Hello Friends! Here is my PODCAST on my Blue Coat Systems (BCSI) Sale, and Neoware (NWRE) and Thoratec (THOR). Thanks for stopping by!

Bob

Try PicoSearch to locate Previous Entries

Try PicoSearch to locate Previous Entries

With indications that the Fed might be soon over its series of rate tightenings, the stock market moved strongly higher in the late portion of the session. Looking through the list of top % gainers on the NASDAQ, I came across Neoware, which has been showing up not infrequently on the gainers list the last several trading sessions. Neoware (NWRE) closed at $25.63, up $2.33 or 10.0% on the day. I do not own any shares nor do I have any options in this company.

With indications that the Fed might be soon over its series of rate tightenings, the stock market moved strongly higher in the late portion of the session. Looking through the list of top % gainers on the NASDAQ, I came across Neoware, which has been showing up not infrequently on the gainers list the last several trading sessions. Neoware (NWRE) closed at $25.63, up $2.33 or 10.0% on the day. I do not own any shares nor do I have any options in this company.  According to the Yahoo "Profile" on Neoware, the company

According to the Yahoo "Profile" on Neoware, the company"...provides software, services, and solutions to enable thin client appliance computing, an Internet-based computing architecture targeted at business customers. Its software and management tools secure and manage a smart thin client appliances that utilize the open, industry-standard technologies used to create alternatives to full-function personal computers and green screen terminals used in business."Looking for the latest quarterly report, Neoware reported 1st quarter 2006 results on November 2, 2005. Revenue grew 63% to $26.5 million from $16.3 million in the prior year same period. GAAP net income for the quarter was $1.84 million or $.11/diluted share, up from $1.39 million or $.09/diluted share in the same quarter last year.

Looking longer-term at the Morningstar.com "5-Yr Restated" financials on NWRE, we can see the beautiful progression in revenue from $17.7 million in 2001 to $89.0 million in the trailing twelve months (TTM).

Looking longer-term at the Morningstar.com "5-Yr Restated" financials on NWRE, we can see the beautiful progression in revenue from $17.7 million in 2001 to $89.0 million in the trailing twelve months (TTM). Taking a look at Yahoo "Key Statistics" on Neoware for some additional valuation numbers on the company, we can see that this is a small cap stock with a market capitalization of only $417.9 million. (I am using the Ameritrade definition for a Small Cap stock, which is under $500 million in market cap, with mid cap being from $500 million to $3 billion, and Large cap being over $3 billion. The market capitalization is calculated by multiplying the current market price by the number of outstanding shares.

Taking a look at Yahoo "Key Statistics" on Neoware for some additional valuation numbers on the company, we can see that this is a small cap stock with a market capitalization of only $417.9 million. (I am using the Ameritrade definition for a Small Cap stock, which is under $500 million in market cap, with mid cap being from $500 million to $3 billion, and Large cap being over $3 billion. The market capitalization is calculated by multiplying the current market price by the number of outstanding shares.

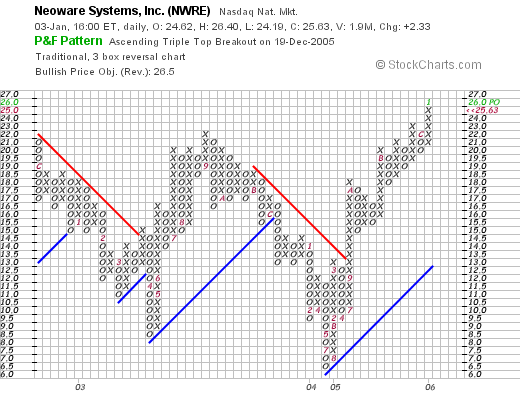

We can see that the chart has been very erratic, trading down to support levels and up to resistance levels several times, and only since about July, 2005, the stock has been trading steadily higher as it broke to the upside. The stock chart looks strong short-term but not particularly overvalued.

So what do I think? Well this is an interesting small cap stock. The steady revenue growth is impressive. As often is the case, as I have found, earnings are more erratic in many small companies. However, at least for the last few years, the company is showing steady growth. Free cash flow is positive and the balance sheet is quite solid. The company has plenty of cash. In addition, the PEG is just over 1.0, and the Price/Sales ratio is towards the bottom of its group. The chart looks strong as well.

If I were in the market to be buying shares, this is the sort of company that I would be buying. However, I actually sold a stock at a loss today (BCSI) and thus am once again sitting on my hands, waiting for a partial sale at a gain instead to signal me to be out in the market buying a new position.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

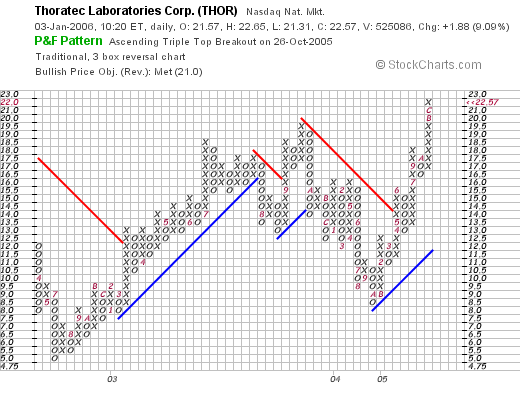

Looking through the list of top % gainers on the NASDAQ today, I came across Thoratec (THOR) that is currently trading at $22.52, up $1.83 or 8.84% on the day. I do not own any shares nor do I have any options on this stock.

Looking through the list of top % gainers on the NASDAQ today, I came across Thoratec (THOR) that is currently trading at $22.52, up $1.83 or 8.84% on the day. I do not own any shares nor do I have any options on this stock. According to the Yahoo "Profile" on THOR, the company

According to the Yahoo "Profile" on THOR, the company"....manufactures circulatory support products for use by patients with congestive heart failure. The company operates in two segments, Cardiovascular and International Technidyne Corporation (ITC). The Cardiovascular segment develops, manufactures, and markets medical devices used for circulatory support products, which include ventricular assist device for the short-term and long-term treatment of congestive heart failure, as well as vascular graft products for use as a shunt between an artery and a vein. It offers a product portfolio of implantable and external circulatory support product devices, including the Thoratec Implantable Ventricular Assist Device, a biventricular implantable blood pump; the HeartMate Left Ventricular Assist System (LVAS), an implantable device for mid to long-term cardiac support for those patients ineligible for heart transplantation; and the HeartMate II, an implantable LVAS consisting of a miniature rotary blood pump that is designed to provide long-term support."Taking a look at the latest quarterly result, the company announced 3rd quarter 2005 results on October 25, 2005. Sales for the quarter ended October 1, 2005, grew 20% to $48.8 million vs. $40.7 million in the prior year. GAAP net income was $3.1 million or $.06/diluted share, up from a loss of $(398,000) or $(.01)/diluted share in the same period the prior year. The company also announced that, according to the report, "...will achieve or exceed the high end of these ranges." regarding prior guidance. In other words they reported a solid earnings report and raised guidance.

What about valuation numbers? Looking at Yahoo "Key Statistics" on THOR, we can see that this is a mid cap stock with a market capitalization of $1.14 billion. The trailing p/e is rich at 100.85 (the company is just turning profitable) with a forward p/e (fye 01-Jan-07) of 46.85. The PEG is also a bit steep at 2.07 (5 yr expected).

What about valuation numbers? Looking at Yahoo "Key Statistics" on THOR, we can see that this is a mid cap stock with a market capitalization of $1.14 billion. The trailing p/e is rich at 100.85 (the company is just turning profitable) with a forward p/e (fye 01-Jan-07) of 46.85. The PEG is also a bit steep at 2.07 (5 yr expected).

So what do I think? This is a very interesting stock that deserves to be on our blog. They have great earnings, revenue growth, have an interesting product, and might well be an acquisition target of a company like Medtronics (MDT). I do NOT have any kind of inside information on anything like that. But wouldn't it make a nice fit in a company that works with defibrillators and other heart products?

Anyhow, that's the pick for the morning. Of course, since I just sold a stock at a loss, I am NOT in the market to buy anything. But if I were, this might be the kind of stock I would be buying! Thanks again for visiting. Please feel free to comment on the blog or email me at bobsadviceforstocks@lycos.com if you have any questions!

Bob

During the week of October 18, 2004, I only discussed one stock, Diagnostic Products (DP), which I reviewed on Stock Picks Bob's Advice on October 18, 2004, when it was trading at $42.18. DP closed at $48.55, on December 30, 2005, up $6.37 or 15.1% since posting.

During the week of October 18, 2004, I only discussed one stock, Diagnostic Products (DP), which I reviewed on Stock Picks Bob's Advice on October 18, 2004, when it was trading at $42.18. DP closed at $48.55, on December 30, 2005, up $6.37 or 15.1% since posting. On October 24, 2005, Diagnostic Products announced 3rd quarter 2005 results. Sales for the quarter ended September 30, 2005, grew 7% to $116.3 million from the same quarter in 2004. Earnings for the quarter came in at $17.1 million or $.56/diluted share, up from $16.5 million or $.55/diluted share the prior year. The company showed growth year-over-year, but it certainly appeared to be a bit anemic.

On October 24, 2005, Diagnostic Products announced 3rd quarter 2005 results. Sales for the quarter ended September 30, 2005, grew 7% to $116.3 million from the same quarter in 2004. Earnings for the quarter came in at $17.1 million or $.56/diluted share, up from $16.5 million or $.55/diluted share the prior year. The company showed growth year-over-year, but it certainly appeared to be a bit anemic.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website. This year I have been using the weekend as a time to take a look at my actual holdings in my trading portfolio. I do this to share with you what I actually own, in addition to the many stocks I like to discuss. And it is also gives me a chance to review my holdings in a more analytic fashion than I might otherwise be doing.

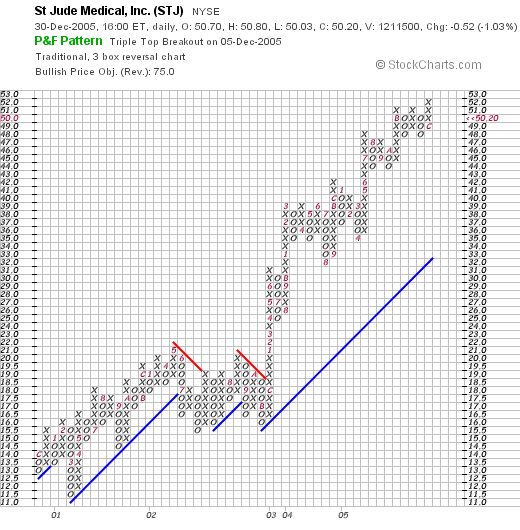

This year I have been using the weekend as a time to take a look at my actual holdings in my trading portfolio. I do this to share with you what I actually own, in addition to the many stocks I like to discuss. And it is also gives me a chance to review my holdings in a more analytic fashion than I might otherwise be doing.May 12, 2003 St Jude MedicalI "Revisited" St Jude (STJ) on April 20, 2005, when STJ was trading at $39.67.

This is one I picked up today. STJ is the stock symbol. I do not as I write and publish this own any shares. Am thinking about suggesting this to my stock club. Company had a great day today with a nice move on the upside. Last Quarter was good and the past five years have been steady growth. Closed at $55.30 up $2.92. So the daily momentum helped it make the list.

I currently own 180 shares of St Jude Medical (STJ) which were acquired 10/15/03 with a cost basis of $28.90. STJ closed on 12/30/05 at a price of $50.20, for a gain of $21.30 or 73.7% since my original purchase. As is my strategy, I have sold portions of my STJ position as the stock appreciated, selling 30 shares on 1/28/04 at a price of $69.84 (STJ had a 2:1 split on 11/23/04). I sold 60 shares of STJ on 7/20/05 at $46.54. These shares were sold at the 30% and 60% appreciation levels. My next sale will either be back at the 30% level on the downside or at 90% appreciation, when I plan on selling 1/6th of my existing position.

I currently own 180 shares of St Jude Medical (STJ) which were acquired 10/15/03 with a cost basis of $28.90. STJ closed on 12/30/05 at a price of $50.20, for a gain of $21.30 or 73.7% since my original purchase. As is my strategy, I have sold portions of my STJ position as the stock appreciated, selling 30 shares on 1/28/04 at a price of $69.84 (STJ had a 2:1 split on 11/23/04). I sold 60 shares of STJ on 7/20/05 at $46.54. These shares were sold at the 30% and 60% appreciation levels. My next sale will either be back at the 30% level on the downside or at 90% appreciation, when I plan on selling 1/6th of my existing position."...engages in the development, manufacture, and distribution of cardiovascular medical devices for the cardiac rhythm management (CRM), cardiac surgery (CS), and cardiology and vascular access (C/VA) therapy areas worldwide. It offers a range of CRM products, such as bradycardia pacemaker systems, tachycardia implantable cardioverter defibrillator systems, and electrophysiology catheters; various CS products, including mechanical and tissue heart valves, valve repair products, and epicardial ablation systems; and C/VA products,that include vascular closure devices, angiography catheters, guidewires, and hemostasis introducers."And what about the latest quarterly result? On October 17, 2005, St. Jude reported 3rd quarter 2005 results. Net sales came in at $738 million, up 28% from $578 million the prior year. Net earnings for the quarter came in at $168 million, or $.44/diluted share up from $91 million or $.25/diluted share in the same quarter in 2004. This was a solid quarter imho for St. Jude.

What about the Morningstar.com information? Does that still look encouraging?

What about the Morningstar.com information? Does that still look encouraging?

The stock moved strongly higher between March, 2001, when the stock bottomed at around $11.50, then hit resistance around $20 in May, 2002. The stock consolidated until December, 2003, when it broke through resistance at around $18 and has moved steadily higher since.

In summary, St. Jude Medical has been a strong stock in my trading portfolio. I was fortunate to buy shares in October, 2003, prior to the latest strong price move higher. I have sold portions of this stock twice as the stock appreciated in value, and am close to a third sale. The latest earnings report is solid, and the Morningstar.com "5-Yr Restated" page also is very strong. To top it off, the chart looks bullish if a bit over-extended.

Anyhow, that's St. Jude! I don't see any reason to sell off the remaining shares and shall be waiting for the stock to either appreciate to another sale point, or backtrack to a sale point on the downside. The price action will determine my future strategy with this company.

Thanks again for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Happy New Year! everyone!

Bob

Hi, Bob. I just listened to the Podcast and was pleased to hear my name. Well, it was backwards but it was me. Hey, I think I finally got it; the rationale behind your system. Two things drove it home. The first was your mention of greed:) And I have to say it's been all about greed for me. The second was your attitude about the long haul, how you were okay following the stock all the way up and then back down to your selling point because you had already taken your profits. Hmmmm, I finally got it: a kinder, gentler trader.First of all, thank you for writing Prudy! And I thought your name was ydurp :).

As always, I am grateful for your help. I have another question and it is about shorts. I watched Mad Money last night and the guy he interviewed was talking about shorts. I gathered people were betting on a stock's failure but the conversation was geared toward stocks that were good companies that didn't stay down. The focus, and this is where they lost me, was when the stock started to pick up. Could you give us a tutorial on shorts? Is it the same as puts and holds?

Grandad's Bluff Post Card from the 1940's

One of the big downsides to short-selling is that the potential losses of a short-seller are INFINITE! That is if you sell a $5 stock short (you are "short" the sale because you sold it and didn't have any of you own to do so!), you could lose an infinite amount of money as the stock can climb as high as the moon! However, if you BUY a stock at $5, the maximum amount you can lose is just the purchase price (everything lol). But a short seller can lose a MULTIPLE of his investment. That is, if he short-sells a stock at $5 and it goes to $15, and he buys it back at that price, he has lost $10/share....more than the $5 original sale price.

I hope you follow :).

In my own evaluations, I often point out the "short ratio". This is a figure that I glean from Yahoo on the "Key Statistics" pages of each stock. This short-interest, which is usually several weeks old, tells me the number of days of average trading volume it would take for all of the shares that have been sold "short" to be covered. That is, if the short-sellers had to all buy back shares to return them to the original owners, the days worth of volume required. This is calculated by knowing the average trading volume of a stock and the number of total shares that have been sold short.

Personally, I use a three day cut-off for significance. This is an arbitrary cut-off that I set up in my reviews; I just needed some figure to distinguish what seemed to be a lot from a little in the number of days, the short ratio. I infer a bullish indicator from a lot of shares sold short. It is possible that the short sellers know something bad about the stock, which will result in the decline of the stock price. But in the face of good news, like a solid earnings report, or a new contract, etc., knowing that there are a lot of shares "pre-sold" so to speak, is imho, a bullish indicator that they might need to rush to cover to prevent their losses from mounting as the stock price moves higher.

When there are a lot of short-sellers out there, and the stock price moves higher, a "panic" might develop as all of the short-sellers rush to the exits. Which for them, means searching for shares to BUY to cover their pre-sold shares. This is called a SQUEEZE....and that is why I think it is bullish.

Anyhow, that was a pretty long-winded answer. I hope that was helpful. Please remember that I am truly an amateur, so my answer is from that perspective. If you or anyone else has questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob