Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend and I wanted to get to a review this evening before I get behind in these reviews another week! As I have pointed out previously, these reviews assume a buy and hold strategy for investing. In actual practice, I employ an 'active portfolio management' approach, seeking to limit losses by selling losing investments quickly and seeking to preserve gains by targeted and partial sales of appreciating stocks. Certainly, the difference in strategy will affect overall performance, but for the ease of evaluation, I have chosen to continue to assume a 'buy and hold' approach for these reviews.

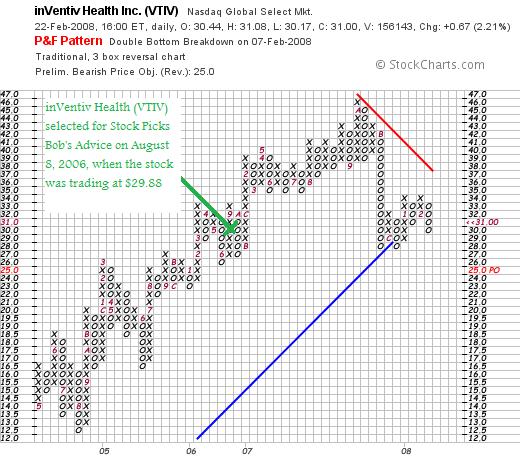

On August 8, 2006, I posted inVentiv Health (VTIV) on Stock Picks when the stock was trading at $29.88/share. VTIV closed at $31.00 on February 22, 2008 for a gain of $1.12 or 3.7% since posting.

On August 8, 2006, I posted inVentiv Health (VTIV) on Stock Picks when the stock was trading at $29.88/share. VTIV closed at $31.00 on February 22, 2008 for a gain of $1.12 or 3.7% since posting.

On November 7, 2007, inVentiv announced 3rd quarter 2007 results. For the quarter, total revenues climbed 29% to $254.9 million compared to $197.8 million in the same quarter the prior year. GAAP income from continuing operations increased 38% to $14.1 million from $10.2 million the prior year. Adjusted diluted eps climbed 26% to $.43/share from $.34/share the prior year.

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that while revenue growth is intact, earnings dipped the latest twelve months to $1.31/share from $1.70/share in 2006. Free cash flow, while also positive, dipped to $32 million in the TTM from $79 million in 2006. The balance sheet remains solid.

Reviewing the 'point & figure' chart on VTIV from StockCharts.com, we can see that the price broke down in November, 2007, when the stock dipped from $42 down to $28/share. The stock is still 'struggling' and does not appear to be respecting the blue 'support line'.

With the satisfactory latest quarter, but with 12 month earnings lagging the prior year and the relatively weak chart,

INVENTIV HEALTH (VTIV) IS RATED A HOLD

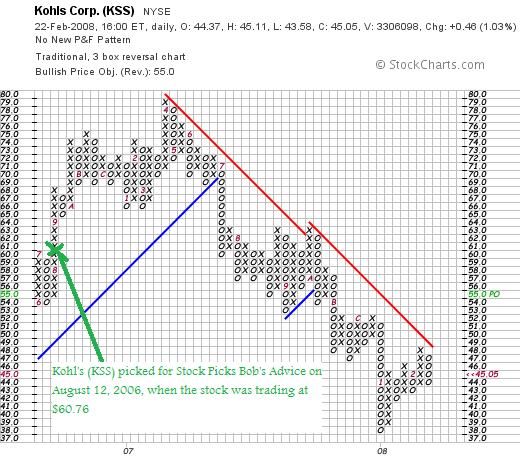

On August 12, 2006, I posted Kohl's (KSS) on Stock Picks Bob's Advice when the stock was trading at $60.76/share. KSS closed at $45.05 on February 22, 2008, for a loss of $(15.71)/share or (25.9)%.

On February 7, 2008, Kohl's announced January same-store sales results and reported a decline of (8.3)% from the year-earlier period. Overall sales declined (20.4)% from last year. With the disappointing sales results, the company announced that the quarter's results "to be at the low end of our guidance of $1.30 to $1.34 per diluted share."

On November 15, 2007, Kohl's (KSS) reported 3rd quarter results. For the quarter ended November 3, 2007, earnings came in at $.61/share down from $.68/share last year. Net income was $194.0 million down from $224.5 million. Sales for the quarter did increase to $3.8 billion from $3.7 billion the prior year.

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that revenue growth remains intact, earnins growth is solid and the total shares are quite stable. Unfortunately, free cash flow which was a solid $1.96 billion in the black for 2007 has turned negative at $(427) million in the trailing twelve months. The balance sheet remains solid.

Looking at the 'point & figure' chart on Kohl's from StockCharts.com, we can see that the stock turned lower in July, 2007, when it broke through support at $70 and has dipped as low as $38 before recently struggling higher to its current level still below the red 'resistance line'.

As much as I 'like the store', with the negative same-store-sales results, the recent lowering of guidance from the company, and the very weak price chart,

KOHL'S (KSS) IS RATED A SELL

So how did I do with these two stocks? Really pretty mediocre. inVentiv (VTIV) showed a gain of 3.7% since being 'picked' on the blog and Kohl's (KSS) had a loss of (25.9)% for an average loss of (11.1)% since posting.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can see how all of the stocks that I actually own in my trading portfolio are performing, or visit my SocialPicks page where my stock picks from the last year and a half or so are evaluated and monitored.

If you still have some time, be sure and stop by my Podcast Page where you can listen to me discuss some of the many stocks I write up here on the blog! Wishing you all a happy and healthy week ahead!

Yours in Investing!

Bob

Updated: Sunday, 24 February 2008 8:52 PM CST