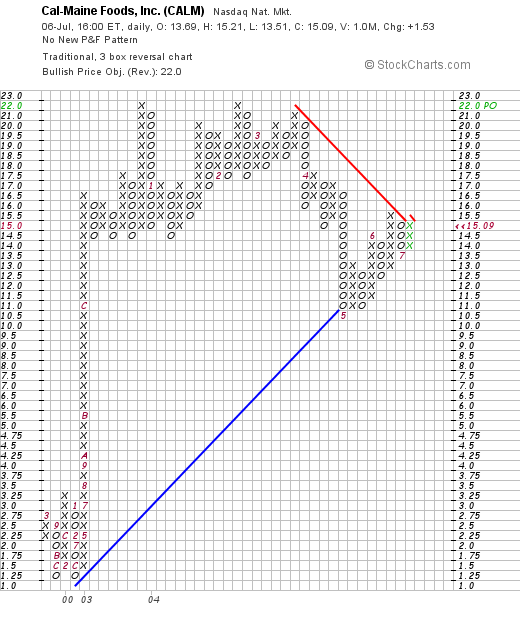

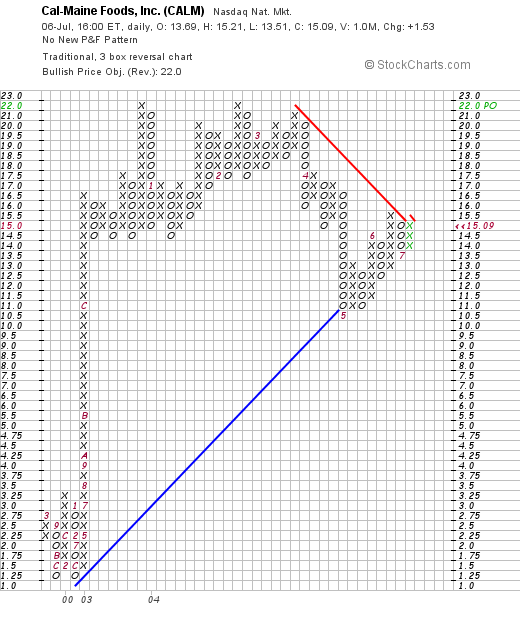

What about Technicals? If we look at a Point and Figure chart from Stockcharts.com:

we can see that the stock has pulled back to its support level, but appears to be moving upward once again! I guess all of those short sellers ASSUMED the stock was a GREAT short because it had climbed so far. That is the error of looking at the past to determine its future fate. That is, just because it moved up TREMENDOUSLY does NOT MEAN that it should NECESSARILY retrace its price action. The move upward, with the P/E UNDER 10 currently, suggests was competely based on the stock being TERRIBLY UNDERVALUED....heck that is at least my take on the matter.

What do I think...I think I will take my eggs "Sunny-Side Up!"...o.k. seriously, this stock really DOES look interesting to me...the valuation is great, the revenue growth is terrific, the earnings consistency however is AWFUL...but they did earn $1 in the last quarter. If they could earn the same the next three quarters....well the stock would be selling for about a p/e of 4! The free cash flow and balance sheet are just fine. And I would love to be buying shares when all of those short-sellers are hanging out....sorry fellows....but why would you sell short in a stock with such a low float?

Thanks so much for stopping by! If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Saturday, 3 July 2004

A Reader Writes "Check out KSWS"

Hello Friends! Well I JUST got done posting that weekend review....boy that can get to be a chore...so I hope you all enjoy that retrospective review....even WHEN the stocks have done relatively poorly! Please remember AS ALWAYS that I am an AMATEUR investor....so ALWAYS check with your own professional financial advisors before making any decisions based on information on this website!

I had the pleasure of receiving ANOTHER idea from Leon who I believe is based in New Zealand: Leon writes:

check out KSWS.....sales up nicely and eps up year on year......

no debt long term

Leon Well, let's take a look at K-Swiss (KSWS) and see how it fits into the scheme of things: (I do NOT own any shares of KSWS...but I do NOT know what Leon's ownership status is...)

KSWS closed at $20.68 on 7/2/04, actually UP $.41 or 2.02% in a down market.

My first step: what were the latest quarterly earnings?

On April 28, 2004, KSWS

reported 1st quarter 2004 results. Revenues increased 31.3% to $152 million from $116 million the prior year. Net earnings increased 59.5% to $21.8 million from $13.6 million the prior year. On a diluted per share basis, this was a 58.3% increase to $.57/share from $.36/share. Leon, I have to admit, these are GREAT earnings!

Second step: what about longer-term results?

Looking at

"5-Yr Restated" financials from Morningstar.com, we can see that except for a dip in revenue between 1999 and 2000 (from $287 million to $223 million), this stock has been doing quite well growing to $465.4 million in the trailing twelve months.

Earnings also dipped between 1999 and 2000, dropping to $.49/share from $.75, but have steadily increased to $1.32 in 2003 and $1.53 in the trailing twelve months. Again this looks nice.

Free cash flow has not only been positive but also GROWING. This is a big plus imho. Morningstar shows $20 million in free cash flow in 2001, $25 million in 2002, $31 million in 2003, and $55 million in the trailing twelve months. Again this looks EXCELLENT.

Balance sheet? Leon, you are right, this looks great too. It does appear that they do have some long-term debt, but Morningstar shows $90.2 million in CASH, enough to pay off BOTH their $48.8 million in current liabilities and $19.3 million in long-term liabilities. In addition, Morningstar shows $154.9 million in other current assets. Again, this is a BEAUTIFUL report.

My third step: What about valuation?

Looking at

"Key Statistics" from Yahoo, we can see that this is a small-cap stock with a market cap of $730.67 million. The trailing p/e is cheap at 13.38, and the forward p/e (fye 31-Dec-05) is even nicer at 12.61. The PEG is GREAT at 1.08, with a price/sales of 1.54. This is priced right!

There are 35.33 million shares outstanding and 25.30 million of them that float. Interestingly, there are 1.72 million shares out short...with a short raio as of 6/7/04 of 4.87. This is DOWN from the prior month's short level of 2.11 million shares...so there IS some short coverage going on, but with the ratio over 3.0, in my book, this is a bullish indicator.

The company even pays a small dividend of $.10/share yielding 0.49%. They last had a split, 2:1 just this past year in December 2003.

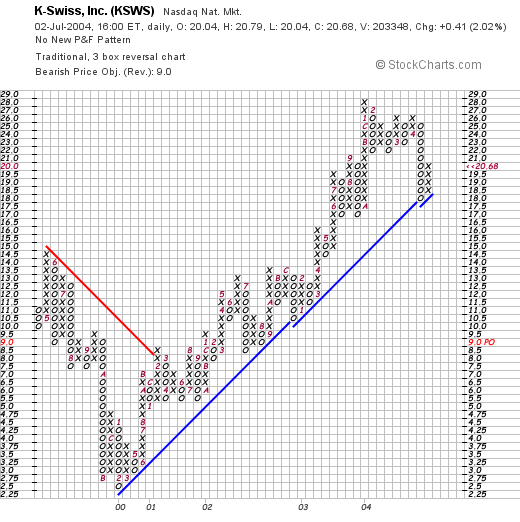

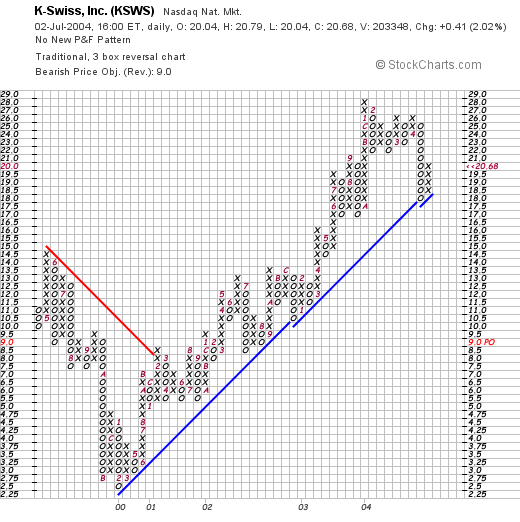

My fourth step: What about technicals?

Again, this looks nice, after breaking through a resistance level of about $8.00 in February, 2001, this stock has traded very consistently higher along its support line. This was recently challenged with a pull back to $18.00 since April, 2004, but has rebounded back above its support level successfully. Again, I am NOT a master technician, but this chart looks fine to me!

What do I think? Well Leon, this stock looks terrific! It DOES fill the criteria that I like to look for. I do not know much about the shoe business except to say how fickle the consumer can be in regards to styles, etc., so on a Peter Lynch kind of level I do not know what to expect. On a purely numerical, technical basis, which is how I select stocks, this is a nice pick!

Please remember that I am an amateur investor! If you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com

Thanks for writing Leon!

Bob

"Looking Back one Year" A review of stock picks from the week of June 23, 2003

Hello Friends! Well we made it to another Saturday. I hope you all have made 4th of July plans....hopefully will get to see some fireworks with the family Sunday....and do the usual 4th of July kinds of things. For any of you who are new around here, well of course make yourself at home, kick back and enjoy the posts. I am an amateur investor, I like to share my ideas about stocks and the market, but please remember to consult with your own professional investment advisor to make sure any investments discussed on this website are appropriate and timely for you. On Weekends, when I get around to it, I like to go back a full year to the early days of this blog and see how the stocks selected are doing now. This approach assumes a buy and hold strategy which is NOT what I do in practice. If a stock drops 8% from the purchase price it is gone. Otherwise, I do continue to hold them and sell portions as the price appreciates.

On June 23, 2003, I

posted Fresh Del Monte Produce (FDP) on Stock Picks at a price of $26.14. FDP closed at $25.45 on 7/2/04, for a decline of $(.69) or (2.6)%.

On April 27, 2004, FDP

reported 1st quarter 2004 results. Net sales increased 11% to $713.8 million for the three months ended March 26, 2004. However, earnings per share came in at $.81/share compared to $1.35/share in the same quarter in 2003. I really prefer to see earnings GROWTH each quarter when I am considering a stock pick.

On June 23, 2003, I

posted Factual Data Corp (FDCC) on Stock Picks at a price of $19.18. FDCC was acquired by Kroll (KROL) for $14.00 and .1497 shares of KROL. Currently with KROL at $36.88/share as of 7/2/04, this works out to $14.00 + (.1497)($36.88)= $19.52. This works out to a gain of $.34/share or 1.8%.

Bankrate (RATE) was

posted on this website at a price of $10.40. RATE closed at $8.12 on 7/2/04 for a loss of $(2.28) or (21.9)%.

On May 4, 2004, RATE

announced 1st quarter 2004 results. Revenue jumped 20% to $10.3 million for the quarter ended March 31, 2004, from $8.5 million last year. Net income rose 17% to $2.4 million or $.15/diluted share vs $2.0 million or $.13/diluted share last year. At least superficially, these are nice results. Things have NOT been that smooth for RATE, which on June 21, 2004,

announced the replacement of the CEO, and just a week ago, on June 23, 2004,

announced guidance for the 2nd quarter 2004: revenue fairly flat quarter over quarter at $10 - $10.2 million, and net income at $.14-$.15/share, which is BELOW last year's $.16/share results. Needless to say, the "street" was not real happy over these announcements!

Digital Insight (DGIN) was picked

Digital Insight (DGIN) was picked for Stock Picks on 6/25/03 at a price of $17.96. DGIN closed at $19.61 on 7/2/04 for a gain of $1.65 or 9.2%.

News-wise, it was

just announced that DGIN will be added to the Standard & Poor's SmallCap 600 Index. Being added to an index is usually bullish for a stock as index funds are then required to purchase shares. On April 22, 2004, DGIN

reported 1st quarter 2004 results. Revenues for the quarter ended March 31, 2004, increased 29% to $45.7 million from $35.5 million the prior year. Net income grew 46% to $4.2 million or $.11/diluted share from $2.9 million, or $.09/diluted share in 2003. Once again we can see the correlation between good earnings report and price performance of a stock!

On June 25, 2003, I

posted Biosite (BSTE) on Stock Picks at a price of $48.15. BSTE closed at $43.60 on 7/2/04 for a loss of $(4.55) or (9.4)%.

On April 28, 2004, BSTE

reported 1st quarter 2004 results. Revenues came in at $57.7 million, a 44% increase over the prior year. Net income was $8.9 million or $.55/diluted share, a 50% increase over the same 2003 quarter. Citing strong sales performance in the first quarter, BSTE RAISED 2004 annual growth target range to 25-35% revenue growth and 25-35% earnings growth on a diluted share basis. These are really nice results...but the stock price still lags my selection price!

HANG IN THERE....just three more selections to review!

In a relatively WEAK performance for Stock Picks, Biovail (BVF) was our weakest! BVF was

selected for Stock Picks on June 26, 2003, at a price of $49.30. BVF closed on 7/2/04 at $18.90 for a loss of $(30.40) or (61.7)%.

On April 29, 2004, this Toronto-based company

announced 1st quarter 2004 results. Revenue for the quarter ended March 31, 2004, came in at $186.6 million DOWN from $191.4 million for the same quarter last year. Net income came in at $21.1 million or $.13/share compared to $57.6 million or $.36/share last year. You can see why the stock has been weak!

I

posted CACI Intl (CAI) on this blog at $34.27 on June 27, 2003. I suppose it DOES help to sometimes have a handle on WHAT a firm does, as CACI as received

bad press recently as the private contractor involved in the interrogation of Iraqi detainees. ANYWAY, CAI closed at $39.79 on 7/2/04 for a gain of $5.52 from our "pick" price or 16.1%.

This stock has held up due to the strong underlying financial performance. CAI, on May 26, 2004,

issued 1st quarter 2006 guidance. They expect revenue to grow 51-55% to approximately $360 million and net income to grow 23% to approximately $16.3 million. These are strong numbers! However, the uncertainty regarding the prison abuse allegations is of great concern to me.

Finally, on June 27, 2003, I

selected Online Resources (ORCC) for Stock Picks at a price of $6.17. ORCC closed at $6.57 on 7/2/04 for a gain of $.40/share or 6.5%.

On April 21, 2004, ORCC

reported 1st quarter 2004 results. For the quarter ended March 31, 2004, excluding one-time events, revenue grew to $9.8 million compared to $8.8 million the prior year. Net income came in at $419,000 or $.02/share compared with "breakeven" the prior year.

So how BAD was the weak actually? During the week of June 23, 2003, to the present time, those stocks had four winners and four losers. However, the BIG loss on Biovail (BVF) (61.7)%...really pulled down the average performance. The average LOSS for the week worked out to an average loss for the 8 issues of (7.8)%.

Thanks so much for stopping by! If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.coma nd I will try to get back to you ASAP!

Happy 4th of July everyone!

Bob

Thursday, 1 July 2004

"Trading Transparency" DJO

Hello Friends! Well THAT nickel sat in my pocket for a total of seventeen seconds. Scanning through the lists of gainers, I came acroo DJ Orthopedics (DJO) an old favorite on this website, and saw that it was making a nice move. I took a peek at the latest Morningstar.com financials, the latest earnings report....and bought 300 shares for $24.04 a few moments ago!

Thanks so much for stopping by! Remember I am an AMATEUR investor, so please do your own investigation and consult with your investment advisors before making any investment decisions based on information on this website. If you have any comments, or questions, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Newer | Latest | Older

I posted TransMontaigne (TMG) on Stock Picks on 6/30/03 when it was trading at $6.48. TMG closed at $5.35 on 7/9/04 for a loss of $(1.13) or (17.4)%.

I posted TransMontaigne (TMG) on Stock Picks on 6/30/03 when it was trading at $6.48. TMG closed at $5.35 on 7/9/04 for a loss of $(1.13) or (17.4)%.  I posted ChoicePoint (CPS) on Stock Picks on 7/1/03 at a price of $36.14. CPS closed on 7/9/04 at $43.01 for a gain of $6.87/share or 19%.

I posted ChoicePoint (CPS) on Stock Picks on 7/1/03 at a price of $36.14. CPS closed on 7/9/04 at $43.01 for a gain of $6.87/share or 19%. Mid Atlantic Medicals Services (MME) was posted on Stock Picks Bob's Advice on 7/2/03 at $55.56. On Octobert 27, 2003, UnitedHealth Group (UNH) announced that it was acquiring MME for $18 in cash and 0.82 shares of UNH. UNH closed on 7/9/04 at $60.25, thus this deal currently values each former share of MME (now MAMSI) at $45.40 + $18.00 or $63.40. This would work out to a gain of $7.84/share or 14.1%.

Mid Atlantic Medicals Services (MME) was posted on Stock Picks Bob's Advice on 7/2/03 at $55.56. On Octobert 27, 2003, UnitedHealth Group (UNH) announced that it was acquiring MME for $18 in cash and 0.82 shares of UNH. UNH closed on 7/9/04 at $60.25, thus this deal currently values each former share of MME (now MAMSI) at $45.40 + $18.00 or $63.40. This would work out to a gain of $7.84/share or 14.1%. I posted Metrologic Instruments (MTLG) on 7/2/03 at $35.60. On July 3, 2003, MTLG had a 3:2 stock split reducing the pick price to $23.73. Again on 10/30/03, MTLG split its stock 2:1 reducing our pick price again this time to $11.87. MTLG closed at $17.65 on 7/9/04 for a gain of $5.78 or 48.7%.

I posted Metrologic Instruments (MTLG) on 7/2/03 at $35.60. On July 3, 2003, MTLG had a 3:2 stock split reducing the pick price to $23.73. Again on 10/30/03, MTLG split its stock 2:1 reducing our pick price again this time to $11.87. MTLG closed at $17.65 on 7/9/04 for a gain of $5.78 or 48.7%. Finally, Digital River (DRIV) was selected for Stock Picks on 7/2/03 at a price of $21.69. DRIV closed at $28.50 on 7/9/04 for a gain of $6.81 over the past year or 31.4%.

Finally, Digital River (DRIV) was selected for Stock Picks on 7/2/03 at a price of $21.69. DRIV closed at $28.50 on 7/9/04 for a gain of $6.81 over the past year or 31.4%.

Hello Friends! TGIF...no not the STOCK....or the RESTAURANT...I mean THANK GOD IT IS FRIDAY! Get a couple of days off to catch up on things I guess. I sure do appreciate all of you who take the time to stop by here and visit. So please make yourself at home....but PLEASE remember that I am an AMATEUR investor...so PLEASE consult with your professional investment advisors before taking any action based on information on this website.

Hello Friends! TGIF...no not the STOCK....or the RESTAURANT...I mean THANK GOD IT IS FRIDAY! Get a couple of days off to catch up on things I guess. I sure do appreciate all of you who take the time to stop by here and visit. So please make yourself at home....but PLEASE remember that I am an AMATEUR investor...so PLEASE consult with your professional investment advisors before taking any action based on information on this website. Scanning through the lists of greatest percentage gainers today, I didn't see much on the NASDAQ that really grabbed my attention. Johnson Controls (JCI) is having a fairly nice day today, trading at $53.24, up $1.97 or 3.84% on the day. I do NOT own any shares nor do I have any options or other leveraged positions in this stock. According to the

Scanning through the lists of greatest percentage gainers today, I didn't see much on the NASDAQ that really grabbed my attention. Johnson Controls (JCI) is having a fairly nice day today, trading at $53.24, up $1.97 or 3.84% on the day. I do NOT own any shares nor do I have any options or other leveraged positions in this stock. According to the  On April 15, 2004, JCI

On April 15, 2004, JCI  How about longer-term? If we take a look at the

How about longer-term? If we take a look at the

I came across Anika Therapeutics (ANIK) today while scanning the

I came across Anika Therapeutics (ANIK) today while scanning the  The products promote the protection of bone, cartilage and soft tissue....The Group also manufactures AMVISC (r) and AMVISC (r) Plus for Bausch & Lomb, which are used as viscoelastic supplements in ophthalmic surgery."

The products promote the protection of bone, cartilage and soft tissue....The Group also manufactures AMVISC (r) and AMVISC (r) Plus for Bausch & Lomb, which are used as viscoelastic supplements in ophthalmic surgery." How about longer term? Looking at

How about longer term? Looking at  Morningstar reports ANIK with $34.8 million in CASH, more than enough to cover both the moderate short-term liabilities of $7.7 million AND the long-term liabilities of $19.3 million combined. In addition, ANIK has $8.1 million in OTHER current assets. This is a very nice balance sheet indeed!

Morningstar reports ANIK with $34.8 million in CASH, more than enough to cover both the moderate short-term liabilities of $7.7 million AND the long-term liabilities of $19.3 million combined. In addition, ANIK has $8.1 million in OTHER current assets. This is a very nice balance sheet indeed!

I first heard about Cal-Maine (CALM) after it was mentioned in the Investors Business Daily (IBD)...some weeks ago. I believe it was in the "New America" section. I do NOT own any shares nor do I have any options on this stock. As close as I get to an EGG stock, lol, is Sanderson Farms (SAFM) that has been listed here, and I do own some shares of SAFM. Somehow, the old joke about which came first "the chicken or the egg"....well in my case, I have invested in chickens first but am ready for eggs now! I think much of the interest in these stocks is related to the ever-discussed "low-carb" phenomenon in which eggs which used to be "bad" are now "good" and "high-protein." This results in all of us who struggle with reducing carbohydrates, I confess I am among the many....taking another look at eggs (No yolk, I am serious!). sorry.

I first heard about Cal-Maine (CALM) after it was mentioned in the Investors Business Daily (IBD)...some weeks ago. I believe it was in the "New America" section. I do NOT own any shares nor do I have any options on this stock. As close as I get to an EGG stock, lol, is Sanderson Farms (SAFM) that has been listed here, and I do own some shares of SAFM. Somehow, the old joke about which came first "the chicken or the egg"....well in my case, I have invested in chickens first but am ready for eggs now! I think much of the interest in these stocks is related to the ever-discussed "low-carb" phenomenon in which eggs which used to be "bad" are now "good" and "high-protein." This results in all of us who struggle with reducing carbohydrates, I confess I am among the many....taking another look at eggs (No yolk, I am serious!). sorry. According to the

According to the  Earnings have been very erratic, going from profits in 1999, to losses in 2000, profit in 2001, loss in 2002, and has improved subsequently. Consistency in earnings has NOT been a strength of this company! The company does pay a small dividend of $.03/share.

Earnings have been very erratic, going from profits in 1999, to losses in 2000, profit in 2001, loss in 2002, and has improved subsequently. Consistency in earnings has NOT been a strength of this company! The company does pay a small dividend of $.03/share.

KSWS closed at $20.68 on 7/2/04, actually UP $.41 or 2.02% in a down market.

KSWS closed at $20.68 on 7/2/04, actually UP $.41 or 2.02% in a down market.

On June 23, 2003, I

On June 23, 2003, I  On June 23, 2003, I

On June 23, 2003, I  Bankrate (RATE) was

Bankrate (RATE) was

On June 25, 2003, I

On June 25, 2003, I  In a relatively WEAK performance for Stock Picks, Biovail (BVF) was our weakest! BVF was

In a relatively WEAK performance for Stock Picks, Biovail (BVF) was our weakest! BVF was  I

I  Finally, on June 27, 2003, I

Finally, on June 27, 2003, I