Stock Picks Bob's Advice

Tuesday, 22 November 2005

November 22, 2005 Morningstar (MORN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

This afternoon, I was busy with my stocks in my trading portfolio with COO being sold on bad news, and CDIS and QSII having quarter positions sold on good news, that is price appreciation. With a second "good news" event, I was entitled to add a position and settled on Morningstar (MORN), which closed at $32.76, up $2.94 or 9.86% on the day. This was enough of a price rise for the stock to make the

list of top % gainers on the NASDAQ today. I purchased some of these shares for my 20th position in my portfolio.

(It is getting late here in Wisconsin, so let me be a bit brief on this review :)) Let's look at the three basic things that got me interested in this stock: latest quarter, Morningstar.com results, and chart.

1) Latest quarter: On November 9, 2005, Morningstar

reported 3rd quarter 2005 results. Revenue came in at $56.9 million for the quarter ended September 30, 2005, up 22% from $46.6 million in the same quarter last year. Net income was $7.5 million or $.17/diluted share, up sharply from $4.1 million or $.10/diluted share the prior year. As good as these results were, these results were $.02 shy of

First Call estimates for the quarter.

2) The Morningstar.com

"5-Yr Restated" financials on MORN. Here we can see the steady revenue growth from $75.0 million in 2000 to $215.1 million in the trailing twelve months (TTM). Earnings have been a bit erratic but have improved from a loss of $(.75)/share in 2000 to a profit of $.21/share in 2004. The last twelve months show MORN with earnings of $.45/share.

Free cash flow has also been improving, increasing from $11 million in 2002 to $38 million in the TTM.

The balance sheet is solid with $135.4 million in cash and $43.6 million in other current assets, balanced against $102 million in current liabilities and only $5.3 million in long-term liabilities.

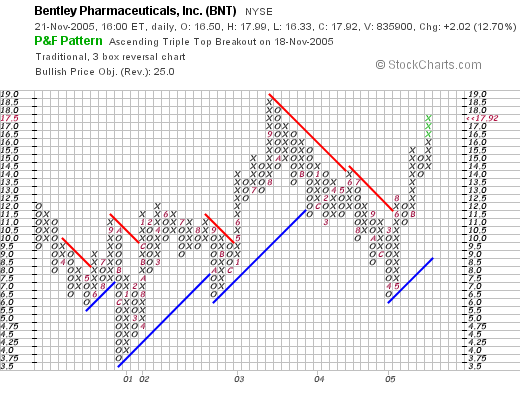

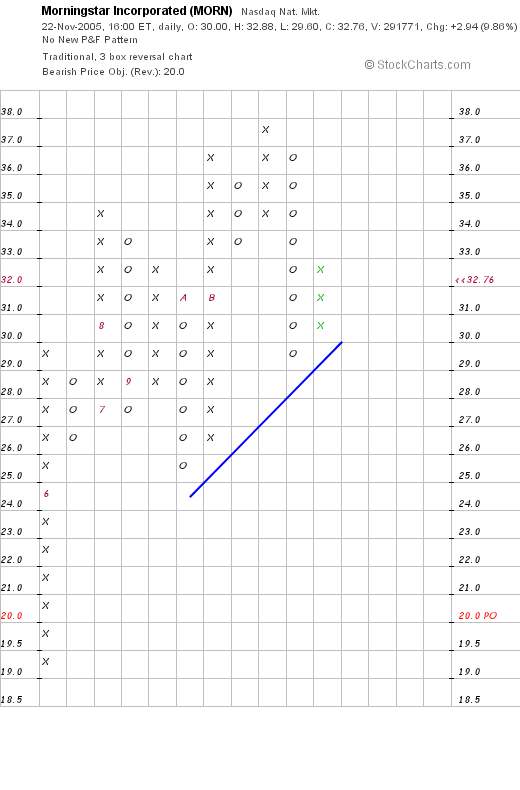

3) The chart:

"Point & Figure" chart on MORN

The chart is limited, as the company is a relatively recent IPO. But all-in-all, the graph looks strong with the stock trading above its support line and appearing to be moving higher.

So what do I think? Well, I liked the stock enough that I bought some shares today! I use Morningstar on the blog all of the time. So I am fairly familiar at least with that part of the service. The latest quarter was strong and the "5-Yr Restated" financials were superb.

Thanks again for visiting. If you have any comments, or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

November 22, 2005 Blue Coat Systems (BCSI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decision based on information on this website.

Earlier today, after selling a few shares of Cal Dive (CDIS), I was "entitled" to add a new position to my portfolio. I purchased some shares of Blue Coat Systems (BCSI) and I promised to post some comments about this stock. As noted, this

is one company that I do own some shares!

Blue Coat closed today at $45.33, up $3.36 or 8.01% on the day. Earlier today, the stock was on the list of top % gainers, but as the market gained strength it no longer was on the list.

According to the

Yahoo "Profile" on BCSI, the company:

"...provides proxy appliances that visibility and control of Web communications. Its ProxySG family of appliances includes the ProxySG 200 Series, the ProxySG 400 Series, the ProxySG 800 Series, and the ProxySG 8000 Series. These proxy appliances leverage existing authentication systems to enable granular policy enforcement down to the individual user. The company’s ProxyAV Web antivirus appliances include the ProxyAV 400 Series and the ProxyAV 2000 Series."

This is a bit "high-tech" for me, but I gather that the company is an internet security company, protecting data, and preventing entrance of internet viruses and worms.

Last week the stock dropped rather sharply when the company indicated some

short-term slowing of revenue growth. However, the stock was rebounding today in the face of a

Raymond James analyst upgrade.

On November 14, 2005, BCSI

reported 2nd quarter 2006 results. Net revenue came in at $36.7 million, a 67.4% increase over net revenue of $21.9 million for the same quarter last year. Net income (GAAP) was $4.2 million or $.28/diluted share, up sharply from net income of $.6 million or $.05/diluted share the previous year, same quarter. Sequentially, this was up from $3.4 million or $.24/diluted share the prior quarter. The company estimated sequential growth for the 3rd quarter for revenue in the 4% - 7% range. Net income for the upcoming quarter was estimated in the $4.4 million - $5.1 million or $.32-$.36/diluted share range. However, this strong growth was below what analysts expected and the stock tanked last week.

Reviewing the

"5-Yr Restated" financials on BCSI from Morningstar.com, we can see that revenue was actually declining from $97.7 million in 2001 to a low of $45.7 million in 2003. Since then, revenue growth has been strong and steady and BCSI reported $108.4 million in revenue in the TTM.

Earnings have been improving from a loss of $(72.20)/share (!) in 2001 to $(.03)/share in 2004 and then turning profitable with $.41/share in 2005 and $.52/share in the trailing twelve months (TTM).

Free cash flow, which was a negative $(17) million in 2003, has improved steadily to $12 million in the TTM.

The balance sheet, as reported on Morningstar.com, looks solid with $53.4 million in cash alone, more than enough to cover both the $34.3 million in current liabilities and the $4.7 million in long-term liabilities combined. In addition, BCSI has another $19 million in other current assets.

Looking at a few

"Key Statistics" on BCSI from Yahoo, we find that the company is a very small mid-cap stock with a market capitalization of $569.84 million. The trailing p/e is rich at 59.10, but the stock is growing quickly, and the forward p/e (fye 30-Apr-07) is only 27.31. Thus the PEG is 0.91. The the Price/Sales ratio is 4.28.

There are only 12.57 million shares outstanding and of these 12.60% of them are out short representing 1.39 million shares or 5 trading days of volume. This looks a bit significant to me. No cash dividend is reported on Yahoo and the last stock distribution was in September, 2002, when a

reverse stock split of 1:5 was conducted.

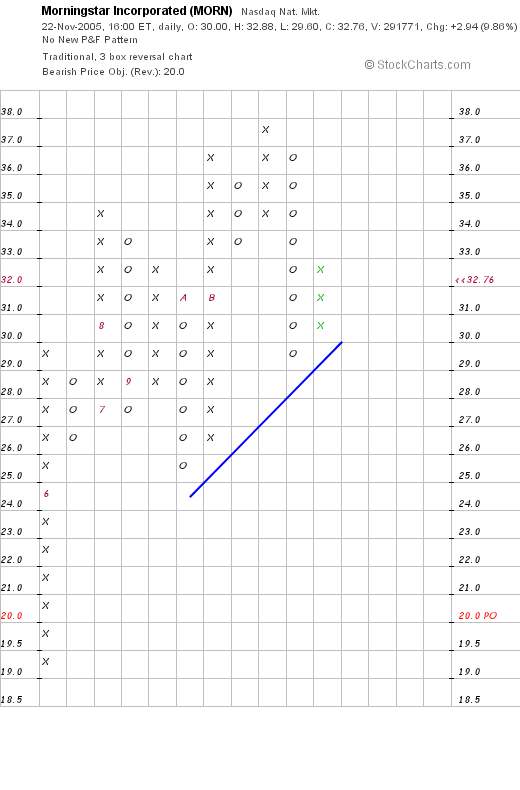

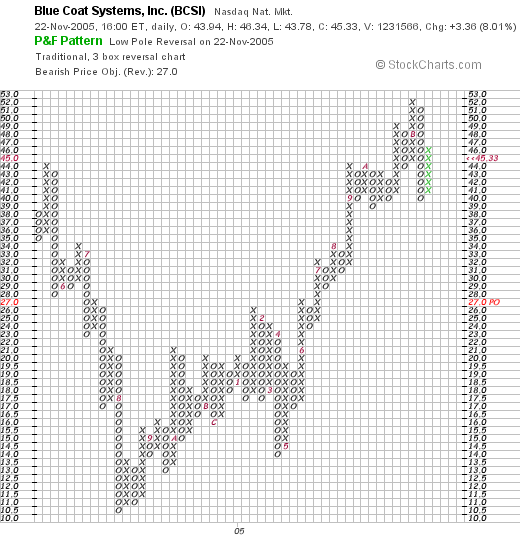

And what does the chart look like?

Looking at a

"Point & Figure" chart on BCSI from Stockcharts.com:

We can see that the stock was actually trading sharply lower from May, 2004, when the stock hit $45/share, down to a low in August, 2004, of approximately $10.50. The stock has traded strongly higher since then to its current $46 level.

So what do I think? This is a very fast growing high-tech stock that had a great recent earnings report; dropped on guidance that was still quite respectable, has a Morningstar.com showing a 'reversal of fortunes' with a contraction in revenue returning to strong growth, a solid balance sheet, and valuation that isn't too bad with an estimated PEG under 1.0. Overall, I liked it enough that I bought shares!

If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or just go ahead and leave your thoughts on the website!

Bob

"Trading Transparency" Morningstar (MORN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A nickel doesn't last long in my pocket :). With the sale of a portion of my Quality Systems at a sales target, this is what I call selling on "good news" entitling me, as long as I am under my maximum # of holdings, to add a position, if a suitable candidate should be on the list of top % gainers.

Morningstar (MORN), a company whose information I use all over this blog, made the list today. (I shall review Morningstar and Blue Coat Systems later today if I get a chance.) I purchased 200 shares of Morningstar at $32.52 a few minutes ago. This brings my portfolio back up to 20 positions, leaving room for potentially five additional stocks.

It is interesting to see my portfolio signals kick in just as the market firms up. Time will tell if they are timely enough. However, for the time being, I have now added two new positions to the portfolio, and have sold my long-standing position in Cooper.

If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com; meanwhile, you are more than welcome to make comments right on the blog!

Bob

"Trading Transparency" Quality Systems (QSII)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A little earlier, in the face of a market firming up this afternoon, my Quality Systems hit a new sell point. Prior to this sale, I had 58 shares of QSII remaining in the trading portfolio, so I entered a sell order and sold 14 share of QSII at $86.23/share. I now have 44 shares left!

I purchased Quality Systems on July 28, 2003, and have a cost basis of only $15.50/share (!). Thus, the stock I sold had a profit of $70.73 or 456.3%. Having sold the stock previously eight times, the last being at a 360% gain, my goal had been at 450% (a 90% interval), and the stock hit the price today. Thus, I shall be targeting a 540% appreciation target for the next partial sale or 6.4 x $15.50 = $99.20, or on the downside, if just in a correction, I will unload the remaining shares at a 225% gain or 3.25 x 15.50 = $50.38.

Quality Systems has been an absolutely fabulous investment for me. I have taken out my original investment several times over, and still have a small position in my portfolio. The company continues its rapid growth. Hopefully, my sales will become fewer and the position with the diminished sales will start growing a bit more significantly!

Thanks so much for stopping by! Please comment right on the blog if you have any questions or comments, or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Blue Coat Systems (BCSI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

That nickel was burning a hole in my pocket and a few moments ago I purchased 160 shares of Blue Coat Systems (BCSI) at $45.80/share. I shall review this a little later on. It isn't a perfect fit, but meets most of the criteria for this trading system.

Drop me a line at bobsadviceforstocks@lycos.com if you have any questions or comments.

Bob

"Trading Transparency" CalDive (CDIS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today, I was bemoaning the fact that I no longer was entitled to purchase a new position with my unloading of my 45 shares of COO on "bad news". But checking my portfolio for my other positions, I noted that Cal Dive (CDIS) had passed the 90% gain level, mandating another 1/4 position sale at a gain (and entitling me to look again for a new holding!).

Thus 28 shares of Cal Dive, which is trading at $73.46 as I write, were sold at $73.40. This was my third partial sale of this stock, which was purchased 11/03/04 with a cost basis of $38.20/share. Thus, I had a gain of $35.20 or 92.1% on the original investment. I now have 85 shares remaining of this position. I will either be selling another 1/4 (21 shares) if the stock hits a 120% gain (2.20 x $38.20 = $84.04) or unloading

all of my shares on the downside if the stock traces back to a 45% gain (1.45 x $38.20 = $55.39).

Thanks so much for visiting. I am on the look-out now and if I find anything I like, I shall keep you posted! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Cooper Cos (COO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I got up this morning pretty excited about the stock market, figuring that nickel in my pocket from my HIBB sale would allow me to purchase a new position. But lo and behold, I found that my Cooper Stock was imploding, at least a bit.

Last night the company

lowered guidance for the 4th quarter and 2006-2007, and the stock really took a nosedive today. As I write, the stock is trading at $53.70, down $(11.12) or (17.16)% on the day.

As I have stated elsewhere, I always reserve the prerogative (isn't

that a great word!) to sell a stock on some fundamental news report. This appeared to qualify, the stock was approaching my sell point of a 90% gain (having sold my last portion at a 180% gain!), and I unloaded my remaining 45 shares. A few minutes ago, I sold my 45 shares at $53.65/share.

I first purchased COO in 2/20/03, just before starting this blog, at a cost basis of $26.98/share. Thus, I still preserved a gain of $26.67/share or 98.9% on these remaining shares. Wasn't really much of a disaster I guess :). This was actually my 6th sale of portions of cooper, my last sale being in January, 2005, at the 180% gain point.

Anyhow, since my latest sale was on "bad news", I am no longer entitled to buy a new position, according to my own trading rules, and shall be back sitting on my hands waiting for another stock to sell on "good news".

If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 21 November 2005

A Reader Writes "Could you tell me....about your trading strategy?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I really look forward to in writing this blog, is receiving mail from readers and sharing with them some of my ideas about investing. First of all, I believe there are

many strategies for investing, buying and selling stocks, and managing a portfolio. I am sure that many are far superior to my approach. However, what I have been doing continues to work for me, so I am happy to share it with all of my readers of Stock Picks Bob's Advice.

This evening, I noticed that Tony T. had written again. He emailed me:

Bob,

So I'm extremely overwhelemed by the amount of knowledge I've gained through reading your site but could you tell me, that is if it is not trouble to you, what articles, by date, talk about your completely trading strategy? I've found some talk about your exit strategy but how do you go about making the decision that a stock fits your system? Also, I know this question is answered usually when you post information and thoughts on a particular stock so I don't really expect an answer from you on that one.

Thanks,

Tony

First of all Tony, thank you so much for all of your kind words. I would like to encourage you to expand your knowledge base by reading not only here, but Money Magazine, Fortune, Business Week, Forbes, Smart Money, Kiplinger's, Smart Money, The Wall Street Journal, and Investor's Business Daily, to name just a few sources of important information on investing. But I appreciate your enthusiasm for this blog and I shall continue to strive to meet your expectations with practical evaluations of stocks.

One of the weaknesses of this blog that betrays its amateur origins is the lack of a good index and search engine. I shall have to add this on as we go along.

However, as I wrote you, I would like to address this issue once again; I am sure I have some similar summaries on other entries. I would like to break this down into how I find a stock and decide to purchase shares, and how I sell a stock and when I sell the position. A second brief topic would be about the overall portfolio and how I manage the holdings.

My first decision in buying a stock is knowing

when I should be making a purchase. I suggest to my readers that they should, when building a portfolio, decide in advance as to the number of positions they would like to own. For me, I have found 25 positions manageable and that is the maximum number of positions within my trading portfolio (I currently own 19 and am preparing to add a 20th position). For arguments sake, let's use 24 positions as being 'fully invested'.

With my approach to investing the portfolio will develop a "posture" towards the investment world. What I mean by that is that we can think of a portfolio as being maximally defensive; with the minimum number of positions held in equities; maximally aggressive, with the maximum number of equity positions and "neutral" with equal amounts of cash and equities. In this example maximum equity exposure would consist of 24 positions. Minimal equity exposure, in my approach, would be at 6 positions, and "neutral" would be 12 positions.

I believe very strongly that stock market success is based on observing market trends, stock trends, and responding to these observations with trading actions. I am not a big believer in "out-thinking" the market; but rather I am a big believer in listening to your portfolio, to the market, and to individual stocks in determining your own response and trading actions.

Thus, start out an investment portfolio in neutral. Let the market tell you whether to shift into gear or into reverse. In this particular model, with a 24 position maximum, then 12 positions would be "neutral". These 12 positions could be bought rather quickly, using 50% of the available cash to make this purchase.

Immediately employ a selling strategy. That is, as I practice, sell losing stocks quickly if they accrue an 8% loss. Otherwise sell winning stocks slowly and piecemeal, selling 1/4 of remaining position at designated gain targets. My current targets on the upside are at 30%, 60%, 90%, 120%; then by 60% increments--180%, 240%, 300%, and 360%...then by 90% increments, 450%, 540%, 630%, and 720%...then by 120% increments, etc.

Additional pointer on selling: after selling a portion of a stock once at a gain, do not wait for the stock to retrace to an 8% loss. Instead sell all of remaining shares on the downside if the stock drops to 'break-even'. If you have sold a stock more than once, allow it to retrace only 50% of the gain before selling all remaining shares. In other words, if a stock has been sold 3 times, last at a 90% gain, only allow the stock price to slip back to a 45% gain before selling all remaining shares.

Next, allow the actions of your 12 original stocks to determine the direction of the entire portfolio. That is, if a stock is sold at a loss, just 'sit on your hands' and don't replace the stock with another candidate. Instead wait for a sale on 'good news' that is after the stock has appreciated to a sale target price, to determine that you should add another postion to your holdings. This prevents you from compounding your losses in the face of a bad market. And encourages you to expand your equity exposure in the opposite extreme; in the fact of an expanding equities market.

O.K. if you have made the decision to buy a stock, how do I pick one? Just like my blog, I first scan the lists of top percentage gainers. I generally avoid stocks much under $10. They are mostly too volatile, but occasionally I have picked a low-priced stock.

At that point, I generally go over to the Morningstar.com "5-Yr Restated" financials for the stock, and look for persistent revenue growth, earnings growth, dividend growth (if present), free cash flow, and a solid balance sheet.

Going over to Yahoo finance, I check on the latest quarterly report, again insisting on positive growth in both revenue and earnings.

Then back to Yahoo "Key Statistics" where I examine the P/E, the PEG, the Price/Sales ratio (using Fidelity.com for research for comparing to other stocks in the same industrial group), the 'short interest' (over 3.0 is significant imho), and review the chart using the "point and figure" approach. I do not ask much from charts except that like persistent earnings, I prefer persistent price appreciation. In other words a chart that looks like the price started lower and has been moving higher!

If I have "permission" to buy a new stock, and one of those stocks

that day fills the criteria, I purchase a position. Lately, I have been trying to buy an approximately $6,000 position with a new stock position. The size of your position depends on the overall size of the portfolio.

I reserve the right to sell a stock with really strong fundamentally bad news....like fraud or a miserable quarter. Otherwise, my action is dictated by the action of the stocks. I have tried to reduce thinking and expand on the powers of observation.

I hope that is helpful to you. I am not sure if I left out anything, but the entry was indeed long enough! If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks.tripod.com.

P.S. When deciding on a specific stock when several meet my criteria, I still go by my seat of the pants feeling on the potential of a stock investment. I am biased towards medical technology stocks where innovation appears to be ongoing and the opportunities appear numerous.

Bob

"Revisiting a Stock Pick" Bentley Pharmaceutical (BNT)

Hello Friends! Thanks so much for stopping by and visiting my blog

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Reviewing the

list of top % gainers on the NYSE, the place where I like to begin my search for picks for this blog, I came across Bentley Pharmaceuticals (BNT) which closed at $17.92, up $2.02 or 12.70% on the day. I do not own any shares nor do I have any options on this stock.

Bentley is an old pick of mine, having

posted Bentley (BNT) on Stock Picks Bob's Advice on October 3, 2003, a bit over two years ago when Bentley was trading at $15.69/share. Since that original post, Bentley has only appreciated $2.23 (only a little more than today's move) or 14.2% since posting.

According to the

Yahoo "Profile" on Bentley:

Bentley Pharmaceuticals, Inc. operates as a specialty pharmaceutical company. It focuses on developing, licensing, and sale of generic and branded pharmaceutical products and active pharmaceutical ingredients, and the manufacturing of pharmaceuticals for others; and research, development, and licensing/commercialization of advanced drug delivery technologies and pharmaceutical products. Bentley pharmaceuticals manufactures and markets approximately 120 pharmaceutical products for various dosage strengths and product formulations of approximately 30 chemical entities in four primary therapeutic areas: cardiovascular, gastrointestinal, neurological, and infectious diseases; as well as markets over-the-counter products.

On November 2, 2005, BNT (which is now on the NYSE)

announced 3rd quarter 2005 results. Revenue for the quarter ended September 30, 2005, came in at $23.5 million, a 30% increase over the $18.1 million reported in the prior year. Net income grew 76% to $2.5 million or $.11/diluted share.

How about longer-term? Taking a look at my next favorite place to find information, Morningstar.com, in particular reviewing the

"5-Yr Restated" financials on Bentley, we can see a beautiful picture of increasing revenue from $19 million in 2000 to $86.6 million in the trailing twelve months (TTM).

Earnings during this same period have improved from a loss of $(.06)/share in 2000 to earnings of $.36/share in the TTM.

Free cash flow, while erratic, has improved from $(2) million in 2002 to $2 million in the TTM. The balance sheet, as reported on Morningstar.com, appears solid with $37 million in cash, enough to cover both the $31.5 million in current liabilities

and the $4.9 million in long-term liabilities. The company is also reported to have an additional $41.4 million in other current assets.

How about valuation? Looking at

Yahoo "Key Statistics" on Bentley, we can see that this is a small cap stock (under $500 million in market capitalization) with a market cap of only $391.39 million. The trailing p/e is a bit rich at 43.81, but the forward p/e is better at 32 (fye 31-Dec-06). However, growth going forward is so great that the PEG comes in at 0.94.

Using the

Fidelity.com eResearch website, we can see that Bentley has been assigned the "Drug Delivery" industrial group. Within this group, the Price/Sales ratio is rather reasonable. Topping the group is Alkermes (ALKS) with a Price/Sales ratio of 15.1, then Nektar Therapeutics (NKTR) at 11.2, ELAN (ELN) at 9.6, then Bentley (BNT) at 4.1, Biovail (BVF) at 4.0 and Andrx (ADRX) at 1.2.

Going back to Yahoo for some additional numbers, we can see that there are only 21.84 million shares outstanding. Currently, there are 1.46 million shares out short with a short ratio (10/11/05)

get this of 34.4! In other words, it would take SEVEN WEEKS of five days/week trading volume just for the shorts to cover this relatively illiquid stock. If I use my modest 3 day short ratio rule, this is one of the biggest short ratios I have ever found on this blog....and it looks pretty significant to me. I wouldn't want to be short shares right now with the stock climbing and very few shares available to buy back. Just my opinion though :).

No cash dividend is reported, and the last stock split was actually a

reverse 1:10 split in July 25, 1995.

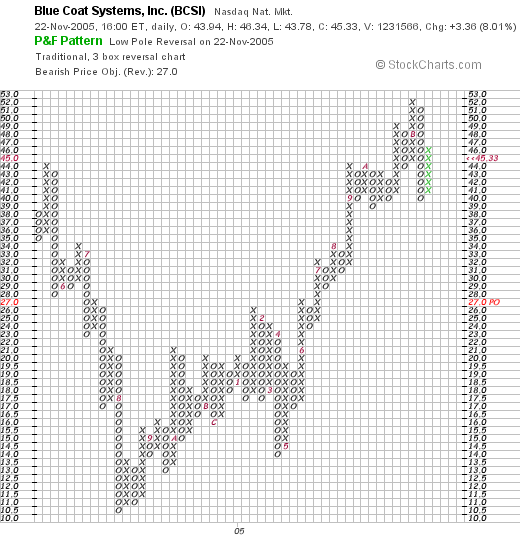

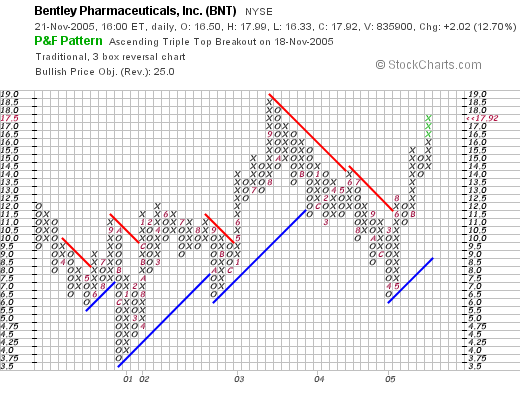

What about the chart? If we look at a

"Point & Figure" chart for Bentley:

We can see what looks like a fairly nice move higher from a low of $3.75 in Decmber, 2000, to a high around $18.50 in September, 2003. However, the stock broke down at that point trading all the way down to $7.00 in April, 2005, until moving higher recently, breaking through resistance in June, 2005 at $12.50, and trading higher to the current level. The stock looks short-term to be moving ahead, but long-term, has been a rather unimpressive stock price move.

So what do I think? Well, if I had sold my HIBB earlier, I might be buying some of these shares today. However, I shall be waiting to see what is moving tomorrow to pick a stock, if I do. Otherwise, the recent quarterly report was solid; by the way, this company does most of its sales in Spain, the Morningstar.com report looks great, and valuation is reasonable with a PEG under 1.0 and a Price/Sales in the middle of the group. The chart, however, looks just fair.

A real wild-card, imho, is the HUGE short-interest. This data is a bit stale, and I don't really know how many shares are out short as I write, but think about how many shares were out short...and the time it would take to cover. Might be a bit of a squeeze going on.

Anyhow, thanks for visiting here. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or leave your words right here on the blog!

Bob

"Trading Transparency" Hibbett (HIBB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, just before the close of trading, I noticed that my Hibbett Sporting Goods (HIBB) had hit a sales target, with a 360% gain over my initial purchase. This is my 8th sale of Hibbett stock, each time selling approximately 1/4 of my remaining shares. As you will recall, if you have been reading my posts here, I sell 1/4 of my shares at the following appreciation levels: 30%, 60%, 90%, 120%, and then by 60% intervals--180%, 240%, 300%, and 360%, and after that by 90% intervals: 450%, etc.

My initial purchase of Hibbett (HIBB) was on March 6, 2003, when I picked up my shares with a cost basis of $6.50. Owning 111 shares of HIBB prior to this sale, I entered an order to sell 27 shares (leaving 84 shares in the account) at $30.11. This was a gain of $23.61/share or 363.2% over my purchase price (!). Thus, my next sale point on the upside would be selling 21 shares at a 450% gain or 5.5 x $6.50 = $35.75, or on the downside at a 180% gain level, I would be selling all of my remaining 84 shares: 2.8 x $6.50 = $18.20.

The

exciting thing about this sale is that I can use this as a signal to add a new position into my portfolio. (Since I am at only 19 positions, with my maximum being 25.) Thus I shall be on the look-out tomorrow, scouring the top % gainers list, looking for something special! I shall keep you posted.

Regards again to all of you readers. Please let me know if you have any comments, questions or other thoughts on what I write, and investing in general. Please feel free to post your words right on the blog or email me at bobsadviceforstocks@lycos.com and I shall try to get to your letter. I cannot get to all of the emails I receive, but I try to answer as many as I can (usually right in the blog).

Bob

Newer | Latest | Older

This afternoon, I was busy with my stocks in my trading portfolio with COO being sold on bad news, and CDIS and QSII having quarter positions sold on good news, that is price appreciation. With a second "good news" event, I was entitled to add a position and settled on Morningstar (MORN), which closed at $32.76, up $2.94 or 9.86% on the day. This was enough of a price rise for the stock to make the list of top % gainers on the NASDAQ today. I purchased some of these shares for my 20th position in my portfolio.

This afternoon, I was busy with my stocks in my trading portfolio with COO being sold on bad news, and CDIS and QSII having quarter positions sold on good news, that is price appreciation. With a second "good news" event, I was entitled to add a position and settled on Morningstar (MORN), which closed at $32.76, up $2.94 or 9.86% on the day. This was enough of a price rise for the stock to make the list of top % gainers on the NASDAQ today. I purchased some of these shares for my 20th position in my portfolio.

Earlier today, after selling a few shares of Cal Dive (CDIS), I was "entitled" to add a new position to my portfolio. I purchased some shares of Blue Coat Systems (BCSI) and I promised to post some comments about this stock. As noted, this is one company that I do own some shares!

Earlier today, after selling a few shares of Cal Dive (CDIS), I was "entitled" to add a new position to my portfolio. I purchased some shares of Blue Coat Systems (BCSI) and I promised to post some comments about this stock. As noted, this is one company that I do own some shares! According to the

According to the

One of the things I really look forward to in writing this blog, is receiving mail from readers and sharing with them some of my ideas about investing. First of all, I believe there are many strategies for investing, buying and selling stocks, and managing a portfolio. I am sure that many are far superior to my approach. However, what I have been doing continues to work for me, so I am happy to share it with all of my readers of Stock Picks Bob's Advice.

One of the things I really look forward to in writing this blog, is receiving mail from readers and sharing with them some of my ideas about investing. First of all, I believe there are many strategies for investing, buying and selling stocks, and managing a portfolio. I am sure that many are far superior to my approach. However, what I have been doing continues to work for me, so I am happy to share it with all of my readers of Stock Picks Bob's Advice. Reviewing the

Reviewing the  Bentley is an old pick of mine, having

Bentley is an old pick of mine, having  Earnings during this same period have improved from a loss of $(.06)/share in 2000 to earnings of $.36/share in the TTM.

Earnings during this same period have improved from a loss of $(.06)/share in 2000 to earnings of $.36/share in the TTM. Using the

Using the