Stock Picks Bob's Advice

Thursday, 29 December 2005

A Reader Writes "Could you give us a tutorial on shorts?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Prudy, who goes by the name of Ydurp on Xanga, wrote me a nice comment and included a question. I want to comment on what she wrote and open up this discussion on short interest, and when to sell stock once again. Her comments:

Hi, Bob. I just listened to the Podcast and was pleased to hear my name. Well, it was backwards but it was me. Hey, I think I finally got it; the rationale behind your system. Two things drove it home. The first was your mention of greed:) And I have to say it's been all about greed for me. The second was your attitude about the long haul, how you were okay following the stock all the way up and then back down to your selling point because you had already taken your profits. Hmmmm, I finally got it: a kinder, gentler trader.

As always, I am grateful for your help. I have another question and it is about shorts. I watched Mad Money last night and the guy he interviewed was talking about shorts. I gathered people were betting on a stock's failure but the conversation was geared toward stocks that were good companies that didn't stay down. The focus, and this is where they lost me, was when the stock started to pick up. Could you give us a tutorial on shorts? Is it the same as puts and holds?

First of all, thank you for writing Prudy! And I thought your name was ydurp :).

Let me comment first on what you wrote about selling. I do believe that we all need to get over our "greed" in dealing with stock performance. When a stock appreciates, it is a happy moment for us. We feel vindicated by our decision to buy the shares. In face we feel "smarter" than the next guy. Heck, I love that feeling. In the same way, I hate to have that feeling of loss, literally, when a stock declines.

In my perspective, feelings quite interfere with our rational management of our stocks. When a stock moves higher, we either want to buy some more shares and really make a lot of money, or we want to sell the whole thing and cash in on the jackpot. Have you ever felt that way?

I think it is far more rational to sell a small portion of a stock that has moved higher, and leave the rest to appreciate some more if that is what the shares are going to do. Sort of like picking the ripe oranges off a tree (I just visited my brother in California who has a great set of navel orange trees....is that spelling correct?)

I sort of explain it like the guy that goes to Vegas to gamble at the slots. He (perhaps me..) arrives at the casino with a roll of quarters in his right pocket. He doesn't want to put all of his winnings right back into the machine, so he puts his winnings in his left pocket, only allowing himself to gamble with the right pocket quarters. I try to do the same when investing. Sort of keep selling off the gains, while leaving the original investment on the table. Do you follow?

As far as the "long haul" is concerned, I don't really know how long that will be. Sometimes I have a stock holding for only a day. Others I have held for years. It depends on how the stock performs. Not on how I feel about the company :).

In other words, if the stock doesn't hit any sale points to unload all of the shares (on "bad news"), then I shall continue to own at least a portion of my original investment.

Now let me review once again when I sell a stock on "bad news". First of all if there really

is some bad news....like fraud, or product problems, or accounting irregularities, I might just unload my entire position on the spot regardless of the price movement. I always leave myself that out.

Otherwise, after purchasing a stock, I only let it decline 8% before unloading my position completely. If the stock goes past 8% on the loss, well I unload it as soon as I find out :). My son says I should be doing things more automatically. Once again, he is correct, and you might want to set up some automatic sales of stock; I continue to monitor this manually.

Other cases: if I have sold a portion of a holding once on "good news", that is, I sold 1/6 of my position at the first sale point which for me is at a 30% gain, then instead of letting the stock drop to an 8% loss, I sell if it retraces back to the original purchase price, the "break-even" point.

If I have sold a stock more than once, for example if I have sold a stock three times with the latest sale point at a 90% appreciation level, I allow the stock price to only retrace back to 1/2 of the highest appreciation level....in this case, letting it drop back to where I had a 45% gain, and then I would sell ALL of my remaining shares.

O.K....now to your question about shorts.

Short sellers do the opposite of what all of average folk do in regards to stocks. That is they actually SELL the stock FIRST and plan on BUYING the stock LATER to COVER their "SHORT SALE".

Do you follow? I don't sell stocks short, but will not rule out ever doing it in the future. Basically, when an investor or speculator buys a stock first, we are gambling on the possibility that the stock will APPRECIATE in value, so that we can sell the stock and pocket the difference. That is, we make money when the stock price goes UP.

Short-sellers do the opposite. Basically, they ask a broker to BORROW the shares from another account and SELL them. They pledge their own assets against this sale, promising to buy the shares back for the account that is missing the shares at a future date. Meanwhile, they are liable for any dividends the stock might be paying to the investor that has had his shares sold (unbeknownst to him or her :)). A short-seller who SELLS a stock FIRST and plans to BUY the shares LATER is gambling that the stock price is actually going to DECLINE. Since the short-seller could therefore buy the stocks back CHEAPER, he or she could thus pocket the difference and PROFIT from a stock's DECLINE.

Grandad's Bluff Post Card from the 1940's

One of the big downsides to short-selling is that the potential losses of a short-seller are INFINITE! That is if you sell a $5 stock short (you are "short" the sale because you sold it and didn't have any of you own to do so!), you could lose an infinite amount of money as the stock can climb as high as the moon! However, if you BUY a stock at $5, the maximum amount you can lose is just the purchase price (everything lol). But a short seller can lose a MULTIPLE of his investment. That is, if he short-sells a stock at $5 and it goes to $15, and he buys it back at that price, he has lost $10/share....more than the $5 original sale price.

I hope you follow :).

In my own evaluations, I often point out the "short ratio". This is a figure that I glean from Yahoo on the "Key Statistics" pages of each stock. This short-interest, which is usually several weeks old, tells me the number of days of average trading volume it would take for all of the shares that have been sold "short" to be covered. That is, if the short-sellers had to all buy back shares to return them to the original owners, the days worth of volume required. This is calculated by knowing the average trading volume of a stock and the number of total shares that have been sold short.

Personally, I use a three day cut-off for significance. This is an arbitrary cut-off that I set up in my reviews; I just needed some figure to distinguish what seemed to be a lot from a little in the number of days, the short ratio. I infer a bullish indicator from a lot of shares sold short. It is possible that the short sellers know something bad about the stock, which will result in the decline of the stock price. But in the face of good news, like a solid earnings report, or a new contract, etc., knowing that there are a lot of shares "pre-sold" so to speak, is imho, a bullish indicator that they might need to rush to cover to prevent their losses from mounting as the stock price moves higher.

When there are a lot of short-sellers out there, and the stock price moves higher, a "panic" might develop as all of the short-sellers rush to the exits. Which for them, means searching for shares to BUY to cover their pre-sold shares. This is called a SQUEEZE....and that is why I think it is bullish.

Anyhow, that was a pretty long-winded answer. I hope that was helpful. Please remember that I am truly an amateur, so my answer is from that perspective. If you or anyone else has questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 28 December 2005

New ***PODCAST*** for Reliv International (RELV)

Hello Friends! Here is the

***LINK*** to the ***PODCAST*** on Reliv International (RELV). Thanks for visiting!

Bob

Tuesday, 27 December 2005

December 27, 2005 Reliv International Inc. (RELV)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NASDAQ today, I came across Reliv International (RELV) which closed at $15.29, up $1.73 or 12.76% on the day, in the face of a very weak Dow and NASDAQ market. I do not own any shares of RELV nor do I have any options.

According to the

Yahoo "Profile" on Reliv International, the company

"...through its subsidiaries, engages in the development, manufacture, and marketing of proprietary nutritional products worldwide. The company’s products include nutritional supplements, weight management products, functional foods, sports nutrition and a line of skin care products. Its nutritional supplements include vitamins, minerals, dietary supplements, herbs, and compounds. The functional foods are products designed to influence specific functions of the body. The company’s products are distributed through a network marketing system."

On November 2, 2005, RELV

reported 3rd quarter 2005 results. Net sales worldwide grew 18% to $28.6 million for the quarter ended September 30, 2005, up from $24.17 million in the same quarter last year. Net income increased 32% to $1.67 million or $.10/diluted share, up from $1.26 million or $.07/diluted share in the third quarter 2004 period.

How about longer-term? Examining the

Morningstar.com "5-Yr Restated" financials on RELV, we can see that except for a dip in revenue from $61.3 million in 2000 to $52.9 million in 2001, revenues have steadily increased to $111.5 million in the trailing twelve months (TTM). Earnings have also improved from a loss of $(.06)/share in 2000 to $.42/share in the TTM.

Free cash flow has been positive and increasing with $4 million in 2002 and $10 million in the TTM.

The balance sheet also looks solid with $4.9 million in cash and $8.9 million in other current assets, enough to pay off the current liabilities of $10.8 million and pretty much also cover the $3.4 million in long-term liabilities.

What about some valuation numbers? Taking a look at the

Yahoo "Key Statistics" on RELV, we see that this is a small cap stock with a market capitalization of only $238.77 million. The trailing p/e is a bit rich at 36.67, but the forward p/e (fye 31-Dec-06) is better at 26.82. I suspect that this is such a small stock that there isn't a PEG listed in Yahoo!

Looking at valuation from a Price/Sales perspective, we find that RELV is moderately valued with a Price/Sales ratio of 1.9. Topping the list in the "Drugs Wholesale" industrial group according to the

Fidelity.com eResearch website is First Horizon Pharmaceutical (FHRX) with a Price/Sales ratio of 3.9. This is followed by Axcan Pharma (AXCA) at 2.9, Reliv (RELV) at 1.9, Cardinal Health (CAH) at 0.4, Amerisource Bergen (ABC) at 0.2 and McKesson (MCK) also at 0.2.

Going back to Yahoo for some additional numbers on this company, we can see that there are only 15.62 million shares outstanding. As of 11/20/05 there were 360,740 shares out short representing 3.90% of the float or 10.4 trading days of volume for this relatively thinly traded company. The company pays a small dividend of $.08 yielding 0.60%. The company last split its stock on 11/14/03 when they declared a 5:4 split.

What about a chart? Reviewing a

"Point & Figure" chart on RELV from Stockcharts.com:

We can see what looks like a gorgeous chart with the stock moving steadily higher from a low of $.63 in September, 2001, to a high of $16 where the stock is trading now. The graph looks strong and I don't see any evidence of the stock 'breaking-down'!

So in summary, in the face of a weak market today Reliv International (RELV) moved strongly higher. The last quarter was solid, Morningstar.com looks great with growing free cash flow, a solid balance sheet, and steady revenue growth. The P/E is a bit rich, no PEG is reported and the Price/Sales ratio is moderate. In addition, there are a lot of shares out short on this stock. Finally the chart looks very strong.

Thus, this is an interesting stock pick for the blog. I have some reservations about the reliance on network marketing to advance sales of a company, but RELV appears to be handling this quite well. I am not in the market for a stock as I write, but this would be a stock I would be looking at if I were!

Thanks again for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 25 December 2005

"Weekend Trading Portfolio Analysis" Starbucks (SBUX)

Hello Friends! Thanks so much for stopping by and visiting my bloc,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before proceeding, I would like to will all of you the Merriest of Christmasses, and the Happiest of Hanukkahs! May you have a wonderful day with family and friends and share the true spirit of these holidays!

One of the things I am trying to do on this blog is to share with you my actual holdings in my trading account and keep you up to date on my actions and thoughts involved in managing my portfolio. I have had the most disciplined trading history since I started doing this as all of my readers are 'witnesses' to my actions, and I feel accountable to you! A few months ago, I started reviewing my holdings, going alphabetically through my list which now stands at 20 positions. Last week I reviewed SRA (SRX) and this weekend I would like to review my holdings and trades in Starbucks (SBUX) one of the longest-held stocks in my portfolio.

I first acqired Starbucks (SBUX) in my trading account on January 24, 2003, about four months before I even started blogging here! My cost basis is at $11.40/share which is an adjusted purchase price as SBUX recently split 2:1 on 10/24/05. SBUX closed at $30.56 on 12/22/05, and thus my current holding of 59 shares has an unrealized gain of $19.16 or 168.1%.

If you are a regular reader of this blog, you will know that my strategy of portfolio management includes selling losing stocks quickly at small losses and selling my gaining stocks slowly and partially at targeted gains which currently stand at 30, 60, 90, 120, 180, 240, etc. Thus, I haved been selling portions of my Starbucks stock already: 25 shares 9/8/03, 15 shares 1/23/04, 15 shares 6/18/04, 10 shares 12/3/04, and 11 shares 12/5/05. These shares were sold at the 30, 60, 90, 120, and 180% gain levels. I have reduced my current sales amount from 25% of a holding to 16% of a holding, as stocks like Starbucks which have been sold multiple times are starting to diminish in size!

Thus on the upside, my next sales point would be at a 240% gain or 3.4 x $11.40 = $38.76. My sale on the downside, barring any news that would lead me to unload my shares earlier (some fundamental information that I would deem to be significant enough to intervent), would be at a 90% gain level...allowing my holding to retrace 50% of the highest targeted sale at a gain....or 1.9 x $11.40 = $21.66.

Anyhow, let's take a little bit of a closer look at this company:

According to the

Yahoo "Profile" on Starbucks, the company

"...engages in purchasing, roasting, and selling whole bean coffees worldwide. The company also sells brewed coffees, espresso beverages, cold blended beverages, food items, teas, branded coffee drinks, a line of ice creams, and a line of compact discs through its retail stores. In addition, its stores offer pastries, sodas, juices, games, and seasonal novelty items, as well as coffee-related accessories and equipment, such as coffee grinders, coffeemakers, coffee filters, storage containers, travel tumblers, and mugs."

On November 17, 2005, Starbucks (SBUX)

announced 4th quarter 2005 results. Consolidated net revenue increased 20% to $6.4 billion and net earnings grew 27% to $494 million. Comparable store sales grew 8% in the quarter. This was a solid earnings report.

When looking at a retail stock like Starbucks (SBUX), one thing I always like to check is the latest "same store sales reports" which for some companies are released on the first Thursday of the month. On December 1, 2005, SBUX

reported same store sales numbers for November, 2005. Same store sales grew 7% outpacing the 3.9% estimated by analysts. Total revenue for the month grew 22% with 354 new outlets in the United States and abroad in the last eight weeks! Total stores now stand at 10,595.

And what does the chart look like? Taking a look at the

"Point & Figure" Chart from Stockcharts.com:

We can see that the stock has been slowly appreciating between 2000 and 2003 and then in May, 2003, really exploded to the upside. The stock looks quite strong to me!

Anyhow, that's another of my holdings to share. My biggest mistake has been to sell too much of this stock and not to buy enough of an initial position. I shall be selling smaller portions (1/6) as the stock hits price targets on the upside.

Thanks again for spending time visiting with me. If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Looking Back One Year" A review of stock picks from the week of October 11, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

During the week of October 11, 2004, I made a single stock selection, Dorel Industries (DIIB), which was

picked for Stock Picks Bob's Advice on October 15, 2004, when it was trading at $28.24. I do not own any shares nor do I have any options on this stock.

DIIB closed at $23.89 on 12/23/05, for a loss of $(4.35) or (15.4)%.

On November 2, 2005, Dorel Industries

reported 3rd quarter 2005 results. Revenue for the quarter declined (2.4)% to $423.3 million from $433.8 million in the same quarter the prior year. Earnings also declined to $19.8 million or $.60/share, down from $28 million or $.85/share the prior year. These numbers missed expectations for revenue ($436.1 million expected) as well as earnings ($.66/share expected).

So how did I do that week? Well, since I only selected one stock as a "pick" my performance was the loss of (15.4)% which was the performance of the only stock, Dorel Industries (DIIB).

Thanks again for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Happy Holidays everyone!

Bob

Wednesday, 21 December 2005

New ***PODCAST*** for Western Digital (WDC)

Hello Friends! This is the

LINK for the ***PODCAST*** on Western Digital (WDC).

Thanks so much for visiting!

Bob

December 21, 2005 Western Digital (WDC)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market closed for trading a few moments ago and one of the top gainers on the

list of top % gainers on the NYSE was Western Digital Corporation (WDC), which traded last (shortly before the close) at $18.43, up $2.87 or 18.44% on the day. I do not own any shares of this company nor do I have any options on WDC.

Apparently, what drove this stock higher was the

announcement of the acquisition of Maxtor (MXO) by Seagate Technology (STX). Apparently investors thought that other disk drive manufacturers like Western Digital might also be in play.

According to the

Yahoo "Profile" on Western Digital, the company:

"...engages in the design, development, manufacture, and sale of hard disk drives worldwide. Its hard disk drive products include 3.5-inch and 2.5-inch form factor drives. The company’s hard disk drives are used in desktop personal computers; notebook computers; enterprise applications, such as servers, workstations, network attached storage, and storage area networks; and consumer electronics products, such as personal/digital video recorders and satellite and cable set-top boxes. In addition, the company’s hard disk drives are used in external hard disk drive products that feature high speed buses, such as 1394/ FireWire/iLinktm, universal serial bus, and Ethernet."

Let's take a look at a few of the things that I like to look at when reviewing a stock for this blog!

On October 27, 2005, Western Digital

announced 3rd quarter 2005 results. Revenue grew from $823.6 million in the year-ago 3rd quarter to $1.01 billion in the quarter this year. Net income came in at $68.8 million or $.31/share, up over 100% from the $30.4 million or $.14/share in the same period last year. Revenue this quarter exceeded analysts' expectations of $823.6 million as well as earnings which exceeded expectations of $.29/share. Thus, not only did WDC post substantial growth, they

exceeded expectations. I cannot emphasize enough the importance of expectations in evaluating the response of investors to a company's announcements.

On November 21, 2005, WDC

announced a $150 million share buyback program. This is a bullish announcement from a company which is reducing its float by buying back shares. Contrast this with the continued issuance of shares by Sirius (SIRI) that was discussed elsewhere on the blog.

In addition, on November 28, 2005, WDC

announced increased guidance for the current quarter,

"...citing especially strong demand for drives used in desktop and notebook PCs and consumer electronics devices."

I sometimes like to talk about a "trifecta", a term that I misuse frequently on this blog, but what I mean by this is the announcement of a company's quarterly report, with increased earnings, increased revenue, and increased guidance. I probably should talk of a trifecta "plus" if the company in addition to all of that also goes ahead and announced a stock buyback program!

What about longer-term results? Taking a look at the

Morningstar.com "5-Yr Restated" financials on WDC, we can see that revenue has steadily increased from $2.0 billion in 2001 to $3.8 billion in the trailing twelve months (TTM).

Earnings during this period have fairly steadily increased (not perfectly though) from $(.59)/share in 2001 to $1.08/share in the TTM.

Free cash flow has been strong with $216 million reported in 2003 and $174 million in the TTM.

Taking a look at the balance sheet, we see that the company has $581.3 million in cash and $690.8 million in other current assets. This is more than enough to cover both the $858.5 million in current liabilities and the $65.3 million in long=term liabilities combined and have over $200 million left.

What about valuation statistics? Looking at

"Key Statistics" on WDC from Yahoo, we find that the market capitalization is a large cap size $3.98 billion. The trailing p/e is very nice at 17.07 with a forward p/e (fye 01-Jul-07) of 13.87, and a PEG of .83. All of these statistics suggest very reasonable valuation.

And the Price/Sales figure? According to the

Fidelity.com eResearch website, Western Digital is also fairly nicely valued from the perspective of the Price/Sales ratio. Topping this list is Network Appliance (NTAP) with a Price/Sales ratio of 6.0. This is followed by EMC Corp (EMC) at 3.5, Seagate (STX) at 1.2, Western Digital (WDC) at 0.9 and at the bottom of the list, with the "best" vcaluation was Maxtor (MXO) at a Price/Sales ratio of 0.3.

Returning to Yahoo for some additional numbers, we can see that there are 215.7 million shares outstanding. As of 11/10/05 there were 18.67 million shares out short representing 8.85 of the float or 6.7 trading days fo volume. Using my arbitrary "3 day rule", this looks significant to me. No cash dividend is paid and the latest stock split reported on Yahoo was a 2:1 split in January, 1997.

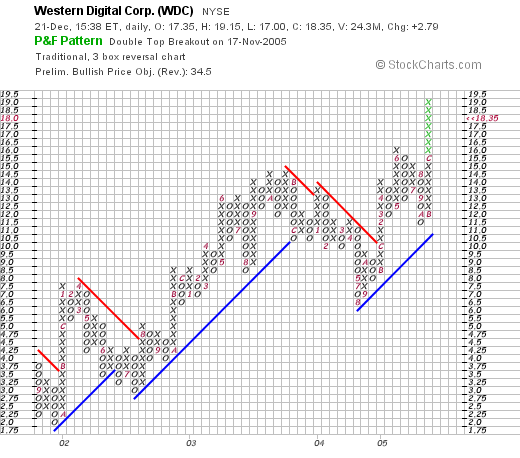

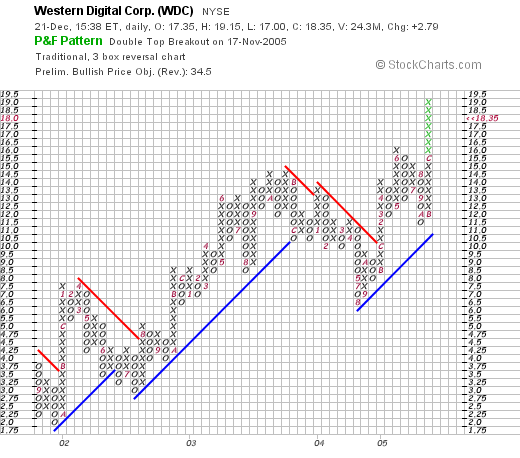

And a chart? Reviewing the

"Point & Figure" chart from Stockcharts.com on WDC:

We can see a fairly strong stock price move since September, 2001, when the stock was trading around $3.00 to its current price range in the $20 area. The stock has moved in a series of "zigs and zags", but the overall stock chart looks very strong.

So what do I think? Let's review: earnings were great, with the company showing both revenue and earnings growth while also exceeding estimates. In addition, the company raised guidance and also started a share buyback.

And Morningstar? The company shows a five year record of growing revenue and earnings, is positive free cash flow solidly, although not growing this element, and has a solid balance sheet with current assets easily paying off both current and long-term liabilities if they so desired.

And valuation quesitons? The company sports a relatively low p/e, has a PEG under 1.0 and a Price/Sales ratio that is nearly the cheapest in its group. There are, in addition, a significant number of shares out short with a short ratio in the 6 range. Finally, the chart looks solid with the stock moving higher on what appears to be a "break-out". There is little I don't like about this particular company!

However, I just sold some shares (PRGS) and until I sell some shares on "good" news, I shall not be in the market to add a new positions. So it shall just have to stay on my buyers' list until such time as this purchase is needed.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 20 December 2005

Another ***PODCAST*** on PRGS, "Trading Rules" and a question about Sirius (SIRI)

I just published a

***PODCAST*** on my PRGS sale, "Trading Rules" and a question about Sirius (SIRI).Thanks so much for stopping by. Please email me at bobsadviceforstocks@lycos.com if you have any questions, comments, or words of encouragement.

Bob

"Trading Transparency" PRGS

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I have discussed over and over again on this blog, my investment approach includes a disciplined selling of stocks on 8% losses after an initial purchase. After I have sold a stock at a loss, I "sit on my hands" so to speak and do not reinvest the proceeds until such time that I have either sold a portion of a holding at a gain or have gotten down to a minimum investment exposure (25% of the maximum # of positions). For me, the minimum would be down to 6 positions!

Checking my portfolio this morning, I saw that Progress Software (PRGS) had dropped below my 8% loss limit, and I entered a sale of the entire position of 240 shares at a sale price of $27.574 a few moments ago. These shares were acquired 6/16/05, at a cost basis of $30.97 (40 shares) and $31.00 (200 shares) as these had been purchased in two lots even though I had entered a single purchase order. Using a cost basis of $30.99, this gave me a loss of $(3.42)/share or (11)%. Since I enter my trades manually, this places me at some additional risk of missing my sale points at either gains or losses. Automating this might be an improvement!

Anyhow, that's the news for now. I am thus "battening the hatches" (did I say that right?), and shall wait for now before any additional trading.

Thanks again for visiting. Please email me at bobsadviceforstocks@lycos.com if you have any questions about anything or comments for my blog. Please also feel free to leave your comments right on the blog!

Bob

Saturday, 17 December 2005

The ***PODCAST*** for SRA International (SRX) A Portfolio Review

Hello Friends! This is the

LINK for my PODCAST on SRA International (SRX).

Thanks for visiting. Email me at bobsadvicerforstocks@lycos.com if you have any questions.

Bob

Newer | Latest | Older

Looking through the

Looking through the  According to the

According to the  On November 2, 2005, RELV

On November 2, 2005, RELV  What about some valuation numbers? Taking a look at the

What about some valuation numbers? Taking a look at the

Hello Friends! Thanks so much for stopping by and visiting my bloc,

Hello Friends! Thanks so much for stopping by and visiting my bloc,  One of the things I am trying to do on this blog is to share with you my actual holdings in my trading account and keep you up to date on my actions and thoughts involved in managing my portfolio. I have had the most disciplined trading history since I started doing this as all of my readers are 'witnesses' to my actions, and I feel accountable to you! A few months ago, I started reviewing my holdings, going alphabetically through my list which now stands at 20 positions. Last week I reviewed SRA (SRX) and this weekend I would like to review my holdings and trades in Starbucks (SBUX) one of the longest-held stocks in my portfolio.

One of the things I am trying to do on this blog is to share with you my actual holdings in my trading account and keep you up to date on my actions and thoughts involved in managing my portfolio. I have had the most disciplined trading history since I started doing this as all of my readers are 'witnesses' to my actions, and I feel accountable to you! A few months ago, I started reviewing my holdings, going alphabetically through my list which now stands at 20 positions. Last week I reviewed SRA (SRX) and this weekend I would like to review my holdings and trades in Starbucks (SBUX) one of the longest-held stocks in my portfolio. I first acqired Starbucks (SBUX) in my trading account on January 24, 2003, about four months before I even started blogging here! My cost basis is at $11.40/share which is an adjusted purchase price as SBUX recently split 2:1 on 10/24/05. SBUX closed at $30.56 on 12/22/05, and thus my current holding of 59 shares has an unrealized gain of $19.16 or 168.1%.

I first acqired Starbucks (SBUX) in my trading account on January 24, 2003, about four months before I even started blogging here! My cost basis is at $11.40/share which is an adjusted purchase price as SBUX recently split 2:1 on 10/24/05. SBUX closed at $30.56 on 12/22/05, and thus my current holding of 59 shares has an unrealized gain of $19.16 or 168.1%. According to the

According to the

During the week of October 11, 2004, I made a single stock selection, Dorel Industries (DIIB), which was

During the week of October 11, 2004, I made a single stock selection, Dorel Industries (DIIB), which was  On November 2, 2005, Dorel Industries

On November 2, 2005, Dorel Industries  The market closed for trading a few moments ago and one of the top gainers on the

The market closed for trading a few moments ago and one of the top gainers on the  Apparently, what drove this stock higher was the

Apparently, what drove this stock higher was the  On November 21, 2005, WDC

On November 21, 2005, WDC  Taking a look at the balance sheet, we see that the company has $581.3 million in cash and $690.8 million in other current assets. This is more than enough to cover both the $858.5 million in current liabilities and the $65.3 million in long=term liabilities combined and have over $200 million left.

Taking a look at the balance sheet, we see that the company has $581.3 million in cash and $690.8 million in other current assets. This is more than enough to cover both the $858.5 million in current liabilities and the $65.3 million in long=term liabilities combined and have over $200 million left.